The market for OOA aerocomposites, 2013-2022

In the coming decade, out-of-autoclave technologies will increase composites penetration into primary flight structures.

Over the past four decades, the use of composite materials in aerospace programs has undergone a remarkable transition. There are many stories that describe this change but none is more significant, in terms of potential, than the advent and evolving growth of aerocomposites made without the use of an autoclave. Out-of-autoclave (OOA) composites manufacturing actually encompasses, as we’ll note, several combinations of methods and materials. Although these methods account for a relatively small part of the total aerocomposites output today, they show much promise for the future. But the outlook for OOA composites depends on a complex set of interrelated factors. To understand the market for OOA aerocomposites, then, we first have to contextualize these materials and processes by looking at the entire aerospace composites market. That begins with a little history.

Looking back

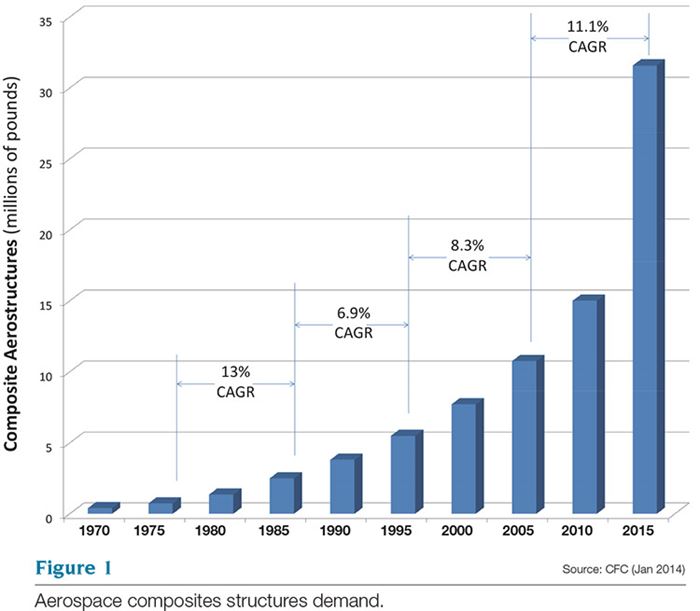

Autoclave-cured composites first found use mainly on military fighter jets and small private aircraft during the 1960s and 1970s and were accepted immediately as the standard because their quality was clearly superior to other forms of composites manufacturing at that time. Initial applications of fiber-reinforced composites, however, were confined to small fairings and noncritical flight structures. Acceptance was understandably slow. In the 1980s, the use of carbon fiber, glass fiber and aramid fiber composites became common in the production of aircraft control surfaces and large fairings, as well as containment and thermal components for rockets, missiles and satellites. Historical data, attributed to the once active Suppliers of Advanced Composite Materials Assn. (SACMA), indicates about 2.8 million lb (1,270 metric tonnes) of composite structures were fabricated for the aerospace industry in 1986. Nearly a decade later, production volumes doubled — thanks in large part to successive technical developments in materials and manufacturing as well as automated-cutting and material-deposition machines. Volumes doubled again by the mid-2000s, reaching more than 10.8 million lb (4,880 metric tonnes).

The view from here

Fast-forward to 2013 and we find that more than 21.3 million lb (9,662 metric tonnes) of finished composite structures were delivered to, or manufactured for, the aerospace industry, representing a value in excess of $9 billion (excluding engineering, prototype, assembly integration, or other value-added services). Notably, by 2015, based on research by Composite Forecasts and Consulting (Mesa, Ariz.), total aerostructures composite volumes are expected to reach more than 30 million lb (13.6 metric tonnes) — about triple the 2005 values (see Fig. 1). Driving this spike in growth are some current production programs that feature airframes that can exceed 65 percent composite by weight, while 15 percent to 40 percent is more representative of the wider aeroindustry.

