Aviation Outlook: Composites in commercial aircraft jet engines

Airlines' need for fuel-efficient flight provides the thrust behind composite lightweighting strategies in jet engine manufacturing.

In the past several issues of HPC, we have outlined the current and future market for advanced composites in the manufacturing of aircraft. In each case (see "Learn More," at left), the number of new aircraft forecasted to be produced over the next 10 years represents significant growth. For aircraft manufacturers in the commercial transport category, growth predictions for new and replacement aircraft have soared to unprecedented heights in anticipation of air traffic to, from, and within emerging Asian economies. Critically, demand from airline customers for greater fuel efficiency and reduced operating costs in these new aircraft has dictated that airframers pursue weight reduction and advanced airframe design. That, in turn, has put a very bright spotlight on composite solutions. Robust demand for jet aircraft necessarily dictates corresponding growth in the production of jet engines, and the same forces are shaping the future of jet engine design. As a result, demand is growing rapidly for composites manufacturing capacity sufficient to supply the increasing number of engine parts that will undergo composite-for-metal replacement.

Turbofans provide thrust for composites adoption

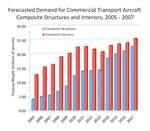

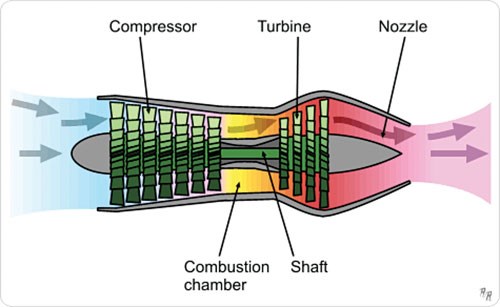

Although the market for jet engines encompasses myriad product variations, engines generally can be classified in one of two categories: turbojet or turbofan. Economically driven design changes in the latter are the most significant factor behind the current surge in the use of composites. The reasons are easily traced to differences in the way each engine type functions.Both engine types operate in much the same way (see turbojet and turbofan schematics, at left). Air is captured by the engine inlet. The incoming air entering the turbojet is fed into a rotating compressor before being sent to the combustion chamber where the compressed air is mixed with fuel and ignited. The high-temperature gas expands as it passes through the turbojet's turbine, creating the engine's forward propulsive force and providing power to the compressor at the front of the engine.

The turbofan engine is a modified turbojet, featuring a large fan section mounted on the front of the core turbine, with an additional turbine in the rear, all connected by a common axle or shaft. Turbofan engines differ in that the front-mounted fan section (sometimes referred to as the cold section) drives some of the incoming air into the engine's compressors but diverts the rest of the airflow around the engine core and out of the tail of the engine structure. This "bypass" airflow provides a second source of thrust — similar to that provided by the propeller on a turboprop engine. The ratio of the air that goes through the core to the air that the bypasses the engine core is a critical design parameter and is referred to as the bypass ratio.

Generally speaking, the greater the volume of air that is bypassed, the more efficient the turbofan becomes. Not surprisingly, the bypass ratios of turbofan engines have steadily increased. The first generation of turbofans developed in the 1960s typically achieved bypass ratios of about 1.5:1 (50 percent more air was bypassed around the core than entered into it). By the 1970s, engine technology allowed companies to produce products with a bypass ratio of 4.5:1. Increasing focus on operating costs and fuel efficiency has driven bypass ratios for engines on commercial transports to as high as 9:1. This trend is physically manifested by enlarging the fan section. The reduction in engine operating costs from these high-bypass turbofans is such that more than 90 percent of all jet engine deliveries over the coming decade will be turbofans.

Fan size and bypass ratio are important for several reasons. With regard to aircraft design, the large fan section in the front places some practical limits on where the engine can be mounted on the aircraft. Early fighter aircraft — for which supersonic speed and aerodynamics outweighed fuel efficiency — were outfitted with the smaller-diameter turbojets, which could more easily be integrated into the streamlined aircraft fuselage. Many modern fighters, however, are powered by low-bypass turbofans. Although engines of this type have relatively small-diameter front fan sections, they are more fuel efficient than traditional turbojets. In the commercial and business jet equation, however, economy is far more important, and passenger cabin space is a primary driver in fuselage design. As a result, most aircraft manufacturers have adopted turbofan engines with fan section diameters large enough to make it impractical to mount them anywhere but below the aircraft's wings or outside the rear fuselage.

