Report suggests up to $14.7 billion in eVTOL market growth by 2041

The demanding requirements of electric-powered flight are said to offer a promising market for a host of new technologies, aviation-grade batteries, electric motors and composite materials being a few.

Photo Credit: IDTechEx “Air Taxis: Electric Vertical TakeOff and Landing Aircraft 2021-2041”

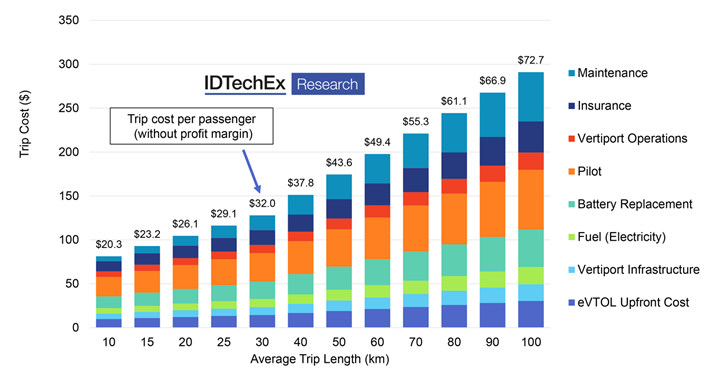

A recently released report, “Air Taxis: Electric Vertical TakeOff and Landing Aircraft 2021-2041” from research and consultancy firm IDTechEx (Cambridge, U.K.) indicates that the market for electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility (UAM) is to grow to $14.7 billion by 2041, with continued opportunities in key enabling technologies, such as aviation-grade batteries, electric motors and propulsion systems, composite materials and eVTOL ground infrastructure.

IDTechEx’s analysis of air taxi/passenger drone operations suggests that there are frequently talked about areas for air taxi deployment which do not look viable, offering commuters no perceivable benefit at greater expense. However, IDTechEx's research also indicates applications where eVTOL aircraft could provide a faster, more direct, and flexible journey at a lower cost than competing transport modes. It is this potential that has attracted the attention of huge companies both inside and outside the aviation industry and stirred major investment into this nascent market.

According to the report, many of the world's largest aerospace and automotive companies are ramping up their interest in eVTOL aircraft, recognizing it as a potentially disruptive new transport mode. Incumbent OEMs like Boeing (Chicago, Ill., U.S.), Airbus (Toulouse, France), Embraer (São José dos Campos, Brazil) and Bell (Fort Worth, Texas, U.S.) have ongoing eVTOL development programs. The major aerospace suppliers — Raytheon (Waltham, Mass., U.S.), GE (Evendale, Ohio, U.S.), Safran (Paris, France), Rolls-Royce (London, U.K.) and Honeywell (Charlotte, N.C., U.S.) — are all investing in eVTOL technologies. Composite material manufacturers like Toray Advanced Composites (Morgan Hill, Calif., U.S.) and Hexcel (Stamford, Conn., U.S.) are working with OEMs on advanced lightweight materials. The automotive industry is taking an interest as well, with Toyota (Japan), Hyundai (Seoul, South Korea), Geely (Hong Kong, China), Stellantis (Amsterdam, Netherlands) and Daimler AG (Stuttgart, Germany) all part of ongoing eVTOL projects.

Photo Credit: IDTechEx “Air Taxis: Electric Vertical TakeOff and Landing Aircraft 2021-2041” and FEV.com.

In January 2020, Toyota invested nearly $400 million in eVTOL startup Joby Aviation (Santa Cruz, Calif., U.S.) in a $590 million funding round joined by private fund manager Baillie Gifford, which famously invested early in Tesla stock at $6 per share. Baillie Gifford have also invested $35 million in German eVTOL OEM Lilium (Munich, Germany). Aside from Joby Aviation and Lilium, the report notes that there are a host of interesting eVTOL startups that have popped up around the world, including Volocopter GmbH (Bruchsal, Germany), EHang (Guangzhou, China), SkyDrive, Vertical Aerospace (Bristol, U.K.), Jaunt Air Mobility (Dallas, Texas, U.S.), Archer Aviation (Palo Alto, Calif., U.S.) and Beta Technologies (Burlington, Va., U.S.). As the first eVTOL aircraft get closer to flight certification, interest in the market is certainly on the rise.

There are opportunities for companies across numerous technologies, the report observes. The demanding requirements of electric-powered flight offer a promising market for developers of many cutting-edge technologies such as lithium metal batteries, advanced composites and axial flux motors. These demands lead many to look at hybrid powertrain options with either existing turbine and piston engines or fuel cells. Those to market first will have the opportunity to be the face of this electrifying new market as a brand leader at the technological forefront. For any company wondering whether they should investigate this market, the question is, why not? The hard work being done over the next decade could pave the way for eVTOL to have a significant role in future mobility.

Overall, IDTechEx's new report provides a comprehensive analysis of eVTOL aircraft for air taxi applications. Along with information and insight into the eVTOL air taxi market, the report contains IDTechEx's 20-year outlook for this sector’s sales, market revenue, battery demand and battery market revenue, with a detailed breakdown of the forecasting methodology.

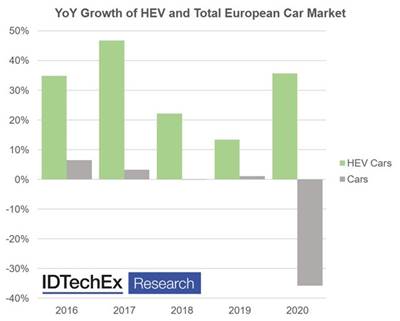

The report also contains detail on the reaction of incumbent OEMs and suppliers to this developing market, along with background into ongoing eVTOL development projects for passenger transportation. Journey time analysis for various air taxi applications is presented, as well as an investigation of the total cost of operation of eVTOL air taxi services, with comparison against current helicopter operating costs.

Read the full report here.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MorePlant tour: Spirit AeroSystems, Belfast, Northern Ireland, U.K.

Purpose-built facility employs resin transfer infusion (RTI) and assembly technology to manufacture today’s composite A220 wings, and prepares for future new programs and production ramp-ups.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreRead Next

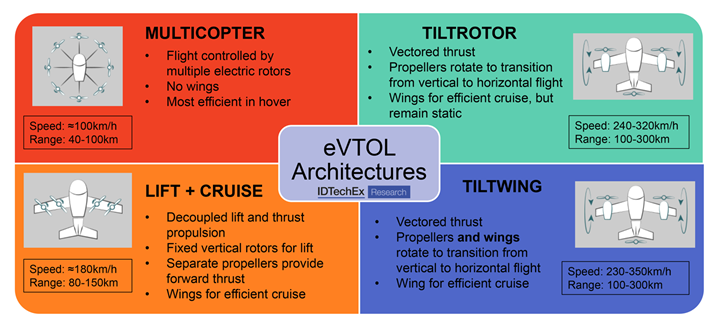

Hybrid electric vehicle market report indicates steady, upward growth

As carbon dioxide emission regulations become stricter across the world, HEV sales show an increasingly upward trend, with expectations to peak at $792 billion by 2027.

Read MoreReport suggests acceleration in fuel cell, electrolyzer development

Recently, new partnerships and research into 3D-printed structural components for solid oxide fuel cells demonstrate new approaches in fuel cell technology.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More