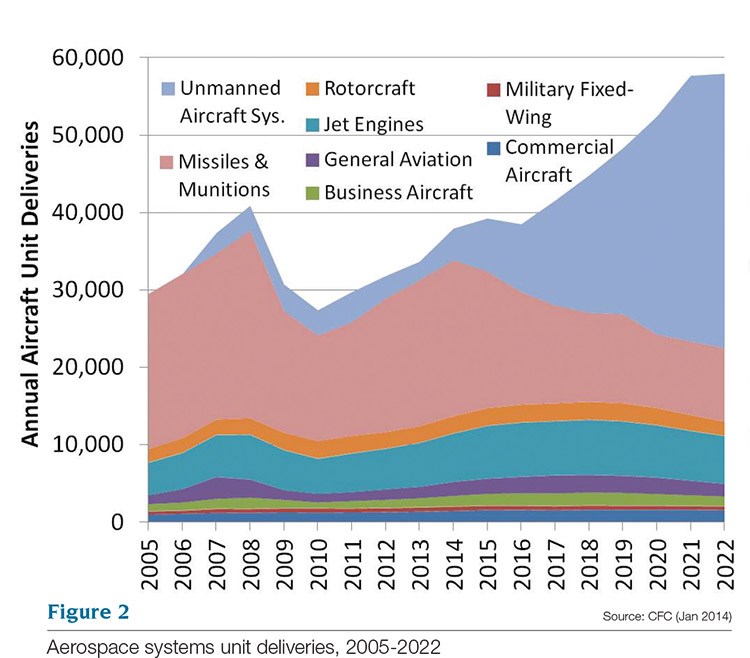

Another facet of the context is the global demand for all aircraft and related aerospace systems. In terms of unit deliveries, it is expected to grow modestly — about 6 percent annually — during the next 10 years. Many of the 452,000 delivered systems during the period 2013 to 2022 (see Fig 2) are attributable to large numbers of relatively small, unmanned aircraft systems (UAS) and missile systems. Without these two components of the aerospace market, annual system deliveries would increase at a much slower rate of 1 percent per year.

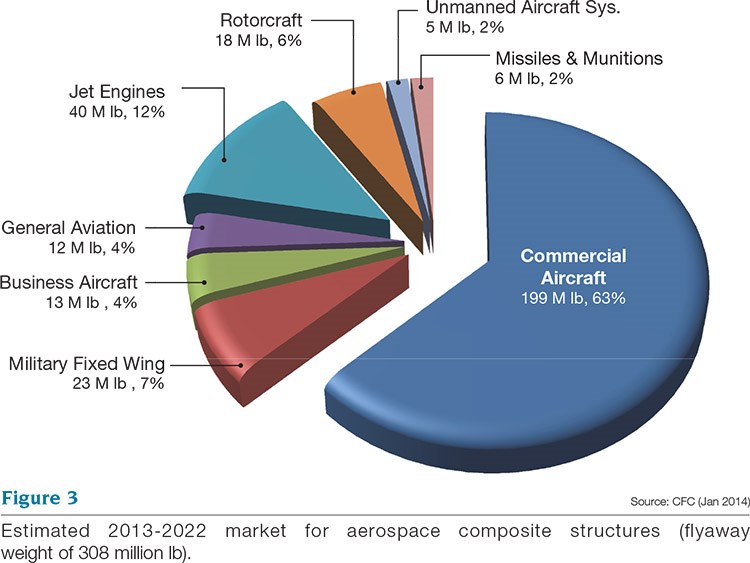

But that is the story the unit numbers tell. When we look at demand for composites by weight (Fig. 3), the dominant submarkets will continue to be fixed-wing aircraft and related jet engines, which represent about 90 percent of the forecasted composite aerostructures demand. Further, about 75 percent of forecasted composite aerostructures demand is associated with commercial and regional jets (not including interiors) and associated jet engines.

