CW Plant Tour: Aeris Energy, Caucaia, Brazil

This young, up-and-coming wind blade manufacturer was founded to serve the Brazilian wind energy market, but it’s poised to do much more.

To get to Aeris Energy, you very likely will pass through Fortaleza, a sunny coastal city of about 3 million people located in the northeast of Brazil in the state of Ceará, just a stone’s throw south of the equator. From Fortaleza, you’ll drive west on Highway 222 for about 45 minutes, and then turn north on to CE-422, which takes you to the Complexo Industrial e Portuário do Pecém (industrial park), just a few kilometers south of the Port of Pecém, one of the largest in Brazil. You will pass an electrical substation, on your left, before approaching Aeris Energy on the east side of the road, readily identified by a large number of wind blades lined up in expansive, open yards next to the facility’s largest buildings.

You will park in the lot next to the security station, and as your passport is checked and verified, you notice three things: It is hot, windy and you are, you believe, very far from civilization. It’s poor preparation, indeed, for entry into Aeris Energy and the education you’re about to receive about its beginnings, the people who work there, the up-close look at its operations and how important this out-of-the-way location is to Aeris, local wind turbine manufacturers and to Brazil.

The wind in Brazil

To understand the genesis of Aeris Energy, you must first understand the Brazilian wind energy industry. The profile of electricity generation in Brazil is unlike that of other major countries. Brazil is the second largest producer of hydroelectric power in the world (behind China), relying on it for more than 75% of its electricity. Most of the hydropower, naturally, comes from river systems in north and northwestern Brazil, which is far removed from major population centers and thus presents a challenge from an energy transmission and reliability perspective.

To stabilize the hydropower situation, Brazil is constructing the 14,000-MW Belo Monte dam on the Xingu River in northern Brazil, which will be, when it opens this year, the second-largest dam in Brazil and the third largest in the world. Still, Belo Monte also is far from Brazil’s major cities, which are located primarily on its east coast.

The inherent problem of hydropower is its dependence on water. When there’s a drought, water flow and energy generation are reduced. The country, therefore, is turning to other resources to help stabilize its electrical energy supply. These include liquefied natural gas, solar and wind power. Wind holds an advantage: During a drought, the generally stiff winds in the northeast region are actually stronger, which makes wind energy complementary to hydropower. Further, the wind turbine manufacturing supply chain in Brazil is mature: the infrastructure and manufacturers are already in place to meet the needs of wind farm development.

This is important because Brazil’s state-run national bank, National Development Bank (BNDES), which finances much of the country’s wind farm development, stipulates that wind farms funded by BNDES in Brazil must use wind turbines manufactured in Brazil. This demand is designed, of course, to drive internal economic development and job creation, which it has: the Global Wind Energy Council (GWEC, Brussels, Belgium) reports that Brazilian wind energy capacity increased from only 29 MW in 2005 to 8.7 GW by year-end 2015, ranking it tenth in the world in total installed wind energy capacity. Brazil installed 2.75 GW of wind energy in 2015 alone. Its wind energy sector now employs more than 41,000 people.

Aeris Energy begins

This demand for locally manufactured wind turbine components drove the creation of Aeris Energy. Any wind turbine manufacturer, if it wants to sell turbines into Brazil, must either establish a facility in Brazil, or find a supplier established in Brazil.

Recognizing this opportunity, around 2009, were five relatively young executives who worked for several years in the Brazilian aerospace sector. Each was educated in composite materials, and each had a deep understanding of the technologies and processes required for composites manufacturing. “The wind industry itself caught our attention,” says Bruno Lolli, one of the executives and currently planning and process management director at Aeris. “The opportunity to work with clean energy was very interesting to us. It was very important.”

Beginning in late 2009 and into early 2010, the five men began to outline the parameters of what would become Aeris Energy. Meeting early in the morning before work at their then-current jobs, and often in the evening after work, they became steadily convinced that their plan had merit. They only lacked what every entrepreneur desperately needs: money.

Fortunately, in early 2010, they connected with an investor who had just sold a company and was looking to put his money to work in the renewable energy sector. Lolli remembers well the investor’s response when they presented their business plan: “He said, ‘Are you presenting this business plan for other potential investors?’ We said, ‘Yes, we are.’ He said, ‘Please stop. My lawyer will prepare some simple term sheets so that we can move forward together.’” Thus began a financial marriage that officially launched Aeris Energy in mid-2010.

