Composites Business Index 49.1: Generally improving

Gardner Business Media’s director of market intelligence Steve Kline, Jr. updates the Composites Business Index for November and December 2013.

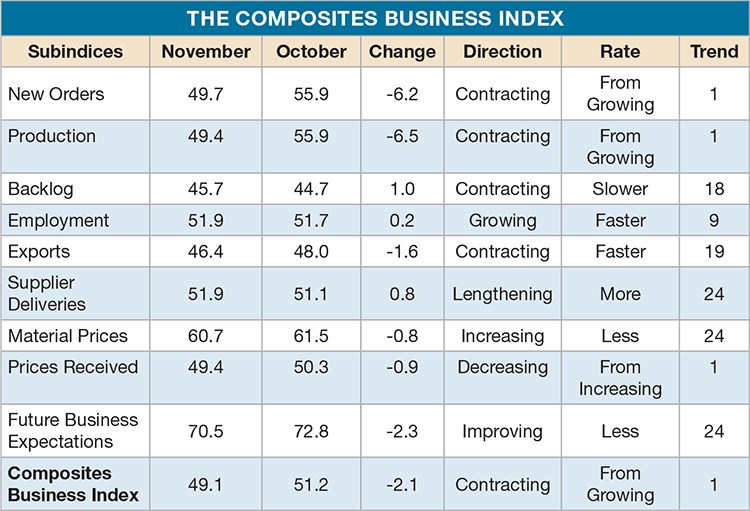

The October Composites Business Index (CBI) of 51.2 showed U.S. composites business activity expansion for the first time since April 2013. October’s index was 6.2 percent higher than in October 2012 and the second straight month of improvement compared to a year ago. (What is the CBI? See "By the Numbers: The Composites Busienss Index," under "Editor's Picks" at top right.)

New orders jumped dramatically, growing for the first time since April 2013, and production grew faster for the second month in a row — both reaching their highest growth rates since May 2012. Backlogs still contracted at a significant rate, but the rate had slowed the previous two months. Employment had grown at a fairly constant rate the previous four months. Exports continued to contract as the dollar remained strong. Supplier deliveries continued to lengthen.

Material prices increased at a faster rate for the second month in a row. Prices received had increased for three straight months, but at a quite modest rate. Future business expectations jumped dramatically, reaching its highest level since April 2012.

Midsize fabricators (50 to 249 employees) grew at a very fast rate in October. Facilities with 100 to 249 employees grew for the ninth time in the preceding 12 months. Fabricators with more than 250 employees contracted for the second time in the preceding three months, but at fairly modest rates. Facilities with fewer than 19 employees were virtually unchanged in October. The rate of contraction at these plants had slowed dramatically and this subindex reached its highest level since March 2013.

The Mountain region grew very quickly. Its subindex was 59.2, the highest since March 2012. New England, the Pacific, and the East North Central moved to expansion. The Middle Atlantic was flat. The South Atlantic and West North Central contracted faster in October.

Future capital spending plans were up 1.5 percent compared to October 2012.

In November, however, a CBI of 49.1 showed that business activity had contracted modestly. Although the CBI had indicated contraction in five of the previous six months, business conditions were improving compared to the same point in 2012. In each of the three preceding months, the index was higher than it was one year earlier. In November, the index was 11.6 percent higher than a year ago.

After strong new orders and production growth in October, both of these subindices barely contracted in November. Backlogs continued to contract, but at the slowest rate since March 2013. Employment had expanded at a relatively constant rate in the previous five months. A strong dollar kept exports in contraction, and supplier deliveries continued to lengthen but at a slower rate than in the first half of 2013.

Materials prices continued to increase, but the rate had moderated over the previous four months. Prices received by fabricators decreased for the first time in three months. This combination put pressure on profits. Future business expectations fell slightly from the October level, but were still at their second highest level since May 2012.

Facilities with more than 50 employees continued to expand as they had for most of 2013. Fabricators with 20 to 49 employees grew for the first time since March 2013. The smallest plants had contracted every month since March 2013.

Regionally, the Pacific grew for the second month in a row and at its fastest rate in November. The only other growth was in the South Atlantic. The Mountain, East North Central, and Middle Atlantic regions contracted after expanding in October. The West North Central contracted for the fourth consecutive month.

Future capital spending plans were way up for the third straight month. Future spending plans were up 54.1 percent from a year ago and the annual change rate was up 11 percent.

Read Next

By the Numbers: The Composites Business Index

Composites Technology magazine's editor-in-chief Jeff Sloan introduces a new column focused on business trends in the composites industry. Written by Steve Kline, Jr., the the director of market intelligence at CT's parent company Gardner Business Media Inc. (Cincinnati, Ohio), this regular offering will gauge composites industry growth (or lack thereof) by means of metrics compiled in the Composites Business Index.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)