Beyond the Concorde: Next-generation SSTs

Civilian supersonic flight could begin a new era as aircraft developers position composites-intensive designs for market entry, particularly in the business-jet niche.

First introduced into commercial airline service in January 1976, the 90- to 120-passenger Concorde supersonic transport (SST) is one of only two such aircraft ever to take to the skies (the other was the ill-fated Tupolev Tu-144) and the only one to enter commercial service. The high fuel costs and environmental concerns associated with these high-flying aircraft was a contributing factor to The Boeing Co.’s (Chicago, Ill.) decision to cancel work on its Mach 2+, 240-passenger B2707 design in 1971. Following the publicity surrounding the crash of a Concorde in July 2000 and the financial impacts in the wake of the 9/11 terrorist strikes, Air France and British Airways decided to retire the fleet. The Concorde’s final flight on Nov. 23, 2003, brought to a close the first era of civilian supersonic transport.

Desire and enthusiasm for SSTs, however, have waned little. Research into SST technology has been an ongoing yet closeted subject within aviation circles for the better part of two decades. Yet it is only in the past five years that these efforts have come far enough that the civilian sound barrier could be broken again. Gulfstream Aerospace Corp. (Savannah, Ga.), Cessna Aircraft Co. (Wichita, Kan.), Dassault Aviation (Paris, France), Tupolev PSC (Moscow, Russia) and several other aircraft manufacturers continue to research designs and the technologies — notably, carbon composites — necessary to initiate a new era for the SST. However, these next-generation aircraft are less likely to be commercial transports targeted to airline operators than a new class of supersonic business jet (SSBJ). By the middle of the next decade, these new aircraft are likely to provide significant lift as the aerospace composites market continues to take wing.

A Concorde for the corporate exec

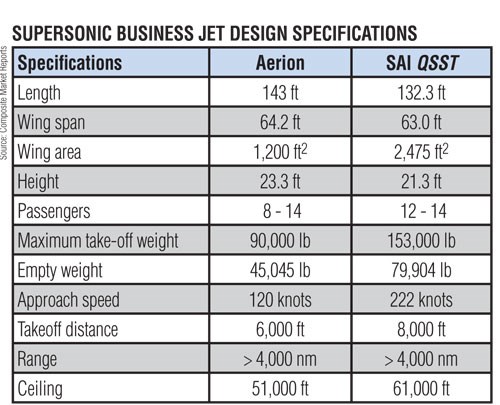

The heir apparent to the Concorde could be the Aerion Corp.’s (Reno, Nev.) 8- to 14-passenger Aerion business jet, which will be capable of speeds up to Mach 1.6 and a range of more than 4,000 nautical miles. But Aerion is not without competition. Michael Paulson, son of the founder of Gulfstream, founded his own firm, Supersonic Aerospace International (SAI, Las Vegas, Nev.), in pursuit of the same niche. Teamed with fabled aircraft design house Lockheed Martin’s Skunk Works (Palmdale, Calif.), Paulson’s firm has developed the Quiet Supersonic Transport (QSST) design, featuring a radical “inverted V-tail.” Meanwhile, Japan Aerospace Exploration Agency (Tokyo, Japan) is working toward a mid-2010 flight of its Silent Supersonic Technology Demonstrator in support of future SST aircraft design and propulsion. Prototype designs for this unmanned test aircraft are undergoing wind tunnel testing for use on transcontinental vehicles capable of carrying 100 to 300 passengers at Mach 1.6 and faster. HiSAC (High-Speed Supersonic Aircraft) — a European research consortium led by Dassault Aviation — is developing three SSBJ designs capable of carrying 8 to 19 passengers, with the intent of flying demonstration aircraft in the middle of the coming decade.These established programs may be joined by others. For example, at the October National Business Aviation Assn. (NBAA, Washington, D.C.) annual convention held in Orlando, Fla., the show floor was abuzz with rumors of a U.S.-led supersonic aircraft program. In May 2008, the National Aeronautics and Space Admin. (NASA) allocated the designation of X-54A to a supersonic experimental aircraft designed to test technologies for reducing sonic boom and gathering scientific data in support of supersonic flight research. The aircraft also will help collect data on sonic boom signatures, which could be used to amend regulatory restrictions on supersonic flight over land. While NASA and Gulfstream have declined further comment, the DOD 4120.15-L – Addendum document, the U.S. Department of Defense’s official list of aircraft and missile designations, includes Gulfstream as the manufacturer of the recently added entry for the X-54A. The document also mentions that the X-54A will be powered by two Rolls-Royce (Derby, U.K.) Tay 651 turbofans, rated at more than 15,000 lbf of thrust. At a press conference on the first day of the business aviation show, Preston Henne, senior VP for programs, engineering and testing at Gulfstream, made the following not-so-subtle observation: “You may be aware that Gulfstream has been working on supersonic technologies for quite some time. At some point, somebody has to do a complete airplane. If so, at some point, there might be a complete airplane designed for low boom and it may have X-54 painted on the side of it.”

