Automotive CFRP: The shape of things to come

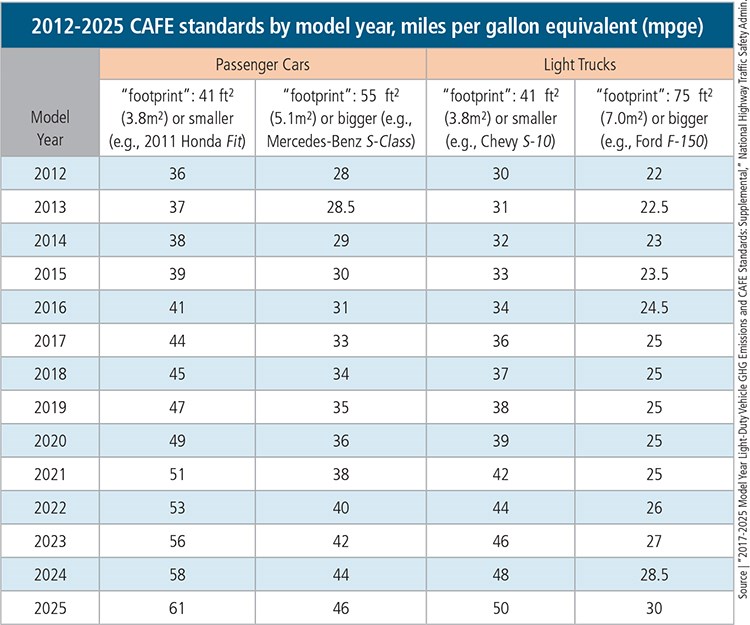

CAFE and CO2 emission standards will drive auto OEMs to fully examine the physics of fuel economy, but will that, at last, steer them toward extensive use of carbon fiber composites?

Share

Read Next

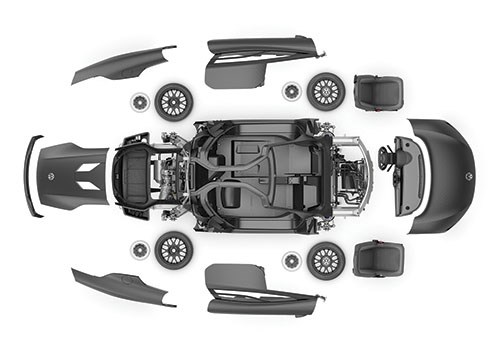

That Bayerische Motoren Werke AG (BMW, Munich, Germany) has stirred up a hornet’s nest of anticipatory buzz within the carbon fiber composites community comes as no surprise. The recently introduced BMW i3 electric commuter car’s carbon composite passenger safety cell (see image 3 at left) tips the scale at a mere 310 lb/140 kg. With annual production volumes targeted at 30,000 vehicles, the i3 is the largest-volume production car ever to make such extensive use of carbon fiber-reinforced plastic (CFRP). And at that production level, the i3 alone could consume more than 9.6 million lb/4,355 metric tonnes of finished CFRP structure each year.

These facts and figures, however, must be put in perspective. The i3 is one of approximately 100 vehicle models manufactured around the world that feature at least some standard equipment (that is, not special-order items) made from carbon composites. Many of them are niche luxury vehicles and supercars or million-dollar hypercars. Together they consume an estimated 11 million lb (4,990 metric tonnes) of CFRP structures annually worldwide. The low-volume i3 program over two or three years will almost double the global automotive CFRP requirements. That begs the question: How many programs similar to the i3 would it take to create a revolution in the advanced composites industry? Which leads to another question: Is the auto industry at this tipping point?

A number of blogs and op-ed columns, at the CompositesWorld.com Web site and elsewhere, have traced a long history of similar anticipation, dating back to the late 1970s and early 1980s. Carbon fiber professionals have said that the history of advanced composites is littered with the bodies of true believers. Fellow CT contributor and consultant Dale Brosius has noted that, despite his many efforts, “carbon fiber is a material of last resort,” and then only as a means to improve fuel economy. But evolving rules in the U.S. and European Union that govern fuel efficiency and CO2 emissions are forcing OEMs to rethink their reluctance to use CFRP, and that fact might — as the data in this outlook demonstrates — limit the body count of true believers this time around.