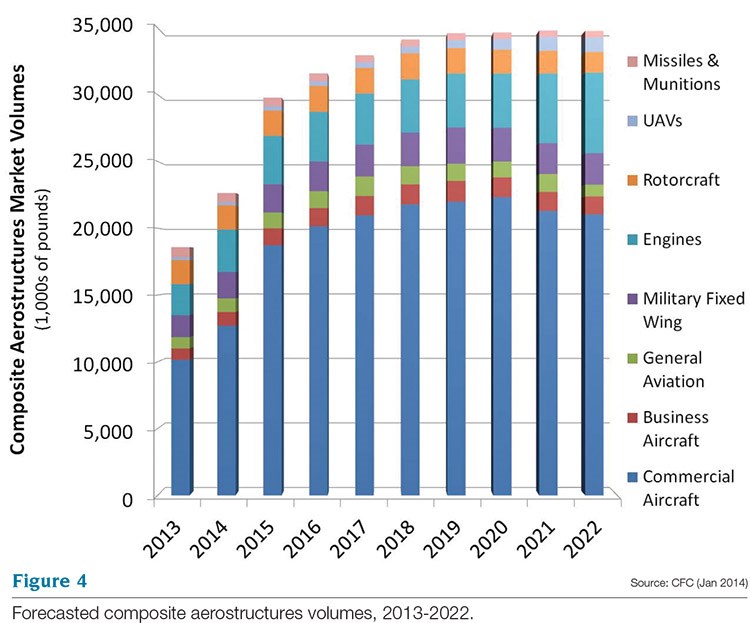

Demand is expected to spike for composite aerostructures over the next several years. The continued ramp-up in production of The Boeing Co.’s (Chicago, Ill.) 787 and the Airbus (Toulouse, France) A350 XWB dominates much of that growth and will be the driving force behind a rapid acceleration in demand over the next three years. But opportunities for more widespread composites adoption are already in the works and include Boeing’s 777X, Commercial Aircraft Corp. of China’s (COMAC, Shanghai, China) C-919, the Irkut MS-21, Embraer’s (São José dos Campos, Brazil) second-generation ERJ-170/190/195X models, and Sukhoi Civil Aircraft’s (Moscow, Russia) SuperJet NG. Although none of these aircraft are expected to adopt a carbon fiber fuselage, CFRP is expected to be the primary structural material in wing and empennage — largely replacing aluminum in these portions of the aircraft. This is expected to drive the overall contribution of composite aerostructures for these new models as high as 30 to 40 percent of airframe weight, compared to 14 to 27 percent in current models. These aircraft will help to drive the continued growth in demand for composites near the end of the forecast period, but will certainly not have the same impact as the Airbus A350 and Boeing 787. As a result, demand for composite aerostructures is expected to plateau, dropping from a compound average growth rate of 20 percent from now to year-end 2016 to very low single-digits by decade’s end (see Fig 4).

OOA: What and why

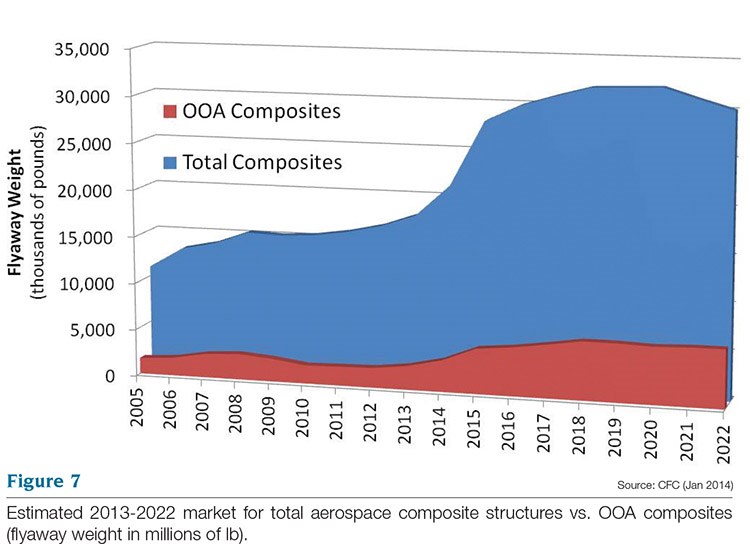

In Fig. 4 and the figures that follow, we see what portion of total aerocomposites demand will be accounted for by OOA composites. Notably, OOA will remain relatively small compared to the total, and we also note a dip in total demand near the end of the forecast period. These phenomena demand some detailed explanation.

