Composites Alive And Well In Offshore Oil Applications

The petroleum industry is moving forward with many interesting projects that will increase composite demand.

For the near future, at least, oil and natural gas will continue to be critically important sources of energy worldwide. As easily tapped land and shallow coastal water reserves continue to decline, deepwater exploration and production is growing and with it, demand for strong yet lightweight materials able to stand up to incredibly harsh subsea environments.

At the recent Fourth International Conference on Composite Materials and Structures for Offshore Operations (CMOO-4), sponsored by the University of Houston's Composites Engineering and Applications Center (CEAC), offshore experts were cautiously upbeat about the future of offshore composites and cited a number of new applications — in progress and planned. During introductory remarks, University of Houston vice chancellor R. Arthur Vailas pointed out that new materials, including composites, are almost a necessity in the deepwater environment, one of the most challenging next to space. Dr. Howard Hwang of Shell Exploration and Production described a few of those challenges, which include high hydrostatic pressure, low temperatures, vortex-induced vibration (VIV), platform designs that are maxed out with regard to payload capacity and scattered fields containing low volumes of oil or gas, which make drilling and gathering of oil increasingly difficult: "Composites can reduce the weight and size of platform structures and therefore reduce infrastructure costs," he explains.

Composites have established some real footholds in offshore apps where their properties enable specific performance attributes, especially when combined with other materials — umbilicals, tethers, spoolable pipe, topside platform pipe, grating, "smart" monitoring systems and new concepts for natural gas transport are just some success stories. Composite material proponents at major oil companies say that, though it may take some time, a few recent setbacks in the areas of risers and gathering pipe can be readily overcome.

Umbilicals and tethers

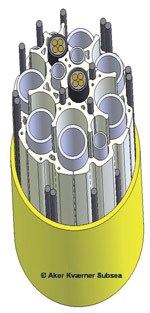

Although the partnership of ConocoPhillips (Houston, Texas) and Aker Kvaerner (Oslo, Norway) — the group that developed the CompRiser and the CompTether during the 1990s — has been dissolved, Aker Kvaerner Subsea AS has continued work on composites applications. The company now is commer-cializing a new umbilical concept, a direct outgrowth of CompTether: the carbon rod dynamic umbilical, the winner of one of 14 "Spotlight on New Technology" awards given by the Offshore Technology Conference in 2005. Turid Storhaug, department manager with Deepwater Composites, a department within Aker Kvaerner Subsea, reports that umbilicals certified by Det Norsk Veritas (DMV, Oslo, Norway) are currently being assembled at Aker's facility in Mobile, Ala. and will be installed this summer in 3,000m/9,842 ft of water on Kerr-McGee's Merganser and Independence Hub MC-920 platforms in the Gulf of Mexico.

Offshore umbilicals are critical to operation of subsea systems in which a host production platform connects to wells scattered over long distances on the sea floor. Typically more than a mile in length and 140 mm to 175 mm (5 inches to 8 inches) in diameter, umbilicals are essentially large hoses or pipelines containing a cluster of smaller, high-pressure hydraulic hoses as well as electrical and optical cables that connect to subsea wellheads for remote operation of valves. Early models were simple thermoplastic tubes bound together, but with increasing water depths, Aker Kvaerner Subsea turned to a design that places the hoses and cables within free-floating stainless steel tubing cradled within plastic profiles, all covered with an extruded thermoplastic overwrap. This arrangement better resists the tensile loads induced by long, free-hanging catenary configurations. But at depths greater than about 2,150m/7,000 ft, the steel elongates under the extreme tensile loading, exceeding the tensile strength of the contained electrical cables, which can short out wellhead connections. "The large tensile loads produced in this type of dynamic service required further axial reinforcement," says Storhaug. "We found that the Merganser/MC-920 environment had surpassed the limits of our patented steel tube product."

