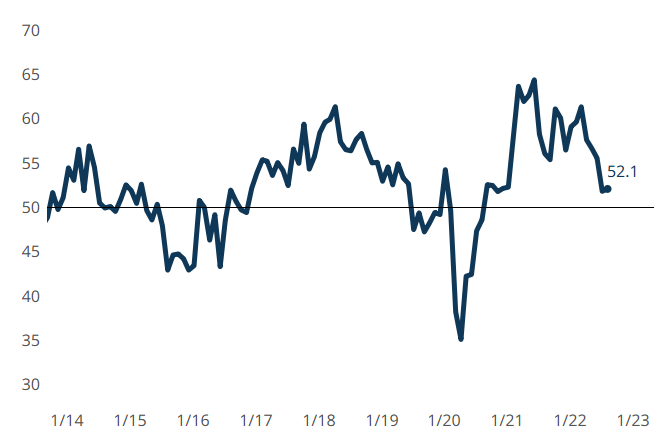

Composites industry GBI holds its own in August

The GBI: Composites Fabricating ended August with slowed expansion but managed to stay above water, with all component indices continuing to show slowed rates of growth.

Toeing the line. GBI: Composites Fabricating ended August with slowed expansion but managed to stay above water (a.k.a. the line dividing business expansion and contraction). Photo Credit, all images: Gardner Business Intelligence

The Gardner Business Index (GBI): Composites Fabricating closed August at 52.1, about the same as July’s reading of 51.8. The month represents a reprieve in slowing growth that started in April, barely remaining within the expansion zone.

All component indices showed slowed rates of growth again in August, with new orders holding its position as the lowest component reading. Backlog, production and employment growth decelerated again, landing at indices practically on top of each other for another month. Supplier deliveries lengthened at a continually slowing rate while exports continued to contract at an accelerating rate.

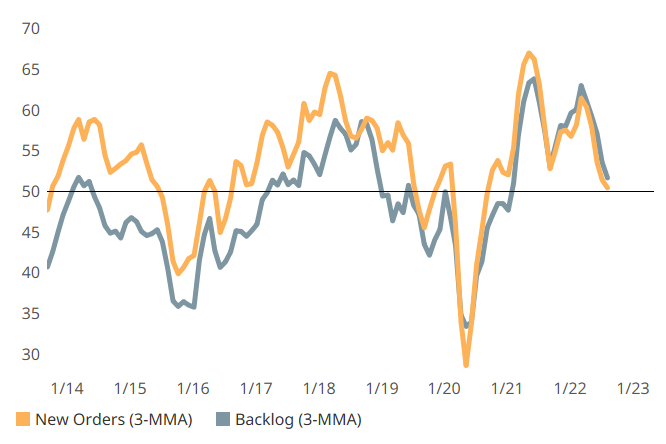

Slowed expansion continues. New orders expansion slowed again in August, barely dodging a “flat” (or “lower”) reading. Backlog followed suit, ending the month with a little more wiggle room than new orders relative to being flat or entering contraction. (This graph is on a three-month moving average.)

Related Content

-

Composites industry GBI contracted faster in July

The GBI: Composites maintains its consistent downward trend for the fifth month in a row.

-

Composites Index shows little change in January

The GBI: Composites Fabricating closed January at around the same contractionary reading in December, with a majority of components following suit.

-

Contraction in composites industry activity slowed in August

The GBI: Composites contracted again in August, but closed up 1.1 points from July, ending 5 straight months of a downward trend.