In Brazil, where the wind blows and blows

CW editor Jeff Sloan is in northeastern Brazil this week, getting an up-close look at the Brazilian wind market, and a dynamic manufacturer of wind blades.

Shorline wind farm, near Port of Pecém in the Brazilian state of Ceará.

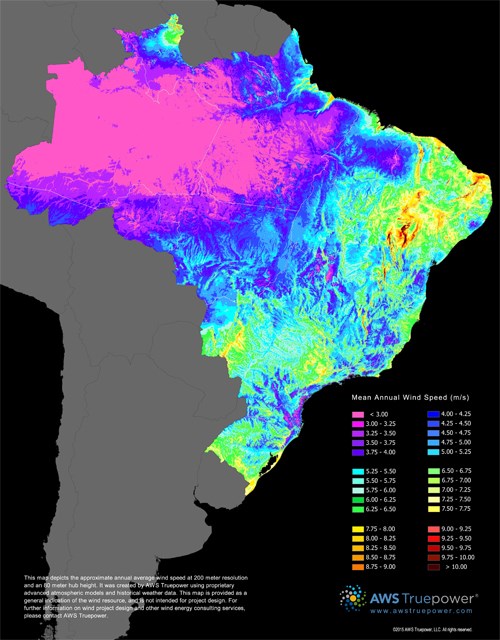

I am in Brazil this week, visiting a wind blade manufacturer, near Fortaleza in the state of Ceará, in the northeast of the country. This region is, for Brazil, where the wind blows at its best, and it has become the de facto home of many of the country's wind farms and some of the country's wind blade manufacturers. We don't talk much about wind energy opportunities in Brazil, but they are substantial for many reasons.

First, the profile of electricity generation in Brazil is unlike that of other major countries. Brazil is the second largest producer of hydroelectric power in the world (behind China), and the country relies on hydroelectricity for more than 75% of its power. Most of the hydropower, naturally, comes from river systems in the north and northwest part of the country, which is far removed from major population centers and thus presents a challenge from an energy transmission and reliability perspective.

Brazil mean annual wind speed.

An inherent problem of hydropower is that it depends on water, and when there's a drought, water flow is reduced, thus energy generation is reduced. To help fill in the of the energy gaps in hydropower supply, the country is turning to other resources to help stabilize energy supply. These include liquified natural gas, wind and solar power. Wind's advantage stems from the fact that the northeast region, where winds are generally stronger, are strongest during a drought, which makes wind energy complementary to hydropower.

Further, the wind turbine manufacturing supply chain in Brazil is already very mature, which means that infrastructure and manufacturers are in place to meet the needs of wind energy farm development. This is important because Brazil's national state-run bank, National Development Bank (BNDES), which finances much of the country's wind farm development, stipulates that wind turbines erected in Brazil must be manufactured in Brazil. This demand for local content is designed, of course, to drive economic development and job creation, which it has.

Indeed, according to the Global Wind Energy Council (GWEC) Brazil wind energy capacity has increased from just 29 MW in 2005 to 8.7 GW by the end of 2015, ranking it 10th in the world in total installed wind energy capacity. Brazil installed 2.75 GW of wind energy in 2015, and the wind energy sector employs more than 41,000 people.

There is still the issue of energy transmission, given that so much of Brazil's wind farms are remotely located, but the Brazilian government is using an auction system to lure transmission developers into bidding on projects. Response to the auctions, however, has been lukewarm, in part because Brazil's economy and political situation are so tenuous.

Still, the country is committed to wind, and the future seems bright. I'll have a full report on my wind blade plant tour in an upcoming issue of CompositesWorld magazine. Keep your eyes peeled.

Related Content

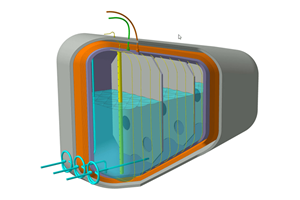

Collins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More