Technicians at Teijin Automotive Technologies manually demold a large SMC battery tray from its tool in a compression press. Photo Credit: Teijin Automotive Technologies

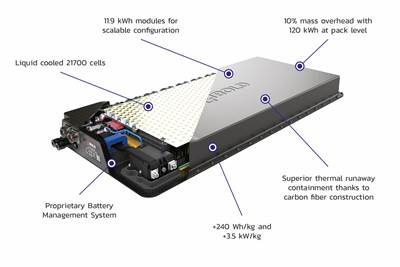

As the automotive industry rapidly electrifies its fleets, interest is growing among OEMs and battery module producers in using composite materials for battery enclosures — covers and trays that hold and protect the frames and battery cells themselves. There are many reasons for this and chief among them is the ability to reduce mass and stack tolerances. Reportedly, empty metallic battery enclosures add 110-160 kilograms to vehicle mass and are now the heaviest component on battery electric vehicles (BEVs) — and that’s before battery packs are loaded.

Another problem is that battery enclosures are multicomponent assemblies. As each component is attached to the previous one, the space taken up by the entire assembly is additive (i.e., it grows taller/thicker). Since different components in a battery, let alone a vehicle, may be designed and produced by different suppliers, if care is not taken to not exceed the total packaging space available, then a complex system like a battery pack can arrive at the assembly line needing more space than vehicle engineers can accomodate. With metal, it is far more challenging and costly to form battery enclosures into complex shapes, which means they must be produced in more pieces that take up more space. However, owing to their high design freedom and parts consolidation opportunities, composite enclosures can be designed into more efficient shapes that require less space. This has numerous benefits, as will be discussed further on.

There is also the poor impact performance of metals. This potentially affects the durability of the battery tray (on which cooling systems are mounted) which is regularly pelted with road debris kicked up by tires. It also can make it more challenging to pass side- and offset barrier-impact tests when attempting to certify the safety of new vehicles. Corrosion is a well-known issue, but less obvious is the fact that, being thermally conductive, metals can transmit heat from inside the modules during normal charging/discharging operations, as well as in thermal runaway events. Metals can also conduct external heat into the battery packs, making it more difficult to keep them operating in the ideal range. Since most battery modules today are packaged under the passenger compartment, mitigation efforts are required to prevent metal enclosures from conducting heat or flame into vehicle interiors long enough to permit occupants to exit (or be helped out by rescue crews) should battery packs become severely damaged. Hence today’s battery enclosures must pass increasingly challenging flame tests — often held for significant periods of time at high temperatures and pressures.

In each of these areas, composite battery enclosures offer quantifiable benefits versus metals: lower mass, higher design freedom with greater space efficiency, faster assembly, no corrosion, greater durability and — with specific formulations — better flame resistance/fire containment. This superior performance can also be cost-neutral or lower cost compared to benchmark metal designs.

No material is without its challenges, however. While thermal insulation is a benefit, electrical insulation requires its own mitigation to ensure battery packs are protected from nearby and onboard electrical signal sources, and that battery modules don’t generate signals that can affect proper operation of other onboard electronics, including advanced driver assistance systems (ADAS). In this article, CW covers the evolving world of simulation, ongoing efforts by Tier suppliers producing battery enclosures, and conductive additives. Part 2 will look at work being done with battery enclosure materials.

Engineering insights

As is so often the case with structural composite applications, particularly those involving discontinuous fiber reinforcement, it is critical to have access to the right virtual prototyping tools and material cards to rapidly and accurately evaluate material and process options in different battery enclosure designs. This helps bring programs to market faster by quickly eliminating designs and materials unlikely to succeed while reducing the time and cost of conducting multiple rounds of “make and break” (molding and physically testing) parts.

As discussed later in this article, many of the Tier suppliers producing battery enclosures have focused on developing their own material cards for composites they formulate and compound in order to increase simulation accuracy. And at least one company is developing its own simulation tools that interface with other major software packages. What do software suppliers themselves have to say about the evolving market for composite EV enclosures?