First, Fig. 4, shows that the anticipated use of aerospace composites, generally, is expected to grow at an average annual rate of about 7 percent between 2014 and 2022 — only slightly more than forecasted aircraft unit deliveries. One reason for this is that a number of cost, technical, and logistical factors seem to dictate that aluminum alloy will continue as the primary material for fuselage production throughout this decade and perhaps well into the next.

In the single-aisle commercial transport class (130 to 210 passengers), continuous improvements in design methodology and new-generation aluminum-lithium alloys have enabled aeromanufacturers to produce a fuselage that is about 3 to 5 percent lighter than a comparable composite fuselage. Aluminum-lithium alloys also offer modest cost savings compared to current carbon fiber-reinforced polymer (CFRP) design concepts. As a result, it seems clear that today’s paradigm of autoclave processing of high-performance thermoset composites will not be sufficient to address the daunting needs of the two most anticipated aircraft programs of the next decade: replacements for the highly successful Airbus A320 and Boeing 737 families.

Using the same materials and processes employed on the new generation of transport aircraft, such notional replacements might have airframes that are as much as 35 percent composites by weight, but fuselages would most likely be constructed of third-generation aluminum-lithium alloys. Replacements for either the A320 or B737 family would need to be produced in volumes in excess of 400 aircraft per year, and could require about 10 million lb (4,536 metric tonnes) of composites per year. With entry-into-service estimated around 2026, replacements for both the A320 and B737 could roughly double the commercial transport sector’s annual demand for CFRP by 2032.

If, however, the aerospace composites industry is to avoid being trapped into organic growth models after 2022, then it needs to address a number of key issues:

• Component cost

• Fabrication labor and assembly cost

• Lightweighting (fuel efficiency) vs. durability (length of service)

• Processing and curing speed

• Capital cost of new manufacturing capacity

Based on the experience of recent Boeing and Airbus aircraft development programs, managing the production upswing for composites-intensive aircraft is not easy when a program’s rate production ranges from 80 to 120 aircraft per year. A big factor is the required investment in new facilities, autoclaves, automated production equipment and other capital equipment. The cost for these items in support of production of large empennage, wing and secondary structures for a single program (let alone two or three) to replace planes in the A320 and B737 families would be several billion dollars. That’s a large slice of the of an estimated $20 billion project development budget.

