Wind energy: Gale force growth ahead

Columnist Dale Brosius addresses recent accomplishments, forecasts and recycling challenges affecting the wind energy industry — and composites use within it.

Last month, I reviewed some of the big introductions that led to growth in composites during the last decade, with some thoughts about prospects for growth the next 10 years. In summary, the future of aerospace appears strong, with current industry R&D focused on high-rate production methods for single-aisle passenger aircraft, high-volume unmanned aerial vehicles (UAV) and the emerging urban air mobility (UAM) market. By contrast, the future for automotive composites is much less clear, clouded by the rise of electrification and shared mobility, plus the continuing need to crack the somewhat nebulous thresholds for component or system costs and production volumes to earn positions on mass-market vehicles.

I also mentioned the dynamic growth of the wind energy industry, which deserves its own column, given its rising importance — and share — of the overall composites market. Statistics from the Global Wind Energy Council (GWEC) show worldwide wind electricity generation capacity has tripled, from roughly 200 gigawatts in 2010, to more than 600 gigawatts by the end of 2019. The main reason? Increased cost competitiveness with other power generation technologies like coal, natural gas and even solar, the last of which is also plummeting in cost.

Wind energy is already the largest consumer (by mass) of worldwide carbon fiber at more than 23,000 metric tonnes.

Dr. Julia Attwood, head of advanced materials at Bloomberg NEF, which studies energy markets, made a presentation covering wind energy at IACMI’s winter member meeting in January 2020. Attwood’s research shows onshore wind today is the lowest cost source of electrical power in the U.S. using the Levelized Cost of Energy (LCOE) metric. LCOE includes initial capital costs, ongoing fuel costs (which is zero for wind), and operation and maintenance costs over the expected lifetime of the equipment. Wind turbines are typically engineered for a lifetime of 20 to 25 years. Bloomberg’s data show wind power at half the cost of coal-based electricity and between 15 and 25% less than natural gas and photovoltaic solar.

Much of the improvement in economics is due to the growing average turbine rotor diameter, which has increased from 90 meters in 2010 to almost 140 meters in 2020, per Bloomberg. Correspondingly, blade lengths have grown from just more than 40 meters to between 65 and 70 meters for onshore blades, and now to 107 meters for General Electric’s new Haliade-X 12MW offshore turbine.

In wind economics, power produced is proportional to the square of the rotor diameter, and, since blades are 3D structures, the rule of thumb is that blade weight is proportional to the cube of the length. However, blades are continually becoming lighter on a weight-per-meter basis, due to improved materials, processing technologies, standards and certification protocols that have reduced safety factors. Carbon fiber spar caps are also becoming more common in longer blades, with Attwood noting that wind energy is already the largest consumer (by mass) of worldwide carbon fiber at more than 23,000 metric tonnes. With wind energy forecast to triple again by 2030 and grow fivefold by 2050, this consumption is expected to lead carbon fiber capacity expansions.

Based on the above, it would seem there are few hurdles that could impede the growth of wind power. However, there are issues to be addressed to assure seamless expansion. The current lengths of onshore blades are limited to what can be transported from central factories across highways, beneath overpasses and around corners, nominally in the 65- to 68-meter range (or roughly 140-meter rotor diameter). If a way can be found to set up temporary factories in wind farm locations, or find ways to split blades for transport, this limitation could be overcome. Offshore blades are typically built at ocean port locations, thus are not similarly constrained.

A second “headwind” is the conundrum of what to do with blades that have reached the end of their useful life and become scrap. This problem is not unique to wind — the Boeing 787 and Airbus A350 will face this problem eventually, as will composite-intensive automobiles. Some forecasts are that more than 50 million tons of blades will need to be disposed of or recycled by 2050. While thermoplastic matrix technology can partially address this, the mix of materials in a blade structure poses a recycling challenge. The industry is actively exploring multiple technologies to address this looming problem, including molding crushed blades into construction panels, and using controlled pyrolysis to convert the polymers in blades into natural gas, recovering the fibers for use as mats or fillers in other composites.

Assuming the industry overcomes these obstacles, as they have previous ones, there is every reason to believe fair “winds” will prevail for a long time to come.

Related Content

Materials & Processes: Composites fibers and resins

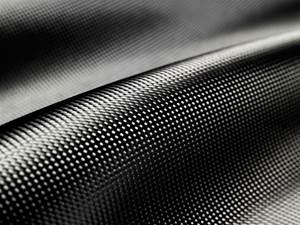

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

Joint project to advance wind turbine blade recycling

A group of European wind and chemical industry partners aims to broaden the range of recycling options for composite wind blades.

Read MoreDecommissioned wind turbine blades used for cement co-processing

An initiative to recycle wind turbine blades includes the use of recycled glass fiber composites for cement manufacturing, replacing raw material and saving energy.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More