As envisioned, SSBJs are expected to have a sales price of more than $80 million (USD). Although this is about twice the price of today’s subsonic intercontinental luxury business jets, which make up the high end of the business aircraft market, there is good reason to believe that SSBJs will find a niche.

Trending away from the terminal

The emergence of SSBJs can be seen as a natural extension of aviation industry response to the evolving air travel culture. The cost of first-class and business travel for intracontinental (let alone intercontinental) flights now ranges into the thousands of dollars per ticket. Delays and aggravation associated with security screening at commercial airline terminals are increasing and are likely to be permanent features of airline service. In response, high-end business travelers are turning in greater numbers to business aircraft and charter services. The same factors are driving development of very light jets for air taxi services. Time spent in the air is just as critical to passenger comfort as it is to pilot performance and safety. The eight hours it takes to fly from most seaboard locations in the U.S. to Europe or the Pacific Rim, or the 18 hours logged between Los Angeles and Sydney, Australia, make intercontinental flights challenging no matter what side of the cockpit door you sit on. If SSBJs can help travelers avoid terminal security hassles, cut the time of long-distance travel in half, maintain existing operating costs and provide passenger capacity and range similar to subsonic bizjets, then there is a strong buying incentive for fractional-ownership aircraft operators and private owners among the super rich.The question remains, Why, after more than 50 years of supersonic flight and the fame of the Concorde, has another supersonic civilian transport not been fielded? The answer has its roots in the Concorde’s history. Although it was, in the beginning, very promising — by 1972, British Aircraft Corp. and Aerospatiale, the aircraft’s prime contractors, had secured more than 70 firm orders — only 20 Concordes were built, and only entered 16 in commercial service. The 1973 oil crisis and its impact on fuel prices, the resulting financial difficulties among airlines and the tragic crash of the competing Tupolev Tu-144 prototype the same year at the Paris Le Bourget air show caused many prospective operators to reconsider supersonic transport as too risky. SST developers today face similar and no less daunting challenges.

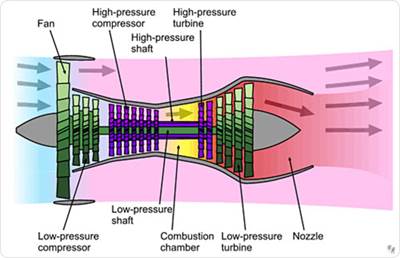

Supersonic flight generally requires heavy fuel consumption, making the plane expensive to fly, and generates disproportionate emissions. In the end, the price of fuel was one of the leading reasons that Concorde was retired from service. Further, the Concordes and the new generation of supersonic transports are designed to fly in the thin, smooth air at 50,000 ft/15,240m or greater. At this altitude, nitrogen oxide from the jet’s exhaust does more damage to the ozone layer than that from high-volume subsonic passenger planes flying at 30,000 ft/9,144m. While emissions were not considered a significant problem for a fleet of 16 aircraft, a fleet of hundreds or thousands of SSTs raises the impact potential by a few orders of magnitude.For aircraft that cruise at Mach 2 for extended periods of time, another challenge is aero-frictional heating. At 60,000 ft/18,288m, outside air temperatures are about -60°C/-75°F. But when that compressed air moves over exterior surfaces, temperatures rise. On the Concorde, cruising at Mach 2, its metal exterior reached 125°C/250°F, creating a temperature gradient that made the aircraft’s insulated passenger windows warm to the touch. Moreover, at Mach 2.0, the metallic structures of the Concorde’s fuselage expanded about 1 ft/0.3m relative to the aircraft’s 129 ft/39.3m length.

