The outlook for unmanned aircraft

Focused on maximizing payload capacity and endurance, the market for composite aerostructures in unmanned aircraft production is poised to grow 300 percent over the next decade.

Share

Military actions in Iraq and Afghanistan have highlighted the ability of the unmanned aerial vehicle (UAV, a/k/a unmanned aerial system or UAS) to perform a wide range of missions from reconnaissance to dropping bombs on enemy combatants. Within the past 20 years — paralleling advancements in microelectronics — UAVs have evolved from what once were either expensive military novelties or something scarcely more sophisticated than radio-controlled models sold to hobbyists into low-cost, low-risk workhorses for armed forces around the world. By some accounts, there are as many as 450 companies worldwide that provide UAVs for this growing multibillion-dollar industry. Many companies are focused primarily or exclusively on UAV development.

Not-quite-so new technology

Unmanned aircraft have been around nearly as long as piloted planes. UAV history goes back to 1916, when one of the first recorded unmanned aircraft, the Sopwith AT, was developed for the British Royal Flying Corps during World War I. It was loosely based on the famous Sopwith Camel and piloted remotely by means of a radio transmitter. Not long after, radio-controlled aircraft saw their first use as aerial targets for gunnery drills.While the effective range of the Sopwith AT was limited to the remote pilot’s line of sight, the key advantage — taking the pilot out of direct danger — prompted continued exploration. During the Cold War, UAVs were rediscovered, and some exotic-looking reconnaissance drones were built to take the place of piloted U-2s and SR-71s, flying deep into former Soviet Union and Chinese territory. Examples can be found in air museums, including the Mach 3+ D-21 and the AQM-91A Firefly reconnaissance drones housed at the National Museum of the Air Force (Wright-Patterson AFB, Ohio).

Although military services have little intention of eliminating human pilots, the missions accomplished today by UAVs vary widely and can include any that military planners deem “the dull, the dirty and the dangerous.” UAVs offer a number of advantages when it comes to long-duration missions (the dull). If an area of interest is pervasively hazardous to humans, as might be the case with nuclear, chemical or biological weapons, autonomous aircraft could fly where a manned system should not (the dirty). Because enemy air defenses and ground fire can be deadly for low-flying aircraft, putting pilots at significant risk (the dangerous), another emerging trend harkens back to the Sopwith AT: The suppression of enemy air defenses (SEAD), including radar and other defense systems, is a key role envisioned for the armed UAV.

In accord with their expanding mission mandate, unmanned aircraft have become much more sophisticated and flexible. They not only take off, fly and land autonomously, but they also enable engineers to push the envelope of normal flight. Some reconnaissance UAVs can fly for up to two days continuously because their remote, ground-based pilots can work in shifts. Removal of the onboard pilot and his/her support systems dramatically reduces the aircraft’s size and power requirements, effectively reducing overall program cost, development time and risk. Further, many advanced flight technologies for piloted craft are initially tested using unmanned subscale demonstrators. Removing the pilot, in this case, allows designers to simplify the aircraft’s design and then test it at reduced risk, and it allows configurations that would be impossible or impractical for human occupation.

A common issue with virtually all UAV platforms is the need to optimize these aircraft to carry the most useful payload, which may consist of additional sensors and other electronics, extra fuel or weapons systems. The sole function of an unmanned aircraft is to get to a target location, perform a task, and then return in the most efficient and cost-effective way. Further, without a pilot aboard, the return trip is optional. Therefore, lightweighting is central to UAV design.