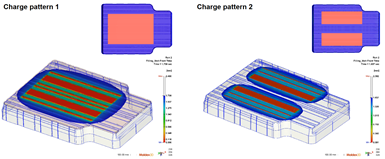

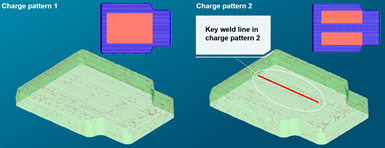

Hexagon analysts have conducted many studies on the impact of processing choices on the final performance of composite parts — especially those with discontinuous fiber reinforcement. For example, choosing one large SMC charge (top left) versus two smaller charges placed adjacent to each other (top right) affects strength of the final part, owing to a weldline that forms where the two charges meet (lower images).Photo Credit: Hexagon AB

“We’ve seen an uptick in the usage of our composites material modeling software because of the move to automotive lightweighting and electrification,” explains Dustin Souza, Hexagon AB senior application engineer, manufacturing intelligence division. Hexagon (Stockholm, Sweden) offers modeling software and engineering services that help engineers design with and reduce mass for a variety of polymer and composite structures. “We’ve had an increasing number of requests to help companies better model their battery covers and trays,” says Souza, noting that the materials Hexagon typically analyzes range from short fiber injection to sheet molding compound (SMC) to continuous fiber composites.

“I anticipate that an injection molded composite will likely be the most successful type of material used for this application in the future — as opposed to today’s SMC or even continuous fiber composites,” notes Souza. “That’s because of the extensive history and experience within the injection molding community, the recyclability of such materials — which aligns with greater interest in sustainability — and the speed of manufacturing that process offers. Speed will be critical when ramping up to higher volume EV production.” He adds that glass or carbon fiber reinforcement will likely be selected based on the class of vehicle and performance requirements involved.

Dassault Systèmes SE (Vélizy-Villacoublay, France) produces software for molecular and product design, structural and manufacturing simulation, and other 3D-related products. With a strong focus on laminate-type composite structures, the company has recently updated its 3DExperience platform (release R2022x) with features that should help analysts working with such materials in battery enclosure designs.

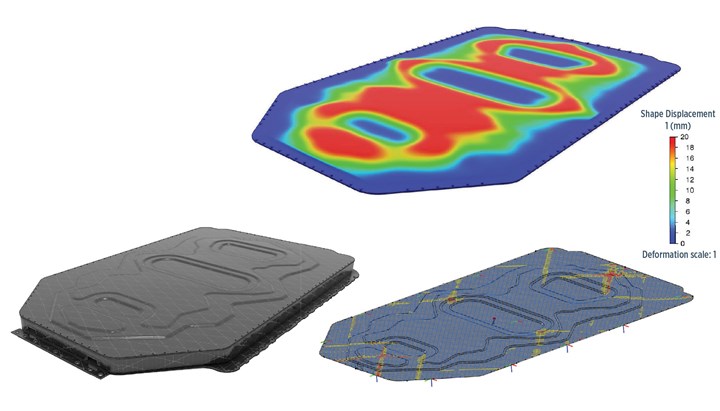

“Our latest offering provides the possibility to automatically generate beads on a shell that enhance its structural performance — much like eigenfrequencies — through generative design solutions,” explains Nicolas Guerin, Dassault Systèmes CATIA composite and generative design portfolio director. “However, unlike generative design based on topology optimization, this technique does not introduce cutouts in the cover. Rather it deforms the surface geometry with respect to the authorized orientations, such as emboss/deboss. By itself, this technique does not change the mass of the part, but it does improve its mechanical performance.” He adds that when coupled with the company’s CATIA composite design module, material anisotropy is considered and the software proposes the best bead pattern to ensure that requirements for frequencies, displacements and strength are respected. The Abaqus solver is used to assess the mechanical response, after which the enhanced design is reviewed for manufacturability.

To showcase the capabilities of the latest release of its 3DExperience platform, the team at Dassault Systèmes conducted a feasibility study on a generic laminate-based battery cover with 40 plies of material totaling 5 millimeters thick. The top image is a post-process visualization of the bead optimization with suggested emboss depth; the lower left image is a rendering of the optimized cover connected to the rest of the case; and the lower right is the result of a manufacturability analysis of the forming process with beads. Photo Credit: Dassault Systèmes SE

“With a quick producibility simulation of the whole ply stack, we can minimize the overall deformation in each ply to reflect sliding that is allowed during forming, then calculate the deformation and deviation in each ply, the sliding at the interface between plies, as well as the instantaneous calculation of the corresponding blank shapes,” continues Guerin. “This provides an excellent starting point for the estimation of material qualities and the preparation of the detailed simulation model.”