Increasing the thickness of internal steel tubes within the umbilical cluster, or adding even more steel, would have increased umbilical weight to an unacceptable level. The company instead has enhanced axial stiffness with carbon fiber rods, nearly as stiff as steel but 80 percent lighter.

Thin carbon rods are pultruded by Vello Nordic AS (Skodje, Norway) using Zoltek Corp.'s (St. Louis, Mo.) Panex 35 commercial 48K tow (produced at Zoltek's Hungarian facility) and vinyl ester resin from Reichhold (Research Triangle Park, N.C.). The 6.5-mm/0.25-inch rods, with a tensile modulus of 150 GPa and tensile strength of 1,730 MPa, are made in 3,050m/10,000-ft continuous lengths. For the Merganser/MC-920 platform project, a total of 384 rods (about 60 tons of fiber) were required for the four-umbilical set. The rods are spooled at the Vello facility onto 1.8m/6-ft diameter reels, a size that permits easy incorporation into the manufacturing line without exceeding the material's strain capacity.

As shown in the figure on p. 36, rods are placed along the outer circumference of and within the umbilical structure, held in place by designed indentations in the extruded internal plastic profiles that cradle the multiple stainless steel tube conduits. The rods are incorporated into the umbilical during manufacturing just like the other elements, at the same helical "lay angle," explains Storhaug. "This is an elegant, cost-effective design that has the benefit of eliminating bulky added buoyancy elements, which greatly complicate installation and add considerable project cost."

Storhaug reports that there is a lot of enthusiasm about offshore composite materials, not only among customers but even within her own company. "We get a lot of phone calls from internal groups who want to learn more. This umbilical project has been very important for carbon fiber in deepwater structural elements — we think that this is the start of something quite big," she concludes.

Another application for thin, pultruded carbon rods is reported by offshore project integrator Deepsea Engineering & Management (Epsom, Surrey, U.K.). Dan Jackson, Deepsea's commercial director, says that his company is investigating carbon fiber tethers as an alternative to polyester mooring ropes for anchoring mobile offshore drilling units (MODUs), essentially ships or moveable semisubmersible structures that drill offshore wells. Multiple tethers are needed to keep the MODU "on station," or centered exactly above the hole being drilled, typically thousands of feet below.

Jackson says that the carbon tethers will perform much better than polyester because they're far stiffer at one-half the diameter. Their stiffness reduces the "watch circle" or the distance tethers allow the MODU to drift from center. The tethers are essentially carbon fiber ropes made from pultruded rods. They are manufactured by Oceaneering Multiflex & Marine Production System (Houston, Texas), an umbilical supplier. The 6mm (almost 0.25 inch) rods are bundled, then multiple bundles are pulled together to form a helical rope. The rope is encased in an outer armor layer made of steel. The overall reeling diameter is a manageable 3m/10 ft.

The 500m/1,640-ft long tethers, produced for Petrobras, are scheduled for a full-scale offshore field trial at the end of 2006, Jackson reports, adding, "Petrobras is very happy so far, with the preliminary test results."

"Smart" composites part of systems monitoring

One area where composites have found a niche is in monitoring systems where they are combined with other materials and sensors. An example is a composite "shape sensing mat" developed by U.K.-based Insensys Ltd. (Hamble, Southhampton, U.K.) for use with a metallic riser system. The flexible mat, which incorporates fiber optics, wraps around a steel riser and enables operators to monitor excessive bending and fatigue life during riser deployment.

"The idea is to incorporate the fiber optics into a structure that can be mounted anywhere on any type of pipe. It's a carrier mat designed to transmit strain data," says Damon Roberts, Insensys' founder and VP. An Insensys mat was installed on the lowest point of a completion-and-work-over riser string on the Enterprise Endeavor, a dynamic positioned drill ship (DPDS) moored in the Gulf of Mexico's Thunder Horse field, during July 2004. The 5.5m/18-ft long mat, affixed to the riser joint by means of straps, extended about 180°, or about half way around the circumference of the pipe. Roberts says the mat successfully reported data to the surface during multiple trips to the sea floor and back during riser deployment (i.e., as the riser was lowered through the water column, joint by joint, then pulled up again), in more than 1,830m/6,000 ft of water.

