VoxelMatters report reveals top companies in composites AM

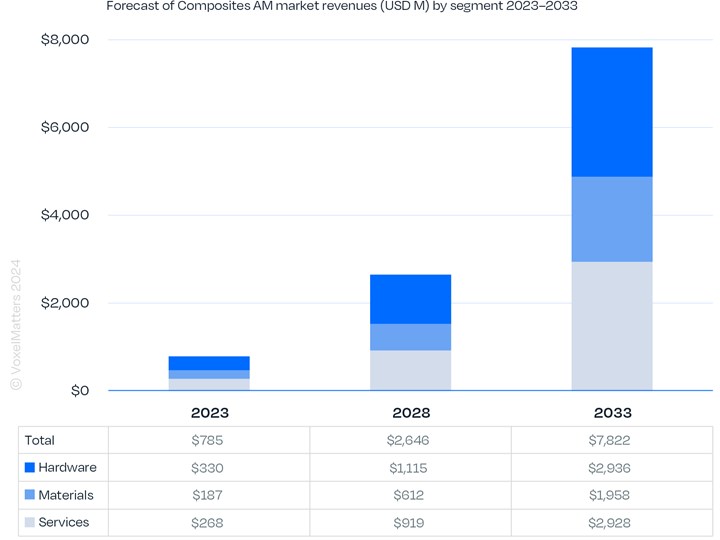

The new market study identifies key players in a $785 million global market that has grown by 21% year on year.

Forecast of composites AM market revenue (USD) by segment: 2028-2033. Source (All Images) | VoxelMatters Research

VoxelMatters Research (London, U.K.), a market analysis company specializing in tracking the global additive manufacturing (AM) industry, has released its new study on composites AM. The 250-page “Composites AM Market 2024,” report reveals that the overall composite AM market has experienced a year-on-year (YoY) growth of +21.1%, with the total market value increasing from $648 million in 2022 to $785 million in 2023.

The study — looking through the lens of 172 hardware manufacturers, 153 material suppliers and 421 service providers — shows this expansion in value is noticeable across the board. Hardware sales went from $278 million to $330 million, showing a +18.5% YoY increase. The Materials segment experienced the highest growth, going from $148 million to $187 million, a +26% increase. Services (AM Service Bureaus) went from $221 million in 2022 to $268 million in 2023, a +21.2% YoY growth.

Representing a young market still very much based on technology development and adoption, the most significant companies in the composites AM market are primarily hardware manufacturers, each holding a leadership (and often pioneering) position in a specific composite AM technology or an important new evolution of a specific technology. Most of these companies also generate revenues as first-party, and sometimes third-party, material providers or as AM service providers.

VoxelMatters Research breaks down the top 10 composites AM companies by revenue below:

- Markforged

The largest company in terms of revenue is Markforged (Waltham, Mass., U.S.). It emerged less than a decade ago from the open-source filament material extrusion 3D printing segment with its continuous fiber fabrication (CFF) technology and today is a public company with revenues of around $94 million in 2023.

CFF combines thermoplastic filament with continuous fiber to create high-strength composite parts. Markforged’s industrial-grade printers, such as the X-Series, use CFF to produce parts that have high strength, stiffness and durability. These printers can use materials like carbon fiber, fiberglass and Kevlar. In addition to industrial solutions, Markforged also offers desktop printers. The Mark Two and Mark One (Onyx Pro) desktop printers feature CFF technology and support materials like Onyx (carbon fiber-filled nylon). These printers are used for educational purposes, prototyping and small-scale production. The base version, Onyx One, supports only chopped carbon fiber materials.

- Stratasys

More than 30 years ago, Scott Crump, the founder of Stratasys (Eden Prairie, Minn., U.S.), invented filament material extrusion (FDM) technology. Through several acquisitions, Stratasys has reportedly become the world’s largest 3D printing company in terms of annual revenue.

