Composites end markets: Pressure vessels (2024)

The market for pressure vessels used to store zero-emission fuels is rapidly growing, with ongoing developments and commercialization of Type 3, 4 and 5 tanks.

Top left, clockwise: Voith HySTech Type 4 carbon fiber/epoxy H2 tanks made with towpreg; Type 3 inner tank for Cryomotive cryo-compressed H2 storage made with towpreg; Worthington Enterprises Cosmos 20-foot container with Fourtis Type 4 composite cylinders; Scorpius Space Launch Company (SSLC) Type 5 linerless, all-composite cryotank. Source | Voith HySTech, Cryomotive, Worthington Enterprises, SSLC

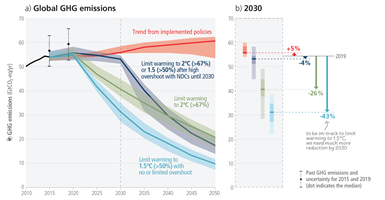

The market for pressure vessels used to store zero-emission fuels such as compressed and renewable natural gas (CNG/RNG) and hydrogen (H2) is growing as industries seek to reduce CO2 emissions and global warming. With the hottest temperatures recorded in 2023, global warming has already reached 1.1°C and emissions continue to rise. A 43% reduction is needed by 2030 to limit warming to 1.5°C.

Source | Figure 2.5, Sixth Assessment Report (AR6), by the United Nations’ Intergovernmental Panel on Climate Change (IPCC), March 2023

RNG and H2 are seen as a key part of the energy mix needed to decarbonize transportation and hit zero-emission targets. The most mature and predominant storage systems for both of these fuels include Type 3 and 4 pressure vessels comprising carbon fiber/epoxy wrapped over an aluminum and plastic liner, respectively, using filament winding.

Increased carbon fiber production

Growing demand for carbon fiber in pressure vessels. Source | Toray, Slide 23, AP-G 2025 strategy document

Toray Industries’ (Tokyo, Japan) T700 standard modulus carbon fiber has become the benchmark for Type 4 pressure vessels storing H2 gas at standard pressures of 350 and 700 bar and CNG/RNG at 250 bar. As reported by CW in March 2023, Toray’s AP-G 2025 strategy document projects 42% annual growth in carbon fiber demand for pressure vessels, reaching almost 40,000 tons/year by 2025. Toray also announced in July 2023 that it would boost carbon fiber production by more than 20% at its plants in Spartanburg, South Carolina and Gumi, Korea to reach 35,000 metric tons/year by 2025. It noted this is in response to rising demand for pressure vessels.

Hyosung Advanced Materials (Seoul, South Korea) is also a supplier of carbon fiber for pressure vessels, with a 2023 production capacity of 9,000 tons/year. In 2022, Hyosung announced it would expand capacity to reach 24,000 tons/year by 2028. Korean media reported in 2023 that Hyosung capacity would reach 16,500 tons in 2024 and 21,500 tons in 2025. The company will also establish a new carbon fiber production entity, Hyosung Vina Core Materials Co., in southern Vietnam. Construction is to be completed in 2025 with an annual capacity of 4,800 tons, expanding to 12,000 tons by 2029 and 21,600 tons by 2032.

Increased pressure vessel and H2 system production

Last year also saw increased pressure vessel production announced by manufacturers including Hexagon Purus (Oslo, Norway), Forvia (Nanterre, France), Plastic Omnium — now OPmobility (Levallois-Perret, France) — and Luxfer Gas Cyliders (Riverside, Calif., U.S.).

Hexagon Purus and Hexagon Agility

H2 storage tank produced at Hexagon Purus Westminster facility for fuel cell buses (top) and H2 infrastructure product and Kassel production site (bottom). Source | CW, Hexagon Purus

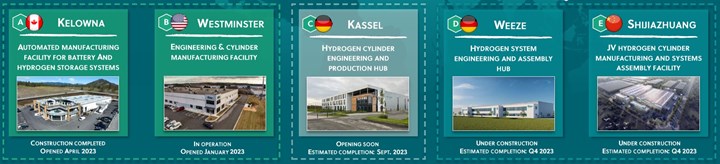

Hexagon Purus supplies battery electric systems for vehicles and Type 4 pressure vessels and H2 systems for vehicles and infrastructure/gas transport. It opened its new Type 4 composite tank production site in Westminster, Maryland in January 2023. CW discussed the history of the Westminster production team and Hexagon Purus’ view of H2 tank markets in a follow-on report in March 2023. The Westminster site will produce up to 10,000 cylinders/year for heavy-duty vehicle applications — including to customers New Flyer bus and Nikola truck — with room to add production as demand for H2 storage tanks grows. Another new H2 tank production site opened in Kassel, Germany, in October 2023 with capacity for up to 40,000 Type 4 cylinders/year for mobility applications, while a third site in Weeze, Germany, was expanded to double annual production capacity of Type 4 cylinder-based H2 systems for infrastructure including distribution, refueling and stationary storage applications.

As reported in the company’s Q4 2023 results, construction is now also complete for a new joint facility by Hexagon Purus and CIMC Enric (Shijiazhuang, China) in Shijiazhuang to manufacture Type 3 and 4 cylinders and systems. Capacity at Shijiazhuang will start at 10,000 cylinders/year and scale to 100,000 tanks/year by 2030. Hexagon Purus also raised 1 billion NOK to support ramping capacity at its newly opened facilities.

In its Q4 2023 results, Hexagon Purus reported that full year revenue increased by 37% versus 2022 to reach 1.32 billion NOK — more than 7 times higher than in 2020. Revenue for 2024 is expected to grow by 50% and reach 4-5 billion NOK by 2025. The company reported that recent market developments have resulted in a slower market for H2 mobility than expected a few years ago. But this has been offset by a much stronger market for H2 infrastructure solutions — 2023 revenue was split 58% infrastructure, 17% mobility and 25% other (maritime, aerospace, industrial gas).

