Composites end markets: Industrial (2024)

The use of composites in industrial applications is increasing, driven by the need for higher performance and longer life, whether its parts for industrial machinery, EOAT components, corrosion-resistant equipment and more.

(Top left, clockwise) Anybrid robotic overmolding for pultrusion, ceramic matrix composite (CMC) burner manifold, Epsilon Composite overmolded pultruded and pull-wound tubes and end-of-arm tooling (EOAT) printed in composites using Markforged printer. (Image in center) Thermoplastic composite tubes made by Alformet using laser-assisted tape winding/AFP. Source | Anybrid, Walter E. C. Pritzkow Spezialkeramik, Epsilon Composite, Savage Automation LLC and Alformet.

The industrial market for composites comprises a range of applications such as parts used in industrial machinery and equipment, components for robots used in automation, corrosion-resistant ducting and other equipment used in manufacturing, as well as pipes, tubes, connectors and fittings that are used in a production environment.

The examples discussed below show how the use of composites in industrial applications is increasing, driven by the need for higher performance and longer life. Manufacturers continue to seek faster processes to lower cost, which may demand equipment with reduced weight that moves faster or with resistance to increased loads, wear and/or higher temperatures. Other applications demand improved environmental resistance to moisture and chemicals. Industrial composites often comprise glass fiber reinforcement in a lower cost thermoset or thermoplastic polymer matrix, but carbon fiber may also be used and is increasing as cost-effective recycled carbon fiber materials become more available. Additive manufacturing/3D printing is also enabling increased use of composite materials in industrial applications.

One important dynamic is that composite materials for automated processing equipment has increased for industrial applications. For example, suppliers of automated fiber placement (AFP) equipment have noted that availability and quality of thermoplastic composite tape has increased in recent years, with suppliers focusing not only on aerospace materials, but also more affordable industrial materials.

Ceramic matrix composites (CMC) for industrial applications

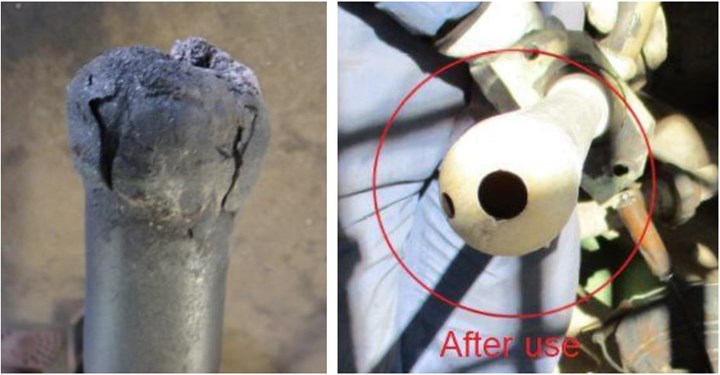

CMC parts boost efficiency, enable energy transition. Burner lances made from Keramikblech oxide fiber/oxide matrix (OCMC) offer 10 times longer life versus metal alloy burner lances used in steam crackers (top). A hybrid OCMC furnace tube (alumina liner, metal insert, outer OCMC sheath) has successfully demonstrated electrical-powered steam cracking (bottom left). BASF Ludwigshafen has installed the world’s first large-scale electrically heated steam cracker plant, with a potential 90% reduction in CO2 emissions (bottom right).

Source | Walter E. C. Pritzkow Spezialkeramik

As explained in “A new era for ceramic matrix composites,” ceramic fiber-reinforced ceramic matrix (CMC) materials are increasingly being sought for use in thermal processes in industry. This is because higher temperatures increase efficiency and CMC enable parts with longer lives at those higher temperatures. For example, prototype CMC reaction vessels for steam cracking hydrocarbons have shown as much as 50-60% improvement versus previous metal versions. The Walter E.C. Pritzkow Spezialkeramik company, near Stuttgart, Germany, is a specialist in oxide fiber-reinforced oxide CMC — trademarked Keramikblech OCMC — which uses fabrics comprised of Nextel 610 and 720 fibers and a hand layup process to create a wide array of parts. “We work mainly with industrial companies,” says Pritzkow, “such as Linde and BASF, but also with companies doing metal casting and heat treatment. We do small series of 10-100 parts but also larger production of parts like burner systems where we deliver 2,000 to 5,000 parts per year.”