To overcome fuel-, frictional-heating- and boom-related challenges, SST designers are addressing the aerodynamic requirements of these fast planes. The Aerion and QSST designs, for example, feature relatively long fuselage and empennage structures and are propelled by relatively powerful and heavy jet engines. In turn, the aircraft are inherently heavier than conventional subsonic business jets. Although the price of fuel has recently dropped after spiraling higher over the past three years, the reduction is, no doubt, temporary. Fuel burn and emissions reductions will remain strong design drivers. Composites will be a critical component of new-generation supersonic jets, enabling low-drag surfaces, minimizing aircraft weight and reducing engine thrust requirements.

Beating boom, drag and thermal expansion

While it is too early to call Aerion’s program a commercial success, the company already has taken deposits for 40 SBBJs, valued at about $4 billion, with the first deliveries targeted for 2014. If regulatory approval is granted, the SSBJ will be capable of flying at speeds up to Mach 1.2 without generating a perceptible sonic boom. One of the most notable technical features of this sleek design is its patented supersonic natural laminar-flow wing. The wing design is the brainchild of Aerion’s chief technology officer, Richard Tracy, an industry veteran who has contributed to a number of classified and unclassified government-sponsored aircraft programs, including the X-30 hypersonic space plane and Northrop Grumman Global Hawk UAV. Tracy also served as chief engineer of LearAvia’s Learstar 600 (when Montreal, Quebec-Canada-based Bombardier Aerospace acquired LearAvia, the Learstar 600 was renamed the Challenger 600 Series bizjets, which also served as the baseline for the company’s Canadair Regional Jet Series). Tracy also was instrumental in development of the Lear Fan 2100 — one of the first all-composite-airframed business planes.Wind tunnel testing of the Aerion SSBJ has shown that the wing’s shape reduces drag by 50 percent, compared to traditional wing architecture, and performs well at both sub- and supersonic cruising speeds. The Aerion’s wing design is largely dependent upon the high stiffness of carbon fiber/epoxy composites to achieve a thin aerofoil without sacrificing flight safety.

The 143-ft/43.6m long, sculpted fuselage could be an ideal candidate for the automated fiber placement process. Using some rough metrics, a switch from aluminum fuselage sections to CFRP might shave up to 1,500 lb/680 kg from the aircraft’s 45,045 lb/20,475 kg empty weight. By virtue of its low coefficient of thermal expansion (CTE), a composite could reduce the thermal expansion that engineers had to cope with on the Concorde’s aluminum airframe. A decision will be based, in part, on the program partners that Aerion needs to move forward to prototyping and certification. At the NBAA show in October, company officials indicated that they expect to announce agreements with several airframe and system partners by the end of this year. (Editor’s note: As HPC went to press in mid-December, no announcement had been made.)

While long and sleek like the Aerion SSBJ, SAI’s QSST, also sometimes referred to as the Skunk Works P422 design, is distinctly different, both visually and technologically. The concept design work to this point already has generated 22 patents, including one for the boom-suppressing inverted V-tail. These technologies have been instrumental in reducing the aircraft’s boom signature, which is advertised as only 1/100th that of the Concorde. At this reduced level, the company believes that its aircraft would receive regulatory approval to fly supersonic over populated areas without provoking any complaints from the general public.Like the Aerion jet, the QSST is baselined for production with composite skins over much of the aircraft’s exterior, with the exception of the fuselage. Development of an all-new aircraft and engines and the advanced technology it takes to fly at twice the speed allowed for existing civil aircraft is a relatively high-risk proposition. The fuselage, then, can become a low-risk element if engineers stick with well-characterized alloys. While requests for more detailed figures were not forthcoming prior to press time, we know the airframes for both the QSST and Aerion aircraft are expected to be at least 30 percent composite by weight. If the fuselages subsequently are converted from aluminum alloy to composite construction, this figure could easily climb to 50 to 60 percent.