Today, Stratasys offers a range of 3D printers across five different technological categories. In 2018, the company introduced the Fortus 380mc Carbon Fiber Edition, its first FDM system dedicated specifically to carbon fiber-filled nylon 12. As part of its transition to the F-line brand, Stratasys now offers the F123CR Series composite 3D printers, in addition to the F190CR and F370CR systems. This composite-ready printer family builds on the simplicity of the F123CR Series printers to provide carbon fiber 3D printing for more demanding applications.

- EOS

EOS (Munich, Germany), a company founded by Dr. Hans J. Langer, leads the industrial selective laser sintering (SLS) 3D printing market and is therefore also a leader in the composites SLS segment. EOS is claimed to be the only company that has introduced advanced systems for high-performance composite polyetherketoneketone (PEKK) powders, such as the EOS P 810. Although this system is not aggressively marketed, it is notable, as it can process the EOS HT-23 PEKK polymer from Arkema to create parts that can withstand temperatures well above 200°C. Hexcel also offers the HexAM service for making composite PEKK parts using modified EOS systems, leveraging a proprietary process acquired from Oxford Performance Materials (OPM).

- HP

Since the launch of MultiJet Fusion (MJF) technology in 2016, HP (Palo Alto, Calif., U.S.) has focused on high-throughput production for parts. To achieve this, HP worked on developing an optimized workflow. As production rates increased, the complexities of the workflow evolved significantly in the HP Jet Fusion 5200 systems. Today, the company’s hardware supports one composite material, the HP 3D High Reusability PA 12 Glass Beads. This material is a 40% glass bead-filled thermoplastic material with high stiffness and reusability. Currently, this material is only available on the 5200 and 4200 platforms.

- Airtech

Airtech (Huntington Beach, Calif., U.S.) has emerged as a leading supplier of pellet materials for large-format additive manufacturing (LFAM) technologies. After larger companies, such as SABIC and Techmer, divested from this market segment due to its limited size, Airtech filled the gap by establishing partnerships with leading LFAM hardware developers worldwide, including companies like Caracol and CMS.

Airtech has developed a series of composite resins (ABS, PETG, PC, PEI, PESU) under the Dahltram brand for use in large-scale 3D printing. These resins address the need for lower coefficient of thermal expansion (CTE) and increased durability when used at both low and high temperatures, including in an autoclave. They are designed for use in any pellet-fed material extrusion 3D printing system.

- 3D Systems

3D Systems (Rock Hill, S.C., U.S.) has been a major first-party provider of 3D printing composite powders for its SLS platforms, including carbon fiber-reinforced and glass fiber-reinforced nylon powders, as well as mineral-filled nylon powders. More recently, the company entered the LFAM segment with the acquisition of the U.S.-based company Titan and is now becoming an increasingly relevant supplier of composite materials in pellet form.

- Ingersoll

Along with Cincinnati Inc. (which has now exited the segment) and Thermwood, Ingersoll (Rockford, Ill., U.S.) was among the first companies to develop LFAM systems. The company, belonging to the Italian Group Camozzi, sells machines in both North America and Europe and can leverage its extensive expertise in the high-end CNC system to produce very large machines with price tags of over $1 million dollars. Recently, the LFAM market has grown significantly and new players have emerged such as CMS in the gantry-based segment, as well as several other operators in the robotic LFAM segment.

- Materialise

According to the report, Materialise (Leuven, Belgium) is one of the largest AM service providers globally, with a sizable installed hardware presence across various technologies. While Chinese companies may have more systems installed, Materialise produces a greater number of parts due to higher demand and its extensive expertise in AM. The company primarily offers composite 3D printed parts using powder bed fusion (PBF) technology, specifically SLS (EOS machines) and MJF (HP machines), as well as FDM parts produced using Stratasys machines. Although LFAM services are currently not available, Materialise remains the largest composite AM service provider in terms of revenues.