Pritzkow sees a large potential for OCMC parts in the future. “More and more applications are being developed,” he says. “In the beginning, we worked with specialty companies and niche applications, but now large companies want to run thermal processes at higher temperatures.” This will increase further, he adds, if oxide fiber costs come down as new production is introduced in Germany. “We’ll get more opportunities to replace metal parts which are destroyed in weeks and months due to coking and corrosion. OCMC parts provide a much higher lifetime — for example, our flame tubes last up to 4 years. Some say that our parts are too expensive, but companies like BASF have found the reduction in maintenance, shutdown and part replacement costs they provide are significant. Time without production is even more expensive. And now these companies can run for longer and at higher temperatures, so their overall efficiency is really benefiting.”

Increased production of composite tubes and pipes

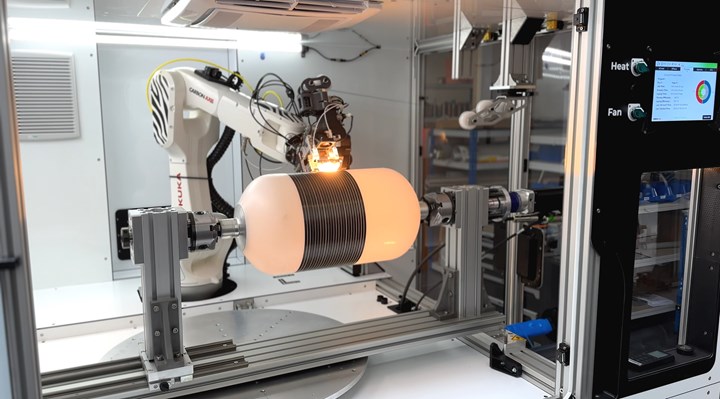

Alformet was founded to produce thermoplastic composite tubes, pipes and pressure vessels. Source | Alformet

As reported in CW’s January 2024 article on the evolving markets and technologies for AFP, automated production of tubes is growing. “Our long-term vision is to commodify thermoplastic composite tubes and pipes,” explains Lucas Ciccarelli, managing director of Alformet. His company was founded by AFP systems supplier Advanced Fibre Placement Technology (AFPT, Dörth, Germany) specifically to make parts. Markets include sporting goods, power tools, pumps and certain parts for cars, offshore piping and automated machines. “It’s very broad and complex, with very different requirements per industry,” says Ciccarelli.

One market is rotor sleeves in electric motors which require very thin-walled structures with a low cost point that demands short production times. Meanwhile, Alformet’s parent company, AFPT, is building laser-assisted tape winding (LATW)/AFP machines for producing 500,000 or more parts per year. These machines typically use five spindles for winding and are designed to run 24 hours per day with a control system that handles complex geometries while maintaining constant temperature. “We have to make these systems reliable and easy to use,” notes Ciccarelli, “because we’re opening new markets with companies that have never worked with AFP or winding before.”

Another AFP company working to advance AFP into industrial sectors is Carbon Axis (La Rochelle, France), which produces the robotic XCell for making parts up to 1 × 0.5 × 0.5 meter using the XPlace AFP head. It is also launching the larger XCell-M, for parts roughly 2.5 × 1.5 meters, with its new XPlace2 AFP head. The modular design of these systems enables standard, compact machines with multiple options, including thermoset, thermoplastic and dry fiber tapes. “We can also integrate a filament winding head and axis as well as ultrasonic cutting for trimming preforms,” says co-founder Chiemi Avila Mori. “We wanted a standard skeleton where you decide which modules and how many you include,” adds co-founder Pavel Perrotey. “You can use a compact, two-bobbin head for more complex parts or a four-bobbin configuration to place wide.” He adds that the goal is to bring AFP outside of aerospace, including sports/recreation, motorsports, medical and industrial sectors. “That is why we target multi-material, multiprocess machines that cost 10 times less than traditional large robotic AFP systems. We enable both R&D and production of many different parts with complex laminates that have a lot of scrap when produced manually. Our machines also consume very little power because that is becoming very important.”