Composites the key to UAV utility

Although it might be an oversimplification, in the UAV industry, weight is a disease and composites are the cure. It is noteworthy that all of the almost 200 UAV models considered in this market outlook include some composite parts. Glass and quartz fiber composites are regularly employed in sensor radomes, nose cones and small fairings. There are a number of cases where glass fiber composites were used in earlier medium-size airframes, but the demand for payload capacity, extended performance, and spiral development of unmanned systems have helped make carbon fiber-reinforced polymer (CFRP) the primary materials used in construction of UAV airframes. And as the UAV market has grown, so has the need for advanced composites.For the sake of simplicity in quantifying composites usage, this outlook breaks down the current market for unmanned aircraft into four basic categories:

• Target drones — UAVs that simulate enemy missiles or aircraft in the demonstration and testing of antiaircraft and antiship missiles systems. The Northrop Grumman Corp.’s (Los Angeles, Calif.) BQM-47 Chukar and Composites Engineering Inc.’s (Sacramento, Calif.) BQM-167 Skeeter aerial targets are two modern examples. Both make large use of advanced composite structures.

• Radar decoys — Unmanned decoy aircraft deployed from a larger manned aircraft and designed to subvert, confuse or fool enemy radar systems. The two dominant decoys in production are the ADM-141 TALD, produced by Brunswick Corp. Defense Div. (Lake Forest, Ill.) in partnership with Israeli Aerospace Industries (IAI, Tel Aviv, Israel); and Raytheon Co.’s (Waltham, Mass.) smaller AGM-160 MALD. Although both are relatively small, each makes use of composite structures to meet performance targets.

• Information, surveillance and reconnaissance (ISR) aircraft — UAVs that perform a variety of surveillance, observation and data-relay missions. For combat troops on the ground, small UAVs, including micro-UAVs (handheld/hand launched), provide “over-the-hill” scouting, to avoid ambushes and scare off insurgents. At the divisional levels, larger unmanned aircraft provide broad-area surveillance, communications relay and data transfer, giving commanders at all levels greater battlefield awareness than before.

• Unmanned combat aerial vehicles (UCAVs) — Aircraft designed to provide unmanned weapons capabilities and support manned aircraft. Their capabilities include the use of bombs and missiles, electronic warfare equipment and directed-energy weapons.

The missions and operational requirements for UAVs can be somewhat fluid because these aircraft are easily modified. In the ISR category, a number of platforms have been redeveloped for offensive purposes. As an example, the MQ-9 Reaper, built by General Atomics Aeronautical Systems (San Diego, Calif.) evolved from the Predator ISR system. Instead of an information payload, the Reaper is fitted with several Hellfire missiles and other weapons, enabling persistent loiter and strike capabilities. Although they are not considered as part of this market outlook, UAVs also are under consideration for a much broader array of missions, including civil aviation applications (see the sidebar “Evolving UAVs for new roles,” at the end of this article, below).

UAV marketplace a moving target

UAVs are now in service in more than 50 countries. During 2007, these aircraft logged more than 500,000 flight hours, and that figure is expected to climb at a logarithmic rate. There are, in fact, thousands of different aircraft in various stages of design, development or production, so it’s difficult to pin exact numbers on a market map that is still unfolding. Aviation analysts at The Teal Group (Washington, D.C.) estimate that the UAV market will account for $55 billion (USD) in total R&D and procurement spending by 2018, compared with about $3.4 billion today. In terms of UAV procurement, the largest share of the market goes to the U.S. military and defense agencies (64 percent). The Asia-Pacific region accounts for 20 percent. European and NATO requirements account for the remaining 16 percent.During research into the composite aerostructures demand for UAVs, we were able to identify almost 70 active companies and nearly 200 unique platforms that were either in or soon to enter production or currently under development. Although we no doubt have overlooked many programs in this list, it’s important to note that the top 30 programs accounted for ~3,000 aircraft deliveries during 2008 and will deliver 3,350 more during 2009 — about 93 percent of the delivery total. Over the next five years, the same programs will deliver about 13,000 aircraft. Over our 2009-2018 forecast period, they will account for close to 65 percent of expected UAV deliveries.

