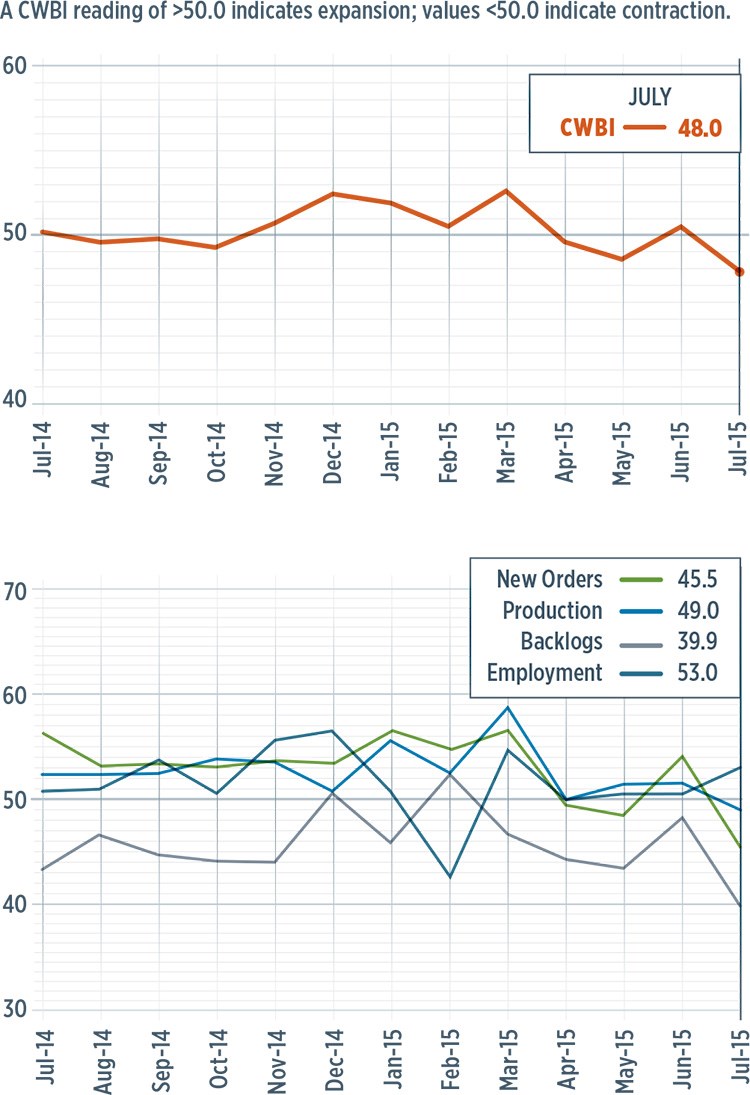

CW Business Index at 48.0 – Lowest since July 2013

Steve Kline, Jr. is the director of market intelligence for Gardner Business Media Inc. (Cincinnati, OH, US), the publisher of CompositesWorld magazine. Here, he presents the CompositesWorld Business Index, a measure of the relative health of the US composites industry, for the month of July 2015.

With a reading of 48.0, the CompositesWorld Business Index for July showed that the US composites industry contracted for the third time in four months. The Index had been trending downward since reaching a peak in March 2015. In July, the index fell to its lowest level since July 2013. Compared with one year earlier, the Index had contracted for seven straight months.

The new orders subindex, in July, had fallen sharply since March, reaching its lowest level since December 2012. Production in July contracted for the first time since December 2013, although the rate of contraction was modest. In July, backlogs had contracted every month in 2015 and that subindex fell to its lowest level since August 2013. The trend in backlogs indicated that capacity utilization at composite fabricators will decline into 2016. Notably, the employment subindex increased. Employment has not contracted since February 2013. However, employment is a lagging economic indicator. Exports continued to contract due to the relatively strong dollar. This subindex has indicated an accelerating contraction in exports since December 2014. The supplier deliveries subindex continued to lengthen at a rate similar to that maintained over the past 18 months.

Composite material prices in the US , in July, had gone up at an accelerating rate since March. In July, the index was at its highest level since October 2014. Prices received increased for the first time since April. Generally, prices received have increased since August 2013. Future US composites business expectations weakened in July compared with June. Generally, expectations had softened since February when the Index was at its second highest level since the survey began in December 2011. Expectations in July had been above average for nine straight months.

In July, activity at US plants with more than 250 employees was unchanged from June. Facilities with 100-249 employees had grown in June and July and had expanded every month but one since June 2014, but the June/ growth have been noticeably slower. Companies with 50-99 employees contracted for the fourth time in six months. Plants with 20-49 employees had contracted nine of the preceding 11 months. Companies with 1-19 employees had only expanded in one of the previous 13 months.

Regionally, the South Central was by far the fastest growing region in July, but there was limited response from this region. The only other region to expand was the North Central-West, which had done so in two of the previous three months. The Southeast was flat in July after rapid growth in June. The West had contracted during two of the preceding three months. The Northeast and North Central-East contracted in July at fairly significant rates.

Future capital spending plans in the US composite community increased in July from June but were still only 60% of their historical average. Compared with one year earlier, spending plans had contracted by at least 21% in each of the previous fivemonths.

Related Content

-

KraussMaffei and partners develop sustainable, safe and stylish children’s bike

The Lion Bike is a German-made, injection molded bicycle with 40% recycled carbon fibers with zero scrap and enabling 67% lower CO2 emissions during production.

-

Colored carbon fiber composite bike wheels launched at The Cycle Show

Wheel brand Parcours reveals composite bike wheels using Hypetex colored carbon fiber to achieve aesthetic, lightweight and performance goals.

-

Mito Materials graphene amplify composite fly fishing rod performance

Functionalized graphene addition to premium-performance Evos and Evos Salt fly rods by St. Croix Fly enables faster recovery, increased torsional rigidity and improved strength-to-weight ratios.

.JPG;width=70;height=70;mode=crop)