Tier supplier challenges

Automotive Tier suppliers face a changing landscape when it comes to producing EV battery enclosures, including looming changes in battery pack energy density and potentially even battery chemistry, more demanding battery safety requirements and a rapid increase in the rollout of EV programs, plus continuing supply challenges.

Teijin Automotive Technologies

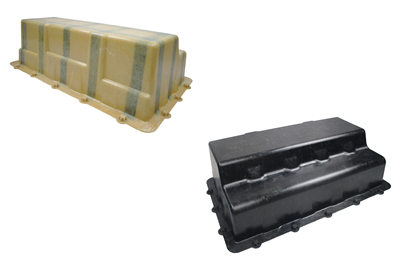

Teijin Automotive Technologies (Auburn Hills, Mich., U.S.) compounds its own SMC and designs and produces a variety of compression molded thermoset and thermoplastic composite parts for the automotive, truck and industrial market segments — including more than a decade of experience molding EV battery covers and full enclosures for OEM customers and their electrification partners in North America, Europe and Asia. The company had this to say when asked about materials specification trends in battery enclosures.

With over a decade of experience designing and molding enclosures for EV battery modules, Teijin Automotive Technologies offers significant experience in materials and process selection to develop solutions that meet OEM performance requirements and cost targets. Photo Credit: Teijin Automotive Technologies

“Typically, OEM customers don’t specify the type of composites; they ask us for our recommendation based on their specific needs,” explains Mike Siwajek, Teijin Automotive vice president R&D. “We’re a compression molder, mostly of thermoset SMC, although we also mold some thermoplastic composites. Our solutions for battery enclosures have traditionally been SMC, owing to the demanding requirements. However, we’re starting to see potential need for continuous reinforcement, so we’ve been looking at RTM [resin transfer molding] and LCM [liquid composite molding, also called wet compression molding] as core technologies, both of which we have in-house but that we’ve rarely been asked to use for the EV enclosures market. More recently, we’ve fielded requests for specific chemistry, such as phenolic, but we still work with our customers to understand the needs of each application and then offer the material/process solution we feel best fits that application.”

Siwajek adds that since battery covers and trays can have different requirements, taking a mixed-materials approach is a viable path forward. For example, Teijin Automotive’s enclosure designs typically use discontinuous glass reinforcement but, where more structural materials are needed, the team can readily combine unidirectional (UD) or multidirectional continuous fiber forms with traditional, randomly oriented chopped rovings. Additionally, he says the chemistries most commonly used in SMC, RTM and LCM — unsaturated polyester (UP), vinyl ester (VE), phenolic and epoxy — are similar enough to use a complete composite design without much difficulty, although the company can also co-mold with metallic elements or combine composite and metal in an assembly.

Beyond mechanical performance, other criteria are also important. “Earlier —maybe 10 years ago — there was significant concern about temperature management of the battery environment, but that seems to have been addressed by the battery manufacturers through electrolyte chemistry,” continues Siwajek. “Fortunately, SMC is a robust material even at extreme temperatures. However, flame and smoke targets are crucial aspects of our formulations, and we incorporate unique chemistries and filler packages to meet thermal runaway requirements. There’s also an additional component of durability in a thermal event that we address through part design.”

He adds that while boosting resistance to electrostatic dissipative (ESD), electromagnetic interference (EMI), radio frequency interference (RFI) and even 5G signals hasn’t been the focus of most customers, it is of concern for some. “We have ways to mitigate shielding requirements, but we offer them on an as-needed basis since they often can adversely affect cost,” he explains.

What challenges has the company been fielding? “While composites don’t traditionally have available material cards [for use in simulation software], we’ve made a concerted effort to create them for our higher volume materials and those we see as crucial for the EV market,” responds Siwajek. “This initiative has proven useful for our design teams and our customers.”

What about all the supply shortages, especially in light of rapid increases in fleet electrification? “In the current market, production capacities are absolutely a concern for OEMs, and such choke points will ultimately affect the Tiers, although we always consider and address capacity according to the business case,” explains Siwajek. “Of more direct concern to us, though, are shortages of many of the raw materials we use in our formulations.”

