Airframers vie for shares in growing short-haul market

OEMs of aircraft with 150 or fewer seats exploit composites’ appeal to fuel efficiency-conscious regional air carriers.

Short-haul air travel is big business. In 2014, says the Regional Airline Assn. (RAA, Washington D.C.), regional airlines flew nearly 157 million passengers in aircraft that range from 9- to 90-seat passenger capacity. Of the 614 U.S. airports with regional service in 2013, 431 were served only by regional carriers. There are about 13,000 regional flights per day — regional carriers account for 50 percent of the U.S. commercial schedule.

Frederic Morais, however, sees the regional aircraft category in broader terms, and therefore, worthy of an even larger share of the flying public’s business. The director of marketing for Bombardier (Montreal, Quebec, Canada), Morais contends that, today, the regional market includes any commercial aircraft with less than 150 seats — up from the sub-100 seat designation used in previous years. The 20- to 99-seat category includes more than 6,000 flying aircraft, but he says the 100- to 149-seat segment adds about 5,000 more. Morais, then, forecasts for his more inclusive 20- to 149-seat category about 13,000 aircraft deliveries in the next 20 years.

“Deliveries in the 60- to 99-seat segment are driven both by emerging markets and up-gauging of smaller 20- to 59-seat aircraft,” he points out, adding that today’s large number of aging commercial aircraft signals an almost certain growth opportunity. “The 100- to 149-seat segment has a large installed base of old aircraft that must be replaced,” he points out, “and we anticipate that market will be stimulated by the arrival of new and optimized aircraft designs like the CSeries.” He also projects increased demand for fuel-efficient turboprops.

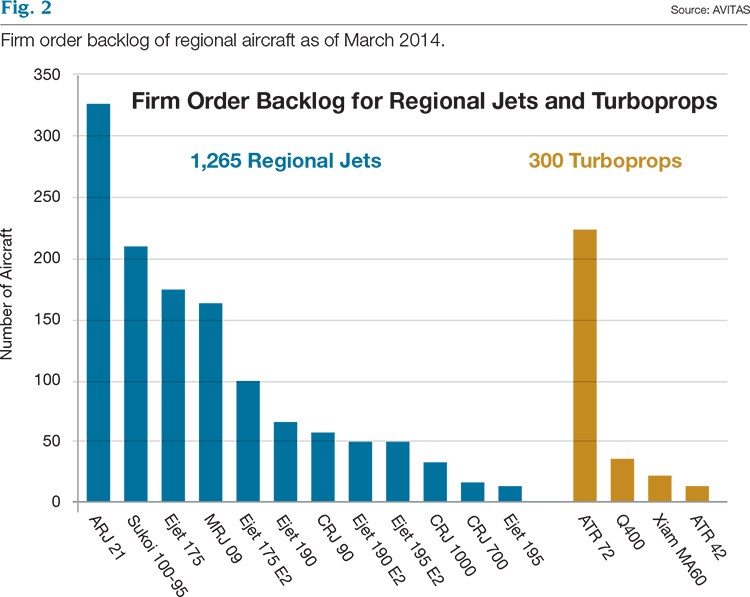

Industry leaders agree, however, that regionals are miles — and some 9,000 actual aircraft — behind the single-aisle, narrow-body jets exemplified by the Airbus (Toulouse, France) A319 and A320 and The Boeing Co.’s (Chicago, Ill.) 737 and 757 — aircraft with seating capacities that vary widely between 100 and 200 passengers. Although growth of regional air share has not kept pace with narrow-bodies, neither in the number of flights nor the number of aircraft built by these major OEMs (see Fig. 2), the regional market nevertheless remains a strong sector, says Michael Miller, VP valuations and consulting for AVITAS Inc., (Chantilly, Va.), a leading advisor to the aviation industry.

That strength and growth potential has encouraged a growing handful of aircraft OEMs to enter the regional jet market in a big way. In fact, Miller points out, “there may not be enough volume to go around for all the entrants.” He suggests that the market may seem “overrun” by startups because aspiring airframers believe their interests are best served by jumping into commercial aerospace with a 70- or 90-seat aircraft rather than building a larger plane that puts them into direct competition with Boeing and Airbus. This appears to be especially true in China, Russia and other developing countries.

