Process automation: A model response to Trumponomics and Brexit?

Offshoring can’t go on forever and a significant trend toward reshoring is probably inevitable.

It is, perhaps, an impossible task to reflect on where current global politics might take our industry, without being overtly political. But whether you agree or disagree with President Trump, Brexit, the southern EU debt crisis, and other tumultuous events of late 2016, it is undeniable that the world is moving into a new political era. Before it all took place, I posed the following question to many of my colleagues and associates: “What could Trump and Brexit mean for the composites industry?”

Implied in this are more practical questions: Is it the case that our industry has relied too much on low-cost labor as the solution to ensure that advanced lightweight structures have the best chance of winning the material technology race? And if “yes,” how damaging could new tariffs and trade barriers be for our industry?

The instinctive reaction to our new political order, which seems to be more inward-looking and less trade-friendly than the business environment of the recent past, is that it is probably bad for business, and that any trade barriers will probably damage our prospects in general. Standard-modulus carbon fiber, for example, has for a long time been freely traded with no tariffs, allowing things like sporting goods to be made at low cost in China and the Far East, and for such items to be freely traded around the globe to the seeming beneft of producers, brands, retailers and end-users alike. So, in general, the sentiment has been less than optimistic about where our industry is heading in this brave new world.

But is this really new? If access to low-cost labor countries is restricted through trade barriers, or just an increased “buy home-produced” sentiment, an obvious response is to reduce to an absolute minimum the number of man hours it takes to produce composite parts, and to produce locally to the market demand. And the most obvious way to do this is through automation — to reduce the number of physical man hours per part rather than merely seeking the lowest cost labor.

This is precisely the same challenge that composite part end-users — such as aircraft and automotive manufacturers — have been putting at the feet of the industry for at least the past 20 years.

Our view at NTPT for a while has been that offshoring manufacturing to China/Asia/Mexico can’t go on forever, that a significant trend toward reshoring of manufacturing is probably inevitable, and that there may be some good business opportunities to be had in providing automated solutions. Our business is based in Switzerland, possibly the world’s most expensive manufacturing environment, so while we have set up a low-cost manufacturing unit in Eastern Europe, we also dedicate a lot of resources to developing and using automated manufacturing processes wherever we can do so.

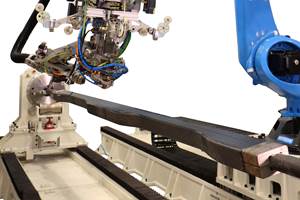

Our newly developed tube manufacturing process is a case in point, from which our first product to market is a new-technology golf shaft – TPTGolf. We have seen little meaningful development in composite golf shaft manufacturing since the early 1990s — other than to move all production, wholesale, to China to chase cost — and so we see our new, fully automated manufacturing process as a model response not only to the slowly rising labor costs in Asia, but also to the economic realities of our time. Happily, the new process also produces a shaft that plays very well.

Other positive examples of similar developments in our industry are press molding, long-fiber injection molding and compression molding from ATL-laid preforms. Each process is seeing intense development, with automation at its core.

Could these new automated manufacturing processes arising from our new economic landscape yield a lower cost per part for composites, and, therefore, positively in influence the market share battle against competitive materials? Consider also that due to new protectionist measures, the cost of producing metal parts could significantly increase as sources of low-cost metal production are subjected to punitive/severe levels of tariffs and, thus, further tip the economic scales in favor of the composites industry, helping us to win the “material choice” battle.

So, while this new wave of protectionism might initially appear to be bad news, if we flip the coin, it is possible to take a positive view of new political developments. For reasons other than the possibility of significantly increased spending on defense and security, it might be a potentially positive catalyst and opportunity for those in our industry focused on innovation and automation. I do anticipate that the evolving political landscape will initiate a new wave of composite manufacturing process developments to the long-term benefit of our industry, and for that reason, I continue to be optimistic and excited about the future.

Related Content

CompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.jpg;maxWidth=300;quality=90)