Sister company Hexagon Agility (Costa Mesa, Calif., U.S.), a business of Hexagon Composites (Ålesund, Norway), produces Type 4 carbon fiber composite tanks for CNG/RNG including truck, bus and distribution applications. When produced from organic waste (e.g., dairy farms) that would otherwise cause methane emissions, RNG is reported to capture more greenhouse gases (GHG) than it emits, making it carbon negative. Hexagon Agility’s Mobile Pipeline modules enable RNG captured and collected from farms to be transported and used nationwide.

Hexagon Agility announced its newly designed Titan 450 module in early 2023. With >90% of the Titan platform redesigned, the Titan 450 reportedly delivers 25% greater gas capacity — ≈500,000 standard cubic feet — while being 20% lighter in the same 40-foot length to deliver more gas with fewer trips. Approved for CNG, RNG, H2 and helium, more than 1,800 Mobile Pipeline modules are deployed globally.

Hexagon Agility’s Titan 53 Mobile Pipeline module uses four carbon fiber-reinforced polymer (CFRP) pressure vessels to transport 7,420 kilograms of CNG/RNG (top). To meet increased demand, two new production lines have been added at the Salisbury, North Carolina facility. Source | Hexagon Agility, Hexagon Composites Q3 2023 report

Hexagon Agility saw record-high activity in its Mobile Pipeline business in 2023. In its presentation of Q3 2023 results, the company noted a strategic shift toward RNG, increasing as a market segment from 10% in 2021 to 50% in 2023. Hexagon Composites expects the addressable CNG/RNG truck market to expand 3X from 2023 to 2024 due to the launch of Cummins’ (Columbus, Ind., U.S.) new 15-liter natural gas engine in the U.S. The X15N is expected to be a game changer in the heavy-duty truck segment. Hexagon customers UPS and Matheson are already part of testing with 25 field units. First deliveries to truck OEMs are expected Q3 2024.

To meet this growing demand, Hexagon Agility is adding two new cylinder production lines to its Salisbury, North Carolina, facility (see CW’s 2018 plant tour) with space to add an additional four lines if/when necessary. A 35% increase in Mobile Pipeline capacity is also being added in Hexagon’s Lincoln, Nebraska, facility.

Forvia Faurecia

Created in 2022, Forvia unites the legacy automotive brands Faurecia and Hella. Faurecia first announced its development of H2 systems for fuel cell vehicles in 2017 and displayed a 700-bar Type 4 tank in 2018. It supplies fuel cell powertrains and components through its Symbio joint venture with Michelin and Stellantis. After opening its H2 storage R&D center in Bavans, France in 2020, Forvia Faurecia announced contracts with Hyundai, Stellantis and Renault/Hyvia. In November 2023, it announced it would supply Type 4 H2 storage systems for a North American automotive manufacturers’ medium-duty commercial trucks, starting production in 2025. One month earlier, it began production at its new plant in Allenjoie, France, targeting up to 100,000 tanks/year by 2030. The company also has two plants in Shenyang, Liaoning province, China, with a capacity of 30,000 Type 3 and 4 tanks per year as well as manufacturing in Korea.

In a December 2023 press event, Forvia Faurecia noted that in North America, the focus is first on the Class 5-8 medium/heavy-duty truck market, with H2 internal combustion engines (ICE) preferred over fuel cells or battery electric vehicles (EVs). This is largely being driven by Cummins’ launch of its X15H and B6.7H engines for H2-powered heavy-duty and medium trucks, slated to be in production by 2027. These zero-emission engines can meet the 2027 NOx regulations which are 80% more stringent than current requirements, according to Cummins CEO Jennifer Rumsey. Meanwhile, in Europe, Forvia Faurecia says there is more opportunity for H2 in light-duty trucks, vans and commercial fleets while interest in Asia, specifically China, spans buses and all classes of trucks. Globally, the company sees battery EVs as a better fit for passenger cars. It also said a second U.S. truck customer would be announced in 2024 as would a new manufacturing plant in the U.S.

Plastic Omnium, now OPmobility

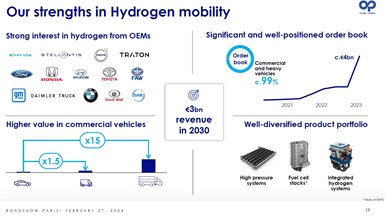

Plastic Omnium, rebranded in March 2024 as OPmobility, is a family-led group with 40,300 employees and 152 production plants in 28 countries, producing millions of bumpers, modules (front end, interior, frunk, charging), tailgates and fuel systems annually. Its New Energies division includes production of Type 4 tanks and the EKPO joint venture with ElringKlinger for fuel cells, as well as integrated H2 systems and powertrains. OPmobility cites investment of €300 million in H2 since 2015, including its 2017 acquisition of Optimum CPV, a Belgian company specialized in the design and production of Type 4 tanks, and the 2019 completion of its Omegatech (Wuhan, China) and Deltatech (Brussels, Belgium) R&D centers.

OPmobility has a range of Type 4 pressure vessels certified for H2 storage per the European EC79 and international R134 standards. Production reported in 2021 includes up to 10,000 fuel cells/year via EKPO (Dettingem/Erms, Germany) and:

- Up to 10,000 Type 4 cylinders/year in Herentals, Belgium

- Up to 60,000 cylinders/year in Gyeongju, South Korea, including supply of up to 30,000 tanks/year for the Hyundai Staria van slated to start production in 2023. (However, a February 2024 Investor’s Day presentation locates the plant for Hyundai in Wanju, South Korea at 30,000 tanks/year).

- Up to 80,000 Type 4 tanks/year in Lachelle, France (announced in 2022 and to support contracts with Stellantis and Hyvia). Both the Korean and French plants are to be operational by 2025.

- Up to 60,000 pressure vessels/year in a 28,000-square-meter mega-plant in the Jiading Hydrogen Park in Shanghai, slated to open in 2026 via the PO-Rein 50/50 joint venture with Zhejiang Rein (Shoazing, China) will produce up to 60,000 pressure vessels/year announced in February 2024.