Regional composites

The use of composite materials in regional airframes has been steadily increasing in the past few years, largely in response to airlines’ concern about the ever-increasing cost of fuel. At CompositesWorld’s High-Performance Composites for Aircraft Interiors conference in Seattle (October 2013), Chris Red, president of Composites Forecasts and Consulting LLC (Mesa, Ariz.), estimated that a mere 1 lb/0.45 kg of weight savings reduces annual fuel expenses (at $3/gal) by $185 to $360 per year for a regional turboprop and $175 to $432 per year for jets, dependent on aircraft size and annual flight hours.

Currently, two OEMs dominate the regional market, Bombardier and Empresa Brasileira de Aeronautica S.A. (Embraer, São José Dos Campos, Brazil). On the strength of that success, each is, in fact, rapidly moving on to produce larger aircraft, even as several competitors ready models for entry into regional airspace.

Bombardier established itself as an aerospace entity in the late 1980s and early 1990s when it acquired two other Canada-based aircraft facilities, De Havilland (Toronto, Ontario) and Canadair (Montreal, Quebec), picked up Learjet (Wichita, Kan.) in the U.S. and then added Short Brothers in Belfast, Northern Ireland. In the de Havilland Q-Series turboprop design (Q is for quiet) in the early 1980s, composites were used extensively in cabin components and secondary airframe structure. The plane had its beginnings at de Havilland as the Dash 8-100, and was rebranded as the Q100.

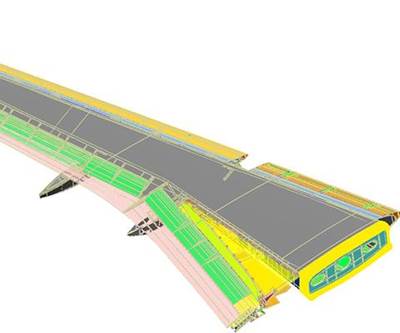

“Composites were estimated at ~10 percent of the empty weight of the aircraft,” says Gavin Campbell, director of design engineering and technology development at Bombardier’s Belfast plant. S-2 glass is still used in radomes for Bombardier’s latest Q400 turboprop series because of its transparency to radar, and Kevlar (DuPont Protection Solutions, Wilmington, Del.) aramid fiber was and still is used for door panels, load-bearing floor panels and other cabin components. Over time, however, some parts were switched to carbon fiber reinforcement. The Q400 NextGen floor panel, for example, is a carbon fiber/honeycomb sandwich construction (see Fig 3). The Q400 also makes use of damage-tolerant Kevlar in its wing leading edges, horizontal and vertical stabilizer leading edges, and dorsal fin — applications that were pioneered in the 1980s.

The Belfast operation began to incorporate carbon fiber composites in the late 1980s, along with honeycomb stiffening for engine nacelles and control components. Campbell says, “The component that was a landmark for Bombardier in use of carbon fiber composites, certified during the 1990s, was the horizontal stabilizers on its business jet, the Bombardier Global Express.” Still used on those parts and now considered a conventional process, Belfast’s automated tape laying of load-bearing skins with woven fabrics in a varied ply orientation was advanced in its time. Although it’s manufactured on a smaller scale, says Cambell, “the stabilizer has all the complexity and all of the load-bearing requirements that a wing might have.”

When it re-engineered its 60- to 99-seat CRJ line of regional jets, Bombardier moved to carbon composite construction for the flaps and aileron high-lift devices. Using carbon fiber reinforcement on the new CRJ NexGen family, Campbell says, “we could tailor the stiffness and strength characteristics to achieve exactly the performance that we were looking for and, at the same time, we could achieve very high strength, reliability and long product life.”

For its all-new CSeries jetliner, aimed at the 100- to 149-seat sector, Bombardier decided on carbon composite wings and is the first commercial aircraft manufacturer to use dry fiber rather than prepreg, for wing structures (see Fig. 1, at left and read more about dry-fiber ATL technology in “Resin-infused MS-21 wings and wingbox,” under "Editor's Picks" at top right.)

