Arkema acquires Ashland’s Performance Adhesives business, reaches new growth milestone

Ashland’s high-performance adhesives portfolio available to the U.S. is key to supporting Bostik’s long-term growth ambition and its aim for an EBITDA margin above 17% by 2024.

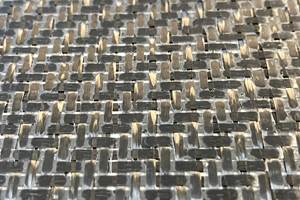

Ashland’s Performance Adhesives business covers a range of high-growth markets such as automotive, flexible packaging, wood bonding for construction, composites and more. Photo Credit: Ashland.

Arkema (Colombes, France) signed on Aug. 31 for the acquisition of Ashland’s Performance Adhesives (Dublin, Ohio, U.S.) business. Arkema says this project aligns with the group’s ambition to become a pure specialty materials player by 2024 and focuses its development on sustainable and high-performance solutions. It is also a key step in supporting Arkema’s adhesives solution business line, Bostik, and its ambition for strong, long-term growth.

“We are happy and proud of this move. In a context of strong earnings growth following the recent divestment of PMMA and the start of the strategic review of Fluorogases, the acquisition of Ashland’s adhesives

business is a fantastic opportunity to reinforce the group’s presence in the U.S. and to accelerate Bostik’s growth,” says Thierry Le Hénaff, Arkema’s chairmain and CEO. “With an excellent business which holds leading positions in many high-growth segments and a high level of profitability, this project fully aligns with the group’s targeted acquisition strategy. Ashland’s adhesives will constitute a new technological platform for our adhesives and the synergies are particularly high, given the geographical and application complementarities with Bostik and our Coating Solutions platform. The cultures of the teams are very close, focused on customer centricity and sustainable innovation. We look forward to welcoming Ashland’s high-caliber management team and to partner together for this highly value creative deal.”

With estimated sales of around $360 million (including pro forma adjustments) and an estimated EBITDA of around $95 million (also including pro forma adjustments) in 2021, Ashland offers a portfolio of high-performance adhesive solutions in high-value-added industrial applications.

The technological, geographic and commercial complementarities of this acquisition will enable Bostik to expand its offering and position itself as a major player in high-performance industrial adhesives.

Further, with its large range of key technologies and well-known brands, Ashland Performance Adhesives is a key player in pressure-sensitive adhesives in the U.S., operating in high-growth applications (decorative, protection and signage films for automotive and buildings, in particular). Combined with Bostik and the Coating Solutions segment’s sustainable and high-performance solutions, its range will reportedly represent one of the most complete offering in the pressure-sensitive adhesives sector.

Ashland also holds significant positions in structural adhesives in the U.S., Arkema notes, especially in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Finally, Ashland Performance Adhesives offers a wide range of adhesives for flexible packaging, addressing growing demand for more sustainable products. Ashland’s Performance Adhesives business, which employs approximately 330 people and operates six production plants, mainly in North America, has enjoyed sustained growth in recent years and has significant growth potential in Europe and Asia. Combined with Arkema’s global positioning, the technological, geographic and commercial complementarities of this acquisition will enable Bostik to expand its offering and position itself as a major player in high-performance industrial adhesives.

This acquisition also upgrades the 2024 profitability target for Arkema’s Adhesive Solutions segment, which now aims for an EBITDA margin above 17%, with sales of more than €3 billion.

Overall, this project offers significant pre-tax synergies estimated at more than $45 million, which will be progressively implemented over the next five years. They will focus on the commercial development of globalized solutions in high-growth segments, procurement synergies through Arkema’s acrylics business and industrial optimizations.

Given these synergies and the anticipated growth over the next few years, the enterprise value/EBITDA multiple will be reduced to 8.7 times in 2026 after taking account of the tax benefits linked to the structure of the transaction, Arkema says, which are estimated at more than $200 million.

This deal will be financed fully in cash, and the level of net debt including hybrid bonds on closing will remain tightly controlled at 1.9 times the 2021 pro forma EBITDA (estimated 2021 Group EBITDA integrating the full year impact of M&A operations already announced in 2021), in line with Arkema’s objective to maintain this ratio below two.

Furthermore, this business represents a high EBITDA-to-cash conversion rate, above the group’s long-term targets, given the tight control of working capital and limited capital intensity. Within the first year of integration this deal will have an accretive impact on net earnings per share and the accretive impact will reach €1 per share by 2026.

Related Content

Pro-Set named official materials supplier for New York Yacht Club American Magic

Competitive sailing team prepares for the 37th America’s Cup beginning in August 2024 with adhesives, resins and laminate testing services for its AC75 monohull construction.

Read MorePark Aerospace launches aerospace, MRO structural film adhesive

Aeroadhere FAE-350-1 is a curing epoxy formulation designed for composite, metal, honeycomb and hybrid applications.

Read MoreHenkel releases digital tool for end-to-end product transparency

Quick and comprehensive carbon footprint reporting for about 58,000 of Henkel’s adhesives, sealants and functional coatings has been certified by TÜV Rheinland.

Read MorePontacol thermoplastic adhesive films are well-suited for composite preforms

Copolyester- and copolyamide-based adhesive films eliminate the need for sewing threads or binders when stacking laminates while improving the final part’s mechanical properties.

Read MoreRead Next

Arkema acquires 10% stake in additive manufacturer ERPRO 3D Factory

Investment enables Arkema to accelerate new development opportunities for high-performance polymers and potential fiber-reinforced materials in additive manufacturing.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More