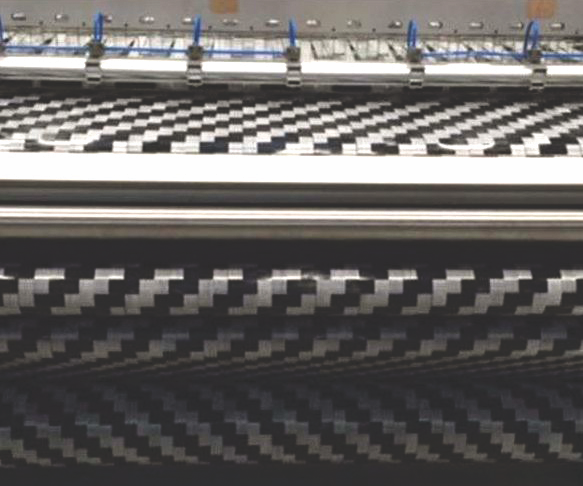

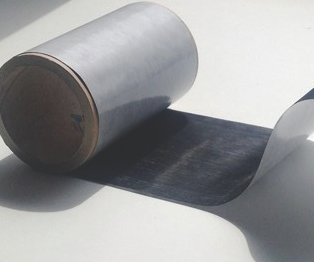

“Spread tow” refers to the practice of spreading a fiber into a thinner, flatter reinforcement, for example a 5-mm wide 12K high-strength (HS) carbon fiber tow is commonly spread to a 25-mm width tape. This unidirectional tape can then be used in automated tape laying (ATL) and automated fiber placement (AFP) processes. It can also be used to produce thin woven fabrics or multilayered noncrimp fabrics. Although it’s possible to spread glass, aramid and polymer fibers, carbon fiber is the reinforcement driving growth in spread-tow technology, as industries from sporting goods to aerospace seek lighter, thinner composites. Spread-tow reinforcements can weigh as little as 15 g/m2 with a thickness of only 0.02 mm (see “A technological brake for the carbon supply roller coaster?”).

According to sources at a global carbon fiber producer, 80% of carbon fiber now used worldwide is spread before further processing. This includes most 50K, 24K and some portion of 12K carbon fibers, which are less expensive than smaller 1K, 3K and 6K tow, yet can be spread to produce high-quality reinforcements that weigh less than 300 g/m2. For example, Toray’s (Tokyo, Japan) epoxy prepreg made with T700S 12K plain-weave fabric, has the same areal weight as a fabric made from 3K tow and is now ubiquitous in rockets and space structures.

Spreading also enables the tailoring of areal weight as well as other properties, such as resistance to crack propagation for improved damage tolerance. The flatness of spread tow means filaments are straighter than those bundled in normal fibers. This results in more efficient load-carrying capability, by weight, and improved surface finish, as well as an aesthetic appeal.

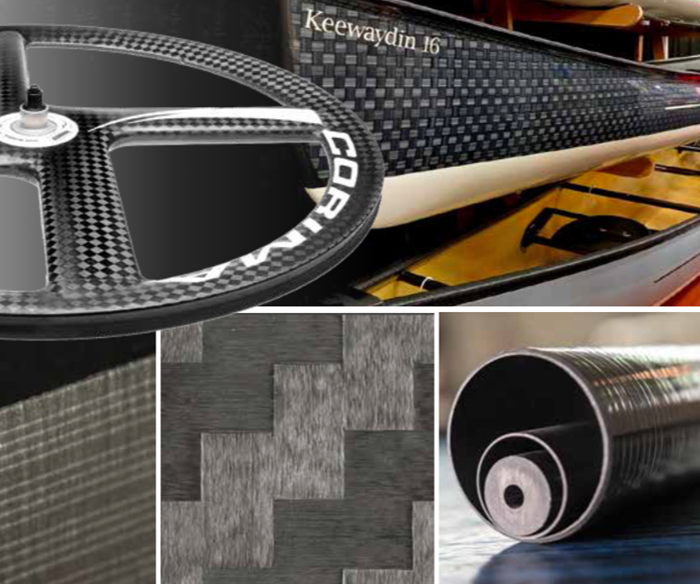

It’s no mistake that spread tow is the starting point for an iconic “woven look” seen increasingly in sporting goods, small airplanes and motorsports applications.