Its new wing factory in Belfast uses Bombardier’s patented Resin Transfer Infusion (RTI) process (a variant of resin transfer injection). Workers first lay up dry fiber over various sections of hard metal tooling that represent the wing’s outer mold line, using laser technology to enable ply placement and fiber orientation. The tooling sections are then assembled and the complete mold assembly and layup (which includes wing stiffeners) is moved into an autoclave fitted with plumbing that enables resin infusion of the closed mold inside the pressure vessel. A vacuum is applied, and the wing is cured under closely monitored temperatures and pressure.

Embraer SA’s early work in composites for primary structure focused on the vertical fins, horizontal stabilizers and pressure bulkheads in its business aircraft: the Phenom 100/300 line and, more recently, its Legacy 450/500 platform. Carbon composites were used in control surfaces and to fashion fairings and ancillary structures. By 2012, carbon composites accounted for close to 20 percent of the structural weight in its executive jets. Embraer announced in 2008 and broke ground in late 2011 for what Marco Túlio Pellegrini, then senior VP of operations and the COO of the firm’s Executive Jets division, called a “state-of-the-art composites center of excellence” located in Évora, Portugal. The facility, representing an estimated investment of $71.6 million (USD), is dedicated to making composite parts via lean manufacturing approaches. The facility features automated capabilities including fiber placement and automated tape laying machines.

The key to Embraer’s regional jet aspirations, however, is its E-jet family. Its first-generation E-jets featured doors and other nonstructural parts made from composite materials. Embraer announced the launch of its new E-Jets E2 commercial aircraft at the 2013 Paris Air Show. These second-generation jets reportedly will offer airlines a family of “leading-edge regional jets” with a capacity for 70 to 130 seats. Embraer foresees a demand for 6,400 jets of this size in the next 20 years.

The family will comprise the E175-E2, E190-E2, and E195-E2 — updated and upgraded versions of its original E-jet trio. Although advanced technologies will be applied to engines, wings and avionics, the E-Jets E2 planes will provide airlines commonality with current E-Jets, yet are expected to yield double-digit reductions in fuel consumption, emissions, noise and maintenance costs. According to Embraer, parts made with composite materials will include flight-control components (flaps, ailerons, elevators, rudder, spoilers), landing gear doors, wing-fuselage fairings and radomes. However, Embraer decided not to use composites on the wing primary structure, after trade studies reportedly indicated that aluminum was the most cost-effective, low-risk choice.

FACC AG (Ried im Innkreis, Switzerland) is designing, building and will provide support for the wing spoilers and ailerons for the E-Jets E2. FACC estimates that revenue from the contract, said to extend for the lifetime of the program, could exceed $120 million (USD), depending on the sales of the aircraft.

Struck in August of 2013, the contract marked a significant expansion of FACC’s relationship with Embraer: Previously limited to the supply of products for aircraft interiors, FACC gained entry into Embraer’s aerostructures (take HPC’s FACC Plant Tour, by clicking on "FACC AG: Aerocomposites powerhouse" under "Editor's Picks").

Installed in the wing trailing edge, above the flaps, the spoilers number six per aircraft side. The aileron is attached to each wing’s trailing edge. Both systems are in design phase and will be tested and manufactured by the FACC Aerostructures division in Austria. The engineering Joint Definition Phase (JDP) began in June 2013. Delivery of the first parts is expected in first quarter 2015.

These moveable flight-control surfaces will incorporate “innovative connecting elements” and the fundamental spoiler and aileron functions will be integrated into one ready-for-delivery unit. According to FACC, the result will be a vital element in Embraer’s effort to give these next-generation aircraft an aerodynamically advanced wing, reduce fuel burn and limit emissions.