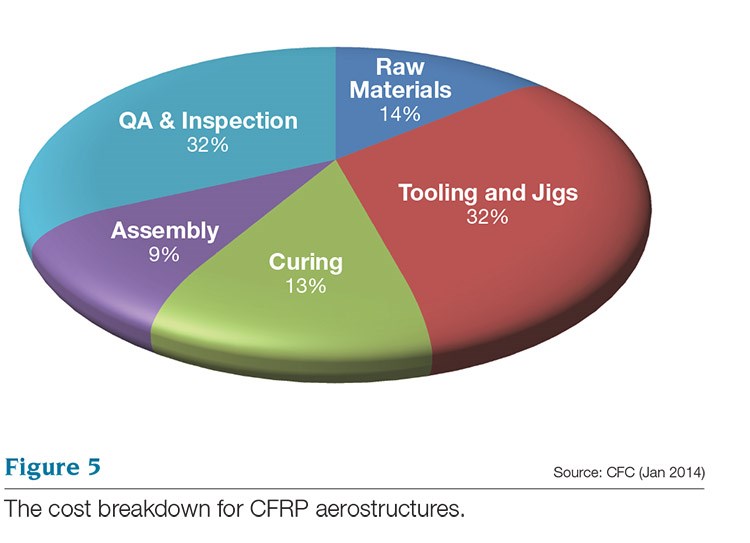

There are, however, opportunities for cost reduction in the manufacture of carbon fiber-reinforced plastic (CFRP) and other composites. Although these include making small gains in raw material costs, the cost breakdowns in Fig. 5 show that quality inspection and control currently account for about one-third of the total cost of producing aerocomposites and are a process bottleneck for many large parts. Fortunately, high-speed CO2 laser equipment and other nondestructive inspection technologies should reduce these costs, improve inspection resolution and substantially trim processing time over the next 10 years — and could cut quality assurance costs in half.

Although automated laminate fabrication and placement equipment is helping to improve fabrication speeds, this equipment is expensive and is often best suited for very large pieces, due to the economics. Tooling, production jigs and related equipment, however, also account for about one-third of typical manufacturing costs — much of which is required to meet the environmental conditions of the autoclave. Curing and assembly costs each represent about 10 percent of typical manufacturing costs. Reducing assembly costs often drives the strategy of parts consolidation — this is a general strength of composites — however, the resulting large assemblies would require equally large autoclaves to accommodate them, defining a technical vs. costs and logistics tradeoff. This reality provides justification for increased development of OOA processes and materials.

Gauging market potential

If composites are to continue to displace traditional metals, then, aerocomposites manufacturers must face these realities. But in doing so, they must also maintain or improve upon the performance properties typically achieved in prepreg-based, autoclave-cured parts. Fortunately, OOA technologies have evolved over the past 25 years, and there is ample evidence that they could play a more significant role in the growth of composite aerostructures manufacturing.

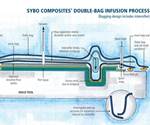

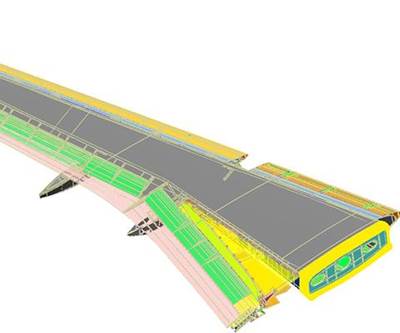

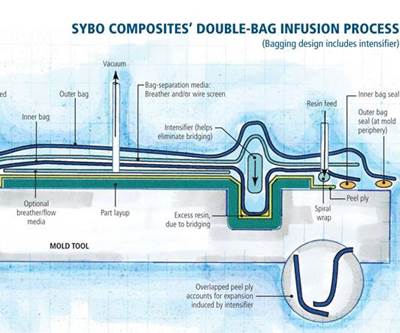

Today, a large number of OOA molding techniques are available to aeromanufacturers: resin transfer molding (RTM); vacuum-assisted RTM (VARTM); Same Qualified Resin Transfer Molding (SQRTM, developed by Radius Engineering Inc. (Salt Lake City, Utah); out-of-autoclave, vacuum bag only; Controlled Atmospheric Pressure Resin Infusion (CAPRI, patented by Boeing) double vacuum bag infusion molding (see "Double-bag infusion: 70% fiber volume?" under "Editor's Picks," at top right), multi-axial compression molding and thermoplastic composite forming and welding. Each of these technologies is now an established production method for aerospace structures. Composite Forecasts’ data indicates that these OOA processes already represent about 14 percent of current aerospace composite shipments, approximately 2.6 million lb (1,158 metric tonnes). The growing applications for the resulting OOA composites include:

• Airbus A340 & A380 wing fixed leading edges

• Airbus A340 & A380 keel beam ribs

• Boeing 787 pressure bulkheads

• Boeing 787 and Airbus A350 XWB trailing edge component packages

• Gulfstream Aerospace Corp.’s (Savannah, Ga.) G650 rudder, elevator, floor beams, etc.