Automotive materials primer

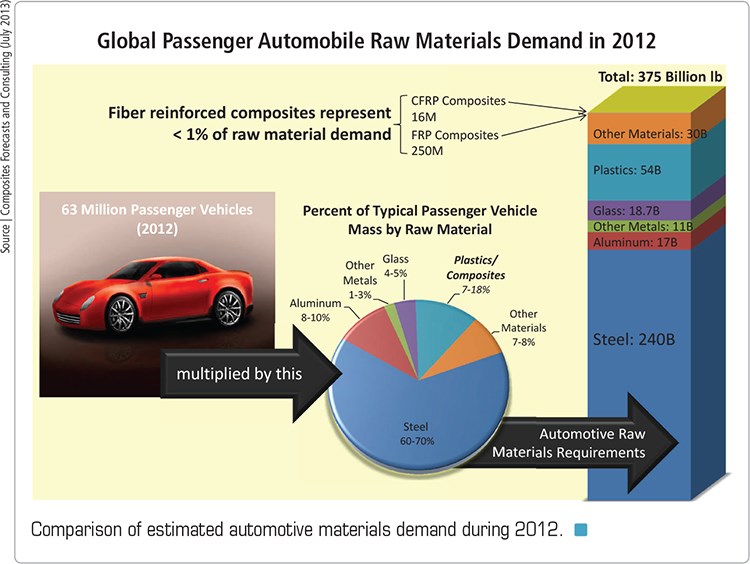

But first, let’s look at the big picture. According to the International Organization of Motor Vehicle Mfrs. (OICA, Paris, France), the global automotive industry produced about 63 million passenger vehicles and 21 million commercial vehicles in 2012. Over the remainder of this decade, the annual production could grow to 100 million vehicles per year, with China accounting for about 18 to 20 percent of the total production and demand. More than 100 OEMs supply these vehicles and offer approximately 1,500 models. The typical passenger vehicle curb weight ranges between 3,000 and 4,000 lb (1,364 and 1,818 kg). The weight of sport utility and crossover utility vehicles (SUVs and CUVs) is generally higher, by 500 to 1,000 lb (227 to 454 kg). By material type, their mass breaks down as shown in the chart on p. 32.

Some quick math tells us that each year more than 300 billion lb (136 million metric tonnes) of new cars and trucks are put into service around the world. For the production of these vehicles in 2012, OICA estimates the steel industry delivered approximately 240 billion lb (108.86 million metric tonnes) to automobile OEMs. The Aluminum Assn. (Arlington, Va.) estimated that 2012 automotive aluminum shipments totaled approximately 16 billion to 17 billion lb (7.26 million to 7.71 million metric tonnes). By way of comparison, the total composites volumes associated with these passenger vehicles represents a market of roughly 250 million lb (113,430 metric tonnes). That’s just shy of 1 percent of the total estimated material weight delivery. During 2013, the CFRP volumes delivered to automotive OEMs are expected to reach nearly 16.5 million lb (7,484 metric tonnes), about 6.5 percent of automotive composites and a miniscule 0.05 percent of the total global automotive material requirements.

Compliance-driven auto design (r)evolution

Against that somewhat humbling background are some present and unpleasant realities for the auto industry. OEMs need to make some big changes to their vehicle lineups over the next 12 years if they hope to achieve the ever more stringent fuel efficiency and emissions standards that are being enacted around the world (see “Automotive weight reduction is increasingly about avoiding extra costs,” under "Editor's Picks," at top right). With iterative improvements over this time period, automakers have a number of milestones to reach, and the penalty for missing them increases each year. Given greater international competition, automakers have reduced vehicle design cycles from about nine years to six or seven years, which gives them two full design cycles in which to develop solutions before 2025. So how will automakers achieve compliance?

