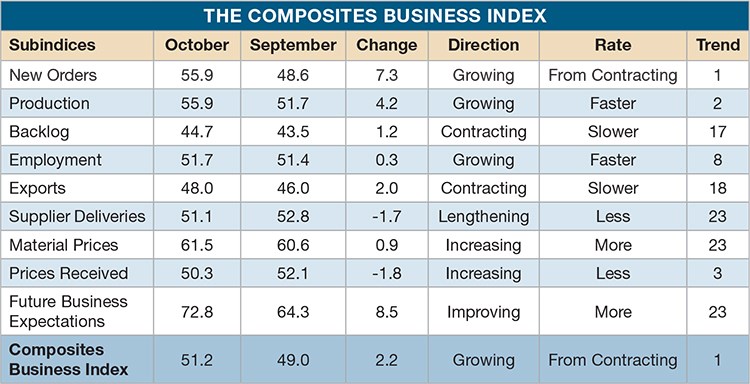

Composites Business Index 51.2: Industry growing again

The September Composites Business Index, 49.0, showed that composites business activity contracted at a slower rate for the second consecutive month.

The September Composites Business Index, 49.0, showed that composites business activity contracted at a slower rate for the second consecutive month. But September still marked a fourth consecutive month of contraction.

Four of the six subindices made positive contributions to the overall index in September. The largest jump came in backlogs, which moved to 43.5 from 39.7. However, backlogs have contracted since May 2012. Production also jumped significantly, moving to growth from contraction. Production has grown seven of the first nine months this year. New orders reached their highest level since May. Also positive was supplier deliveries, which lengthened just slightly. Employment grew for the seventh consecutive month but at a slightly slower rate. This had a slightly negative impact on the overall index. The worst performer was exports, which dropped to 46.0 from 48.3, contracting for the 17th consecutive month.

Material prices increased at a faster rate in September, but the rate of increase was the second slowest since November 2012. Prices received jumped to 52.1 from 50.3, the second month this subindex grew at a faster rate. Business expectations fell slightly but were still above the levels reached in the second half of 2012.

After contracting in August for the first time since November 2012, fabricators with more than 250 employees grew in September. Facilities with 100 to 249 employees continued strong, growing at their fastest rate since July 2012. Fabricators with fewer than 100 employees contracted in September and those with 50 to 99 employees did so for the second time in 2013. Fabricators with 20 to 49 employees saw their best business conditions since March.

Two regions expanded in September. Both the West South Central and the Middle Atlantic grew for the second month in a row. New England and the South Atlantic moved from growth to contraction. The East North Central, Pacific, and West North Central regions contracted at a slower rate.

Capital spending plans were at their lowest level since March 2013. However, planned expenditures were 11 percent higher than they were in September 2012.

The CBI of 51.2 in October, however, showed business activity had expanded for the first time since April 2013. The rate of growth was the fastest since March 2013. October’s index was 6.2 percent higher than it was in October 2012. This is the second straight month the index has improved compared to the same month one year ago.

New orders jumped dramatically, growing for the first time since April 2013 and reaching their fastest rate of growth since May 2012. Production grew faster for the second month in a row, reaching its highest growth rate since May 2012. Backlogs still contracted at a significant rate, but slower than in the previous two months. Employment had grown at a fairly constant rate the previous four months. Exports continued to contract as the dollar remained relatively strong. Supplier deliveries lengthened again. Material prices increased at a faster rate for the second month straight. Prices received increased modestly for the third straight month. Business expectations jumped, reaching its highest level since April 2012.

Midsize fabricators (50 to 249 employees) grew fast in October. Facilities with 100 to 249 employees grew for the ninth time in 12 months. Fabricators with more than 250 employees contracted modestly for the second time in three months. Facilities with fewer than 19 employees were virtually unchanged after the rate of contraction slowed dramatically.

The Mountain region grew at an incredibly fast rate. Its index was 59.2 — the highest since March 2012. The New England, Pacific, and East North Central regions moved to expansion from contraction. The Middle Atlantic region was flat after two months of growth. The South Atlantic and West North Central contracted faster in October.

Future capital spending plans were up 1.5 percent compared to October 2012. October was the second month of growth in capital spending plans.

Read Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.JPG;width=70;height=70;mode=crop)