After OPmobility’s 2022 announcement to supply pressure vessels for the Ford F-550 Super Duty hydrogen fuel cell truck, it was reported in August 2023 that the company was exploring two sites in Michigan with production expected to support 40,000 vehicles/year by 2027. The company has also announced a relationship with French heavy-duty fleet specialist Hyliko and reported it will invest ≈€100 million/year until 2030 to support and ramp production of H2 systems.

Luxfer Gas Cylinders

Luxfer Gas Cylinders (Riverside, Calif., U.S.) manufactures aluminum and composite pressure vessels for a wide range of markets including self-contained breathing apparatus or SCBA (e.g., firefighters), scuba, aerospace and marine inflation, medical, CO2 for beverages, fire extinguishers, performance racing and industrial gases. It also supplies G-Stor Pro Type III and G-Stor Go Type 4 tanks at pressures up to 350 bar for alternative fuels such as CNG and H2 and is exploring 700 bar tanks but has no commercial products at this time. The majority of its sales currently are Type 3 cylinders (aluminum liner overwrapped with carbon fiber/epoxy) into CNG and also non-fuel applications, as well as Type 1 aluminum cylinders. The company has five manufacturing facilities. Type 3 and 4 tanks for alternative fuels are made at Riverside (Calif., U.S.) and Calgary (Canada); Type 4 cylinders for non-fuel applications are manufactured at Riverside and Pomona (Calf., U.S.); Type 2 cylinders may also use composites and are produced at Riverside and Nottingham (U.K.). Note, the latter produces the company’s Type 1 cylinders as well as complete systems integrating Type 3, 4 alternative fuel cylinders. The majority of Luxfer’s composites manufacturing is done in Riverside.

In September 2023, Luxfer announced a new £1 million production facility at its Colwick, Nottingham, site to support virtual gas pipelines that can distribute H2 across the U.K. and Europe. The site will produce multiple element gas containers (MEGCs) using Type 3 or Type 4 cylinders. MEGCs include the G-Stor Hydrosphere — available in 20-, 40- and 45-foot lengths — to transport up to 1.5 metric tonnes of gas, and the smaller G-Stor Pro Bundle, which is available in lengths of 1,804, 2,298 or 3,350 millimeters to transport 32, 44 and 70 kilograms of H2 gas, respectively.

Additional players, use of towpreg in pressure vessels

In December 2023, Worthington Industries (Columbus, Ohio, U.S.) split into Worthington Steel and Worthington Enterprises, the latter housing its Sustainable Energy Solutions business, which includes three manufacturing facilities. The Worthington Austria composite cylinder plant is located at the European SES headquarters (near Vienna, Austria) and was commissioned in 2021, while the Portowa composite cylinder plant in Słupsk, Poland was acquired in 2011. Both facilities produce COM3T Type 3 (up to 350 bar) and Fourtis Type 4 tanks (up to 700 bar) for CNG and H2 onboard fueling systems and Cosmos gas transport containers.

Worthington’s Amtrol-Alfa plant in Guimarães, Portugal, has also expanded to include Type 3 and 4 pressure vessel lines for small-scale H2 industrial applications, H2 drones and SCBA. To become a full-system provider, Worthington acquired PTEC Pressure Technology GmbH in 2021, which designs and assembles the gas street components (from filling receptacle down to pressure regulator) found in complete onboard fueling systems for heavy-duty vehicles and transport applications.

COM3T 200-bar Type III cylinders for CNG (top) and Cosmos 20-foot container (bottom) with Fourtis Type IV composite cylinders. Source | Worthington Enterprises

Although Worthington no longer has composite cylinder facilities in North America — it sold Structural Composites Industries (SCI, Pomona, Calif., U.S.) to Luxfer in 2021 — it is committed to the growing alternative fuels storage market. “Our own know-how and production expertise reaches back more than 30 years,” notes Radiša Nunić, director of composite market development for Worthington’s SES business. “We continue to develop and invest, both in the mature CNG market and the rapidly growing hydrogen economy. We see increased demand in H2 storage for vehicle onboard fueling systems as well as gas transport and refueling infrastructure. Although our customer base is balanced between Type 3 and 4 cylinders, if H2 demand continues to increase, we believe this will drive an increase in Type 4 cylinders. For example, 700-bar cylinders per the new EU regulation ECE R134 offer advantages in fatigue versus the aluminum liner in Type 3 vessels, and also potentially in price, weight and H2 capacity. But each individual application has a unique business case, and both types of cylinders are currently growing in use. We see a lot of growth in public transport, as well as long-haul and commercial vehicles.”

Although Worthington primarily uses wet filament winding in its H2 and CNG cylinder production, it has also developed serial production of certified cylinders made with towpreg. “Our towpreg tanks are of a smaller size, mainly produced in Portugal” says Nunić. “Both technologies make sense. It’s a question of product size, type, demand and quantities.”

Voith HySTech

Voith’s Carbon4Tank is made using precision towpreg, enabling a 15% reduction in carbon fiber and 4-6 times faster winding. Source | Voith HySTech

Meanwhile, Voith HySTech (previously Voith Composites, Garching bei München, Germany) received R 134 certification in December 2023 for its Carbon4Tank 350-liter, 700-bar Type 4 storage vessel for H2 made using towpreg. “We started our development to industrialize H2 storage tanks in 2020,” says Carolin Cichosz, CTO of Voith HySTech. “We already had more than 10 years of experience in wet filament winding of large CFRP [carbon fiber-reinforced polymer] rollers for the papermaking industry.”

It also had experience in industrializing structural CFRP parts for the high-volume auto industry using its own prepreg tape. “We use towpreg winding because we know that the highest automotive standards, volumes and industrialization are only possible when you have a process that is super precise,” she explains. “We have a high degree of control over the fiber impregnation process to minimize deviations in the material properties, so that the tank has less deviations in its properties. This enables a more accurate margin of safety in design and a 15% material reduction. The fibers also don’t slip as much in radius areas during winding, which also increases our precision, and we can achieve winding speeds that are 4-6 times faster than wet winding.” The tanks then move through a continuous automated line for oven cure and finishing, using the same concepts as wet-wound tanks.