From a brand and vehicle lineup perspective, an OEM could boost its corporate-wide fuel efficiency by selling more small and efficient vehicles in place of larger ones. Aston Martin (Gaydon, Warwickshire, U.K.), for example, recently introduced its Cygnet, a $49,500 upscale version of Toyota’s (Aichi, Japan) $15,500 subcompact city car, the iQ. Market reception of the Cygnet has been extremely weak because it is the polar opposite of BMW’s marquee performance brand. In the large sedan category, the OEM can downshift the size of its vehicles or eliminate larger models. Indeed, Ford Motor Co.’s (Dearborn, Mich.) successful Crown Victoria and General Motors Co.’s (Detroit, Mich.) Caprice, at least temporarily, have gone the way of the dodo bird — making room for smaller, more exciting products.

A second tack is to sacrifice some performance in favor of greater fuel efficiency. This seems likely for moderately priced models because horsepower and torque ratings for most vehicles have increased 25 to 50 percent over the past decade. Reversing that trend with smaller, high-efficiency gas or diesel engines is relatively easy and, therefore, can reduce the cost of achieving a higher overall miles per gallon equivalent (mpge). However, this strategy would be anathema to consumers of luxury and performance vehicles.

In fact, neither of these paths to better overall fuel economy, despite their merit, will have much appeal for OEMs that specialize in luxury automotive brands. More importantly, even those whose production lines roll out large numbers of the smallest cars on the road will need to address more broadly the physics of fuel economy.

Toward that end, one piece of low-hanging fruit is to reduce vehicle rolling resistance, the measure of friction or energy loss where, literally, the rubber meets the road. As a general rule, the heavier the vehicle, the greater the rolling resistance. Over the past decade, customer aesthetic preferences have favored larger, heavier wheels (along with larger cars). One strategy is to equip vehicles with high-pressure (50 psi) tires. Although they are more expensive, they can reduce rolling resistance by 25 to 35 percent. For most cars on the road, reverting to smaller-diameter wheels with high-pressure tires would provide small but notable benefits. This could be acceptable to most automotive consumers, but aficionados of luxury and performance vehicles would find the loss of road grip and style a bitter pill.

Aerodynamics is another way to enhance vehicle efficiency, especially at freeway speeds. Reducing vehicle wind resistance requires a two-pronged strategy: reducing the car’s frontal area (a product of the car’s height and width) and its drag coefficient. Obviously, there are limits to how far height and width can be shaved without sacrificing occupant space and safety. The drag coefficient for most passenger cars ranges from 0.35 to 0.20 (the lower the drag coefficient, the better), and it has remained fairly steady for the past 15 years. Some tricks, such as the louvered grills in the Ford Fusion Titanium editions and better use of underbody fairings can make general improvements, but substantial innovation based on the common four-wheel layout is limited.

Power plant reengineering is a more promising area of research. Hybrid-electric and plug-in electric vehicles already show substantial gains over their straight internal combustion engine (ICE) counterparts. ICE efficiencies can be gained through turbochargers and improved air intake to the combustion chambers. Valveless engine combustion chambers and novel engine architectures also reduce internal engine friction, but they are either technically and commercially premature, or they’re governed by patents that reduce their potential for widespread adoption. Reducing internal friction in transmissions and other key components also can improve overall efficiencies. On the whole, increasing powertrain efficiency could contribute as much as 25 to 35 percent of the sought-after improvements between now and 2025.

No room for half measures

But these measures, all good, are still not enough. The 600-lb gorilla in the room is vehicle mass. Of all the factors that influence vehicle efficiency, mass is the most influential and reducing mass need not involve significant sacrifices in the realm of driver/passenger comfort. In fact, for hybrids and plug-ins, weight reduction is critical to achieving driving ranges comparable to traditional ICE-powered vehicles. Virtually every new car introduced to the market will have to go on a weight-loss plan.

Every 100-lb/45-kg reduction in weight is said to improve fuel efficiency by roughly 2 to 3 percent. From a vehicle design perspective, however, a 100-lb/45.4-kg reduction in one area sets up the potential for further weight reduction in a variety of other components and systems — resulting in a virtuous spiral of lower weights. Vehicles with all-composite bodies-in-white (BIW) could weigh 50 to 70 percent less than a steel BIW, netting about 250 lb/113 kg in savings. And the virtuous spiral would permit engineers to downsize engines, transmissions, brakes, suspension members, batteries and more, potentially reducing vehicle weight by an additional 500 lb/227 kg!