Composites downsize weight in upsized fans

As the price of fuel rises, end-users of commercial, business/private and military aircraft are appealing to manufacturers for more efficient power plants. To achieve this goal, engine manufacturers, generally, are looking for ways to develop turbofans with even higher bypass ratios. This is achieved with larger and heavier fan sections. To put this in context, jet engine builder GE Aviation's (Evendale, Ohio) CF6-80C2 engine — in service for decades on The Boeing Co.'s (Seattle, Wash.) 747-400 and 767-200/300, and Airbus SaS' (Toulouse, France) A330-200/300 — has a bypass ratio of 5:1. The fan section for the CF-6 engines accounts for 20 percent of its total weight. In GE's recently introduced GEnx engine, however, the bypass ratio is a much higher 10:1, and the fan accounts for 30 percent of total engine weight. Similarly, Pratt & Whitney's (Hartford, Conn.) Geared Turbofan (GTF), which is being developed for the Mitsubishi Regional Jet (MRJ), produced by Mitsubishi Aircraft Corp. (Nagoya, Japan), and the C-Series jets forthcoming from Bombardier (Montreal, Quebec, Canada), is expected to have a bypass ratio from 10:1 to as high as 12:1.Although the GTF and GEnx engines will contribute about 60 percent of the fuel-burn reductions claimed for these new transport aircraft compared to planes now in service, Boeing and Airbus have expressed skepticism, indicating to engine OEMs that they will need greater improvements to justify designing replacements for their hot-selling B737 and A320 Series single-aisle aircraft. Accordingly, engines for this next generation of single-aisle planes could have even higher bypass ratios, requiring proportionally larger fan sections. As a result, the fan section could comprise as much as 35 percent of an engine's total weight of approximately 6,000 lb/2,722 kg.

The trend to larger and heavier fan sections is a key driver for the adoption of composites in future engines. The addition of 1 lb/0.45 kg to the fan blade assembly requires a compensatory 1 lb/0.45 kg increase in the weight of the fan blade containment case (which must prevent broken blades from exiting the engine and damaging the aircraft). That 2 lb/0.9 kg increase, in turn, will mandate a compensatory 0.5 lb/0.23 kg increase in the weight of rotor and engine structures as well as an incremental 0.25 lb/0.11 kg uptick in the aircraft's wing/fuselage structures. This cascading effect on aircraft mass has put a premium on weight reduction in fan components, providing the greatest opportunities for expanding the use of composite materials and technology in jet engines. Notably, sources at GE Aviation say the company actually is saving money by substituting composites for metals in fan components, as a consequence of the rapidly escalating prices for conventional structural alloys and the long lead times required by their suppliers. This situation has prompted the company and its competitors to explore expanding the applications of carbon fiber-reinforced polymer (CFRP) to other components of their engines.

Aircraft statistics provide engine demand baseline

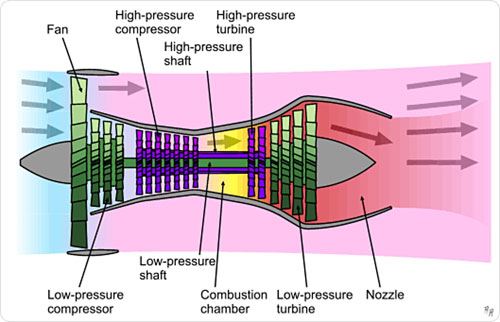

Thus far, we have established the rationale for the use of composites in jet engines and why there is good reason to expect that greater amounts of these materials will be incorporated into new engines delivered during the next decade. In HPC's previously published "Aviation Outlooks," we calculated totals for business/general aviation and commercial transports. Additional figures on military aircraft were compiled for HPC's recently published Aerospace Composites: A Design and Manufacturing Guide.Accounting for some minor program updates since those articles and supplements were written, we find that between 2008 and 2017:

- Producers of jet-powered general aviation and business jets will deliver 22,382 business jets.

- Commercial transport aircraft deliveries are expected to total 13,436 units.

- Military jet deliveries (fighters, trainers, transports and special-mission craft) will total 3,826.

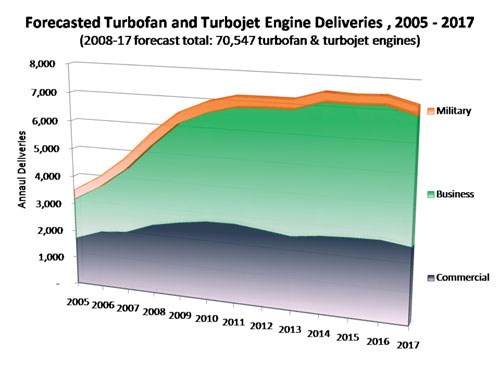

Based on these figures, and taking into account which engines are supplied to which aircraft programs and in what quantities, we find (as expected) that the growth curve related to aircraft deliveries almost exactly matches the growth in forecasted engine deliveries. During the next 10 years, the 39,644 new jet aircraft will need 70,547 power plants (not including spares or replacement units). Included in this total are 42 engine families from 12 producers, a list that includes individual OEMs and several joint ventures.