“We are currently setting up our first pilot line in Munich/Garching, just a few meters from our automotive components manufacturing plant,” says Cichosz. “This includes a sophisticated IT infrastructure enabling us to measure data during manufacture and do online evaluations. We can optimize the manufacturing process and control the entire production cycle with everything completely connected, which provides full traceability and understanding of what is happening within our processes. And we have room to add a second and third line here in Munich, but we will also discuss with our customers where future production lines should be set up.”

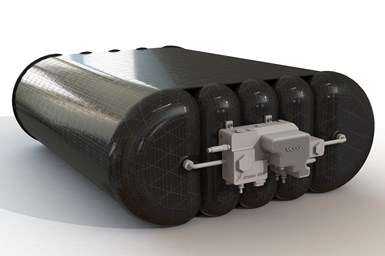

The Carbon4Tank plug-and-play H2 system for heavy trucks features four 350-liter tanks in a vertical configuration for 1,000 km of range. Source | Voith HySTech

The current Carbon4Tank measures 2.14 meters long with a 560-millimeter outer diameter. Trials are ongoing in both fuel cell and H2 combustion engine commercial vehicles as well as in construction machines. “We see the largest market in heavy trucks but also where long distances and high amounts of energy are required, including rail, bus, industrial vehicles and some stationary applications,” adds Cichosz.

For more discussion on the growing trend of towpreg winding for H2 storage vessels, see the January 2024 article, “The next evolution in AFP.”

Type V linerless pressure vessels

As the market for Type 4 tanks grows, manufacturers continue development of all-CFRP Type 5 tanks without a liner. Eliminating the liner is estimated to reduce weight by 10-30% versus Type 4 tanks and provide 10% more internal volume for H2 storage. However, winding of the vessel still requires some type of mandrel, and without a liner, the gas or liquid inside the tank can permeate through the composite laminate. This must overcome for prolonged use, especially while enduring repeated cycling of pressure, temperature and external loads. But if this can be overcome, Type 5 tanks should be more amenable to conformable, non-cylindrical geometries currently being sought for better fit into cars, aircraft and other vehicles (see “Conformable tanks” below). Originally used in the space industry to store liquid oxygen (LOX), hydrogen (LH2) and other cryogenic fuels, Type 5 tanks are now being developed for transportation applications on Earth.

SSLC

Scorpius Space Launch Company (SSLC, Torrance, Calif., U.S.) reports its first commercial deliveries of Type 5 tanks were in 2006. However, through its sister company Microcosm, its first success was achieved in 2000 — a sub-scale LOX tank supplied for Garvey Spacecraft’s Kimbo IV rocket. In 2008, SSLC supplied a pair of Type 5 tanks to Garvey Spacecraft for its Prospector 9A (P-9A) demonstrator nanosat launch vehicle (NLV) as part of a Phase 2 SBIR with the Air Force Research Laboratory (AFRL) — reportedly the first first launch vehicle to achieve flight with two Type 5 cryogenic propellant tanks. It also supplied high-pressure helium tanks and larger propellant tanks for companies competing in the 2006-2009 Northrop Grumman Lunar Lander XCHALLENGE, part of the XPRIZE competitions.

By 2018, SSLC reported having delivered well over 100 Pressurmax Type 5 tanks to more than 25 customers. In a 2023 interview with CW, SSLC president and CEO Markus Rufer noted deliveries now exceed 150 tanks to customers that include space launch companies and SSLC tanks are operating in space, but he is not permitted to discuss details. Featured in the 2023 article, “Type 5 pressure vessel enables lunar lander,” SSLC’s contract with Intuitive Machines (Houston, Texas, U.S.) includes supplying ≈1-meter long × 1.3-meter diameter propulsion tanks storing cryogenic LOX and liquid methane (LCH4) with boiling points of -183°C and -162°C, respectively — for the Nova-C lunar lander. Named Odysseus, the spacecraft successfully landed on the moon on Feb. 22, 2024 — enabling the United States’ first return since Apollo 17 and the first commercial lunar lander to transmit data for NASA payloads from the lunar surface. Intuitive Machines listed the Type 5-enabled propulsion system as a key to this success. Rufer notes, that with the successful completion of the IM-1 lunar mission, Pressurmax linerless Type 5 tank systems have now reached the highest NASA/USAF/ESA/ISO technology readiness level (TRL) definition of TRL 9.

SSLC Type V tank showing the blue sheen of its Sapphire 77 resin. Source | SSLC

SSLC tanks have previously passed cycling at temperatures down to -196°C and pressures up to 552 bar. Rufer notes the company’s approach was never really aimed at eliminating microcracking, but instead to produce a Type 5 tank laminate that would not allow microcracks to extend or link up, thereby meeting performance requirements. Another key feature is the use of industrially available materials such as off-the-shelf carbon fiber —e.g., a 2008 tank used IM7 from Hexcel (Stamford, Conn. U.S.). The resin it uses, however, was developed in-house. Named Sapphire 77 for its blue sheen and testing at 77 Kelvin/-321°C, it too is made from industrial ingredients, though some aren’t normally used in composite resins. Sapphire 77 has been tested from -321-170°C and with all tank fluids used in space, even hydrazine.

Another SSLC tank feature is using CFRP instead of metal for flanges and bosses used to connect with fueling systems. This eliminates issues with coefficient of thermal expansion (CTE) mismatch which can lead to leaks. In fact, all SSLC tank features (e.g., internal anti-slosh baffles, external stiffeners, gussets/brackets/braces for attaching other system components) are built from CFRP and integrated into the tank structure. “We want to eliminate secondary structures and mass, so that the Type 5 tanks become the primary load-bearing structure of your vehicle,” says Rufer. “Thus, you don’t need the weight and cost of another tube as a fuselage and all of the tank features are integrated into it. This enables a different design approach and new solutions and performance that are just not available when you use a metal tank or composite-overwrapped metal tank. Our design approach opens up other trade spaces in your vehicle design because your tank is now your load-bearing chassis.”