- MCPP

Mitsubishi Chemical Performance Polymers (MCPP, Greer, S.C., U.S.) is a division of Mitsubishi Chemical Corp. that specializes in performance polymers. In 2018, MCPP acquired Dutch Filaments, a filament supplier based in the Netherlands. This acquisition enables MCPP to develop and market a wide range of composite filament materials, including engineering, high-temperature and recycled filaments, as well as pellets for large-format AM. Its 3D printing range features raw materials sourced from Lehvoss and DSM/Covestro.

- SABIC

SABIC (Riyadh, Saudi Arabia) is a chemical manufacturing company that operates as a subsidiary of Saudi Arabian-owned oil and gas company Saudi Aramco, following an acquisition agreement in 2019. The company is a leading producer of various plastic materials, such as polyolefins, polypropylene and polyethylene. In recent years, SABIC has also ventured into manufacturing 3D printing polymers, including high-performance ULTEM thermoplastic filaments. SABIC specializes in creating special compounds for LFAM through its Thermocomp AM product line. These materials are designed specifically for large-format, pellet-fed extrusion systems and are based on four of SABIC's amorphous resins: ABS, PPE, PC and PEI.

Composites AM Market 2024 report

The new Composites AM 2024 market report spans over 250 pages and includes 140 charts and data tables, focusing on all technologies and materials used in composites AM to produce prototypes, tools and end-use parts across various key industrial segments such as industrial, automotive, consumer, aerospace, design and energy.

By leveraging VoxelMatters Directory — a global directory of verified AM companies, currently consisting of nearly 7,000 companies — the research team identified 172 hardware manufacturers, 153 material suppliers and 421 service providers. In total, the underlying dataset for this market study comprises over 138,000 data points.

Other prominent and up-and-coming companies featured in the report include: 3D Systems, 3Dxtech, 9T Labs, Airtech, ALM, Anisoprint, APS, Arkema, Arris Composites, BASF, Belotti, Breton, CEAD, CMS, CRP, Caracol, Continuous Composites, Coriolis Composites, Demgy, Desktop Metal (ETEC and Desktop Health), Electroimpact, EOS, Evonik, Farsoon, Formlabs, HP, Hexcel, Ingersoll, Kimya, Lehmann&Voss, Markforged, Massivit, Mitsubishi MCPP, Nanovia, Polymaker, SABIC, Solvay, Stratasys, TreeD, Weber Additive and Xenia Materials.

In addition to supporting the market analysis and development efforts of existing suppliers, the report is aimed at companies seeking to enter the market and take advantage of emerging opportunities. OEMs looking to implement AM for composite part production will benefit from this study by quickly and accurately understanding the technologies, materials and services currently available, as well as the benefits and challenges associated with each. Finally, this document serves as a guide for investors seeking the next disruptive production technologies.

To learn more about the scope of this study and the methodology behind this research, please view the report.

Related Content

Large-format 3D printing enables toolless, rapid production for AUVs

Dive Technologies started by 3D printing prototypes of its composite autonomous underwater vehicles, but AM became the solution for customizable, toolless production.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreNovel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreRead Next

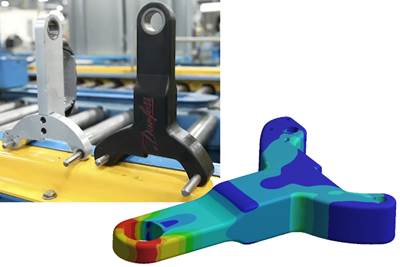

How to validate 3D-printed composite part performance

Integrated Computational Materials Engineering (ICME) workflow simulates composite material performance to speed development, optimize performance and reduce costs for a redesigned 3D-printed CFRP bracket.

Read MoreIncreased molding productivity via additive manufacturing

Companies in multiple segments turn to 3D printing for end-of-arm tools, fixtures for increased safety and functionality, lower cost and faster turnaround times.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)