By comparison, Rolls-Royce Plc's (Derby, U.K.) Market Outlook 2007 for jet engines, which does not include military aircraft deliveries, forecasts that between 2007 and 2016 the demand for new jet engines will total a little more than 60,100 units, valued at $310 billion (USD). While slightly more dated, The Market for Turbofan and Turbojet Aviation Engines, Forecast International's (Newtown, Conn.) 10-year forecast (2006-2015), says turbofan and turbojet engines will total 59,794 units, which are valued at $188.6 billion. Of these, 86.6 percent are expected to be installed in commercial or private civil jet aircraft, while the remainder will find use in military aircraft programs.

We believe that much of the difference in unit production predicted by our outlook (performed in third-quarter 2008), Rolls-Royce's outlook (updated in 2007) and Forecast International's 2006 figures, is largely a function of the changes in annual aircraft deliveries between 2006 and 2008. Data used to develop our forecast show that annual engine deliveries will grow by about 1,700 units during this three-year period. If we normalize our data to that presented in the other two forecasts, then the 10,000-unit spread between the three forecasts is reduced by half, in which case they only differ by about five percent. We believe that the larger engine production volumes in our forecast are justified based on the past three years of record sales for new aircraft and the related aircraft delivery backlogs — developments that have defied the expectations of most aerospace analysts. Based on the delivery forecasts, we expect that between 2008 and 2017, annual turbofan and turbojet unit deliveries will grow 25.9 percent. Within this window of time, the average annual jet engine output is expected to total 7,055 units per year, compared to just under 5,000 units in 2007.

Demand for composite engine structures quantified

To calculate composite structure requirements, it was essential to first determine what components are made with composites on each engine type. Given the number of turbofan and turbojet engine products available to the market and their many unique composite components, a complete accounting here would prove excessively lengthy. We have, instead, elected to highlight applications on a few key programs from among the many we examined, which illustrate the growing usage of composite materials.Perhaps the most significant advance in the use of composites in engine design occurred just over a decade ago, with the entry into service of GE Aviation's GE90, which powers the Boeing 777. Its 22 fan blades are composed primarily of IM7/8551 carbon prepregs from Hexcel (Dublin, Calif.). The blades have proven themselves up to the rigorous demands of commercial flight operations — only three blades have been removed from service during more than 12 years of service. Altogether, the 22 blades have a combined weight of about 770 lb/349 kg of composites. With the inclusion of composite fan blade platforms, spacer bars, acoustic liners and bushings, the front fan section of each GE90 engine carries about 1,300 lb/590 kg of composite structures — only 8 percent of the engine's total mass where an all-metal fan case would account for 30 percent or more of the mass. That represents a significant overall engine weight reduction.

One of the first and most successful jet engines on record as using composites is the CFM56 Series of turbofan engines built by CFM International (a joint venture between GE Aviation and Snecma, Courcouronnes, France). These engines entered service in 1982 and now fly on the Boeing 737 Series and the Airbus A320 Series and A340 transports. Over the past 26 years, CFM International has delivered more than 18,000 engines. As originally designed, composite applications on CFM56 engines include the air intakes, fan cowl, thrust reversers and nacelles and represent between 460 lb to 515 lb (209 kg and 234 kg) of composite structures, depending on the specific variant.

Constantly focused on operating cost reductions, CFM International has developed a comprehensive technology update package, marketed under the trade name LEAP 56. CFM began production last year and already has delivered more than 1,000 new engines for new aircraft. Each of these enhanced turbofans features a more efficient engine core, compressor and turbine as well as infusion molded fan blades and a composite fan case. Given these modifications, composite materials now make up roughly 20 percent, by weight, of each new CFM56 engine.

Another engine program that has attracted attention for its use of composites is GE Aviation's GEnx, designed for the Boeing 787 and 747-8. This program applied and enhanced the GE 90 blade technologies and added a composite fan containment case and additional ducting to the mix. The current configurations of the GEnx are estimated to include nearly 2,200 lb/998 kg of composite structures, representing about 15 percent of the engine's mass. As noted earlier, pressure from aircraft operators and the pricing and availability of alloys have given GE reason to consider adding more composites to the GEnx, including the booster blades and vanes, aft fan case, outlet guide vanes and other rotor parts. By switching to composites for these components, GE estimates that it could cut the weight of its current baseline GEnx design by an additional 300 lb/136 kg per engine.