Magna International

Another company, Magna International Inc. (Aurora, Ontario, Canada), has produced EV battery trays in metals through its Cosma division since 2011. Its Exteriors business was recently awarded its first composite battery cover for a program starting production in 2024. In addition to producing automotive and commercial vehicle components at facilities in 28 countries, the company also offers design, engineering, CAE analysis and prototyping support to customers.

“To help make our simulations more accurate, we’ve been working on our own simulation capabilities to better predict material flow and structural performance, plus we also conduct our own materials characterization and build our own material cards for use in CAE packages,” explains Brian Krull, Magna Exteriors global director of innovation. “This increase in capability will help us design and engineer more efficient, lightweight solutions for future developments. These advances will further drive confidence in the use of composite materials in structural applications.”

Krull notes that Magna Exteriors has been involved in development activities with OEMs on composite battery enclosures since 2019. The initial focus was on compression molded SMC with flame-retardant (FR) UP or VE matrices. This technology offers a good balance of moldability and fire/thermal performance as well as opportunities to overmold inserts, locally reinforce with continuous fiber materials and co-mold crossmember beams.

However, as the energy density of batteries continues to increase, he says Magna is fielding more requests for composites with very high fire and thermal resistance, plus resistance to internal pressures to withstand thermal runaway events for up to five minutes to meet evolving global standards. In fact, the team is even seeing composites being considered as a thermal barrier in some metallic-enclosure constructions. That, in turn, provides opportunities for higher performance resins like phenolic. Depending on the size and complexity of battery enclosure components there may even be opportunities for injection or injection/compression molded thermoplastics.

Magna Exteriors has been working with OEMs, suppliers, engineering partners and laboratories to develop multiple product offerings that meet stringent UL 2596 box thermal runaway test requirements with a resin system that addresses flame and smoke toxicity in wall sections of 3.0 millimeters or less without compromising moldability or design freedom. Photo Credit: Forward Engineering North America, LLC/Magna Exteriors

“We continue to explore various composite materials technologies, including continuous and discontinuous fiber, to improve functionality, minimize mass and cost, and maximize performance,” adds Krull. After collaborative work with both global suppliers and OEM partners, Magna has developed patent-pending multi-material enclosure solutions featuring flame retardant composite covers and hybrid trays combining both aluminum and composites. These systems are lightweight and said to offer excellent performance against extreme temperatures, pressures and flame in the case of thermal runaway events. “With our CAE expertise, we can offer a tailor-made solution that combines discontinuous and continuous fiber composite materials for local stiffening that also meets high internal pressure thermal events,” he explains.

Another issue Tier suppliers are closely watching is the need to dissipate electrostatic charges from cables and battery enclosures to ensure proper functioning of other onboard electronics. Krull adds that OEMs have different strategies to overcome EMI/RFI issues, with some integrating shielding at the component level while others focus on shielding the enclosure itself. He says Magna has developed a patent-pending EMI/RFI solution for battery covers that provides shielding effectiveness over a wide range of frequencies and can easily be integrated into a complex geometry at low cost.

What challenges does the industry face with the rapid ramp up of EV programs? “These are large parts that require high tonnage presses with big platens, so capacity is something we’re keeping a close eye on, although Magna is ready and willing to deploy capital resources for the right program and location based on OEM needs,” adds Krull. “Another potential issue with the use of thermoset materials is the ability to recycle or reuse parts at end of life. To meet future sustainability requirements, material suppliers will be required to formulate sustainable and recyclable options that not only meet the mechanical and thermal performance for battery enclosures, but also hit automaker price targets.”

STS Group

Formed in 2013, STS Group AG (Hagen, Germany) is a global supplier of composite components and systems for automotive and commercial vehicles with a focus on emissions reduction and alternative powertrains. The company has supplied SMC battery covers for multiple programs in China since 2019 and is nearing production on programs expected to launch in Western Europe next year. Anticipating growing demand in North America, the company broke ground on a new SMC molding facility in Virginia this summer. STS is vertically integrated, so it not only compression molds SMC parts but also formulates and compounds its own material and provides design and engineering support. A sister division produces laminate composite parts for the performance automotive segment.