The biggest decision the five faced, says Lolli, was where to physically locate the facility. All five men had originally come from the São Paulo area, but they knew, because transportation represents as much as 20% of a wind blade’s cost, that their plant had to be located where wind turbines were being installed, in the northeast, where half of Brazil’s wind potential is located. Aeris Energy’s founders also knew, says Lolli, that access to overseas shipping facilities would be critical to the company’s long-term growth, particularly if it ever wanted to reach non-Brazilian markets. Therefore, Caucaia was chosen, and construction began in 2011.

By late 2011, with construction complete, Aeris won its first blade manufacturing contract, with India-based wind turbine maker Suzlon Ltd. This was followed in early 2012 with a contract with Spain-based Acciona and, in late 2012, with WEG (pronounced “vegg”), a Brazilian energy and industrial equipment specialist. The Suzlon contract expired in 2013, but it was replaced quickly by one with Vestas Wind Systems A/S in early 2015, and General Electric (GE) in 2016. Blades made by Aeris range in length from 53.7m to 61.2m.

During this growth period, Aeris went from per annum production of 100 blades in 2013 to 2,000 blades today, operating out of a sprawling 55,000m2 multi-building campus that employs 2,500 people. The company has become a stalwart employer, a highly respected blade manufacturer and a vital cog in the Brazilian wind energy machine.

The tour

Perhaps it goes without saying, but the sheer size of wind blades makes their manufacture a logistical challenge several orders of magnitude more complex than most composites manufacturing.

Quantities of core material, glass fiber fabric, epoxy resin, epoxy adhesive and bagging materials are measured in thousands of kilograms. Molds are long and complex, and the number of employees required to produce a single blade introduces an error potential that makes quality control that much more challenging.

Aeris manages this complexity, and the people within it, by organizing its manufacturing around its customers. So each customers’ work is organized, based on the molds dedicated to its blades. Lolli is CW’s guide during the plant tour, and our first stop is administration, where the board of directors (the five founders) works alongside employees in human resources, finance, control and contract management. is open-concept work area, says Lolli, fosters communication among managers and the rank-and-file, and puts the five founders in direct proximity to day-to-day operations of the plant.

Next stop is the GE/WEG building, featuring three 56.9m GE molds and one 53.7m WEG mold. We enter the building from the middle of its long side and find the largest molds, for the wind blade shells, lined up one after the other along the left side of the facility, each fully open, surrounded by workers and in various states of being laid up with dry glass fiber fabric and core material, including balsa and foam (Figs. 2-4). Some ply and core placement is guided by overhead lasers. Each mold is a clamshell construction, comprising two halves connected by massive hinges.

On our right, across from each mold, are smaller tools, used to fabricate the corresponding shear webs and spar caps, and these are also being laid up. It is obvious, looking at the molds, that the architectures and material selection for the turbine manufacturers’ blade designs vary. Where and how core and glass are applied is readily apparent. Similarly, shear web and spar cap designs also differ significantly.

Once layup of each blade half is complete, spar caps are placed in each half, and then the entire mold is bagged for resin infusion. The molds are heated and full cure takes about a day, says Lolli, but the blades usually can be bonded within 4-5 hours of infusion, followed by demolding. Aeris, he says, carefully controls mold temperature and manages exotherm closely.

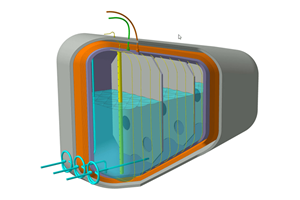

When infusion is complete, the molds are prepared for shear web attachment. The shear web, which runs about 90% of the blade’s length, is a large composite structural beam that is attached to and works with the spar cap to stiffen the blade and carry bending loads. The three primary blade components — shells, spar caps and shear web — are critical not only to blade function, but also blade longevity. Each must meet closely managed specifications to provide optimum wind turbine performance, says Lolli.

Passing through the building, we see an overhead crane transferring a shear web into one of the GE mold halves. Workers are carefully positioning the web onto adhesive attachment points in the mold on the spar cap to ensure precise location and fit. After we leave, workers will apply bonding paste to mating points of the mold half with the shear web. Then, the mold half without the shear web attached will be closed over the half with the shear web, thus completing blade fabrication.