Pultruded and pull-wound composite tubes

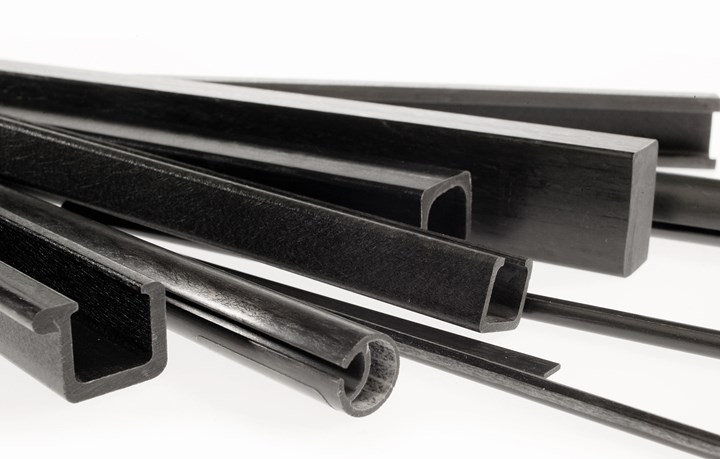

Exel Composites produces a wide range of pultruded and pull-wound composites used in axles for roller doors and awning systems, rungs for ladders and more. Source | Exel Composites

Another process used in the growing production of composite tubes is pultrusion. Companies that have reported on their pultruded composite technologies in 2023 include Avient Corp. (Avon Lake, Ohio, U.S.) in its CAMX preview and Exel Composites (Vantaa, Finland), which announced that its pultruded rods are used in outdoor umbrella and parasol systems by manufacturer Umbrosa (Roeselare, Belgium). Umbrosa’s products are used in environments including seasides and jungles where they must endure long-term exposure to saltwater, rain, high winds and UV rays. Composites help provide the durability required to remain in place for long periods of time without experiencing damage.

Exel also specializes in pull-winding, explaining that although the process involves pulling fibers through a resin bath and heated die for curing, like pultrusion does, it offers the ability to cross-wind fibers in different orientations by winding them around a mandrel first. A mix of fibers can be used in this highly automated and repeatable process for high-volume, cost-competitive composite products which is particularly well suited for thin-walled, hollow composites including telescopic pole applications which requires high hoop strength. Pull-winding also helps to prevent deflection in axles for roller doors or awning systems and can be used for production of rectangular composite ladder rungs.

FRP bushings for composite tubes

Cyrco Inc. (Greensboro, N.C., U.S.), a company that repairs, rebuilds and constructs cooling towers, has developed fiber-reinforced polymer (FRP) bushings that can be used with structures made from bolted composite tubes and profiles. When such structures are subjected to wind and other loads (vibration, traffic, etc.), they can flex, causing movement and bolt friction to drilled holes in the FRP tubing. With back-and-forth movement over time, the bolt hole size can increase. Cyrco’s FRP bushings encase the bolt’s “file-like” threads and prevent hole wear. The FRP bushings lock into place pre-assembled, enabling workers to guide bolts through entrance and exit holes for reduced build times. They also prevent under- or over-torqued bolts. Through tensile strength testing performed by the Joint School of Nanoscience and Nanoengineering of North Carolina A&T State University, Cyrco’s FRP bushings created more than a 6.0 shear service factor. This is more than twice the minimum 3.0 Cooling Tower Institute (CTI) standard, according to Cyrco.

Overmolded composite tubes and profiles

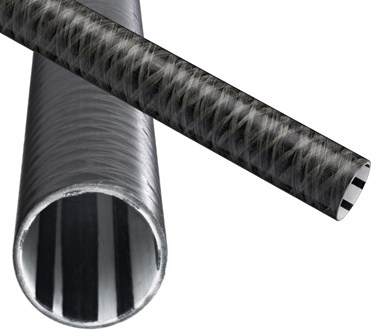

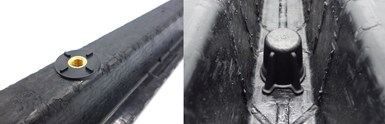

Functionalizing semi-finished pultruded/pull-wound profiles. Epsilon Composite with injection molding partner Somocap developed and patented a thermoplastic composite injection overmolding process for its thermoset composite tubes. Source | Epsilon Composite

Instead of bolting pultrusions together, Epsilon Composite (Gaillan Médoc, France) has developed an alternative process. The company specializes in pultrusion and pullwinding of medium- to large-series, high-performance carbon fiber composite parts. For many of the end-use parts made from its profiles and tubes — e.g., aircraft struts, industrial parts, technical rollers and more — metal or plastic end fittings and inserts are often bonded or bolted to add functionality or a connection point for other parts. In 2012, Epsilon Composite began experimenting with alternative methods and settled on using composite injection overmolding. However, as explained in “Novel processes for hybrid thermoset-thermoplastic pultruded parts,” Epsilon’s pultruded profiles are made with epoxy or other thermoset resin, while injection overmolding uses a thermoplastic matrix, injected under high heat and pressure.