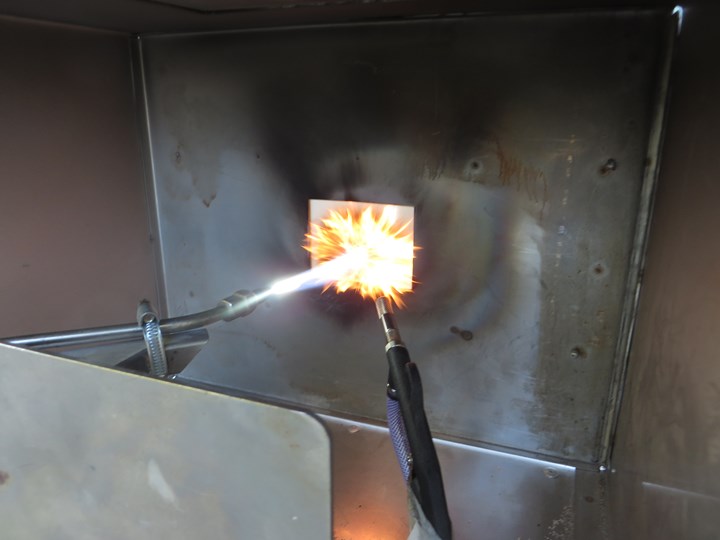

STS Group works with materials suppliers, OEMs and battery-module producers to develop formulations that meet specific flame exposure requirements for EV battery covers. The company not only can perform in-house UL 94 testing, but has developed its own internal procedure (above) to evaluate the flame-exposure performance of STS’ own SMC formulations. That method is said to be adaptable to meet specific test requirements from OEMs and battery-module producers. Photo Credit: STS Group AG

“Mechanical and fire performance and fast processing have made SMC a great challenger for battery covers, and our current formulations are based on chopped glass fibers with polyester or vinyl ester resin,” notes David Ponce de Leon, STS North America director of sales and business development. “However, the higher mechanical requirements for battery trays are best served by using high-performance SMC or carbon prepreg. Anticipating [that] battery energy density will increase, and OEMs will require higher performance in the near future, we’ve spent the last three years validating phenolic and epoxy matrices with continuous glass or carbon fiber rovings or fabrics that can provide residual mechanical performance after long exposure to high temperatures. In parallel, we’ve worked on EMC [electromagnetic compatibility] and intumescent formulations.”

Ponce de Leon adds that few automakers rely solely on a material’s UL 94 V-0 performance. Rather, OEMs and some battery-module suppliers tend to require specific flame-exposure testing, such as continuous exposure to an 850°C flame for five minutes with repeated exposure for one minute to temperatures of 1,250°C. In that context, to test the effectiveness of its own SMC formulations, STS has developed its own internal test method. The process involves repetitive cycles alternating between flame exposure at 1,400°C and sand blasting. The test can be modified to meet specific OEM or battery-module producer requirements. He adds that STS’ SMC formulations are always designed with raw materials that don’t generate brominated or chlorinated compounds and with industrial production in mind. He adds that flow behavior is the main limitation to fire performance improvements with current SMC formulations.

TPI Composites

TPI Composites Inc. (Scottsdale, Ariz., U.S.) is another supplier that is producing composite battery enclosure components for an undisclosed vehicle and OEM currently ramping up major programs in multiple geographies. Best known for its work in composite wind blades, TPI also produces a variety of composite components for passenger vehicles, commercial trucks, light rail and buses, and has roots in the high-performance sail and powerboat markets.

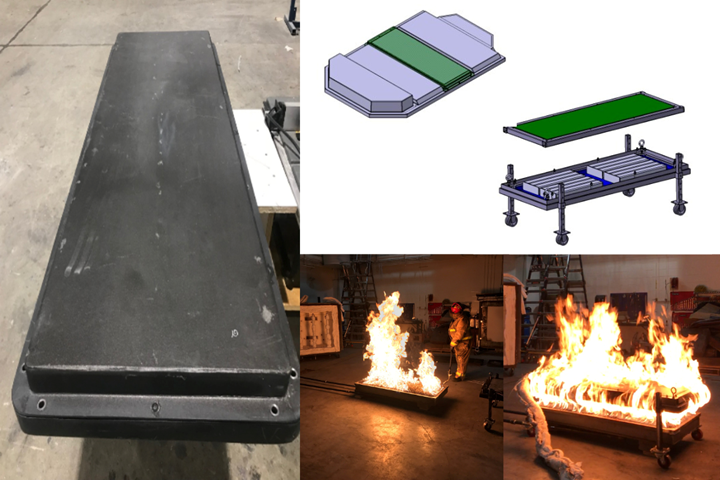

TPI reports that it has conducted extensive down-selection work on fire protective systems for EV battery enclosures, including cone calorimetry tests on multiple resin systems and fire-protection layers, as well as subcomponent testing, direct torch burn-through testing and more. The goal in each case is to minimize cost and weight and assure manufacturability. Photo Credit: TPI Composites Inc.