Having established a significant and growing presence in the power plants used on large commercial transports, the composite fan blades, fan containment cases, by-pass ducts, and other common composite structures in the engine market are migrating to a number of smaller engine platforms. Snecma, for example, is adapting these technologies for its developmental Silvercrest engine, which is designed for regional and business aircraft capable of carrying 30 to 40 passengers. Snecma also is supplying similar components for inclusion in the Powerjet SAM146 turbofan, which powers the Sukhoi (Moscow, Russia) Superjet 100 regional jet, which made its first flight on May 19, 2008. (Powerjet is a joint venture between Snecma and NPO Saturn of Rybinsk, Russia.) Even the makers of engines for many light business jets are actively adopting more composite structures. Composite bypass ducts are a common application across most of these smaller turbofans. More recently, infusion molded composite fan containment cases, produced with braided carbon fiber reinforcements supplied by A&P Technology (Cincinnati, Ohio), are being developed for turbofan engines in the Williams International (Walled Lake, Mich.) product line.

Engine composites poised for a decade of growth

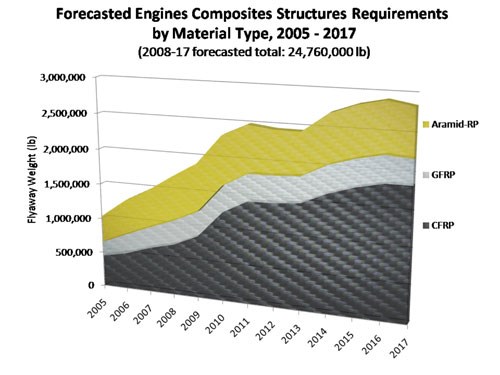

After performing an extensive survey of individual composite applications on each of the engines examined for this forecast, we paired the resulting data with engine production rates. We found that demand for composite engine structures during 2007 totaled approximately 1.49 million lb (675.85 metric tonnes), including carbon fiber, glass fiber, Kevlar, various epoxy and high-temperature matrix systems and core materials. At the Tier 1 and Tier 2 supplier level (including those applications produced in-house by the OEMs), this represents a market value of $400 million to $450 million. This demand is expected to grow at an average annual rate of 7 percent over the next 10 years — reaching as much as 2.92 million lb (135.49 metric tonnes) in 2016.Over the entire forecast period, our data suggest that a total of 24.76 million lb (11,231 metric tonnes) of composite structures will be delivered to engine manufacturers, with a value of $7 billion to $8 billion.

These figures are certainly eye opening. Yet, it's important to note that our estimates are based only on identified applications. The jet engine manufacturing industry is highly competitive, and its participants are engaged in ongoing research into high-tech innovations that, for much of their development cycles, are not public. Therefore, this forecast, though extensive, cannot account for as yet unidentified but possibly significant composites applications. Our survey results also do not include numbers for replacement, albeit infrequently, of damaged or worn composite components. And, with the exception of some of the well known "technology insertion" updates, our forecast does not account for potential midlife upgrades that could boost composite content. Therefore, we believe that our numbers should be considered somewhat conservative. Certainly, they make it abundantly clear that jet engine structures represent another rapidly growing market for advanced composite materials.

Related Content

ASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreRead Next

Aviation Outlook: Composites in rotorcraft reaching new altitudes

One of the earliest markets for advanced composites, helicopter manufacture is and will continue to be a stronghold for industry growth.

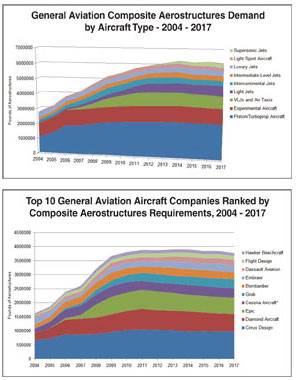

Read MoreAviation Outlook: Composite aerostructures in General Aviation

Although the math is fuzzy and once helpful category distinctions are blurring, the forecast for this sector’s use of fiber-reinforced polymer remains strong.

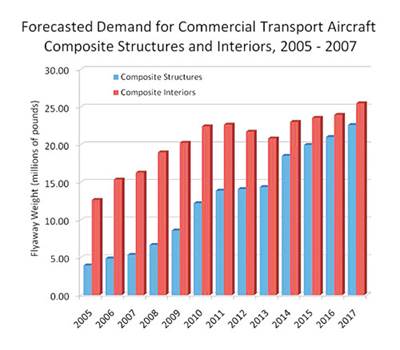

Read MoreAviation Outlook: Fuel pricing ignites demand for composites in commercial transports

A confluence of aircraft OEM technical innovation and economic pressures on their airline customers creates increasingly favorable market conditions for aerospace composites.

Read More