Infinite Composites

Infinite Composites (Tulsa, Okla., U.S.) was founded in 2010 and delivered its first Type 5 composite pressure vessels in 2013 for compressed natural gas (CNG) vehicles. In 2016, it decided space was a better fit for its technology and received requests from SpaceX and NASA Marshall Space Flight Center. Since then, it has supplied its Arctic CPV and non-cryogenic Infinite CPV Type 5 tanks sized 5 to 325 liters for use in spacecraft, aviation, ground transportation and industrial gas applications. “We currently have projects for rockets, LEO and GEO satellites, lunar landers, unmanned aerial vehicles, hypersonic vehicles, H2-powered aircraft and specialized niche programs,” says Matt Villarreal, CEO of Infinite Composites. “We’ve completed 18,000 pressure cycles for Federal Motor Vehicle Safety Standards [FMVSS] 304 testing and post-crash survivability and bonfire testing. We’ve proven our technology in a lot of different applications, and now we’re focused on completing qualifications and scaling for serial production.” In February 2024, the company announced funding to scale up its products in both size and pressure to aid the growing H2 economy. “Our mission is to make Type 5 composite pressure vessels as ubiquitous as metal tanks,” adds Villareal.

Infinite Composites has seen an increase in requests to use its tanks not only for space, but also H2-powered vehicles on Earth. The company is working with multiple players in H2-powered aircraft, delivering 10 Type 5 composite tanks for testing. However, tanks used for transportation on Earth experience far more pressure cycles (tens of thousands) compared to those used in space vehicle (tens to hundreds). “But the major difference,” says Villareal, “is the risk of damage from external sources. That drives significantly more rigorous testing to mitigate.” Infinite Composites has already done this type of testing and sees the technology for these applications converging.

“We’re at the intersection of all these markets,” he explains. “We’re even selling some of the same tanks to H2 aircraft programs that we would to space vehicle groups because they meet all the same standards and safety factors and went through the same testing. I don’t think there will be a big difference in the technologies that are being used in these markets within 5 years or so. The Type V5tanks that we produce already exceed the DOE targets for gravimetric efficiency for H2 storage in vehicles, and they’re exceeding the targets previously set for space applications.”

Omni Tanker

OmniTanker Type IV tank technology used in cargo tank trucks has been further developed with Lockheed Martin Australia and University of New South Wales for Type V tanks. Source | OmniTanker website

Founded in 2006, Omni Tanker (Smeaton Grange, NSW, Australia) manufactures specialized road tanker equipment for corrosive chemicals using its patented carbon fiber composite materials technology. A seamless plastic liner (OmniShield) made from polyethylene or fluorinated thermoplastic receives a patented high-strength interface (OmniBind) to achieve a structural connection with reportedly no delamination and excellent durability to the CFRP outer laminate (OmniFort) made with aerospace-grade materials and integrated passive fire protection. These non-cryogenic Type 4 tanks range from 4,000 to 20,800 liters with a maximum working pressure of 2.75 bar.

In July 2021, Omni Tanker announced a $AUD 1.4 million project with Lockheed Martin Australia (Canberra) and University of New South Wales (UNSW) Sydney to develop and commercialize a fluoropolymer-lined Type 4 tank and a linerless Type 5 tank as cryofuel tanks for satellites. The project would use a nano-engineered additive product invented by the UNSW research team led by Professor Chun Wang, which enables CFRP to withstand cryotemperatures without matrix cracks.

In December 2023, Omni Tanker announced it had completed the collaborative research project, building both Type 4 and 5 tanks, which met performance metrics at -269°C. Omni-Tanker then built operational-scale demonstrator versions of the tanks for Lockheed Martin’s LM2100 satellite were then manufactured at Omni Tanker's advanced manufacturing facility. “We have been able to translate our composite road tanker technology to the global space sector, where performance, weight and cost are of paramount importance,” says Omni Tanker CEO Daniel Rodgers. “OmniTanker can develop and deliver composite pressure vessels to meet demanding technical requirements quicker and at a lower cost than exotic materials such as titanium, which are widely used in the space sector.”

Liquid H2 storage

Multiple solutions will be required in the H2 market to meet the wide range of requirements for storage and refueling. LH2 offers increased volumetric density, enabling 40% more fuel storage versus compressed gas (CGH2) in 700-bar Type 4 tanks. Thus, lightweight LH2 storage is seen as vital, for example, to decarbonize longer range aircraft for zero-emission aviation where there is simply not enough space to house the large Type 4 CGH2 tanks that would be required.

Fabrum

Fabrum’s onboard LH2 storage uses a metal shell for ground-based vehicles and all-composite construction for aviation. Source | Fabrum

CW reported in February 2023 that Fabrum (Christchurch, New Zealand) delivered its first lightweight composite LH2 tank for aviation. The tank was slated for testing in early 2023 by Filton Systems Engineering (FSE, Bristol, U.K.). Fabrum had previously announced it was working with FSE and GKN Aerospace (Redditch, U.K.) to develop a complete fuel storage and delivery system. “We’re excited to now tie our aerospace and hydrogen systems together for actual flight and full certification with FSE,” says Fabrum chairman and co-founder Christopher Boyle. “We’ve always believed H2 is the ideal alternative fuel for aviation, and over 17 years, we’ve developed enormous capability and understand the drivers for aviation systems.”

The company’s website describes its onboard LH2 storage as using proprietary triple-skin tank technology that provides enhanced thermal insulation. It notes ground-based vehicle tanks use an outer metal skin while aviation tanks are entirely composed of advanced composites.

