Hexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Hexagon Purus manufacturing facility for Type IV composite tanks in Westminster, Md., U.S. Photo Credit: Hexagon Purus

Hexagon Purus (Oslo, Norway) is helping to combat climate change and drive energy transformation through its zero-emission energy storage solutions. A key milestone in this mission is the Jan. 26, 2022 opening of the new Hexagon Purus manufacturing facility for Type IV composite cylinders in Westminster, Md., U.S. These tanks are used to store compressed gas hydrogen (CGH2), and this facility, says the company, will help Hexagon Purus to meet the growing demand for zero-emission mobility and infrastructure systems as governments and industries worldwide increase their commitment to combating our worsening climate crisis.

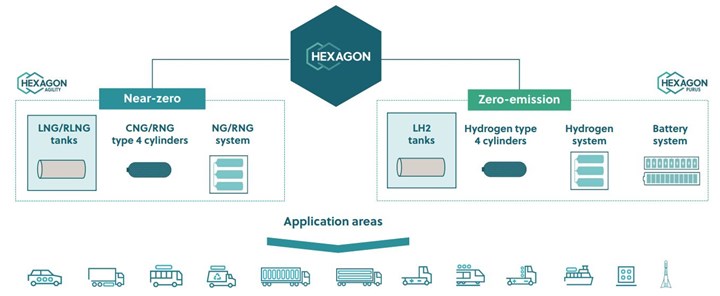

Photo Credit: Hexagon Group Q1 2022 results presentation, May 12, 2022.

The 60,000-square-foot (5,574-square-meter) facility in Westminster will support production of up to 10,000 cylinders/year for heavy-duty vehicle applications and will employ up to 150 skilled workers. This new facility expands cylinder production capabilities and has space to install additional production equipment as demand for hydrogen storage cylinders continues to grow.

“We are currently providing hydrogen storage solutions for several heavy-duty trucking and transit bus OEMs such as Nikola, Hino and New Flyer, that demand the highest standards,” says Dr. Michael Kleschinski, EVP at Hexagon Purus. “This site will serve a dual role, not only as a top-of-the-line production site but also as a technical center of excellence, providing engineering and research and development.”

“Deciding on the site for this world-class facility was an easy choice,” adds Jim Harris, managing director at Hexagon Purus Westminster and VP of Hexagon Purus cylinders in North America. “Maryland continues to evolve and grow, allowing us to attract top talent in all areas of our organization.”

“As the nation looks to continue its growth in alternative energy, I am thrilled to have Hexagon Purus — a company focused on clean energy solutions through hydrogen and battery systems — located in Westminster,” says Westminster Mayor Dr. Mona Becker. “Not only will we benefit from their innovation, but we will also benefit from their economic development and the jobs which they will bring to the city.”

History in Type IV tanks, future production

Hexagon Purus was established in 2020, but its parent Hexagon Group (Ålesund, Norway) has a much longer history. Established in 2000 as Hexagon Composites, it acquired Ragasco and Raufoss Fuel Systems (Raufoss, Norway) and Lincoln Composites (Lincoln, Neb., U.S.) between 2001 and 2005.

Hexagon’s four business units in 2023. Photo Credit: Hexagon Group

Ragasco invested in highly automated, high-volume production of liquid propane gas (LPG) tanks in 1998, Raufoss delivered its first compressed natural gas (CNG) cylinders for automotive/commercial applications in 1992 and Lincoln Composites produced filament-wound carbon fiber rocket motor cases for NASA in 1963.

Hexagon then acquired Agility Fuel Solutions (Costa Mesa, Calif., U.S.) and xperion Energy & Environment (Kassel, Germany) from AVANCO (Herford, Germany) in 2016 to extend its systems capabilities in the U.S. and carbon fiber Type IV tank production in Europe.

Hexagon Purus Type IV CGH2 cylinder production in Kassel, Germany. Photo Credit: Hexagon Group

Thus, Hexagon’s vision for clean energy transformation has continued for more than 20 years, as has its investment, evidenced most recently by this new facility in Westminster, Maryland.