One of Epsilon’s core end markets, industrial applications such as arms for machinery or robotics, was the first application for its injection overmolding joining process. Source | Epsilon Composite

Working closely with its injection molding partner Somocap (Jatxou, France), Epsilon Composite developed a technology to produce hybrid thermoset composite pultruded parts overmolded with thermoplastic fittings. First, a hollow, tube-shaped thermoset composite profile is produced via pullwinding or pultrusion. The end of the profile is then machined to allow for the shape of the end fitting to be attached, which provides a rough surface area for the profile to attach to. Next, a tool/plug is positioned within the profile in the injection machine, and the thermoplastic is then injected, under a specified heat and pressure, around the profile and end fitting, binding them together. A range of materials have been used, from relatively low-cost polyamide 6 (PA6) filled with glass fiber, to higher performance materials such as polyetheretherketone (PEEK), polyphenylene sulfide (PPS) or polyetherimide (PEI) reinforced with glass or carbon fiber. Unreinforced resin systems can also be used.

Compared to other methods like bonding or mechanical fasteners, overmolding is said to offer lower cost, weight savings and improved impact tolerance. If metal is replaced by a thermoplastic, corrosion risks can also be eliminated. The first commercial use case of this technology was in 2015 with a U.S.-based company, manufacturing pultruded rods for use in industrial robotics. Epsilon Composite has also used the technology for aircraft struts and in agricultural machinery, working with a customer to replace steel spray boom arms for industrial tractors with 50-meter-wide pultruded composite booms. This technology has become a go-to solution for the company’s large-series parts across end markets. “We’ve been making tens of thousands of parts with zero failure,” says Romain Coullette, sales director for Epsilon Composite.

Robotic overmolding

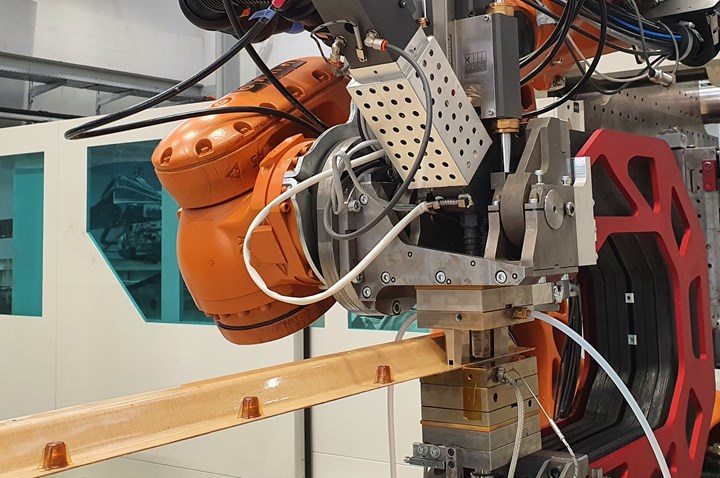

Anybrid’s robotic overmolding process can be used inline with pultrusion, extrusion and similar processes to add fasteners, stiffening ribs, lights, sensors or other functionalization. Source | Anybrid

Another option for overmolding composite pultrusions to functionalize them for industrial applications is Anybrid’s (Dresden, Germany) robotized injection molding (ROBIN) process. “We developed this robotized injection molding machine in 2019 to produce hybrid components,” says Michael Stegelmann, managing partner at Anybrid (see “Robotic injection molding for functionalize composites”). “Hybrid components” refers to functionalizing a structure with an injection molded polymer to create local attachment points, stiffening ribs, etc. Anybrid has miniaturized the injection molding process to fit within a robot arm end effector, enabling pultrusions to be overmolded inline or molded structures to be functionalized within a robotic cell. Anybrid has demonstrated this with the Innovation Group REHAU Industries (Rehau, Germany), which produces polymer-based solutions for construction, automotive and industrial applications including window profiles and components for car exteriors, bumpers and air duct systems. The two companies used the ROBIN process to integrate threaded fasteners into a narrow, omega-shaped profile made using PA6 reinforced with 47% glass fiber roving and then overmolded with a similar material.

Stegelmann explains the steps involved: “First, we position the metal insert inside the small injection mold within the ROBIN machine. Next, the ROBIN system is aligned with the profile, and then the mold is closed, and the fastener is overmolded. Because the mold is very small, ROBIN is able to reach even between the high walls on the back side of this profile and overmold fasteners with anti-twist resistance or integrated sealing, for example.”