GKN Aerospace

Source | GKN Aerospace HyFIVE consortium press release

GKN Aerospace then announced in August 2023 that it would collaborate with Marshall (Cambridge, U.K.) and Parker Aerospace (Cleveland, Ohio, U.S.) under a memorandum of understanding (MOU) to explore LH2 fuel system solutions for zero-emission aircraft. The MOU included all areas of LH2 fuel system development, with composite and metallic technology development of interest. GKN Aerospace also announced an EPSRC Prosperity Partnership with the University of Bath under the name Zenith, which includes a substantial focus on composite materials and structures for H2 storage. In March 2024, GKN formalized these collaborations into the HyFIVE consortium, with £40 million in funding from the U.K. Aerospace Technology Institute. The goal is ground testing of a fully integrated LH2 fuel system. GKN reports HyFIVE will complement its H2GEAR electric propulsion program and provide a path to delivering the technology and supply chain required for H2 regional aircraft and beyond.

NCC

Reported in October 2023, the National Composites Centre (Bristol, U.K.) announced it successfully tested a range of composite cryogenic storage tanks with LH2. Having designed and manufactured the tanks, NCC noted that this expertise, in addition to its composite cryogenic storage tank testing program and concepting tools, will be used to support the U.K.’s transition to the H2 economy. Two tanks were tested — a single-piece construction and a split-piece design. Both were 30 liters in capacity, designed for a pressure of 8 bar and manufactured using automated fiber placement (AFP) on-site at the NCC. The tanks comprised only a single skin to contain the LH2. The testing, undertaken with Filton Systems Engineering (FSE, Bristol), used an LH2 vacuum test chamber and cryo-rated testing instrumentation. The NCC is developing a state-of-the-art manufacturing and test facility for H2 transport and storage, including pressure vessels and pipes, which will underpin its design, test and manufacturing capabilities. A filament winder and thermoplastic pipe winder were to be installed at the facility by the end of 2023.

Airbus

In January 2024, CW reported that Airbus is opening a new ZEROe development center (ZEDC) in Stade, Germany, to develop H2 technologies. Airbus ZEROe programs target future zero-emission, LH2-fueled aircraft, proposed to enter into service by 2035. The ZEDC in Stade will focus on cost-effective lightweight H2 systems using fiber-reinforced composite materials, including cryogenic LH2 tanks. “This ZEDC will benefit from the broader ecosystem of composite materials R&D such as the Airbus subsidiary Composite Technology Center and the CFK NORD research center in Stade, as well as further synergies from space and maritime activities,” says Airbus CTO Sabine Klauke.

Stade is also the site for Airbus’ production of composites-intensive vertical tail planes (VTP). The team in Stade will cooperate with ZEDC working on metal tanks, especially those in Bremen, Germany, and Nantes, France. The work will include part design and manufacturing, as well as testing assembly methods. It will also contribute to the work at other ZEDC including in Madrid, Spain, and Filton, U.K.

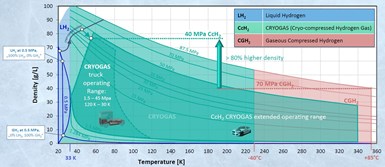

Cryo-compressed H2 storage

This third option offers a hybrid solution between LH2 and CGH2 storage. CcH2 uses cold temperatures (e.g., 40-80K/-233°C to -193°C) and medium pressure (e.g., 350 bar) to eliminate LH2’s boil-off issues and achieve higher storage densities than CGH2 and LH2. This technology was developed at BMW (Munich, Germany) from 2003-2013 and at Lawrence Livermore National Laboratory (LLNL, Livermore, Calif., U.S.) from late 1997-2020.

CcH2 systems are now being commercialized by two companies founded in 2020: Cryomotive (Grasbrunn, Germany) evolving from the work at BMW and Verne (San Francisco, Calif., U.S.).

Reported advantages include:

- Extended range of 1,000-1,300 kilometers for heavy-duty trucks versus 724 kilometers for similar volume, 700-bar CGH2 tanks.

- The H2 is stored as cold gas, not liquid, eliminating boil-off issues and reducing insulation requirements and cost.

- CcH2 tanks use 60-80% less carbon fiber versus Type 4 tanks which reduces a large cost plus supply issues.

- Vehicles with CcH2 storage can be refueled at existing 350-bar CGH2 (if the CcH2 max. operating pressure is > 440 bar to comply with max. CGH2 refueling pressure) or LH2 in stations with cryogenic compression.

- CcH2 systems can feed to fuel cells at 5-15 bar and internal combustion engines at 10-50 bar.

Cryomotive

Cryomotive CcH2 tanks feature a Type III inner pressure vessel and outer aluminum jacket (not shown). Here, an aluminum liner is wrapped with carbon fiber/epoxy using a Mikrosam system. Source | Cryomotive

As explained in the January 2023 CW article, “Cryo-compressed H2, the best solution for storage and refueling stations?” BMW presentations from 2010-2013 describe a prototype CcH2 system for a car that enabled <5-minute refueling and >500-kilometer range. The system used a 235-liter composite-overwrapped pressure vessel (COPV) as an inner tank and cryoinsulation between this inner tank and a metal outer tank/jacket. This CcH2 tank reportedly stored 7.1 kilograms of hydrogen at 350 bar — versus 2.5 and 4.6 kilograms of hydrogen in standard 350-bar and 700-bar CGH2 tanks. When BMW chose not to commercialize the system, key researcher Tobias Brunner acquired key patents to adapt the CcH2 technology for trucks, commercial vehicles and aircraft, and founded Cryomotive.

Cyromotive’s initial towpreg winding trials support its decision to switch away from wet winding. Source | Cryomotive

Cryomotive’s latest Cryogas storage tanks measure 2,450 × 700 millimeters in diameter, with a water volume of ≈540 liters storing 39 kilograms of CcH2. For a heavy-duty truck system of two side-mounted vessels — analogous to current diesel tanks, one each on the left and right — this would provide close to 80 kilograms CcH2, while a three-tank system mounted in a rack behind the truck cab could provide 120 kilograms. Cryomotive will test its CcH2 system on a MAN (Munich, Germany) truck in 2024/25 and aims to start commercial operations in late 2025, scaling from hundreds of CcH2 tanks by 2026/27 to thousands by 2027 onwards. Cryomotive has also switched away from wet winding, saying it will proceed with scale-up using towpreg winding for a more industrialized, mass production design.