• Mitsubishi Aircraft Corp.’s (Tokyo, Japan) MRJ regional jet’s vertical stabilizer

• Wingtip extensions for Northrop Grumman’s (Falls Church, Va.) RQ-4B Global Hawk

• The pressurized cabin section of the Bombardier Aerospace (Montréal, Québec, Canada) Learjet 85

• Diamond Aircraft (Wiener Neustadt, Austria) and Cirrus Design (Duluth, Minn.) general aviation airframes

• RTM’d propeller blades for turboprop aircraft

• Turbofan engine fan blades and spacers, containment cases, stator vanes, etc.

• JASSM/JASSM-ER VARTM fuselage sections

• Foldable wings, control surfaces and launch tubes and containers for missiles and munitions

When we look at the adoption of OOA processes in current composites production programs, the pattern looks similar to that for autoclaved composites during the 1980s and 1990s: Widespread adoption started largely with secondary flight structures, fairings and control surfaces.

To a considerable degree, the fiber volume and porosity of many OOA processes and materials have been limiting factors. For primary airframe components of commercial transports and military aircraft, most manufacturer specifications target less than 1 percent void content and fiber volume fractions of 65 percent or greater. For secondary structural components void content can range to about 2 percent. With the exception of those who employ RTM, current users of OOA processes and materials have struggled to meet the thresholds for acceptable secondary structures performance. Aerospace OOA void content typically ranges between 1.5 and 5 percent. That and the related knockdown in structural performance and the ability to withstand hot/wet conditions have limited OOA’s ability to serve in large primary airframe components. Most of the OOA prepreg materials also have significantly shorter out-lives before they lose tack and suffer performance degradation compared to popular autoclave-curable systems.

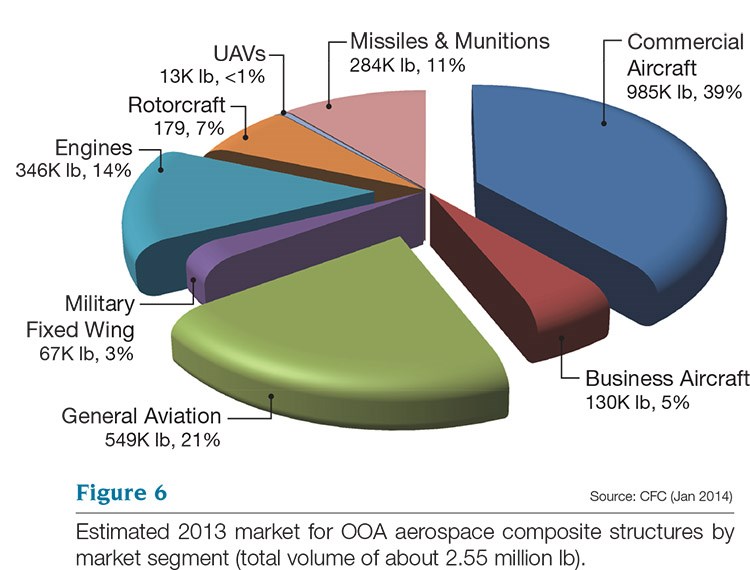

Not surprising, then, is the fact that, until the recent ramp in production related to the Boeing 787 and Airbus A350 XWB commercial twin-aisle aircraft, small general aviation or privately owned aircraft were the largest aerospace users of OOA materials and processes. Prior to the Great Recession in 2008, general aviation manufacturers are estimated to have produced roughly three-quarters of all of their composite structures using OOA processes and accounted for about 57 percent of the total demand for OOA composite aerostructures. But if we consider the increasing use of OOA composites in secondary and flight-control components alone for previously noted commercial transport programs, then commercial aircraft and related engines will account for about 55 percent of OOA composite production in 2022 (see Fig. 6).