Hexagon Purus is also expanding its operations in Europe and China. In June 2022, Hexagon Purus in Kassel, Germany, broke ground for its newest 38,800-square-meter facility which will house production and a development and pilot production center for new products. Groundbreaking was also scheduled for Q2 2022 in Shijiazhuang, Hebei, China, for a new joint facility by Hexagon Purus and CIMC Enric (Shijiazhuang, China) to manufacture Type III and IV composite cylinders and systems. Similar to Westminster, the Shijiazhuang facility will begin with a capacity of 10,000 cylinders/year. It is slated to then scale to 100,000 tanks/year by 2030. In addition to this facility, the CIMC-HEXAGON New Energy Technologies management office and engineering hub will be located in the Beijing Daxing District International Hydrogen Development Zone.

“We are growing and expanding,” says Morten Holum, CEO of Hexagon Purus. “We provide solutions to help solve one of the greatest challenges to people on this planet: global warming. We see unprecedented growth in demand for our products and technology. This is the energy transition. This is our purpose and why we are investing here in this facility.”

Mayor Becker agreed and quotes newly inaugurated Maryland governor Wes Moore: “Clean energy will not just be part of Maryland’s economy but will define Maryland’s economy.”

History in Maryland, future in Westminster

Hexagon’s history in Maryland began in Taneytown, where MasterWorks Inc. was producing roughly 1,200 Type III and IV pressure vessels per year for a range of applications, including commercial launch vehicles and manned spacecraft propulsion systems. Hexagon acquired MasterWorks in 2014.

Morten Holum, Hexagon Purus CEO (left), and Jim Harris (right), managing director at Hexagon Purus Westminster. Photo Credit: Hexagon Purus

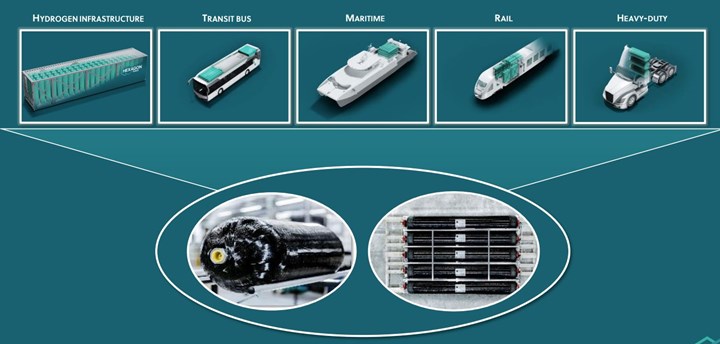

Hexagon Purus is delivering hydrogen storage systems to a wide range of transport and infrastructure applications. Photo Credit: Hexagon Purus

“This has been a journey that started 11 years ago,” says Harris, who was previously managing director at MasterWorks. “Hexagon approached us and then acquired us. Now, we are building Type IV tanks for transit buses, heavy-duty trucks and infrastructure applications.”

The latter includes containerized distribution of hydrogen from production sites and also mobile refueling units. “And we are still manufacturing aerospace tanks as well,” adds Harris. “Our heritage aerospace fuel storage solutions include the NASA Commercial Crew Program which has supported every U.S.-based manned space mission since 2018.”

The preparation of this facility began two years ago, says Harris. “We saw the coming growth and understood we needed to expand. Hexagon Purus management in Norway worked with us starting in late 2020, and our thanks go to the authorities in Westminster, Carroll County and the state of Maryland in helping us to secure and prepare this facility. Thanks also to our amazing team, which began moving everything from Taneytown after Thanksgiving, and within eight weeks has set up our operations in this modern facility. Here, we will produce the most efficient hydrogen storage systems for the mobility and infrastructure markets.” Kleschinski notes this facility will also be the global center of excellence for Hexagon space and aviation pressure vessels.

Hydrogen vs. CNG tanks, buses and trucks

The tanks made in Westminster will use the same basic technology as those made by Hexagon Agility for CNG/RNG (renewable natural gas) storage, except they will contain H2, which is a much smaller molecule than methane (natural gas) and is typically stored at higher pressures of 350 and 700 bar versus the 200- and 250-bar tanks standard for CNG/RNG trucks and buses. Kleschinski explains that this combination requires a different design approach to meet safety requirements. “Hexagon Purus in Westminster will manufacture 10 different types of tanks based on our current list of customers,” he adds. That list will most likely grow, and Hexagon can accommodate its customers with a wide range of tank sizes and pressures, as explained in the 2021 article, “Hydrogen is poised to fuel composites growth.”