Verne

In 1997, Salvador Aceves and Gene D. Berry highlighted the benefits of CcH2 through thermodynamic modeling. Aceves’ team at LLNL designed and built three generations of tanks and tested them onboard a passenger vehicle. In 2020, David Jaramillo co-founded Verne with Edward McKlveen and Bav Roy, to explore applications of CcH2 for heavy-duty transportation. Dr. Aceves subsequently joined Verne in an advisory role.

Verne 2023 CcH2 demonstrator tank including CFRP-wrapped inner pressure vessel and planned side-mounted configuration for Class 8 trucks. Source | Verne

In December 2023, Verne announced the demonstration of a system storing 29 kilograms CcH2 and subsequently completed testing onboard a vehicle. Verne has received letters of intent from truck fleets to supply CcH2 systems for >150 trucks and aims to start demonstration programs with multiple fleets in 2025. For trucks, Verne tanks will range from 2,000-3,000 millimeters long × 660-710 millimeters in diameter, enabling configurations of 2-4 tanks holding 60-130 kilograms of CcH2 gas and a range of 800-1,600 kilometers.

Verne has also announced a partnership with hydrogen-electric aviation developer ZeroAvia (Hollister, Calif., U.S.) to explore using CcH2 storage for zero-emission H2-fueled powertrains. Thus, Verne is developing a CcH2 technology platform which can be optimized for a variety of applications including trucking, aviation, mining and H2 distribution. It has received financial support from the U.S. Department of Energy’s ARPA-E, Bill Gates’ Breakthrough Energy Fellows and Amazon’s Climate Pledge Fund, among others.

Conformable H2 tanks

Type 4 CGH2 tanks are cylindrical because, second to a sphere, that is the most efficient structural shape to resist high internal pressure. However, they don’t easily fit into vehicles. A growing trend is to develop conformable H2 storage tanks that fit into the same flat space as a battery pack for electric cars, for example, better fit into wings or fuselages of small aircraft.

TU Munich

In February 2023, CW reported on two programs aimed to produce scaled manufacturing demonstrators for conformable CGH2 tanks using carbon fiber composites: Polymers4Hydrogen (P4H) and Hydrogen Demonstrator and Development Environment (HyDDen). A partner in both projects is The Chair of Carbon Composites (LCC) at the Technical University of Munich (TUM, Munich, Germany).

Proof-of-concept cuboidal tank using a 3D printed hexagonal skeleton with pultruded CF/PA6 rods inserted as tensions struts and then filament wound. Source | TU Munich LCC

P4H produced a proof-of-concept cuboidal tank using a thermoplastic skeleton with integrated composite tension straps/struts that was then overwound with carbon fiber-reinforced epoxy. HyDDen pursued a similar design but explored using AFP to produce an all-thermoplastic composite tank.

Carbon ThreeSixty

Rendering of planned HiDEN conformable H2 storage system. Source | Carbon ThreeSixty

In March 2023, Carbon ThreeSixty (Chippenham, U.K.) announced it was developing a high-density energy network (Hi-DEN) based on arrays of “micro” H2 storage vessels. The idea is that Hi-DEN could be reconfigured to fit available vehicle space. Carbon ThreeSixty aimed to increase CGH2 stored by 15-20% and demonstrated this through testing a fully functional prototype. Carbon ThreeSixty planned to oversee the use of resin transfer molding (RTM) while partners Antich & Sons (Huddersfield, U.K.) would develop 3D woven preforms and Viritech (London, U.K.) would develop the tank and fill control system as well as integrate/demonstrate the system in its fuel cell electric vehicle (FCEV) powertrains and provide a route to market.

Polar Technology Management Group

“Hydrogen in a Box” features multiple co-dependent chambers in an integrated unit. Source | Polar Technology Management Group

In June 2023, Polar Technology Management Group (Eynsham, U.K.) announced it had developed a conformable tank concept with Moog Controls called “Hydrogen in a Box” to efficiently store and release H2 in mission-critical environments, aimed for commercial air transport. A 6-month technology evaluation determined the design could be adapted for 350- and 700-bar Type 3 and 4 tanks. Kieran Burley, lead engineer at Polar Technology, explains the concept: “Combining novel design solutions along with innovative manufacturing processes, we can package H2 storage efficiently in a series of co-dependent chambers forming a storage bank, rather than fitting a number of standard independent cylinders into the space.” The design shown at right was actually patented by Thiokol in 1995, see TU Munich’s review in the Feb. 2023 article.

Noble Gas Systems

Noble Gas Systems conformable tanks store CGH2 for vehicles, bulk storage and other applications. Source | Noble Gas Systems

In July 2023, CW reported that 350-bar conformable tanks produced by Noble Gas Systems Inc. (Novi, Mich., U.S.) passed HGV2 standard performance tests. Conducted by certified third-party laboratories, the tests included burst, permeation, ambient cycle, extreme temperature cycle, H2 cycling, accelerated stress rupture, bonfire and penetration. Noble Gas Systems conformable tanks comprise a polymer liner, braided fiber reinforcement and a protective outer shell. Although its tanks do not rely on resin, and thus, are not a fiber-reinforced polymer (FRP) composite, they do provide a commercially viable alternative to Type 4 composite storage tanks and one that can be configured to fit into the same flat space occupied by current battery enclosures for EVs.

Noble Gas has already delivered prototypes with capacities ranging from less than a kilogram to over 10 kilograms of CGH2 and has customer systems in development up to hundreds of kilograms. Applications include small vehicles as well as bulk storage systems. The company is further developing its technology for 500-bar and 700-bar tanks and scaling production.