Spread tow also has proven useful in the design of laminates that withstand significantly greater stress before first-ply failure and last-ply failure (see Fig. 1), according to Dr. Stephen Tsai, professor emeritus at Stanford University (Palo Alto, CA, US) and co-developer of the Tsai-Wu failure criterion for anisotropic materials. His idea for bi-angle CF multiaxial fabric, launched as C-PLY by Chomarat (Le Cheylard, France and Williamston, SC, US), combines one thin fiber layer at 0°, with a second at a shallow angle, such as 20°, to achieve autoclave-cured unitape prepreg performance in resin-infused laminates made without the time or cost of an autoclave (see “Bi-angle fabrics find first commercial application”).

Spreading and weaving: Parallel developments

Today, there are a number of companies that can supply the equipment necessary to spread tow for tapemaking as well as tape-capable fabric-weaving equipment. But the suppliers mentioned here are those credited with significant developments that often represent spread-tow technology’s innovative turning points.

Tape weaving — weaving a fabric with tapes instead of tows — was invented in 1995 by Dr. Nandan Khokar at Chalmers University of Technology (Gothenburg, Sweden). He presented his work in 2002, where students Andreas Martsman and Henrik Blycker saw the potential value to composite parts manufacturers and founded Oxeon (Borås, Sweden) in 2003, becoming VP of marketing and sales and CEO, respectively.

“There was nothing called spread tow when we started Oxeon,” says Martsman. Oxeon introduced its TeXtreme spread-tow fabrics in 2005. TeXtreme spread tow fabrics have been widely adopted in motorsports and sporting goods — Bauer, Bell, Cobra and Giro, to name just a few — as well as industrial and aerospace applications. The latter include BlackWing sport aircraft and a new commercial aircraft seat developed with HAECO Cabin Solutions (Greensboro, NC, US) that reduces its previous composite seat’s weight by 20%.

Although Oxeon was first to market, there was ongoing development elsewhere. In a 2001 patent application, heavy-tow carbon fiber producer Zoltek (St. Louis, MO, US) detailed a carbon fiber splitter device, which used a spreader bar and two or more eccentric splitter bars. That same year, founders of what would become North Thin Ply Technology (NTPT, Renens, Switzerland) began developing thin-ply materials aimed at improving CF sails. This thin-ply technology was used in 2005 by the Alinghi America’s Cup yachts and branded as 3Di by NTPT sister company North Sails (Milford, CN, US). NTPT now sells thin-ply prepreg as well as composite tubes and blocks made with thin ply materials into the aerospace, marine, automotive, sporting goods and consumer goods markets.