Over the coming decade, the potential for OOA technologies to produce large, unitized composite primary structures could be more fully realized or, at least, better understood. Integral bonding of components will simplify assembly and further reduce the need for costly and heavy fasteners. In fact, process analyses by some OOA manufacturers indicate that they are able to reduce component manufacturing costs between 25 percent and 60 percent compared to traditional autoclave methods.

At the same time, there is also the potential to double processing speeds, cut energy consumption in half and reduce facilities and equipment costs by more than 60 percent. Moreover, OOA methods, such as the Quickstep process (Quickstep Composites LLC, Bankstown Airport, New South Wales, Australia) and double vacuum bag curing of prepregs, have demonstrated the ability to achieve the <1 percent void content desired for primary structures. Although there are still many challenges — the need to improve hot/wet performance, material out-life and preform production/material deposition rates for OOA-specific material forms — development work over the past few years is beginning to show results.Newsworthy examples already exist. AeroComposit, part of Russia’s United Aircraft Corp. (UAC, Moscow, Russia), has teamed with FACC (Ried im Innkreis, Austria) and Diamond Aircraft to produce prototypes for the Irkut (Moscow) MS-21’s wing, using an OOA VARTM process (click on “Resin-infused MS-21 wings and wingbox," under "Editor's Picks”). This MS-21 infusion-molded wing is also expected to provide the basis for the next-generation Sukhoi Super Jet variant, which will compete in much the same market space as the Bombardier CSeries. The vertical stabilizer for Mitsubishi Aircraft’s MRJ, the pressurized cabin for Bombardier’s Learjet 85 and the thermoplastic composite empennage structures on Gulfstream’s G650 represent some of the first OOA primary aerostructures to reach the market. These programs increase annual composite structures volumes produced by OOA methods from 2.6 million lb (1,179 metric tonnes) in 2013 to 6.25 million lb (2,835 metric tonnes) in 2022 — 18 percent of the total forecasted aerostructures market (see Fig. 7).

Although the technology strategies for the announced new airliners seem fairly well set over the next few years, there is still territory in which OOA expertise could be applied. Technical upgrades to replacement jet engines on existing aircraft are likely, to help improve fuel efficiency and reduce noise. Therefore, OOA components could displace autoclaved nacelle and fan case structures. Already, a number of tests have demonstrated the potential of dry fiber placement and high-temperature resin infusion for components such as nacelle shrouds. 3-D woven preforms for infusion molding could provide solutions for stringers and other components. Multiaxial compression molding could provide spinners and other complex shaped devices as a lower-cost alternative to RTM. And some OOA processes might offer further potential for engine cascades and acoustic panels — some of the most common composite engine applications.

Overcoming the odds: What if?

OOA composites also are being considered for midlife replacement parts and upgrades on a few military (transport, fighter and helicopter) programs. In the business jet market there is, perhaps, room for six credible new aircraft products to enter the market over the next decade. Each could take advantage of OOA techniques, buoyed by general aviation experience and improved materials and processing techniques. Other applications are expected in a range of low-speed missiles and UAVs, where spiral platform development is common and production volumes can exceed several hundred units per year.

Further, NASA is developing prepreg-based OOA methods with an eye on its next-generation heavy launch vehicles. Some of the components for the proposed Space Launch Vehicle are extremely large. The main core engine will stand 200 ft/61m high. It is expected to be the most powerful launch vehicle ever built, capable of lifting, eventually, 286,600 lb (130 metric tonnes) of cargo or manned spacecraft into low Earth orbit. The payload fairings for some of its cargo stages are expected to measure 16.4 ft in diameter by 32.8 ft long (5m by 10m) and weigh approximatey 8,375 lb (3,800 kg). According to program descriptions, five planned variants could fly about 20 missions. Given the component size and low production volumes, OOA processes are seen as key to keeping tooling and manufacturing costs down. Recent success in developing OOA carbon fiber/BMI prepreg shows that it is possible to achieve satisfactory results for the application. This material could be exploited by developers of a number of private launch vehicle and other spacecraft systems.