As we leave the GE/WEG building, we notice, in the facility’s midsection, between the blade molds and the spar cap/shear web molds, the blade root molds. Oriented with the blade-mating side facing the blade molds to permit easy attachment with minimum effort, each is being laid up and infused, to coincide with its blade.

Adjacent to the GE/WEG building is the newest structure on the Aeris campus, where Acciona’s blades are laid up — at 61.2m, the longest Aeris manufactures. During our visit, this space was being reconfigured to accommodate mold reorganization. Aeris is building another structure like it. Two more WEG molds and the Acciona molds will eventually be moved to these spaces.

Cutting, kitting, resin

Next stop is the cutting and kitting building, where glass fabric, peel ply and infusion bagging film are cut and kitted for all non-Vestas wind blade assembly. The room is dominated by a large 10m-long Eastman Machine Co. (Buffalo, NY, US) automatic cutting table for the cutting of glass fiber fabric and, next to it, a 25m long table for manual cutting of peel ply and lm (Fig. 5). Glass fiber fabric is delivered to this room from the warehouse on large rolls. Glass used here includes fabric from Owens Corning (Toledo, OH, US), SAERTEX GmbH & Co. KG (Saerbeck, Germany), CPIC (Chongqing, China) and Gammatensor (Alcoy, Spain). Owens Corning materials are supplied from Rio Claro (São Paulo, Brazil). Saertex materials are supplied from Indaiatuba (São Paulo or Huntersville, NC, US). Cut plies come off the table, are immediately re-rolled by workers and then stacked on pallets and prepared for delivery to molds.

Lolli says that one of the challenges of molding large blades from large molds is dimensional accuracy. Even the very best molds made to the highest standards are unlikely to match, exactly, the plies in the as-designed layup schedules. Thus, it is also unlikely that plies cut to design spec will lay up without some gaps or overlaps. Because of this, kit development for each blade design is, upfront, an exacting, time-intensive process that, ultimately, ensures that Aeris’ blades meet spec with minimal waste.

To start, Lolli says, when a mold is delivered, the first plies are cut to a size a little bit larger than print. These are placed in the mold and trimmed by hand to the geometry of that specific mold, with no gaps or overlaps. These plies then become the new masters for that mold and are used to program the recipe in the cutting table software. The goal, notes Lolli, is to deliver kits to each mold that are complete and precise. “Material coming into the kitting room is in a form we cannot control,” he says. “When it leaves here, it must be perfect. The production hall is an assembly line, not a manufacturing line.”

From the cutting and kitting building, we venture outside toward Aeris’ resin storage facility — a massive walled, roofed shed, vented to the outside with large, windowless openings near the roof line. Inside, stacked almost to the ceiling, are hundreds of epoxy containers, and several of adhesive bonding paste.

Most of the epoxy resin, and all of the bonding paste used at the Aeris facility is supplied by Hexion Inc. (Columbus, OH, US). The resin is Hexion’s RIM 035C, designed for infusion and used for all non-Vestas blades. The bonding paste originally supplied to Aeris was Hexion’s RIM BP135G3, but that is increasingly being replaced by the new RIM BP535, which Hexion says offers better exotherm properties and much improved mechanical properties (Fig. 6). For the occasional hand layup and repair work that must be done on blades, Aeris uses Hexion’s HLU L135 resin system.

Hexion’s presence at Aeris is substantial and longstanding. Indeed, Lolli credits the resin supplier with not only providing material that does the job, but in helping the blademaker optimize and improve its manufacturing operations all around. Hexion not only built a resin manufacturing facility in Itatiba, Brazil, to serve Aeris and the rest of the domestic market, but Hexion personnel are routinely at Aeris to provide technical and other assistance. “Hexion’s support has helped us be competitive,” says Lolli. “It is a partnership we have with Hexion, and not just in a commercial sense.”

Finishing

After they are laid up, infused, bonded, assembled and have their roots attached, all non-Vestas blades are transferred to the finishing building for painting prep (Fig. 7). Here, workers conduct nondestructive testing, assessing, in particular, bondline quality. Lolli says that about 90% of all blade failures can be traced to bond failures, so Aeris must check every bondline against design allowables, and then decide if remediation is required. “Rework is very expensive,” Lolli notes. “Not to deliver the product is the most expensive.”