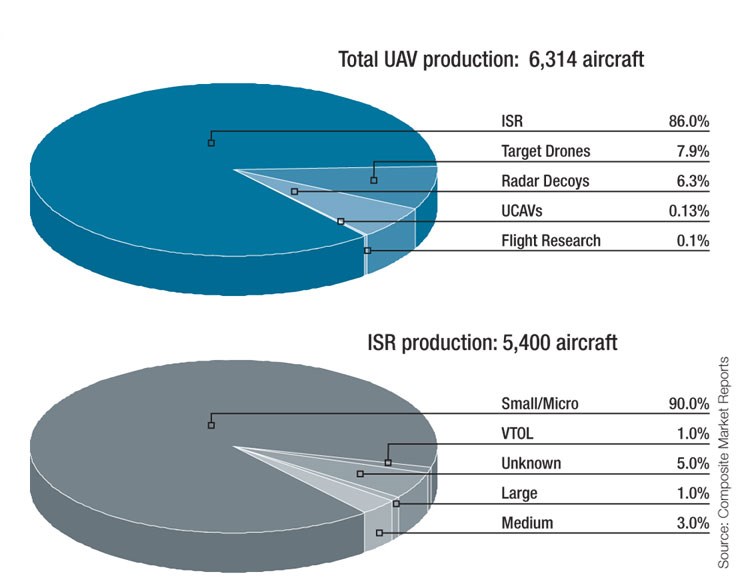

As we break the market down by category, we see that there is a great disparity in share of market. In the target drones category, close to 300 were delivered to militaries around the world during 2007, replacing about 250 that were launched. Relative to the whole, target drones represent about 10 percent of current UAV procurement and deliveries. The unpowered radar decoy segment is a smaller niche, with 245 units delivered in 2007 and only 115 last year. Over the full forecast, radar decoys will represent less than 1 percent of total UAV production. Combined, UAVs in the target drone and radar decoy segments will account for about 400 deliveries each year through 2018.

The ISR category is the largest market component in terms of value and production, accounting for almost 86 percent of all the unmanned aircraft produced (an estimated 6,314 aircraft between 2007 and 2008) and more than 90 percent of all R&D and procurement, worth an estimated $1.5 billion during 2008 (see pie charts on p. 37). Of the estimated 23,000 identified UAV aircraft that we expect will be produced during the next 10 years, ISR platforms constitute the overwhelming majority, at 20,000 vehicles. Because of the wide range of vehicle sizes and configurations, this outlook breaks the ISR market into four subsegments:

• Large fixed-wing – aircraft with wingspans greater than 30 ft/9.1m and typically powered by a turbine or turbofan jet engine. Examples include Northrop Grumman’s RQ-4 Global Hawk; General Atomics’ RQ-1 Predator; the Heron, built by the Malat Div. of IAI, and several other medium- and high-altitude, long-endurance platforms.

• Medium fixed-wing – aircraft with wingspans ranging from 15 ft to 30 ft (4.5m to 9.1m) that fly a variety of missions. Examples include AAI Corp.’s (Hunt Valley, Md.) Shadow 200 and Shadow 400, and Swift Engineering’s (San Clemente, Calif.) Killer Bee (see "Blended Wing UAV" under "Editor's Picks" in “Learn More”).

• Small/micro fixed-wing – aircraft with wingspans less than 1 ft up to 15 ft (0.3m to 4.5m). Examples include AeroVironment’s (Monrovia, Calif.) RQ-11B Raven and Wasp, and Advanced Ceramics Research’s (Tucson, Ariz.) Silver Fox and Coyote.

• Vertical takeoff and landing (VTOL) – These unmanned systems include traditional helicopter, ducted-fan and tilt-rotor designs. Examples: Northrop Grumman’s RQ-8 Fire Scout, The Boeing Co.’s (Chicago, Ill.) A-160 Hummingbird, Bell Helicopter Textron’s (Ft. Worth, Texas) Eagle Eye and Honeywell’s (Albuquerque, N.M.) Micro Air Vehicle.