“The thing that’s really driving OEMs today is finding a way to create the safest battery system that’s also cost effective and mass efficient, which is becoming more challenging as production volumes really start to ramp up,” explains Todd Altman, TPI senior director, transportation business unit. “Battery packs are very sophisticated systems, and enclosures have a multifaceted role: to protect vehicle occupants from internal fires, protect modules from external fires, protect cells from damage during severe impacts, keep batteries at optimal temperatures and provide adequate stiffness to carry the system long term.”

He adds that composites’ ability to reduce mass, assembly and stack-up tolerances, offer superior and integrated fire protection, reduce moisture and corrosion issues, and still meet mechanical performance is a strong selling point. Additionally, composites help bring products to market faster than traditional metal stamping. Altman predicts dramatic shifts in composites’ penetration of this segment in the coming years. He says that TPI has spent six years developing and validating a variety of material/process options that are tunable to meet a range of mass, cost and other performance requirements. These are largely based on continuous fiber (glass, carbon or a mix) impregnated with either phenolic or a high-temperature FR epoxy for high-pressure RTM, LCM and other technologies.

“One of the signature benefits of composites is that they offer significant flexibility to tune a solution — via resin, reinforcement and processing — to meet very specific performance requirements,” continues Altman. “We’ve invested a lot of time and energy developing an elegant package to address fire protection, EMC/EMI shielding and more. Our systems have passed demanding thermal tests at four major EV manufacturers and we’ve heard very positive feedback. When you combine this with our global manufacturing footprint — in the U.S., Mexico, Turkey, India and China — we can easily support the auto industry’s drive to dedicated EV platform needs.” He adds that TPI also is involved in advanced development programs for battery enclosures on Class 4-8 electric trucks that are expected to launch in the 2023-2024 timeframe.

Tiny but mighty

Additives are an important element of formulation work to change the functionality of composite materials. Nanoparticle additives — particularly graphene nanoplatelets (GNP) — are starting to play a role in battery enclosures by helping these normally thermally and electrically insulating materials shed heat better and shield battery modules against stray signals from a wide variety of external drivetrain power systems and other onboard and nearby electronics, including ADAS radar and LiDAR.

Advanced Material Development (AMD)

Advanced Material Development Ltd. (AMD, Guildford, U.K.) is active in commercializing technology in this area. The company funds research at universities in the U.K. and U.S. and works with industry partners to develop applications and prepare them for scale up, commercialization and, ultimately, licensing. AMD’s work is based on an enhanced “platform technology” for liquid processing of 2D (nano) materials, enabling applications in key areas such as advanced sensors, electronics and devices, composites and functional coatings.

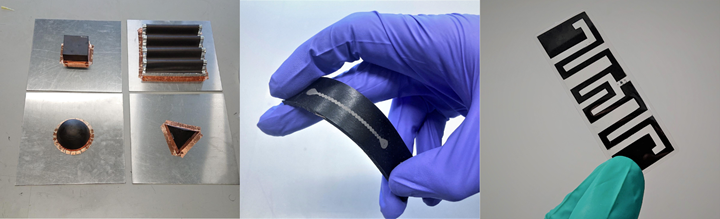

“We supply nanocarbon formulations in the form of additives, conformal or sprayable coatings, and flexible or stretchable films that can be integrated into plastics, composites, coatings and foams to protect sensitive components,” explains Paul Mumford, AMD director of business development. “Our chief market is with water-based solutions, although our formulations are also compatible with other solvents. The functionalities we can add to composites are EMI shielding and temperature management for non-metallic battery pack enclosures — essentially replacing the attributes of the aluminum shield they replace. In each case, we’re working with customers to find the most performant and cost-effective approach using our nanoparticle formulations.”

Among the many ways AMD says its GNP-based products can be used to enhance the performance and safety of EV battery packs is to boost EMI shielding of the composite enclosure to eliminate the need for an aluminum shield (left), as a printed strain sensor to monitor torque of a structure in real time (middle) and as a printed antenna to transmit sensor data (right). Photo Credit: Advanced Materials Development Ltd.