Although CFRP promises extreme weight savings, there are competing factors that limit its potential in vehicle applications. Foremost is cost. CFRP is roughly 10 times more expensive to manufacture than aluminum and magnesium, and it’s even more costly than advanced high-strength steels and glass fiber-reinforced plastics. Equally challenging is productivity. Despite the recent advent of snap-curing thermoset resins, less costly out-of-autoclave processing and the alternative of thermoplastic matrices, which have driven down cycle times from eight hours or more to about 10 minutes, cycle times still limit CFRP’s uses to models produced in volumes of 40,000 or fewer vehicles per year.

Another factor is end-of-life regulations. Metals are readily recycled, but the same cannot yet be said of CFRP (see “Recycling carbon fiber back into the automobile,” under "Editor's Picks"). This leads to higher relative material costs, landfill expenses and further exposure to fines in some regions. The time, expense and limited availability of CFRP repair services present further obstacles and the potential for higher insurance rates. Given these concerns, auto OEMs have opted for less risky and less expensive solutions and will continue to do so unless they are driven by other economic considerations and model brand appeal.

In CFRP’s favor, building automobiles that comply with corporate average fuel economy (CAFE) and emissions standards will require adoption of all the previously mentioned strategies. Advanced high-strength steels, aluminum and magnesium are material solutions that will work for the majority of vehicles entering the market. It is in the uncompromising world of luxury cars that the need for mass reduction will loom most large and the additional cost of weight-loss strategies can be most easily absorbed. In this market space, then, CFRP will find its greatest opportunities.

Demand for automotive CFRP

The previous discussion of the road to vehicle efficiency and the material opportunities and barriers along the way indicates that during the next 10 to 15 years carbon fiber will not be in everyone’s carport. New vehicle applications appear to be limited by processing speed and costs, with most opportunities in applications serving models produced at volumes of less than 40,000 vehicles per year and sold at a price in excess of $60,000 — the i3 is an outlier to this general guideline. With this in mind, let’s look at the market for these types of vehicles.

Global passenger-vehicle and light-truck production currently totals about 63 million units annually. Of this total, luxury autos account for about 9 percent. Making up these 6 million cars are approximately 210 models, representing a wide array of body styles and layouts, including compact coupes and sedans, midsize vehicles, large passenger vehicles, luxury trucks, and SUVs and CUVs. Somewhat surprisingly, about 100 current or anticipated new models make some use of CFRP — nearly four times as many as 10 years ago!

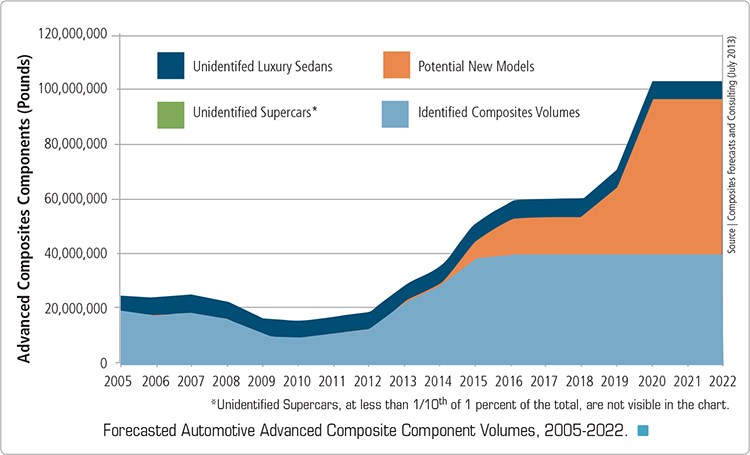

Based on available information about these vehicles and some more moderately priced sports cars and SUVs that also will incorporate CFRP, we estimate that the total weight of CFRP components will grow from 16.5 million lb (7,486 metric tonnes) in 2013 to 36 million lb (16,334 metric tonnes) in 2016. After factoring in the CFRP applications that auto OEMs have announced for the next three years (“identified composites volumes”), anticipated or “potential new models” over the following seven years and some notional accounting of a small number of “unaccounted supercars” and “unaccounted luxury sedans” that are not included in our analysis, the accompanying graph (above) shows that by 2022 the total weight of carbon composites going into cars annually could exceed 100 million lb (nearly 453,600 metric tonnes). This indicates that CFRP manufacturing will grow dramatically and will augment expanding opportunities for other composites and lightweight metals.

