By the Numbers: The Composites Business Index

Composites Technology magazine's editor-in-chief Jeff Sloan introduces a new column focused on business trends in the composites industry. Written by Steve Kline, Jr., the the director of market intelligence at CT's parent company Gardner Business Media Inc. (Cincinnati, Ohio), this regular offering will gauge composites industry growth (or lack thereof) by means of metrics compiled in the Composites Business Index.

Most manufacturing industries eventually develop a trade or industry association. Such groups solicit membership from the industries they serve and, in return, provide a variety of services, including lobbying, training, conferences, trade shows, communications, marketing data, certifications and more. In the U.S. composites industry, we have the Society for the Advancement of Material and Process Engineering (SAMPE, Covina, Calif.) and the American Composites Manufacturers Assn. (ACMA, Arlington, Va.) and, at the periphery, the Society of Plastics Engineers (SPE, Troy, Mich.).

One of the core services of a trade association is to measure and assess the health of the industry served by collecting data from supplier-members relating to quantity and value of goods sold into a given market. This is often done by measuring manufacturing machinery sales. For instance, if you want to gauge the health of the plastics processing industry in the U.S., one thing you might do is look at the annual sales of injection, extrusion and blowmolding machinery into the U.S. market. This is, in fact, done by the Society of the Plastics Industry (SPI, Washington, D.C.) and has for years provided reliable signals regarding the health of that market.

The composites industry, however, because of its myriad resin, fiber, tooling and processing system types, lacks the two or three ubiquitous machine types that could provide this type of bellweather data. And a desire to protect coveted intellectual property often makes composites industry suppliers and manufacturers alike reluctant to share data. As a result, we are forced to look in the margins among end markets for indirect signals and data regarding the health of the industry. That’s why we track automotive sales, boat sales and shipments, wind energy installations and other metrics. From this data, we hope to glean some understanding of composites activity. This is fine, but there is no substitute for the proverbial horse’s mouth — folks like you who, every day, design and manufacture the composite structures on which this industry is built.

With this in mind, we launch By the Numbers, a new column authored by Steve Kline Jr., the director of market intelligence at our parent company Gardner Business Media Inc. (Cincinnati, Ohio). Kline will present, each issue, the results of monthly surveys of CT readers (read his first offering by clicking on "Composites Business Index 51.6: Contraction ends, trend is up," under "editor's Picks," at top right. He’ll collect data on new orders, production, backlogs, employment and other factors. These data will be aggregated and analyzed to produce for you the Composites Business Index (CBI), designed to signal industry expansion or contraction, along with a sense of overall trends.

The composites industry’s material and process diversity is among it’s greatest assets, but I will also be among the first to admit that the resulting fragmentation makes anyone who has tried to comprehend this industry’s ebbs and flows feel like a herder of cats. We hope By the Numbers will help impose some order in our disorderly economic sector and that you will benefit from the CBI as we try to provide intelligent, reliable and actionable market data.

Related Content

Collins Aerospace to lead COCOLIH2T project

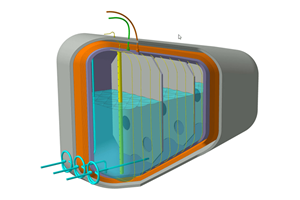

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreAchieving composites innovation through collaboration

Stephen Heinz, vice president of R&I for Syensqo delivered an inspirational keynote at SAMPE 2024, highlighting the significant role of composite materials in emerging technologies and encouraging broader collaboration within the manufacturing community.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreRead Next

Composites Business Index 51.6: Contraction ends, trend is up

Gardner Business Media's director of market intelligence Steve Kline, Jr. makes his debut as an HPC columnist in By the Numbers, where he will plot a new measure of the composites industry's economic health, the Composites Business Index.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)