Reported data consisted of direct strain measurements, obtained with Bragg grating strain gages. The tiny gages, about 5 mm/0.2 inch long, are placed at various points along fiber-optic cables, themselves only 0.25mm/0.01 inch in diameter. When light pulses are passed through the cables and thus through the gratings, any bending of the pipe changes the wavelength of the light transmitted or reflected by the fiber, in a linearly proportional relationship. By placing the sensors around the circumference of the riser pipe, at different "clock" positions, Roberts explains, it becomes possible to monitor actual pipe strain: "The strain differential shows the magnitude of the bending and hence the strain in the riser string." Real-time light wavelength monitoring is accomplished with an opto-electronic "interrogation unit," also part of the sensing mat.

The benefit of composites for this application is that the fiber optics and sensors can easily be embedded within the layup, to form a flexible yet strong sensing "mesh" in the desired configuration. For the Enterprise Endeavor project, the mat was fabricated with multiple plies of woven biaxial E-glass fabric in an epoxy matrix, using a vacuum-assisted resin transfer molding (VARTM) process in an open, curved composite mold. Fiber-optic cables with Bragg grating sensors were located at three stations along the length of the mat, in the middle of the layup thickness. The biaxial fiber architecture makes the mat flexible longitudinally, enabling it to conform to the pipe shape, while maintaining enough stiffness in the hoop direction to hold the cables and sensors in place and keep them separated properly, says Roberts. At the upper edge of the mat, cables were gathered together in a customized "exit structure," that was potted for water and pressure resistance.

Roberts says the concept has tremendous flexi-bility for many different types of structures: "We could do multiple units on a single long riser string, or a very long mat covering several riser joints." The mats don't need to be directly in contact with the pipe, but can be installed over deepwater insulation units, he continues, as long as such units mimic the general shape of the pipe. They can even be placed onto pipelines remotely, by an underwater ROV (remotely operated vehicle).

While the composite will likely absorb approximately 1 to 2 percent water (by weight), says Roberts, the structural performance knockdown (if any) isn't an issue: "The application isn't structural, it must simply maintain enough strength to hold the sensors in place."

Roberts' company isn't the only one that envisions "smart" composites for offshore applications. SMARTEC SA (Manno, Switzerland) uses the phenomenon of Brillouin scattering — when refracted light changes its path slightly due to variations in density, which can be caused by temperature gradients — in its SMARTape and SMARTProfile sensors. The sensors can be incorporated into the walls of coiled tubing or pipelines. The company is a partner with Smart Pipe Co. LP (Houston, Texas). The latter is developing self-monitoring pipelines that use the temperature gradient changes to detect leaks. One of its applications is a pull-through system that acts as a liner to remediate existing oilfield pipelines — special machinery literally folds the flexible pipe liner into a C-shape for easy installation, says Smart Pipe's Steve Catha. Another partner is Airborne Composites (Leidschendam, The Netherlands), which sells PDT-Coil, a smart downhole coiled tubing complete with power and data transmission capabilities for drilling or workover applications.

Spoolable pipe

The concept of spoolable composite piping has been around since the 1960s. Conoco was the first oil company to push for a commercially viable product in the mid-1980s. Although they were envisioned for high-pressure downhole and offshore uses, composite spoolables, for the present, find greater use in onshore gathering systems, says Mike Feechan, VP of operations at Fiberspar LinePipe LLC (Houston, Texas), owing to their corrosion resistance and the fact that they can be produced in long, continuous lengths that reduce connections.