To support the manufacture of 100 million lb (45,360 metric tonnes) of finished CFRP parts, the automotive supply chain will require nearly 95 million lb (39,225 metric tonnes) of raw carbon fiber. Today the auto industry (including race car teams and aftermarket accessory vendors) consumes about 3.5 percent of the global carbon fiber production capacity. According to this outlook, by 2022, that could grow to nearly 25 percent.

Given the number of companies looking to expand their current automotive composites business and those that are considering entry into the market, it is not enough to say that volumes are growing. It is important to understand what applications are driving this change. Composites Forecasts and Consulting LLC (Mesa, Ariz.) has recently released a market report that details related activity within the supply chain. Based on the published data, it is estimated that in 2013, nearly 2.25 million individual composite components will have been fabricated and delivered to OEMs. These components are in production at 35 companies around the world, with about 70 percent of the volume coming out of Europe.

Composite components are included in virtually all facets of a vehicle’s design, including:

• Chassis members

• Body panels and exterior accessories

• Structural and cosmetic interiors

• Suspension

• Vehicle drivetrain, exhaust and

engine bay cosmetic pieces

• Brake system

• Fuel components

• Wheels and other components

Suppliers that build chassis, body panel, brake rotor and driveshaft components are currently the largest consumers of CFRP materials and will continue to drive growth over the forecast period. Combined, these components account for 87 percent of the identified component volumes and 95 percent of the identified delivered material weight. The Composites Forecasts and Consulting report noted, however, that current improvements in vehicle drivetrains and aerodynamics, as well as weight reduction, will not be enough to meet the 2025 emissions targets, which opens the potential for some of the other application sectors previously listed here.

In the past year, for example, carbon fiber wheels have appeared on high-end sports cars, such as Koenigsegg Automotive AB’s (Ängelholm, Sweden) Agera and the more affordable F-Type series from Jaguar Land Rover Ltd. (Whitley, Coventry, U.K.). Composite seating also seems to be an application with considerable potential, and suspension components appear to be a near-term target, including leaf and coil springs. Further, other suspension components, including sway bars and suspension arms and frames, could be supported with existing filament winding and resin transfer molding (RTM) processing techniques, cutting by two-thirds the weight of these components compared to today’s metal versions. OEM use of these emerging components is expected to grow about 600 percent over the forecast period, and they present many additional opportunities for aftermarket suppliers.

As this outlook makes clear, a great many factors have had an impact on why and how carbon fiber composites made their way into the automotive industry and how those inroads will continue into the future. To be sure, there will be challenges for the composites industry to overcome if it is to compete in this marketplace. Chief among them are cost and scalability. Over the next few years, a few notable examples of critical composite structures for mass-production automobiles will hit the streets. The impact of these relatively small-volume production models will create a huge but relatively isolated impact on the demand for CFRP goods and services. During the remainder of this decade, we are likely to see a small number of additional luxury cars and sportscars join the fray — again with relatively high impacts on the advanced composites supply chain.

Given the preceding discussion, it could be too early to claim that CFRP will displace traditional materials in automobiles to the extent that it has in aircraft, but its fair to say that the signs are pointing in that direction. As noted earlier, there are almost two full vehicle design cycles between now and 2025. There is plenty of time for auto OEMs and the composites supply chain to figure out how they, together, can make the most of this automotive opportunity.

Related Content

Bladder-assisted compression molding derivative produces complex, autoclave-quality automotive parts

HP Composites’ AirPower technology enables high-rate CFRP roof production with 50% energy savings for the Maserati MC20.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRead Next

Plant tour: A&P, Cincinnati, OH

A&P has made a name for itself as a braider, but the depth and breadth of its technical aptitude comes into sharp focus with a peek behind usually closed doors.

Read More