Hexagon Purus announces contract with New Flyer, results for Q4 2023

Supply of Type 4 composite H2 storage tanks for North American bus market extended, 2023 revenue up 37% due to H2 infrastructure solutions, heavy-duty truck, bus and aerospace, with 50% revenue increase expected in 2024.

Share

Hexagon Purus (Oslo, Norway) has announced key developments that occurred in Q4 2023. “In 2023, Hexagon Purus achieved significant growth,” says Morten Holum, CEO of Hexagon Purus. “The lion’s share of the investment program is completed, and we are now moving into the ramp-up and operational execution phase. With positive gross margins on customer deliveries, the EBITDA margin will continue to improve as the utilization of the new capacity increases. Over the past few years, we have delivered transformational growth, with revenue the last 12 months now more than seven times higher than in 2020. We have a solid foundation for 2024 and I remain confident that we will continue to deliver on our short- and medium-term targets.”

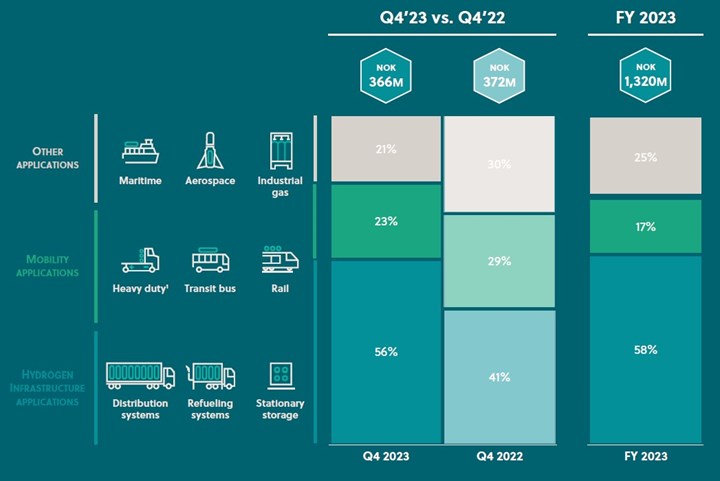

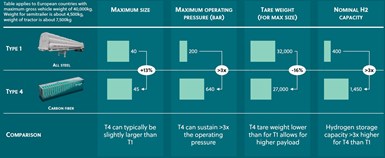

Hexagon Purus achieved 37% growth in revenue for 2023, led by infrastructure solutions, heavy-duty truck, bus and aerospace (top). It reports weight and storage benefits driving its Type 4 carbon fiber composite tank solutions versus legacy Type I steel tanks (bottom). Source | Hexagon Purus

In Q4 2023, Hexagon Purus generated NOK 366 million in revenue. About NOK 40 million of revenue was pushed out to Q1 2024 due to technicalities related to revenue recognition. Hydrogen (H2) infrastructure solutions continue to be the main driver of growth, coupled with increasing activity within mobility applications, including heavy-duty vehicles and transit bus as well as aerospace. For the full-year 2023, revenue ended at NOK 1,320 million, up 37% compared to full-year 2022.

Total assets at the end of the Q4 2023 amounted to NOK 3,773 (versus 2,655 million in FY 2022). The year-over-year increase in total assets is mainly driven by increases to property, plant and equipment as part of the ongoing capacity expansion program, combined with an increase in working capital to address a higher activity level. Trade receivables increased to NOK 275 (229) million in Q4 2023 and inventory stood at NOK 482 (332) million. The company’s working capital reflects growth throughout 2023, which is expected to continue into 2024.

Net cash flow in Q4 2023 was NOK -138 (16) million from operating activities and NOK -111 (-118) million from investing activities, of which NOK -105 million is investments in production equipment and facilities for the ongoing capacity expansion program. Net cash flow from financing was NOK -18 (10) million. The majority of outflow from financing is related to lease payments, which amounted to NOK -17 (-9) million in 4Q 2023. Cash and cash equivalents ended at NOK 307 (382) million.

Outlook

The clean H2 industry is facing headwinds in terms of higher construction and operating costs and higher cost of capital on the back of rising interest rates. This has resulted in a higher levelized cost of renewable H2, which has slowed down development of the global H2 industry compared to previous expectations. However, as announced by the Hydrogen Council in December 2023, roughly 1,400 H2 projects have been announced worldwide, up more than 35% compared to the number of projects announced in May 2023. The majority of these projects have been added in Europe, and $570 billion in direct investments has been announced in total through 2030, of which approximately 7% have passed the final investment decision (FID) stage. Of the 1,400 projects, more than 70% are expected to be in full or partial deployment by 2030.

For Hexagon Purus, recent market developments have resulted in a slower market for H2 mobility than expected a few years ago. This has been offset by a much stronger market for H2 infrastructure solutions.