Workers in the finishing building also remove excess paste from the bond lines, fill in small holes in the blades, adjust and trim the root, attach an aluminum tip at the end of the blade, and sand the entire surface of each blade skin. Each blade is then transferred to a massive booth to be painted. This is the noisiest, smelliest, dustiest, dirtiest process that Aeris performs, but it is vital to creating a blade surface that, when installed on a turbine, most optimally captures wind energy.

It is in the finishing building that Lolli pauses at the tip of a finished wind blade. He points out the unique curvature of the blade as we look down its length, and he emphasizes the importance of a strong adhesive to maintain blade integrity. Our tour is joined here by Johannes Meunier, Hexion’s global segment leader, wind/composites, who is a member of a larger technical team from Hexion that has provided critical technical support to Aeris as it has developed its wind blade manufacturing (see the Side Story titled, “Wind blade economics”).

Meunier points (Fig. 8) out that the leading edge, particularly near the tip, is the part of the blade most subject to abuse in service. On a turbine with blades 56.9m long, rotating at 15 rpm, tip speed is 200 mph/322 kmh. Even half way along that blade, rotational speed is 100 mph/161 kmh. at leading edge, therefore, is being impacted at high speeds and quickly eroded by dust, insects, hail and a variety of other materials. Protection against that erosion is a massive challenge for any wind blade manufacturer, Meunier says. And it’s a problem not yet solved.

Vestas operations

Notably, Aeris Energy’s facility is the second in the world at which Vestas allows its blades to be manufactured by a non-Vestas entity. In fact, the wind turbine manufacturer is famous for the stringent control is exerts over its manufacturing operations. Thus, Aeris must make Vestas blades to the same exacting standards Vestas maintains in its internal operations.

All Vestas operations — cutting, kitting, molding, assembly, finishing — are confined to one building. And there, everything is done to the Vestas spec, as if it were done by Vestas itself. To accomplish this, Aeris sent teams of employees, for weeks at a time, to the Vestas blade manufacturing facility in Windsor, CO, US, where they learned Vestas production standards and practices. In addition, Vestas placed in the Aeris plant two employees of its own to oversee operations.

Cutting and kitting, as with non-Vestas blades, is done on another large Eastman Machine cutting table.

On the production floor, Aeris runs four Vestas-made molds, making 54m blades for the Vestas V110-2.0MW turbine. Lolli says it takes Aeris about 24 hours to make one Vestas blade, with three blades per day coming off the floor. Highly engineered, each features a five-piece shear web and a pultruded carbon fiber spar cap. The result is a highly optimized blade that, at 8 MT, weighs 27% less than other blades of similar length.

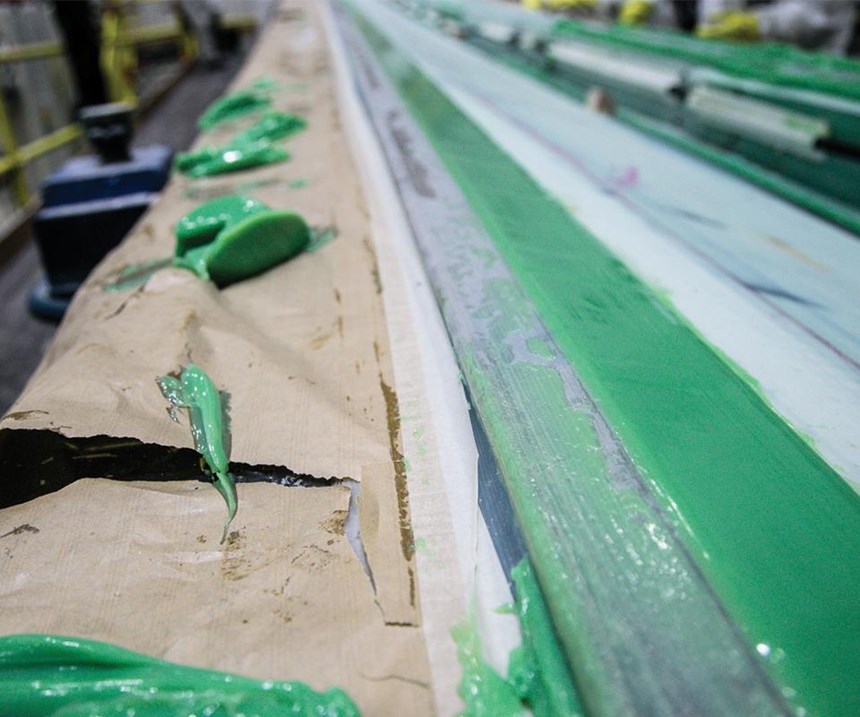

While we were in the Vestas production hall, workers had just placed the shear web in one mold half and were in the process of applying Hexion’s BP535 bonding paste (bright green) to the mold’s mating surfaces. With this done, technicians, supplies and equipment are cleared from the work area, and the other mold half is hinged over and onto the shear web half. It takes about 90 seconds for the mold to close. Workers then climb into the closed blade and remove excess bonding paste squeezed out when the halves mated.

