Composites Business Index 48.2: Contraction begins to slow

Gardner Business Media’s director of market intelligence Steve Kline, Jr. updates the Composites Business Index.

In July, the Composites Business Index (CBI) of 47.7 indicated that composites business activity in the composites industry had contracted for the second consecutive month, having moved steadily lower since it had peaked in March. Employment was the only index to make a positive contribution in July, expanding for the fifth straight month. All other subindices performed worse in July than in June. New orders contracted for the third month and at a slightly faster rate. Production moved from growth to contraction for the first time this year. Backlogs continued to contract, and did so more significantly and at their fastest rate for the year to date. Exports remained mired in contraction. Supplier deliveries lengthen in July, having done so at a fairly constant rate all year.

Material prices increased in July. The rate of increase reached its fastest pace since March. Prices received by composites fabricators decreased for the third time in four months. The combination of increasing material prices and decreasing prices received had a significant negative impact on profitability. But future business expectations improved noticeably in July. They reached their second highest level since May 2012.

The business activity this year through July was much higher at large than at small facilities. Those with more than 250 employees had grown at a consistently strong rate since December 2012. Facilities with 50 to 249 employees had grown in all but a couple of months in that same time period. However, fabricators with fewer than 50 employees had, through July, contracted four straight months. The smallest facilities (fewer than 19 employees) contracted in July at the fastest rate since the CBI began in December 2011.

In July, the strongest region for the year was the West North Central, which had grown for five straight months. The Mountain region experienced the fastest growth rate in July, and it was its first month of growth since February this year. All other regions contracted in July.

Future capital spending plans were at their second lowest level in July since June 2012. Planned spending was more than 25 percent above the historical average. Compared to July 2012, spending plans in July 2013 were up by 16.1 percent.

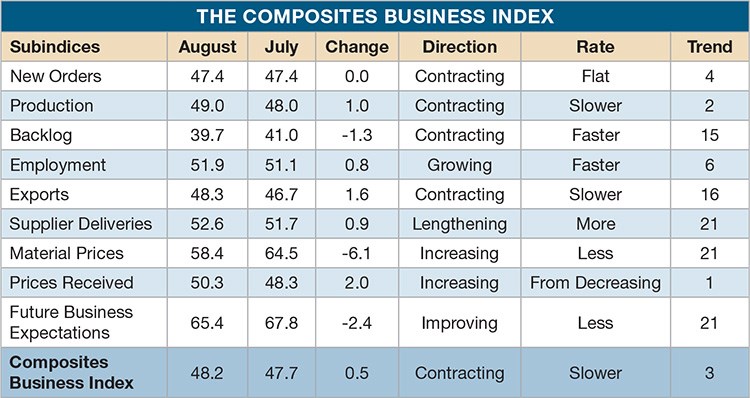

In August, a CBI of 48.2 showed that composites industry business activity had contracted for the third consecutive month, but the rate of contraction had slowed, indicating a possible break with its downward trend. Two subindices made positive contributions: Employment grew for the sixth straight month, and suppler deliveries continued their long-term lengthening trend. Production and exports continued to contract in August but did so at slower rates. Exports, in particular, had contracted at a steadily slower rate since December 2012. New orders contracted for the fourth consecutive month. The only subindex to negatively impact the CBI was backlogs. In August, it contracted for the 15th month and had done so noticeably faster each month since February.

Material prices increased in August at their slowest rate since November 2012. Prices received increased slightly after decreasing three of the previous four months. Future business expectations fell somewhat after having stayed fairly level for six months.

One month does not a trend make, but activity based on plant size could be shifting. Fabricators with more than 250 employees contracted for the first time since November 2012. Those with fewer than 19 employees continued to contract, but at a much slower rate. The small facility index, however, moved up to 43.9 from 38.9 in July. Those with 50-249 employees continued strong.

Four regions expanded in August. The fastest rate was the West South Central, which had grown five of the previous seven months and, thus, was 2013’s best performer to date. Meanwhile, New England, the South Atlantic and the Middle Atlantic all moved from contraction to expansion. But the West North Central, which had strong growth the previous five months, fell off sharply.

Future capital spending plans were just above the historical average in August. However, the month-over-month rate of change contracted for the third time in five months.

Read Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)