The coating can also be structured to act as a meta surface and allow a window to be dialed in that permits a small section of the frequency spectrum to be transmitted, while attenuating everything else. Through this window, systems can “talk” to each other, while all extraneous background radiation is blocked. The company also notes its coatings are specifically tailored to match substrate materials and maintain strong bonds across a broad range of temperatures and challenging environments.

Still other battery applications that AMD is exploring include the ability to embed structural health monitoring (SHM) within the enclosure itself. “Where required, we can print strain sensors on cell packaging that feeds sensor data on the status of the cell,” continues Mumford. “Additionally, we can print ultrasensitive strain sensors that monitor strain or torque in real time. As a nanoscale transducer, AMD’s graphene-based material is more sensitive, accurate and robust than many of the current surface-mounted strain-sensing units.”

NanoXplore

Another company involved in qualifying graphene for battery enclosures is NanoXplore Inc. (Montréal, Quebec, Canada), which claims to have the largest GNP production facility in the world, capable of producing 4,000 tonnes/year of graphene powder for use in the transportation and industrial sectors. In addition to developing new applications for GNP and producing standard and custom graphene-enhanced plastic and composite formulations, NanoXplore also owns several processors and produces precision plastic and composite parts for the automotive, medical, electro-mechanical and watchmaking markets.

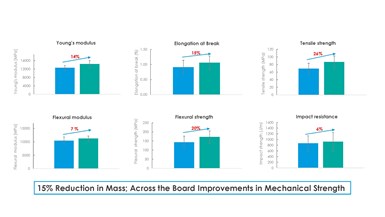

Recently, the company announced a long-term supply agreement with Molding Products LLC (South Bend, Ind., U.S.). The latter will compound graphene-enhanced SMC sold under the name GrapheneBlack SMC, which is said to provide up to 15% weight reduction versus conventional SMC of the same specific gravity at neutral cost on a component basis. Other benefits include increased strength (up to 26% higher tensile, compressive and torsional values) and stiffness (providing better resistance to vibrational loading), which provides concurrent opportunities to reduce nominal wallstock. It also improves sound damping, UV stability, chemical resistance and surface finish and paintability; reduces stress-crack resistance; provides process enhancements; and promotes flame retardancy and thermal conductivity.

Low loadings of GNP additive in SMC can have a significant impact on many properties. Above are graphs tracking SMC without (blue) and with GNP (teal) showing improvements in six mechanical properties. Photo Credit: NanoXplore Inc.

“With our partners Molding Products, we’ve developed a stronger, lighter, higher surface quality SMC that’s perfect for lightweight composite exterior body panels and battery enclosure components for passenger cars and trucks, and we deliver this superior performance without increased cost to the OEM,” says Tarek Jalloul, NanoXplore technical project lead. He adds that the company is close to commercializing its first transportation application with the GNP-enhanced SMC but can’t disclose further details.

Next month in Part 2, we’ll continue the discussion with a focus on materials development efforts.

Related Content

Mar-Bal expands SMC expertise through AltraSet materials division

The BMC company aims to fill the SMC market gap for those seeking optimal, low-volume demand with custom formulation and high material value.

Read MoreIDI Composites opens new global headquarters, manufacturing and technology center

The Noblesville, Indiana, facility includes SMC and BMC manufacturing, an R&D center and the company’s corporate headquarters.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreGraphene-enhanced SMC boosts molded component properties

CAMX 2023: Commercially sold GrapheneBlack SMC from NanoXplore increases part strength, stiffness and provides other benefits for transportation, renewable energy, energy storage and industrial markets.

Read MoreRead Next

Protocol aims to improve testing of thermal runaway for composite EV battery enclosures

Hyundai-Kia and Forward Engineering developed a resistive, heater-based material test, recently published as a UL standard, to aid and speed composite battery enclosure development.

Read MoreTroubleshooting thermal design of composite battery enclosures

Materials, electrical insulation and certification are all important factors to consider when optimizing electric battery performance against potential thermal runaway.

Read MoreSMC material configurations tailored to automotive battery enclosure design

SMC battery cover offers various module configurations, levels of performance, mass and cost for electric vehicles.

Read More

.jpg;width=70;height=70;mode=crop)