In June of this year, Embraer announced that it had concluded the preliminary design review, and thus the Joint Definition Phase (JDP), as well as the wind tunnel tests, on the E190-E2 jet. The next step in its development is the critical design review, when the product’s maturity will be validated, opening the way for prototype production. Scheduled to begin revenue service in 2019, the E195-E2 entered its Joint Definition Phase in May this year. Concurrently, Embraer concluded concept studies for the E175-E2, which is expected to enter service in 2020, and commenced the preliminary studies as well as the aerodynamic wind tunnel tests. The E175-E2 will have wings and engines that are optimized for the aircraft’s size, distinctly different from the configuration that was adopted for the other models.

Although Embraer and Bombardier dominate this segment, they are no longer alone in regional air space. The following OEMs are vying for market share:

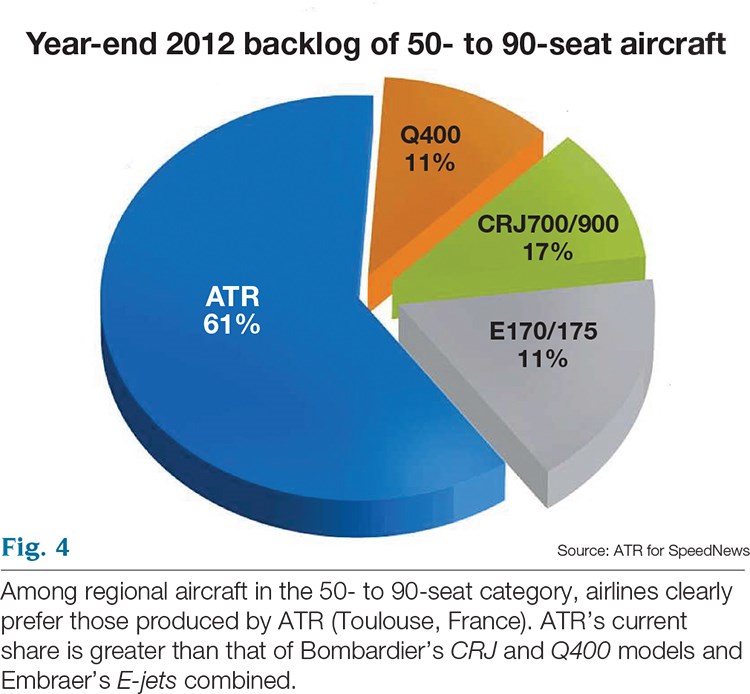

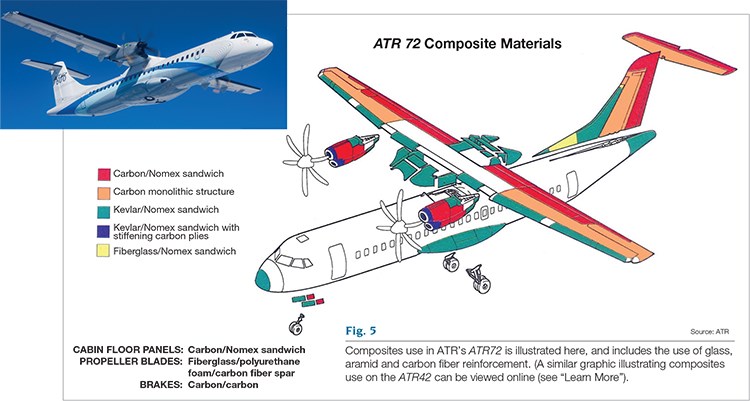

ATR, an Alenia Aermacchi SpA (Venegono Superiore, Italy) and Airbus Group joint venture based in Toulouse, is rapidly gaining market share in the 50- to 70-seat range with its regional turboprops and claimed 61 percent of the sub-90 seat market at the end of 2012 (see Figs. 4 and 5). Filippo Bagnato, ATR CEO, foresees growth in the regional market due mainly to the development of new regional networks in Southeast Asia and Latin America. Growth will be augmented as aging turboprop fleets are replaced in Europe and the U.S. “We estimate a global demand for some 3,300 turboprops within the next two decades,” Bagnato says.

