Composites Business Index 48.6: First contraction in four months

New orders contracted for the first time in four months.

New orders contracted for the first time in four months. A slide in the new-order growth rate over three months was the most significant reason the CBI grew more slowly during that period. Production, however, grew for the fifth month, and employment was on the rise at a consistent rate for three months. Supplier deliveries lengthened at their second fastest rate since October 2012. Backlogs continued to contract, which they have done since June 2012. Exports also continued a prolonged contraction. These two subindices held back what could otherwise have been significant growth.

Material prices continued to increase. Prices received increased in May after decreasing in April. However, the rate of growth in prices received was much lower than the rate of growth in material prices. Future business expectations, however, continued to improve; they hit their highest level since May 2012.

In April, facilities with more than 50 employees grew but those with fewer than 50 employees contracted. That continued in May.

The West North Central U.S. grew for the third straight month and was the second fastest growing region in May. The South Atlantic and West South Central had grown in three of the past four months. The East North Central grew after contracting for three months. After growing in four of the previous five months, the East South Central was flat in May. Both the New England and Pacific regions contracted in May. The Middle Atlantic had contracted in three of the past four months. And the Mountain region showed contraction for the third consecutive month.

Future capital spending plans in May were at their second lowest level of 2013, but they were still slightly above the historical average.

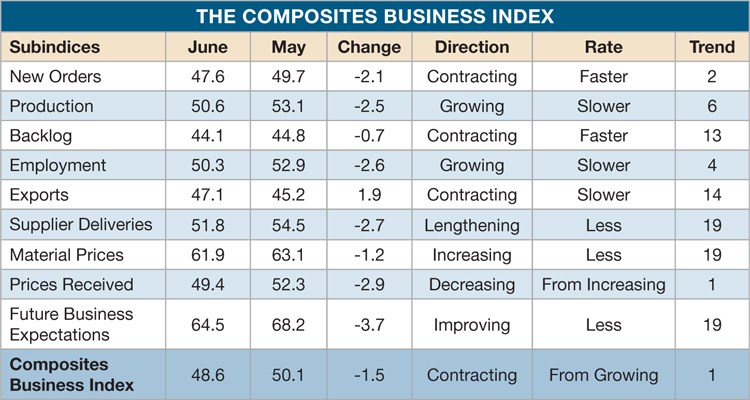

The CBI of 48.6 in June, however, showed overall contraction for the first time since January this year. New orders contracted for the second month and did so faster than in May. Production grew for the sixth straight month, but at a slower rate. The relatively strong performance of production compared to new orders, however, resulted in further backlog contraction, which prolonged an already lengthy period of contraction that began in June 2012. The extended contraction could indicate excess capacity.

Employment continued to grow in June, but it did so at its slowest rate this year. With the strong performance of the dollar, exports continued to contract. Supplier deliveries lengthened as they have done each month since the index was created in December 2011. That said, the rate of increase was the slowest since November 2012. As with backlogs, the slowing rate of increase in supplier deliveries could indicate a buildup of excess capacity in the supply chain.

Material prices increased in June, but (again) the rate of increase was among the slowest since November 2012. Conversely, prices received decreased for the second time in three months. This hurt profitability — another sign of excess capacity. Future business expectations weakened somewhat in June but remained above 2012’s lowest levels.

Throughout 2013, business activity at large facilities has significantly outpaced that at small facilities. a trend amplified in June. Shops with 100 to 249 employees reached their highest index level since January 2013 while shops with more than 250 employees reached their highest index level since July 2012. But shops with 50-99 employees contracted for the first time since December 2012, and shops with fewer than 50 employees continued to contract, but faster.

In the U.S., regionally, the strongest performer in June was the West North Central, which has grown for four straight months. Also strong were the South Atlantic and West South Central, both of which have grown for four of the last five months. All the other regions contracted in June.

Read Next

Composites Business Index 51.6: Contraction ends, trend is up

Gardner Business Media's director of market intelligence Steve Kline, Jr. makes his debut as an HPC columnist in By the Numbers, where he will plot a new measure of the composites industry's economic health, the Composites Business Index.

Read MoreComposites Business Index 50.9: Industry returns to growth

Gardner Business Media's director of market intelligence Steve Kline, Jr. makes his debut as an CT columnist in By the Numbers, where he will plot a new measure of the composites industry's economic health, the Composites Business Index.

Read MoreBy the Numbers: The Composites Business Index

Composites Technology magazine's editor-in-chief Jeff Sloan introduces a new column focused on business trends in the composites industry. Written by Steve Kline, Jr., the the director of market intelligence at CT's parent company Gardner Business Media Inc. (Cincinnati, Ohio), this regular offering will gauge composites industry growth (or lack thereof) by means of metrics compiled in the Composites Business Index.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)