Forvia Faurecia

The top concept is from the company’s May 2023 General Meeting and the bottom from a May 2023 Mobility Engineering article. Source | Forvia Faurecia and Mobility Engineering

The Pioneering Technologies page on the Forvia Faurecia website notes that it first displayed its concept for a conformable CGH2 tank at the CES show in January 2023. In its press kit for IAA Mobility 2023 (Sep. 5-10, Munich, Germany), the compact underbody design was described as: “An innovative, prism-shaped composite structure that offers up to 50% more storage capacity and thus greater independence compared to cylindrical tanks.”

The concept was also shown at the company’s General Meeting in May 2023. However, a May 2023 article in Mobility Engineering shows a very different product. In this article, the H2 storage module is a box, and engineers claimed it enabled 40-50% more H2 onboard at 700 bar. They explained it still uses a carbon fiber composite exterior and nylon/PA liner inside. Meanwhile, a prototype is in use and the technology is being further readied for production.

Thermoplastic composites and recycling in H2 storage

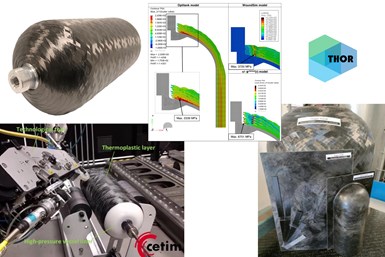

The THOR project demonstrated a Type 4.5 thermoplastic composite CGH2 tank and recycling processes. Source | THOR project

The Thermoplastic Hydrogen tanks Optimized and Recyclable, or THOR project, was funded by the Fuel Cells and Hydrogen 2 Joint Undertaking (FCH2JU), now Clean Hydrogen Partnership, to develop an industrializable and recyclable pressure vessel for H2 storage. The THOR project produced 15 thermoplastic composite (TPC) tanks in collaboration with AFPT (Dörth, Germany), a supplier of laser-assisted tape winding (LATW) technology and equipment. These included tanks that were tested to burst pressures of approximately 1,500 bar, just 6% short of the 1,580 bar required per the EC79 qualification standard. CW discussed the project in detail in a February 2024 article. Key aspects include:

- Use of WoundSIM software to convert the baseline carbon fiber/epoxy design to TPC and Optitank software developed by project partner Cetim (Senlis, France) to correctly model the geometry and stiffness of the wound composite.

- Ability to achieve a “Type 4.5” tank because the first composite layer in the TPC laminate can be welded to the PA thermoplastic liner if the materials are compatible.

- Recycling trials demonstrated the concept of using Cetim’s Thermosaïc process to turn the tank laminates into chips and process those into ready-to-use panels with higher performance than short fiber compounds. These panels can be stamped into TPC parts.

- Cetim installed a new HySpide TP machine enabling 10 times higher winding speeds for demonstrating an industrial solution for producing reduced cost tanks.

AFPT was also a participant in the 3-year LeiWaCo project funded by the German government and led by the Airbus subsidiary Composite Technology Center (Stade). The project targets economic series production of TPC pressure vessels for LH2 tanks in aviation and other transportation applications and will produce demonstrators to be tested in a setup representing the operational environment to achieve a technology readiness level of TRL 5.

Fraunhofer IPT has developed a new recycling process to peel carbon fiber/thermoplastic UD tape from the tank liner through the “Tankcycling” research project. Source | Fraunhofer IPT

In July 2023, Fraunhofer IPT (Aachen, Germany) announced that through the “Tankcycling” research project, it developed a novel recycling process to recover fiber from TPC H2 tanks made using LATW. The team succeeded to reuse these fibers in new products without any significant loss of quality, with more than 90% of the recycled material’s mechanical strength retained. The recycling process, patented by Fraunhofer IPT (DE 10 2016 117 559 A1), makes it possible to remove the unidirectional (UD) carbon fiber/thermoplastic polymer tape from the thermoplastic liner in a peeling process. In this way, the tape can be reused for other products that are also manufactured with the tape winding process. Project researchers have developed a plant prototype with various modules enabling recycled of complex shaped pressure vessels.

Also in July 2023, Voith Composites (now Voith HySTech) announced its work to develop recycling for composite H2 tanks that it manufactures with thermoset carbon fiber/epoxy UD tape. Two different recycling processes are being developed with Toray (Tokyo, Japan, for materials), Tenowo (Hof, Germany, for nonwoven manufacturing) and Delta-Preg (Sant'Egidio alla Vibrata, Italy, for resin impregnation):

- Cuttings from Voith’s winding process are collected, cut to ≈60 millimeters in length, oriented and converted into a dry nonwoven fabric, then impregnated with resin and laid up as a prepreg stack to be pressed in a closed-mold process into a final end-use part. Demonstrator components include an underbody stiffening component for a European sports car displayed at JEC World 2023.

- An acid-based solvolysis process is used to extract 60-80-millimeter-long carbon fibers and resins from a composite part, which are then re-oriented and converted into 50-millimeter-wide UD tapes that are impregnated with epoxy and can then be tailored into a preform for a new automotive component, using the automated Voith Roving Applicator (VRA) technology.

Pilot-scale systems have been developed and initial results are positive, for example tensile strength of the recycled carbon fiber (rCF) tapes is in the range of 80-90% compared to virgin carbon fiber. Future development goals for Voith Composites include to remanufacture the extracted resin components into new resins and to move toward bio-based or recycled resin with its rCF products. Voith Composites intends to give its tanks a second life after 15 years, as fully functional CFRP automotive structural components, and continues to work with its automaker partners to incorporate rCF components into production sports and luxury vehicles.

Related Content

Composites end markets: Infrastructure and construction (2024)

Composites are increasingly used in applications like building facades, bridges, utility poles, wastewater treatment pipes, repair solutions and more.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreYour must-have composites industry guide for 2025

Welcome to CW’s annual SourceBook, your guide to suppliers of machinery, materials, software and other services for the composites industry.

Read MoreRead Next

Composites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreComposites end markets: Industrial (2024)

The use of composites in industrial applications is increasing, driven by the need for higher performance and longer life, whether its parts for industrial machinery, EOAT components, corrosion-resistant equipment and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)