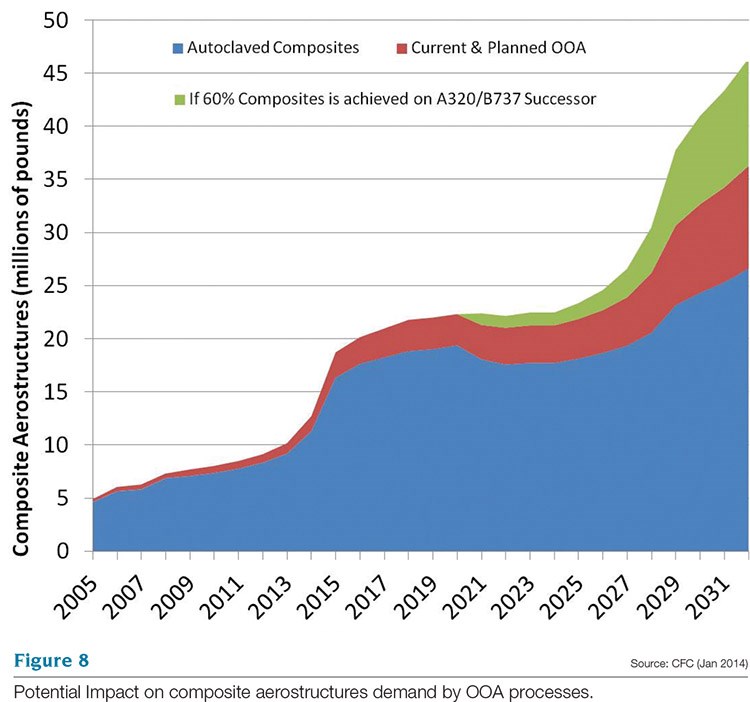

Given the current levels of development and production of OOA advanced composites, it seems likely that continued development will provide some compelling arguments for greater aerospace market penetration. If the airframes of potential successors to the Airbus A320 and Boeing 737 families are to incoporate more than 30 to 40 percent composites by weight, OOA seems almost necessary. What’s more, Airbus and Boeing will be able to do nearly 10 years of materials and process development before final decisions have to be made. That makes it conceivable that successors to legacy aircraft could adopt an all-composite wing and fuselage. If that happens, composites could make up more than 60 percent of total airframe mass. Hypothetically, that aircraft could require close to 40,000 lb (18,150 kg) of CFRP composites.

If this “succesor” scenario is realized, the total market for commercial transport structures could grow an additional 25 percent by 2032. That addititional 10 million lb (4,536 metric tonnes) per year (see Fig. 8) is roughly equal to all composite aerostructures production in 2005. During the development of a single-aisle successor through 2032, acceptance of OOA processes in the fuselage could help generate an additional $12 billion in new demand. At this level, OOA-processed structures might represent more than 40 percent of production totals, compared to today’s 14 percent share. Further, accessing the single-aisle fuselage means the difference between the overall composites aerostructures market growing at an average annual rate of about 5 percent vs.10 percent by the middle of the coming decade.

Related Content

From the CW Archives: Airbus A400M cargo door

The inaugural CW From the Archives revisits Sara Black’s 2007 story on out-of-autoclave infusion used to fabricate the massive composite upper cargo door for the Airbus A400M military airlifter.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreBladder-assisted compression molding derivative produces complex, autoclave-quality automotive parts

HP Composites’ AirPower technology enables high-rate CFRP roof production with 50% energy savings for the Maserati MC20.

Read MoreRead Next

Resin-infused MS-21 wings and wingbox

Moscow-based aeromanufacturer uses out-of-autoclave composites in attempt to leapfrog Airbus and Boeing with wider, lighter, more efficient single-aisle airliner.

Read MoreDouble-bag infusion: 70% fiber volume?

A double vacuum-bag system and tight process control enable repeatable fiber volumes of 60 to 70 percent and improves consistency of infused laminates.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More