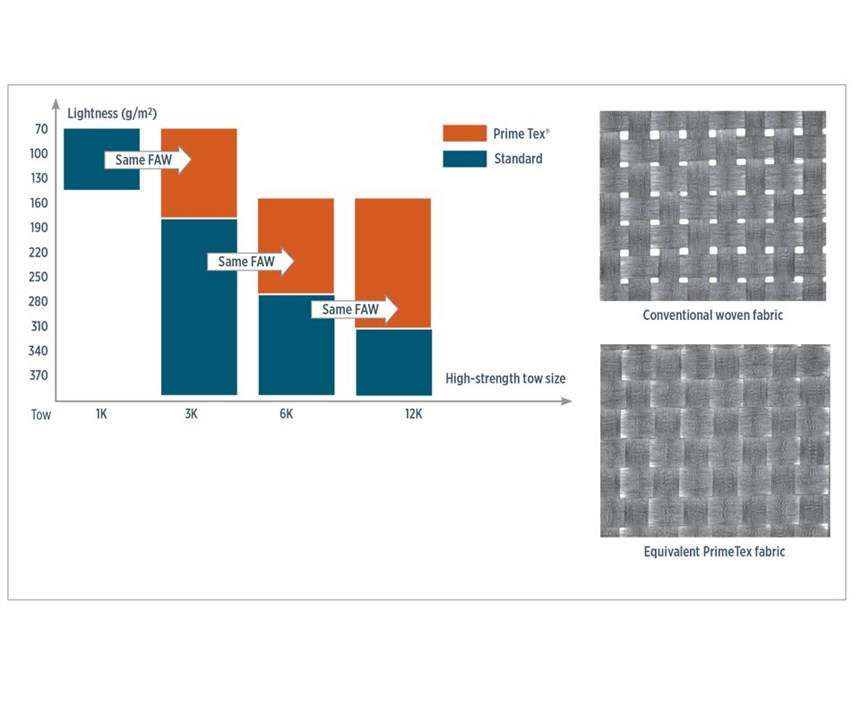

Also in 2005, Boeing Aerostructures Australia (Melbourne, Victoria) produced >9m long trailing-edge skins for The Boeing Co.’s (Chicago, IL, US) 787 Dreamliner, using resin infusion and PrimeTex spread-tow fabrics, developed by carbon fiber manufacturer Hexcel (Stamford, CT, US). Notably, PrimeTex fabrics, are unique in construction: “We do not spread tows into tapes and weave,” says Guillaume Coustaud, Hexcel’s composites marketing manager for reinforcements in Europe. “We weave the fabric and then spread it, using proprietary technology, resulting in a flatter fabric, without having to spread the input fibers” [See Fig. 2]. Hexcel PrimeTex fabrics have expanded: They are used in CORIMA bike wheels and Fischer skis, for example, as well as space, defense, automotive and marine applications.