Talking later about the importance of bonding paste in wind blade manufacturing, Hexion’s Meunier notes that BP535’s attributes — low density, high toughness, low sag, spreadability and longer working life — can allow wind blade fabricators to eliminate use of the “galactica,” a multi-million dollar superstructure typically used to support a shear web on the spar cap and mold shell until the bonding paste cures. This is part and parcel with an overall effort by blade manufacturers and material suppliers to optimize blade fabrication, while not only maintaining, but improving, quality.

Immediately adjacent to the production floor is the Vestas finishing hall, where operations are similar to those in the non-Vestas finishing building: NDT, filling, sanding, painting. One difference: Vestas tips its blades with copper, instead of aluminum.

After a Vestas blade is painted and deemed complete by Aeris, one of the two Vestas employees on site is called upon to inspect and certify that it meets the company’s standards. The blade is then transferred outside, ready for shipment (Fig. 9).

Human relations

Technical issues aside, one of the biggest challenges Aeris faces, given its location, is finding, training and retaining qualified employees.

Ceará state, like many developing regions, lacks or has a minimum of the education, health care and transportation resources necessary to provide a company like Aeris with a steady supply of able workers. This means that even the most qualified employees — most likely from Fortaleza, an hour away — probably have no access to reliable transportation, and could easily miss work if they or a family member is beset by poor health.

Recognizing this, Lolli says Aeris has invested heavily, first, to recruit and train employees but, second, to create a work environment that provides basic needs for each worker. “It is not hard to manufacture blades fast,” Lolli says. “But you must have the right people with the right behavior.”

Training at Aeris, Lolli notes, is organized into four tiers, revolving around processes and materials. Employees are expected to complete at least three of those levels. And for employees who have not completed high school, Aeris hires teachers to help them earn their diplomas.

To meet basic needs, Aeris’ efforts start away from the plant. Before each shift (the company runs three shifts daily, six days a week), a dozen buses fan out across the region and pick up employees at several designated locations. Once at the plant, before he or she begins work, each employee is given a snack and a drink. This is followed, mid-shift, by a full meal in the company-run and –funded cafeteria.

After they eat, employees can relax, read, play games or nap at the Aeris Living Center, a large, open-air, covered facility that includes a small library. Finally, to maintain employee health, Aeris pays fully the healthcare insurance premium not just for every worker, but every worker’s family. The company also provides — on site, full time — a nurse and physician. When each shift ends, the same buses return all workers home.

Lolli says that in 2015 the company evaluated its work environment and position in the larger economy and established three goals it intends to meet: by 2018, be ranked among the 10 best places to work in Ceará; be among the 100 most sustainable companies in Brazil; be among the 1,000 biggest companies in Brazil.

Going forward

Looking to the future, Aeris seems primed for growth, wherever it occurs. The company is already located within 500 km of 70% of Brazil’s wind farms, and as long as the Brazilian wind market sustains its growth, Aeris is poised to ride along. If, however, domestic conditions change, or if customers need Aeris’ blades outside of Brazil, the company’s easy access to overseas markets offers a path to sustainable growth. In the meantime, the company has room to expand, strong investor support, excellent technical expertise, a well-developed workforce and a manufacturing model that emphasizes quality and customer service.

Says one of the Aeris founders, “We are who we are. We work hard, we do good things and sometimes we make mistakes. If we see a problem, there is a chance for us to fix it. But the blades we deliver must work. We can have a problem here. We cannot have a problem at the wind farm.” So far, so good.

Related Content

JEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreMingYang reveals 18-MW offshore wind turbine model with 140-meter-long blades

The Chinese wind turbine manufacturer surpasses its 16-MW platform, optimizes wind farm construction costs for 1-GW wind farms.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More