“We see great potential to use Anybrid’s mobile injection molding in a variety of continuous process lines,” says Dr. Stephan Sell, research chemist at REHAU, “such as thermoplastic extrusion, pultrusion or CCM [continuous compression molding], for the production of composites parts for transport or industrial applications, for example. It enables monomaterial systems — products that consist of the same polymer matrix. Steps such as gluing are eliminated. This makes production faster and the products easier to repair or recycle.” He notes that ROBIN also saves costs. “Using the small injection molding robot makes it possible to dispense with large, expensive tools. The logistical effort is also reduced since profiles no longer have to be moved to injection molding machines. We have shown that costs can be reduced and productivity and flexibility increased in our extrusion lines.”

For more details, including demonstration of ROBIN to functionalize large 3D-printed structures, its use with CQFD Composites’ (Mulhouse, France) reactive pultrusion process — which in-situ polymerizes thermoplastic composite profiles — and work with wood polymer composites (WPC) including CXP cellulose crosslinked polymer from Dongnam Realize (Daejeon, South Korea). (Read “Robotized system makes overmolding mobile, flexible.)

Composites for end-of-arm tooling (EOAT)

Zero Tolerance LLC (Clinton Township, Mich., U.S.) is a toolmaker specializing in production of high-complexity, tight tolerance, small-to-medium size injection molds for a range of industries. The company acquired several 3D printers including an X-7 industrial-grade continuous carbon fiber composite printer from Markforged (Waltham, Mass., U.S.) and two additional FDM/FFF Markforged models: an Onyx One discontinuous carbon fiber printer and a Mark Two continuous carbon fiber printer. Initially, Zero Tolerance used its printers to produce prototypes and proof of concepts for customers using polyamide (PA) and polylactic acid (PLA). More recently, it has produced human-operated end-of-arm tooling (EOAT) to assist in molding operations.

The design freedom of polymer/composite additive manufacturing (AM) makes it easy to design different front-facing/insert holding (middle left and right) and rear-facing/handle versions (right) of the claw manual EOAT that Zero Tolerance LLC has produced for its own and customer molding operations. (Left middle shows an unloaded EOAT waiting for inserts and right middle shows inserts preloaded.) Not only did 3D printing a manual EOAT greatly reduce cost versus using a robot, but it increased operator safety and shortened the effective cycle time versus loading inserts by hand into the hot mold cavity (left showing operator using the claw to rapidly load inserts). Source | Credit Zero Tolerance LLC

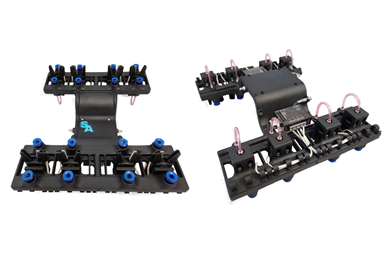

Another company using this approach is Savage Automation LLC (Farmington, Utah, U.S.), which specializes in developing and producing robust EOAT and fixtures that solve problems and simplify installation and operations for injection molders. “We produce a lot of one-off products of high complexity and high value with lots of design time involved, so additive is perfect for that kind of low-volume/high-mix work,” says founder Richard Savage. “Basically, we consider additive to produce anything that’s high cost or takes a long time to machine in metals.” Molders typically send Savage Automation a mold layout and a part drawing that the team uses to design an end effector, fixture or other manufacturing aid. Next, the team produces prototype aids on its Onyx One FDM/FFF printer from Markforged Inc., which can print in neat or discontinuous carbon fiber-reinforced PA6.

Two views of a largely 3D-printed EOAT showing pneumatic grippers and suction grips on the part-facing side (left) and connections on the robot-facing side (right). Source | Savage Automation LLC

Savage notes that with conventional EOAT, there’s no easy location to position air/vacuum lines, so tools end up with a nest of lines that are zip-tied together. “With additive [manufacturing], we can just print integral channels so air lines run through the body of the part and there’s only one connection line for each hookup and it’s clearly labeled. It’s the same thing with mounting grippers or suction cups — you can just print them into the body so you don’t have to worry about screws coming loose and pads or gripper fingers falling off. Another way we’ve changed our design approach as we’ve learned more about 3D printing is that we now manipulate the ductility and Shore hardness of a part, not by changing the polymer, but by changing how we print the lattice, our printer orientation and so on. As you modify the lattice and its thickness, you modify the flexibility of the geometry, which is very helpful when you need to control grip forces to handle delicate parts.”