Spoolable composite pipe consists of a thermoplastic liner overwrapped with a structural laminate of glass or carbon fibers in an epoxy matrix, which is then covered with an outer sacrificial wear layer of either unreinforced or glass-reinforced thermoplastic. In "bonded" spoolables, the thermoplastic liner is directly bonded to the structural laminate, while "unbonded" pipe has multiple discrete and unattached structural layers (composite and/or metallic) over the liner that can slip in relation to each other, allowing higher spooling strain and generally higher pressure capacity.

Fiberspar manufactures its bonded pipe by first extruding the thermoplastic (usually high-density polyethylene or crosslinked polyethylene) in the appropriate size, typically 62 mm to 112 mm (2.5 inch to 4.5 inch) in diameter. The liner acts as a moving production mandrel, pulled through a system of orbital filament winding devices that wind the wet-out glass or carbon fibers around it in a helical fashion. The production rate is typically 3m/10 ft or more per minute. The proprietary fiber architecture, winding angles and wall thickness of the structural laminate have been optimized in order to accommodate high spooling strains and pressure loads, says Feechan.

More than 1.8 million m (6 million ft) of spoolable pipe have been installed onshore in North America in the last five years, in applications such as wellhead production gathering lines, flow lines and injection lines. The composite product is displacing steel primarily because of speed and ease of installation — more than a mile of pipe can be spooled onto a single reel. "Experimental trials are one way to show feasibility and gain acceptance," he says, pointing out that Fiberspar both manufactures and installs its products, using appropriate equipment compatible with the composite. He expects that more than 1.2 million m (4 million ft) of additional spoolable line pipe will be installed this year and reports that the company has tripled its capacity to accommodate high demand. One growing use involves pulling the spoolable pipe through leaking steel pipelines, as a remediation measure, creating an impermeable and corrosion-resistant liner.

Opportunities for offshore spoolable applications are growing slowly. Statoil (Stavanger, Norway) tried a composite spoolable pipeline project several years ago with mixed results. Bjorn Melve, Statoil's composite champion, says the company qualified an offshore spoolable pipeline for 380 bar/550 psi glycol service at a water depth of 300m/980 ft, in the North Sea's Åsgard field. The now-defunct NAT Compipe AS (Tau, Norway) manufactured the 6.5 km/4 mile-long continuous pipe in the late 1990s. Pipe laying was complicated because of its buoyancy and the use of installation equipment and methods designed for steel, says Melve. But the biggest issue was the pipe's extreme elongation under pressure loading. "The internal pressure caused a 0.41 percent strain," he reports. "The resultant buckling made the pipe jump completely out of the sea floor trench in some areas." Unfortunately, the pipeline was abandoned because of uncertainty regarding its performance. But, says Melve, an appropriate design with the correct winding angle and wall thickness can result in an elongation matching that of a steel pipe of similar size for any type of pressure application.

Dozens of potential apps will consume composites

Pipelines are not the only means of petroleum product transport under consideration. Trans Ocean Gas Inc. (St. Johns, Newfoundland, Canada) has a new concept — transporting compressed natural gas (CNG) by ship in large composite pressure bottles or tanks. A $1.5 million joint industry project (JIP) involving Trans Ocean Gas, Composites Atlantic Ltd. (Lunenberg, Nova Scotia, Canada), certification society Det Norske Veritas and several other parties are currently verifying the technology for certification. "About half of the world's discovered natural gas is considered 'stranded,' or beyond the economical limit of a pipeline, and most is located offshore," says Trans Ocean Gas president Steven Campbell. "CNG transport by ship will allow stranded gas to be economically gathered and delivered to market."

While the company is mum on specific fabrication and material details, the concept involves filament winding large, cylindrical, fiberglass-reinforced pressure tanks as long as 12m/40 ft, with thermoplastic liners and stainless steel fittings on both ends. They will be placed upright in modular "cassettes" holding from 16 to 25 tanks, and connected to upper and lower piping manifolds for ease of filling and draining. Cassettes will be permanently installed and transported in container ship hull forms, says Campbell. Pressure will range between 10 Mpa and 25 MPa (1,450 psi and 3,600 psi) and temperature will be kept as low as possible, to maximize the amount of gas that can be transported. Says Campbell, "The density of our CNG is about 85 percent that of LNG without processing." Prototype bottles are being fabricated by Composites Atlantic and will be tested as part of the JIP.