Hexagon Purus’ firm customer purchase orders backlog stood at approximately NOK 1.3 billion as of Q4 2023, with the vast majority for execution during 2024 — which is expected to continue to grow as 2024 progresses — mainly driven by call-offs from already secured long-term agreements with companies including Air Liquide, Linde, Lhyfe, Nikola, Solaris, Hino and Daimler.

Hexagon Purus is expecting revenue growth of at least 50% year-over-year in 2024. 2025 is also expected to be a year of significant growth, as several long-term agreements are maturing and in tandem with higher utilization of the production footprint. The company retains its target of NOK 4-5 billion of revenue in 2025. Improving profitability and reaching EBITDA break-even in 2025, combined with prudent and restrictive capital deployment, is of critical importance. Initiatives are underway to underpin and build momentum towards reaching profitability by 2025, focused along three axes:

- Maximizing capacity utilization: Ramp-up and high utilization of production capacity footprint and a newly installed asset base.

- Operational improvements: Operational excellence with a focus on quality, reducing scrap and inventory management.

- Minimizing capital spend: Complete current capacity expansion program, including anew Dallas, Texas facility, but limits to new investments beyond already committed investments or initiated capacity expansion programs. Hexagon Purus will also put a focus on optimizing working capital position.

These initiatives, combined with the expected revenue growth and mix for 2024, are expected to further improve Hexagon Purus’ gross margins in 2024. Combined with continued cost consciousness throughout the organization, this growth is expected to bring benefits of further operating leverage to the fixed cost base in 2024. Hexagon Purus’ largest business unit — the H2 infrastructure and mobility business — is expected to reach EBITDA break-even in 2024 (excluding the Chinese joint venture). Additionally, initial revenue from the Hino and Daimler programs in 2024 for the battery systems and vehicle integration business unit will help absorb parts of its cost base.

Consequently, 2023 was the expected trough from a group EBITDA perspective, and significant improvements to its margin are expected in 2024. The company retains its target of reaching EBITDA break-even in 2025. (Learn more: HPUR Q4 2023 report and HPUR Q4 2023 presentation.)

Hexagon Purus selected by New Flyer for the fourth time

Hexagon Purus has been selected to supply Type 4 composite H2 cylinders for the fourth year in a row by New Flyer (Winnipeg, Canada), a global manufacturer that delivers low- and zero-emission heavy-duty transit buses to customers across the U.S and Canada (read “Longtime partner New Flyer selects Hexagon Purus to outfit hydrogen transit bus”). The cylinders will be delivered throughout 2024.

Purus will continue to provide its Type 4 H2 storage cylinders for New Flyer’s next-generation, zero-emission H2 fuel cell electric transit bus, the Xcelsior Charge FC, which enables a driving range of 370+ miles/600 kilometers on a single refueling. The total value of this contract is estimated to be approximately $4 million.

Production of the Type 4, Buy America compliant H2 storage cylinders will be out of Hexagon Purus’ facility in Westminster, Maryland. (See also, “Hexagon Purus Westminster: Experience, growth, new developments in hydrogen storage.”) Since 2020, Hexagon Purus has delivered H2 cylinders for well over 100 New Flyer fuel cell electric transit buses.

“Transport accounts for around 20% of global greenhouse gas emissions and H2 can play an important role in cleaning up this sector,” says Michael Kleschinski, EVP H2 mobility and infrastructure for Hexagon Purus. “We are proud to be part of New Flyer’s effort in decarbonizing transit bus operations in North America. We have delivered H2 cylinders for New Flyer transit buses for 4 years, and each year our contract size has grown, highlighting our strong relationship … and strong market position now with both U.S. and European bus OEMs.”

Related Content

Hexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreOn the radar: Cryogenic testing of composites for future hydrogen storage

Netherlands, U.K., France, Germany and the U.S. build up test capability, look at thermoset and thermoplastic composite materials.

Read MoreUpdate: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreRead Next

Flagship Climate Impulse project targets non-stop, green hydrogen-powered flight

Bringing on Syensqo as its main materials and technological partner, Swiss explorer Bertrand Piccard hopes to stimulate climate action by demonstrating disruptive solutions in this 2028 aircraft design.

Read MoreInfinite Composites awarded $470K contract to develop larger, higher pressure H2 tanks

Manufacturing Type V composite pressure vessels, Infinite Composites will match this project with a recently received $1.6 million award from the Army for conformable hydrogen tanks.

Read MoreSirius Aviation reveals hydrogen VTOL aircraft, the Sirius Jet

Propelled by a hydrogen-electric propulsion system, the composites-intensive vehicle will take flight in two version options by 2025.

Read More

.jpg;maxWidth=300;quality=90)