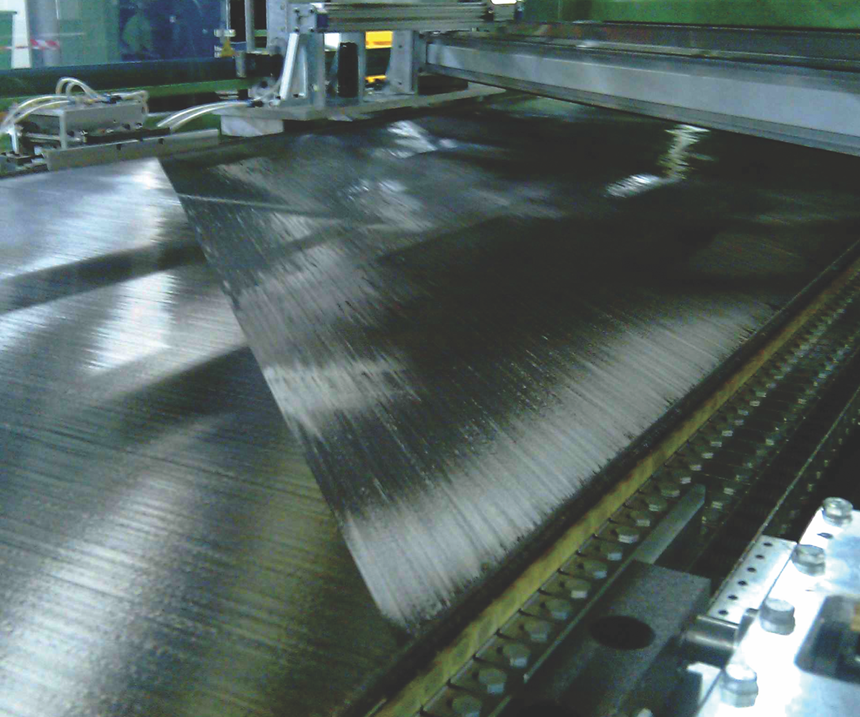

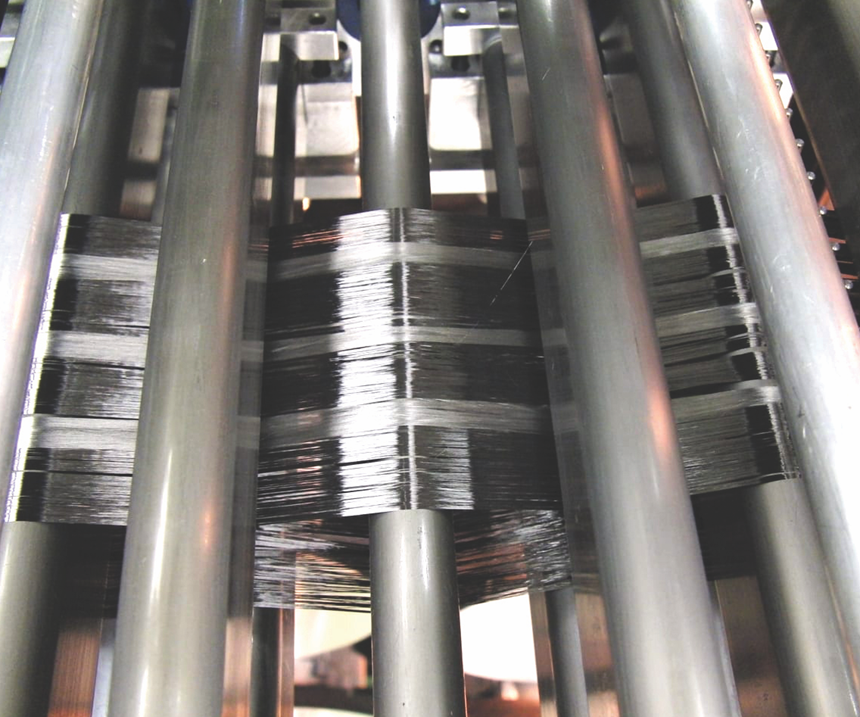

In parallel, LIBA (Naila, Germany), launched its MAX 5 weft insertion machine for producing CF multiaxial fabrics in 2002, developed spread-tow technology in 2004, launched its UD 500 offline spreading machine in 2007 and then used that technology to revise its MAX 5 machines, enabling weft insertion of carbon fiber UD tapes. The machine also offered the ability to place discrete layers at angles from -45° to 45°, adjustable in 1° increments. The UD tapes could be spread online up to 227 mm wide or offline up to 254 mm wide. The offline system could spread 50K or 60K fiber, with the possibility to add a second level for spreading 12K or 24K tow. The online system offered only the latter. LIBA was acquired in 2014 by Karl Mayer (Obertshausen, Germany).

Sigmatex installed MAX 5 machines in both its Benicia, CA, US and Norton, UK sites. MAX 5 machines were also purchased by SGL Kümpers (Lathen, Germany), FORMAX (Leicester, UK, acquired by Hexcel in 2016) and Vectorply (Phenix City, AL, US). Chomarat used MAX 5 machines to produce C-PLY multiaxials in France in 2010 and in its new US facility in 2014. They also produce Chomarat’s C-WEAVE line of woven spread-tow fabrics.

Chomarat North America president Brian Laufenberg also notes that “we have been quite successful in spreading the very large and low-cost 457K tow carbon fiber developed at Oak Ridge National Laboratory (ORNL, Oak Ridge, TN, US).” He is referencing ORNL’s 400K-600K tow made from low-cost, textile-grade precursor converted into a carbon fiber that offers 400 ksi tensile strength and 40 Msi modulus (see “ORNL seeks licensees for its low-cost carbon fiber technology”). “This is spread into 120-g/m2 plies and converted into ±45° biaxial carbon noncrimp fabric,” Laufenberg adds. “We don’t just buy a machine from the manufacturer and use it, but instead adapt it quite a bit, and we are continuing to develop the technology.” For example, the 457K tow was also spread to make a 600-g/m2 highly permeable wind blade spar cap reinforcement that was subsequently pultruded and used in a 9m thermoplastic blade fabricated by the Institute for Advanced Composites Manufacturing Innovation (IACMI) and nominated for a 2018 JEC Innovation award.

Another major player is DORNIER Composite Systems (Lindau, Germany). “We produce machines and full production lines, not materials or parts,” explains DORNIER Composite Systems product manager Mario Krupka. “However, we offer our customers the ability to make trials in our technology center, where we have all our machines including spread tow lines, tape production lines and machines for weaving tapes/spread tow, as well as standard and 3D weaving equipment.” Like Oxeon, DORNIER first entered the market by weaving tapes. “There was customer demand 7 years ago, so we developed a special tape-weaving machine,” Krupka explains. “The customers came back and wanted to make the tapes themselves.” Thus, DORNIER also makes fully impregnated thermoset and thermoplastic prepreg tape production lines. The latter, he notes, may use spread-tow glass fiber just as often as CF tapes.