"Composites are the preferred material over steel," notes Campbell, "because of lighter weight, corrosion resistance (thanks to the thermoplastic liner), cryogenic temperature resistance and crack and rupture resistance. Cost is also competitive with steel, given the proposed bottle size and relatively high steel prices."

Det Norske Veritas' Andreas Echtermeyer reports that his organization has developed acceptance criteria for the large composite tanks, as well as the necessary test requirements. Testing of tanks is scheduled to start in April of this year, and full certification is anticipated in October. "Our 40-ft refrigerated modal container will hold just over 500,000 ft3 at -5°C/20°F," concludes Campbell, adding, "The 40-ft composite 'reefer' containers will be available for lease by the end of the year."

While several presenters at CMOO-4 discussed composite riser projects in the works, their optimism was somewhat overshadowed by the industry's inability to get a number of composite riser joints installed on the ConocoPhillips' Magnolia tension leg platform (TLP) in the Gulf of Mexico. The CompRiser project, which was originated and championed by Conoco and Kvaerner in 1997, saw titanium-lined composite risers successfully tested on Statoil's Heidrun platform in the North Sea (see HPC July 2002, p. 40). The next-generation design has steel replacing the titanium as the liner material. A steel-lined riser design was successfully qualified for Magnolia, but field joints failed the factory acceptance pressure tests in late 2004. The cause of the failure appears to be a problem with welds in the steel liner, which allowed leakage, says Marc Leveque, principal engineer with ConocoPhillips. "For the Magnolia project, it's too late to get any risers in place now," states Leveque. "The problem was found at the very last moment and there wasn't time to continue — it's very painful, given the amount of money spent." ConocoPhillips terminated the CompRiser project and is no longer part of a riser JIP, but Leveque says that other JIP entities are likely to carry on. Shell Oil is pursuing a steel-lined riser project, working with Lincoln Composites (Lincoln, Neb.). Several European groups, including the Institut Francais du Petrole (Ruell-Malmaison Cedex, France), Vetco Gray (Stavanger, Norway) and Umoe Mandal (Mandal, Norway), also are developing riser concepts.

Other projects to watch for include a new flexible fiberglass pipe produced by Deepflex (Houston, Texas), which is similar to a steel-armored unbonded spoolable pipe but of all-composite construction. It's made with precured unidirectional laminate strips for pressure containment. Deepsea also is investigating a subsea buoyancy element. The hollow, thick-walled, cylindrical vessel is made with carbon fiber/epoxy sandwich construction to take the high compression loading of the deepwater environment. The element could be used for subsea separation, to house electronics or equipment on the seabed or for riser buoyancy.

"Deepwater development can be profitable and sustainable," sums up Shell's Hwang. "By working together with industry groups and contractors we can develop the best system solutions." Those solutions without a doubt will continue to include high-performance composite materials.

Related Content

Braskem demonstrates PP solutions using Weav3D composite lattice technology

Partnership combines Braskem’s polypropylene sheets with Weav3D Rebar for Plastics technology to address new structural, automotive applications requiring high-strength, lightweight material solutions.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read More3D-woven composites find success in aerospace, space

CAMX 2024: Bally Ribbon Mills experts are displaying the company’s various joints, thermal protection system (TPS) technologies and other 3D woven composites for mission-critical applications.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read MorePlant tour: A&P, Cincinnati, OH

A&P has made a name for itself as a braider, but the depth and breadth of its technical aptitude comes into sharp focus with a peek behind usually closed doors.

Read More

.jpg;maxWidth=300;quality=90)