There is a fairly strong consensus among aircraft OEMs and industry analysts that demand will support sales of roughly 300 to 400 supersonic aircraft during the first 10 years of production. Potential military applications — maritime surveillance or dignitary transportation — could drive up demand by another 150 to 200 aircraft within the same time window. Assuming that these orders materialize and that the ordered models survive the certification process and are delivered, the average output for SSBJs could be about 50 aircraft per year, with peak output probably approaching 75 units per year, worldwide. Realistically, this would provide only enough room for two programs to survive and prosper.

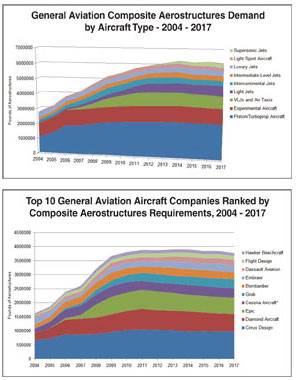

Figures published in HPC’s recent “Aviation Outlook” for business aircraft composites (see “Learn More,” at right) included the delivery of about 110 SSBJs between 2014 and 2017. This compares to about 200 ultralong-range intercontinental business jets delivered to customers during 2008 and the 1,700 additional planes forecasted to be delivered between now and 2017. Given the 40 orders Aerion already has for its aircraft, there is a good chance that at least one prototype SSBJ will be flying within the next six years. While the Aerion and QSST are the only officially announced programs, revised regulations that permit supersonic flight over land could encourage other prospective competitors to field SSTs.Tentative estimates of SSBJ composite structures content show that even if only a few of these aircraft were built each year, it would create a significant new demand for both materials and manufacturing capacity. Assuming that the 110 deliveries forecasted during the 2014 to 2017 time frame actually materialize, supersonic aircraft could represent a projected 200,000 lb to 230,000 lb (90,718 kg to 104,326 kg) of structures annually. At this volume SSBJs would account for about 9 percent of all business aviation composites after only about two years of deliveries.

Flying into heavy traffic

Although the history of business jets is crowded with a vast number of great designs, the potential impact of supersonic business jets on the composites industry looks promising. Supersonic flight has been around for more than half a century, but the challenge of designing a new aircraft that satisfies the evolving noise and emissions requirements amid high fuel costs is no less daunting than it was for the Concorde. Only Aerion is proposing a business case for its aircraft that does not require permission to fly supersonic over land. It remains to be seen whether the FAA, ICAO and other regulatory bodies can be persuaded to amend rules to allow for this possibility. Without it, almost half of the potential SSBJ market disappears. Nevertheless, it is with great optimism that we must wait to see the civilian sound barrier broken again — only this time, leaving our windows and eardrums intact.Related Content

Plant tour: Arris Composites, Berkeley, Calif., U.S.

The creator of Additive Molding is leveraging automation and thermoplastics to provide high-volume, high-quality, sustainable composites manufacturing services.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreHexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreRead Next

Aviation Outlook: Composites in rotorcraft reaching new altitudes

One of the earliest markets for advanced composites, helicopter manufacture is and will continue to be a stronghold for industry growth.

Read MoreAviation Outlook: Composite aerostructures in General Aviation

Although the math is fuzzy and once helpful category distinctions are blurring, the forecast for this sector’s use of fiber-reinforced polymer remains strong.

Read MoreAviation Outlook: Composites in commercial aircraft jet engines

Airlines' need for fuel-efficient flight provides the thrust behind composite lightweighting strategies in jet engine manufacturing.

Read More