ATR began using composites in the 1980s for wing flaps, ailerons and some fairing panels on its original ATR42, and designed and produced a full composite outer wingbox for its 1980s-version of the ATR72. Typically, the company uses Kevlar aramid fibers for secondary structures, rather than fiberglass, and still uses Kevlar for ATR42 and ATR72 fuselage fairings, tail cones, trailing edge panels and other airframe elements.

With the entry of the ATR72 into service in 1988, the company began using carbon composites for the outer wingbox. “Until a few years ago, this part was one of the largest composite parts on a commercial aircraft,” Bagnato says. Today, ATR reduces weight on its latest ATR72 model by using carbon composites to build the primary structural outer wingbox skin, spars and internal ribs, and vertical and horizontal stabilizers, as well as secondary elements, including the nacelle fairing, engine cowl and flight controls (wing flaps and aileron, and empennage rudder and elevator.)

In Japan, Mitsubishi Aircraft Corp. (Nagoya) and parent company Mitsubishi Heavy Industries Ltd. (MHI, Tokyo) are winging into regional air with that country’s first commercial passenger jet, the Mitsubishi Regional Jet (MRJ, see Fig. 6,). The MRJ family, thus far, boasts two models: the MRJ90 and the MRJ70, designed to accommodate 90 and 70 passenger seats, respectively. Long a manufacturer of composite structures and parts for other aircraft — most notably, Boeing’s 787 — MHI determined to enter the field with a high-end jet featuring a composite empennage and new-generation, fuel-efficient engines, built by Pratt & Whitney (Hartford, Conn.). Parts for the MRJ are manufactured primarily at MHI’s Oye plant in Nagoya, and its nearby Tobishima plant, and assembled at MHI’s Komaki South Plant.

Hideto Kurosawa, head of public and customer relations for Mitsubishi Aircraft’s Corporate Communications Group, expects growth in the overall market due to the steady increase in general passenger traffic across the spectrum of aircraft sizes. Replacement of smaller aircraft and upgauging to larger aircraft are considered strong factors in the expected growth.

Overall, the MRJ will be approximately 10 percent composite materials. Glass fiber-reinforced composites will be employed in nonstructural areas, including the belly fairing, nose cone and flap hinge fairings. “The use of fiberglass composites on the MRJ follows true-and-tried practices on aircraft that are currently flying,” says Kurosawa, who expects their use to continue in future generations of aircraft. “Fiberglass composites are a proven material in terms of durability and applicability in the areas noted.”

The MRJ will integrate carbon composites into control surfaces, such as flaps, spoilers, ailerons, rudder and elevators, as well as vertical and horizontal stabilizer boxes. “Carbon composites are known for weight and strength benefits and MRJ is using them for these benefits,” Kurosawa notes. “Moreover the use of carbon composites in both structural and nonstructural areas leverages greater maintenance advantages, such as lower weight and corrosion resistance — factors that drive maintenance pluses.”