For the foreseeable future, manned fighter aircraft will continue to dominate airspace, but militaries are keen to capitalize on the improvements in ultra-efficient engine technologies and fifth- and sixth-generation stealth technology to provide persistent weapons capabilities beyond the endurance of human pilots. General Atomics and Northrop Grumman for the U.S., EADS (Schiphol-Rijk, The Netherlands) for Germany, Dassault Aviation (Paris, France) for France, Alenia Aeronautica (Rome, Italy) for Italy, and additional European, Chinese, and Russian firms are developing UCAV demonstrators. Between now and 2018, roughly 75 UCAVs, representing a half-dozen different configurations, are predicted, but given the current fiscal environment, this could be a bit optimistic. Conservatively, at least a few dozen demonstrators will be built.

Today, U.S. military concerns claim the lion’s share of R&D and procurement funding in the overall UAV market, so it should come as little surprise that U.S. firms dominate manufacturing. AAI, AeroVironment, Advanced Ceramics Research, Composites Engineering, General Atomics, Northrop Grumman, Raytheon and Elbit Systems (Haifa, Israel) are among the most prolific. All but Elbit are headquartered in the U.S. Our research suggests that U.S.-based companies will win 75 percent of the worldwide R&D, testing and evaluation work and more than 60 percent of total worldwide procurement contracts. Over time, however, greater international participation is expected to erode North America’s advantage. At the end of our forecast period, platforms developed in Europe, Asia and elsewhere should account for nearly half the deliveries.

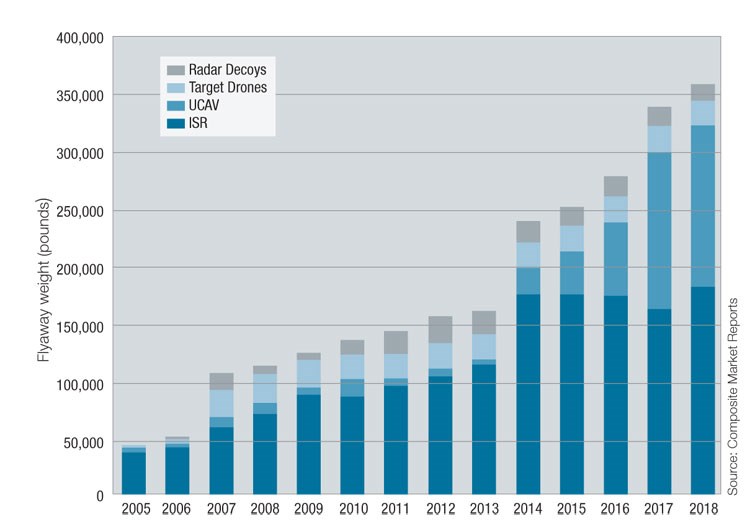

When we correlate the composite content of each of our 30 key production programs with the reported annual aircraft production rates, we estimate that 105,000 lb and 112,000 lb (231 and 247 metric tonnes) of composite structures were fabricated, respectively, to support UAV production in 2007 and 2008. In 2009 and 2010, despite global economic conditions, this statistic will grow 10 percent yearly. The data suggest that seven programs, each comparable in size to manned aircraft programs, will drive industry needs:

• Northrop Grumman’s RQ-4B Global Hawk

• Composites Engineering’s BQM-167 Skeeter

• General Atomics’ RQ-1B, MQ-9 Warrior/

Mariner, RQ-1C

• Northrop Grumman’s RQ-8 Fire Scout

• AAI Corp.’s Shadow 200 & 400

• Northrop Grumman’s BQM-47 Chukar

• Northrop Grumman’s X-47 N-UCAS

Over the next three years, these models and their variants will make up 70 percent of total UAV composite structures requirements. Although it is not our intention to discount the utility of the thousands of small/micro ISR aircraft produced each year, their size dictates that, in 2008 and 2009, they will account for only ~5,000 lb/2,270 kg of finished aerostructures annually. Over our 10-year forecast, they represent roughly 3 percent of composites demand.