Rapid Robotics Inc. (San Francisco, Calif., U.S.) designs and produces fully automated cobot cells also in its Novi, Michigan facility. At both locations, engineering teams prototype concepts for EOAT and other manufacturing aids on FDM/FFF printers. Once designs are production ready, durable components are produced on banks of Markforged carbon fiber composite printers. “What we design and print is highly dependent on the type of task we’re trying to automate,” says Forest Lee, Rapid director of brand narrative. “While it’s possible to find off-the-shelf part pickers and grippers that could work, often standard offerings aren’t the right size, or they aren’t durable enough to operate in hot or dusty environments, or they’re heavier than what we can print ourselves.Weight is important as it affects the speed at which our cobots operate and that, in turn, impacts cycle times for the process we’re trying to automate. Hence, we use a lot of purpose-printed components. With additive manufacturing, we have great flexibility, can prototype and produce parts faster and more efficiently and that enables us to build systems JIT [just in time].” For more details, read “Increased molding productivity via additive manufacturing.”

3D-printed molds

Finally, composites additive manufacturing can also be used to produce a wide range of molds and tooling used for industrial applications. Some of the companies and technologies highlighted in 2023 include:

⇒ Massivit 3D (Lod, Israel) and its patented dual-head gel dispensed printing (GDP) to manufacture industrial, isotropic, epoxy-based molds to produce full-sized parts (1.2 × 1.5 × 1.8 meters). The system crafts epoxy molds, but also enables tooling applications for thermoforming, resin transfer molding (RTM) and reaction injection molding (RIM). Custom molds for composite parts can be manufactured using Massivit’s patented cast-in-motion (CIM) technology to automate isotropic mold production and decrease fiber-reinforced polymer (FRP) tooling time by up to 80%, thereby decreasing labor-associated costs by 90%. See “Large-scale additive system prints industrial molds for composites” for more information.

⇒ CEAD (Delft, Netherlands) is a global large-scale 3D printing company which now has an office in Detroit, Michigan. The company offers its CFAM gantry-based cells and Flexbot flexible and scalable robot-based systems as well as a range of extruders which are used, for example, on existing CNC machines and in BEAD hybrid machines. The latter are made in partnership with Belotti (Suisio, Italy) and combine large-scale AM and CNC machining. In 2023, Airtech International (Huntington Beach, Calif., U.S.) installed a CEAD machine in its Additive Manufacturing Center of Excellence in Springfield, Tennessee (read CW’s 2023 plant tour). Airtech reports the CEAD Flexbot features a 3 × 1-meter build volume, CNC milling capabilities and Dynamic Flow Control, making it an all-in-one advanced solution for precision manufacturing that will help Airtech in its continued development of resins for 3D printing and exploration of applications across diverse markets.

⇒ In 2023, Caracol (Barlassina, Italy) opened its U.S. headquarters in Austin, Texas. The company says this strategic investment will enable production and assembly of its integrated hardware and software LFAM platforms, Heron AM, directly in the U.S.

⇒ At CAMX 2023, Thermwood Corp. (Dale, Ind., U.S.) demonstrated its LSAM Additive Printer system which features a single-fixed gantry, a 5 × 10-foot moving table, a 4-foot maximum print height and a maximum print temperature of 450°F. The Additive3D simulation module from Purdue University’s LSAM Research Laboratory was also on display.

Related Content

Composites end markets: Pressure vessels (2024)

The market for pressure vessels used to store zero-emission fuels is rapidly growing, with ongoing developments and commercialization of Type 3, 4 and 5 tanks.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreComposites end markets: Sports and recreation (2024)

Light weight and high performance continue to make composites popular in the elite sporting good market. Sustainability in both materials and recycling solutions are a key innovation area.

Read MoreComposites end markets: Infrastructure and construction (2024)

Composites are increasingly used in applications like building facades, bridges, utility poles, wastewater treatment pipes, repair solutions and more.

Read MoreRead Next

Composites end markets: Sports and recreation (2024)

Light weight and high performance continue to make composites popular in the elite sporting good market. Sustainability in both materials and recycling solutions are a key innovation area.

Read MoreComposites end markets: Infrastructure and construction (2024)

Composites are increasingly used in applications like building facades, bridges, utility poles, wastewater treatment pipes, repair solutions and more.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More