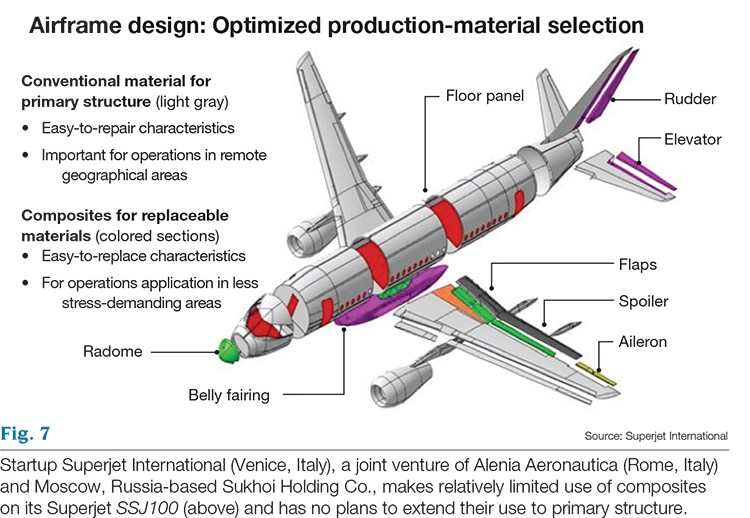

Superjet International is a regional jet startup with ambitious plans. Established in 2008, the Venice, Italy-based airframer is a joint venture of majority shareholder Alenia Aeronautica (Rome, Italy, 51 percent) and Sukhoi Holding Co. (49 percent), a Moscow, Russia-based civilian and military aviation company that emerged from the collapse of the U.S.S.R. Superjet produced 25 of its 98-seat SSJ100 aircraft in 2013; 26 were in service by April 2014. John Buckley, Superjet’s VP of business development, based in Washington D.C., says, “We are adding aircraft every month.” A total of 40 were forecast for this year and 50 are expected to follow in 2015.

Targeting worldwide service capability, the company is establishing maintenance and repair operations (MROs) in support of the aircraft by partnering with existing MROs in Europe, the Americas, Africa and Asia.

Notably, Superjet has limited the use of composite materials on its jets to what it considers “replaceable parts,” and does not expect to build composite primary structure (see Fig. 7). “The extensive use of composites increases manufacturing cost,” Buckley contends. “In the case of large transport aircraft, the cost of composite technology seems to be worth the weight savings — for example, in the B787 some 25,000 lb [11,340 kg] of weight savings was achieved, but at significant cost,” he maintains. “In manufacturing the SSJ, Sukhoi wanted to have a known construction material, both from a cost perspective and certification risk, which we consider is not balanced by weight savings in aircraft having less than 150 seats.”

Desirable diversity

New entries in the regional aircraft market, no doubt, will make for stiffer competition among the participating OEMs, but that’s a welcome development for regional air carriers. AVITAS’ Miller points out that the deployment pattern — that is, how the aircraft are actually used in terms of miles traveled per flight — will be considerably short of the planes’ ultimate ranges. Moreover, the airlines’ passenger seating requirements will vary greatly, depending on the route and region. “One size does not fit all,” he sums up, so a broad range of airplanes with a variety of seat densities is a necessity.

In North America, another factor that will affect regional aircraft deployment is a contractual arrangement between airlines and the Air Line Pilots’ Assn. International, which limits the number of regional jets that can be flown by a given airline. The largest pilots’ union in the world, it represents 50,000 pilots employed at 33 U.S. and Canadian airlines. This “gives the pilots a big chip in the game overall with respect to how many of the regional airplanes can be used,” Miller notes. Further, pilots must be specifically trained and qualified to fly regional aircraft. Consequently, RAA chairman Brad Holt says many RAA member airlines were forced to park aircraft and cut services in 2014 because “there simply aren’t enough qualified pilots to fly these airplanes.”

Challenges notwithstanding, composites use will expand in the commercial aircraft market, and integration into regional airframes is expected to keep pace. Although incursion of composites into both the regional and jumbo jet categories (less-than-150 seats and more than 300 seats, respectively) has lagged behind the trend set by OEMs in the mid-size, twin-aisle class — no regional aircraft manufacturer has yet tackled a composite fuselage — composites use in primary structure is no longer off-limits in any commercial transport segment. Composite wings, tail structures and other control surfaces are well established in regional aircraft, and composites use in second-generation programs is unlikely to go anywhere else but up.

Related Content

3D weaving capabilities achieve complex shapes, reduce weight and cost

JEC World 2024: Bally Ribbon Mills is displaying film-infused 3D woven joints, woven thermal protection systems (TPS) and woven composite 3D structures.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read More3D-woven composites find success in aerospace, space

CAMX 2024: Bally Ribbon Mills experts are displaying the company’s various joints, thermal protection system (TPS) technologies and other 3D woven composites for mission-critical applications.

Read MoreRead Next

Resin-infused MS-21 wings and wingbox

Moscow-based aeromanufacturer uses out-of-autoclave composites in attempt to leapfrog Airbus and Boeing with wider, lighter, more efficient single-aisle airliner.

Read MoreFACC AG: Aerocomposites Powerhouse

This pragmatic Austria-based innovator is pursuing lofty goals in an aerocomposites future full of opportunity.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

Composites_ATR42.jpeg;width=860)