Industrialization and cost

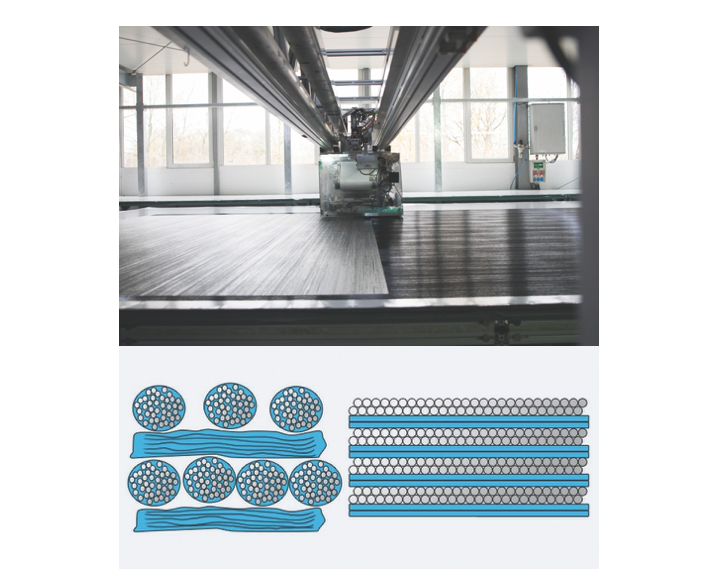

One key to spread tow’s reach in the market is the extent to which it has been adapted for mass production. NTPT makes spread tow products, “But we are also an automation company,” says company president James Austin, noting that it sells specialized automated tape laying (ATL) equipment, developed in-house. “Because the layers are so thin — for example 0.03 mm for a 30-g/m2 prepreg — we could be laying 10 to 100 plies, which hindered material sales in the beginning. But as we have automated both lamination and kitting, this has changed. Now, we see more opportunity to help other companies develop these types of unique solutions for various market niches.”

When Austin says automated lamination, he means digitally controlled application of 10 or 16 layers on a 10m-by-4m working area. “If you’re making a 1m-by-1m part, then we can cut that large area into 40 tiles. At 10 layers each, you can generate a 400-layer stack on one machine that has been running in the background, laminating and kitting the materials for this part in a cost-effective manner.”

Oxeon’s Martsman, looking back, notes, “Our products are much more industrialized than when we first introduced them, and the technology has developed substantially. We have worked with these materials for 15 years, in many different types of parts and have learned what works, where.” He sees Oxeon as more of a development partner than a material supplier. “With the flexibility that our technology provides, we can enable manufacturers to try many more options.” How? “With traditional weaving technologies you need 500 bobbins, even if the trial amount needed is only 5m2,” he explains. “But we can easily set up a few bobbins and produce 10m2 of product with 10 variations. So the customer can have a more efficient development.”

Does this higher performance product command a price premium? “Not necessarily,” says Hexcel’s Coustaud. “If PrimeTex was so much more expensive, then it would not have been used as much as it has. It has won its way due to performance at the right cost per application.”

Krupka at DORNIER comes back to scale, “You can spread 50K tow to 100 g/m², cut the tapes to 25 mm width and weave them to a 200-g/m² fabric. A weaving speed of 50 picks per minute allows making 1.25 linear meters of fabric, or 2.25m² of 180-cm wide fabric. This is very economical vs. using a more expensive, lighter CF tow to make the same areal weight.”

Controlling areal weight and crack propagation

Although automation and cost control have certainly helped remove barriers to spread-tow acceptance, it is the technology’s tailorability that is now aiding its expansion in the marketplace. “I think it is hard for people to understand the flexibility in our technology,” says Martsman. “We spread tow to whatever width we prefer. Thus, a 10-mm wide spread tow is one areal weight and an 11-mm wide tow is a different areal weight. We can also use a wide array of input tows — from 1K to 60K and even 320K from SGL. We can also take multiple input tows. So you really can tailor precisely the fiber areal weight that you want.”

According to Krupka at DORNIER, spreading a single tow vs. multiple tows is performed on the same machine, but uses a different setup. Single-tow spreading makes sense for smaller 12K or 24K tow, but requires a larger number of spools. Alternatively, multiples tows are often used to make wider tape that is then slit into the desired widths. “Multiple tow spreading makes you independent from the tow size with respect to areal weight,” he adds, however the exact spreading ratio depends on the customer and application requirements.

As areal weight is tailored, so is thickness, with a distinct benefit in impact resistance. “Impact performance improves with thinner plies,” says Oxeon’s Martsman. Bob Skillen, founder and chief engineer at VX Aerospace (Morganton, NC, US), who has used Chomarat’s C-PLY in multiple aircraft projects, agrees: “A greater number of thinner plies makes a stronger and tougher part than fewer, thicker plies.” He notes that thin-ply, bi-angle laminates outperform conventional quasi-isotropic laminates (i.e., 0°, 90°, +45°, -45°).

“We go super quasi-isotropic,” says Austin at NTPT, “using eight fiber orientations instead of four, and we can even go to 16 in extreme cases. Because the layers are so thin, this achieves a kind of homogeneity, with very good resin-to-fiber distribution, which improves filament-to-filament load transfer for higher performance.”

Using spread-tow vs. normal fiber bundles in woven fabrics also offers an impact improvement. “Woven fabrics distribute impact energy to more fibers because they are interlaced instead of simply placed on top of each other, as in multiaxial fabrics,” Martsman explains. “However, weaving crimps the fibers, which limits how much energy they can absorb because it lowers their load-carrying maximum. Spread-tow fabrics have much less crimp, providing the best of both worlds.”