Hexagon Purus Westminster (top left, clockwise) 60,000-square-foot facility with room to install multiple new production lines; filament winding system with three bus tanks in process; CGH2 tanks certified for vehicle applications worldwide, and proof testing performed for every tank. Photo Credit: Ginger Gardiner, CW

The tanks Hexagon Purus produces for fuel cell buses store roughly 30-40 kilograms of CGH2 at 350 bar. Tanks for railcars also use 350 bar and store 200-250 kilograms of CGH2 for a range of 700-800 kilometers, while 700-bar tanks are used to store 70-80 kilograms of CGH2 onboard heavy-duty trucks.

Infrastructure applications such as distribution and mobile refueling modules use 250-517-bar tanks sized to fit into 20- or 40-foot containers. All of these tanks use significant amounts of carbon fiber, and if used in the U.S., a glass fiber outer wrap for fire protection per transportation regulations.

“We are working with several bus OEMs worldwide, including New Flyer here in the U.S. and Solaris and Caetano in Europe,” says Kleschinski. The CIMC-HEXAGON joint venture has also supplied Hong Kong-based Bravo Transport Services with a Type IV CGH2 storage system is working with Bravo to develop more such buses within Bravo’s 1,700 transit bus fleet.

“Transit buses are a good market for hydrogen,” says Holum. “Hydrogen allows a high supply of power which meets the large energy demands on buses in hot or cold climates to power air conditioning and heating, in addition to propulsion. It also allows for flexibility in vehicle operation due to longer driving range and short refueling times.” Kleschinski notes refueling varies from 10-12 minutes for 350-bar tanks and 15-20 minutes for 700-bar tanks. Holum says the transit bus market in the U.S. is trailing versus Europe but looks optimistic for the next decade. “We see an uptick in sales for our customers and we believe sales will increase as transit fleet operators gain experience with fuel cell buses.”

Holum is also bullish on the heavy-duty truck market. “Nikola began serial production of BEV [battery-electric vehicle] trucks last year in Arizona and has already produced 10-15 units of their FCEV truck so far. They will start serial production of these FC [fuel cell] trucks in the second half of 2023.” Hexagon Purus is also supplying Toyota Motors North America (TNMA), who recently displayed its Kenworth hydrogen truck at the CES (Consumer Electronics Show) and has begun taking orders.

For the bus and truck markets, both BEV and hydrogen-powered fuel cell electric vehicles (FCEV) are needed, says Holum. “There are a lot of truck and bus duty cycles that can be met with BEVs, but there are also many duty cycles where you need hydrogen-powered vehicles as well. And you also need the recharging and hydrogen refueling infrastructure as well as the electricity and hydrogen supply to support that. OEMs are working on both types of vehicle platforms and there will be more fuel cell and hydrogen-powered vehicles developed. Hexagon Purus supplies both BEV and FCEV power systems so either way, the market supports our growth.”

About the hydrogen market

Hydrogen is a key contributor to the energy transition and continues to build momentum globally. More than 30 countries have released hydrogen roadmaps, and according to the Hydrogen Council’s state of the industry report Hydrogen Insights 2022, 680 large-scale projects announced globally reflect an investment of $240 billion until 2030, a 50% increase since November 2021. Green hydrogen is projected to supply up to 25% of the world’s energy needs by 2050.

The transportation sector accounts for about 20% of global carbon emissions. However, the demand for hydrogen in transport vehicles is increasing. According to the International Energy Agency’s (IEA) Global Hydrogen Review 2022, trucks and buses are driving hydrogen demand in transport due to their high annual mileage and heavy weight relative to electric cars. The number of heavy-duty hydrogen trucks increased 60-fold from 2020 to 2021, while demand from commercial vehicles — vans and trucks — has reached 45% of total hydrogen demand in the transport sector.

Related Content

Cryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreRead Next

Plant Tour: Agility Fuel Solutions, Salisbury, NC, US

This systems integrator enables CFRP pressure vessel growth in commercial vehicles by combining composites and alternative fuel systems expertise.

Read MoreHydrogen is poised to fuel composites growth, Part 2

Potential for Type IV composite tanks in H2 refueling stations and distribution, plus targeted cost reductions and emerging technologies for tank recertification and monitoring.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read More

.jpg;maxWidth=300;quality=90)