Globally, the UAV composites market is expected to swell by nearly a factor of three by 2018, approaching 335,000 lb (738 metric tonnes) of airframe structure per year. From 2009 to 2018, UAV composites will total almost 2 million lb (907 metric tonnes).

Factoring in the various composite applications and their respective materials of construction, it appears that CFRP accounts for 83 percent of the total market by volume. At the Tier 2 and 3 levels, manufacturing of UAV composite aerostructures represented $18.4 million to $20.0 million in 2007 (not including the value of R&D, engineering, testing and assembly). The market grew another 6 percent in 2008. Expectations for 2009 are an additional 10 percent, raising the estimated value by ~$23 million. We forecast that UAV composite aerostructures manufacturing could account for $340 million over the next 10 years, reaching as much as $60 million, annually, by 2018.

For material suppliers, CFRP production for UAVs should require 99,200 to 110,230 lb (45 to 50 metric tonnes) of raw standard- and intermediate-modulus carbon fiber and about 20,300 lb (9.2 metric tonnes) of continuous glass and quartz fibers — primarily in prepreg. Growing aircraft production rates are expected to drive raw fiber requirements as high as 302,240 lb (138 metric tonnes) by 2017 and require about 1.75 million lb (795 metric tonnes) of material over the forecast period. For prepreg suppliers, the total will be ~$250 million of new business and as much as $40 million per year by 2018.

Because this outlook focuses on the best-known, primarily Western programs, some of our production figures could be conservative. Considering the growing utility and cost-effectiveness of UAVs and the expansion of Asian and Pacific militaries, it is possible that UAV programs in these regions could boost composites demand by an extra 20 percent by 2018.

A smaller part of the larger whole

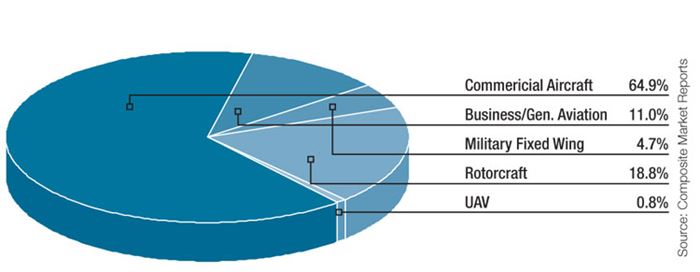

Although demand for UAVs and the composites they require will dramatically increase, it is important to keep things in perspective. Compared to commercial, civil and traditional military aircraft production, the UAV market is small (see pie chart on p. 38). Requirements for the business, general aviation, rotorcraft and military fixed-wing markets are 8 to 13 times greater. Although demand growth in commercial transports is expected to outpace the rest of aircraft manufacturing through our forecast period, the UAV market will gain ground on the others. By 2018, manned military fixed-wing requirements will be only three times larger, and business jet requirements will be 10 times larger. In the decade beyond 2018, however, it is likely that UAVs will increasingly replace manned systems in many military and government commercial functions. To what extent is anyone’s guess. If the current trend holds and the vast potential for civil systems is realized, UAVs could realistically assume as large a place in the aerospace market as their manned counterparts.

Related Content

Bio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreThe lessons behind OceanGate

Carbon fiber composites faced much criticism in the wake of the OceanGate submersible accident. CW’s publisher Jeff Sloan explains that it’s not that simple.

Read MoreMcLaren celebrates 10 years of the McLaren P1 hybrid hypercar

Lightweight carbon fiber construction, Formula 1-inspired aerodynamics and high-performance hybrid powertrain technologies hallmark this hybrid vehicle, serve as a springboard for new race cars.

Read MoreRead Next

Sky's The Limit For Composites-intensive UAVs

Market growth is being spurred primarily by post-9/11 combat actions, homeland security and natural disasters.

Read More