Martsman also notes that large aircraft OEMs are combining thin plies with traditional thick plies. “For example, five thin plies with 10 standard thick plies gives an interesting crack propagation behavior that allows them to tailor the damage tolerance performance in the aircraft structures.”

There is one caveat to all the performance benefits. “You have to adapt your computer models and simulation for thin materials because the mechanics are different,” says Martsman, noting that Oxeon invested heavily for this purpose in finite element analysis (FEA) capability three years ago. “We can combine our materials with other materials and model variations in the laminates and structural performance. We model new designs for customers and compare to what they have today, including evaluation of different options, such as change in fiber type, areal weight or putting more fiber in one direction vs. another. It’s important to be able to compare all of these options quickly and easily.”

Future products, processes and applications

What does the future hold for spread tow? “We see growth not only for aesthetics, but parts can be up to 20% stiffer,” claims Krupka at DORNIER. “This is due to less crimp. For example, using 20 layers of spread tow fabric instead of 10 layers of 3K fabric achieves a higher stiffness for the same wall thickness. We are seeing more interest in using tapes and tape-woven fabrics for structural reinforcement because of this.”

Another driver is the use of fully-impregnated thermoplastic tapes. “The high impact resistance of these materials is very attractive for automotive parts like doors and bumpers,” Krupka notes. “Composites from glass fiber/polypropylene tapes are price competitive to lightweight metals like aluminum or magnesium, and the forming process is fast with a high degree of design freedom.” He cites applications in high-end car models in Asia and Europe that are now migrating into mass-produced models.

Austin at NTPT discusses new opportunities in legacy markets like marine and golf shafts. For marine, NTPT’s prepreg automation has enabled sandwich panels for bulkheads and other interiors that offer lower cost, delivery time and weight vs. resin infused panels. In golf shafts, a discontinuous prepreg technique achieves improved performance, which Austin believes may provide benefits in other tubulars like driveshafts (see “Spread tow brings new life to legacy markets”).

He also sees opportunity in new markets, such as urban mobility, where a growing number of programs are developing unconventional aerospace vehicles like electric vertical takeoff and landing (EVTOL) aircraft (e.g., the Airbus Vahana). “These are all very weight-dependent and natural applications for thin-ply materials,” he contends. “We are actively working on multiple programs, pursuing ultra-lightweight aerostructures. There are also a lot of electric motor applications for CFRP with tremendous opportunities for us. I think there is a lot more going on here than people appreciate. We think electric vehicles will have a significant impact on the future of our company.”

Martsman at Oxeon is also optimistic about aerospace, for which his company’s new ±45° Spread Tow Grid is made. He says scrap reduction is driving increased demand. “For a 1m part made from a 1m-wide 0°/90° fabric, you produce your bias plies by cutting this at an angle, but that results in 50% scrap. Another case is larger parts like a 1.5m-wide wingskin where you can only get 1.6m wide 0°/90° fabric. Again, you cut bias plies at an angle, which produces triangles that are thrown away. The scrap rates are amazingly high when you make large parts such as tanks and floor panels.”

DORNIER is also developing products for increased productivity, including machines to make thicker tapes and wider fabric, increasing widths from 150 cm to 266 cm. “We are also looking at weaving wider tapes, moving from 40-mm warp and 45-mm weft to 50 mm. Higher speed is also a priority, but the faster you go, the lower the quality. Customers want 50 m/min and perfect tape quality. While this is not possible, we do continue to develop improvements.”

Hexcel sees a continuing market for spread tow in both woven fabrics and multiaxials, producing the latter in Leicester, UK. “We are still working on developments across all markets,” says Coustaud. “This is a key technology and we will keep pushing it.”

Related Content

People in composites: April 2023

Concordia Engineered Fibers, Nawa Technologies, IACMI, Joby Aviation and Akarmak America have made new personnel announcements in April 2023.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreIACMI receives funding renewal from U.S. DOE to continue composites R&D

Over the next five years, IACMI aims to further composites R&D efforts to support U.S. decarbonization and its pillars: technology, economy and workforce development.

Read MoreRead Next

How is tow spread?

ITA characterizes tow spreading processes and parameters as it develops new technology to speed production (100 m/min) and reduce width variation (<1mm).

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.jpg;maxWidth=300;quality=90)