Composites Business Index 56.8: Best since February 2012

Gardner Business Media's (Cincinnati, Ohio) director of market intelligence Steve Kline Jr. updates the U.S. Composites Business Index for April and May 2014.

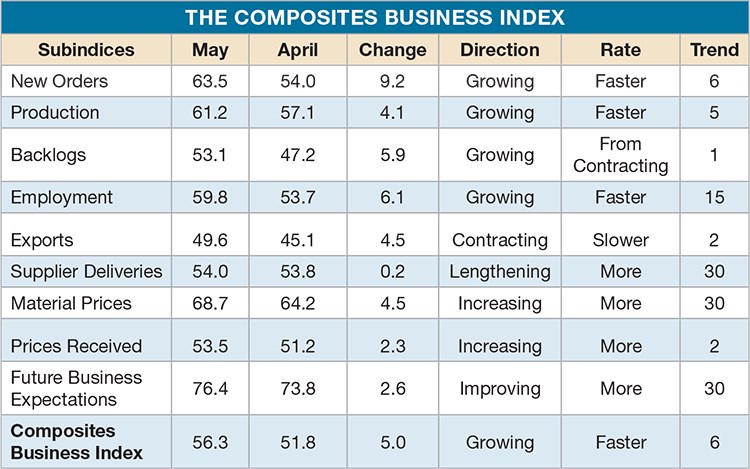

In April, the U.S. Composites Business Index of 51.8 lengthened its growth string to five months, but it was also the CBI’s lowest showing in 2014.

Every subindex contributed to the slower rate: New orders grew for the fifth straight month, but the rate had slowed significantly since its January peak. Production had expanded for four straight months but at its slowest rate in 2014. Backlogs contracted for the first time this year but were still 6.5 percent higher than they were one year earlier. The accelerating annual rate of change in backlogs indicated higher capacity utilization and capital spending for the rest of 2014. Employment increased at a faster rate than at any time since August 2012. After growing in March, exports contracted significantly in April. Supplier deliveries lengthened at a slower rate but continued a trend begun in October 2013.

Material prices increased at the March rate. To that point, material prices had increased in 2014 at a significantly faster rate than they did in 2013. Prices received increased slightly in April after decreasing in March. Future business expectations remained high.

A prime source of April’s slowdown was the mid-size fabricators category (50 to 249 employees). After growing for some time, it contracted sharply. For fabricators with 100 to 249 employees, the overall index fell nearly 20 points. The largest fabricators saw their growth rate dip somewhat. But this was counterbalanced by faster growth at plants with 20 to 49 employees. Those with fewer than 20 contracted at the March rate.

Four of the five U.S. regions grew in April. The North Central – East grew at the fastest rate for the second month in a row. The Northeast, Southeast and West followed, the latter growing for the ninth month in the past 10. The lone region to contract was the North Central – West.

Compared to one year earlier, April’s future capital spending plans subindex was up 9.1 percent.

The May CBI of 56.8 showed that the composites industry grew for the sixth straight month, and at its fastest rate since February 2012. Compared to one year earlier, the index was up 13.6 percent. This was the fastest rate of month-over-month growth since December 2013.

In a reversal of April, every May subindex contributed to the faster growth rate. The new orders rate jumped dramatically, reaching its third highest level since the CBI began in December 2011. Production and backlogs continued to expand, the latter at it fastest rate since March 2012 and 18.5 percent higher than one year earlier. The annual rate of change in backlogs continued to accelerate, indicating higher capacity utilization and capital spending for the rest of 2014. Employment expanded at its second fastest rate since the Index began. Exports contracted for the second straight month. Supplier deliveries continued to lengthen at a slightly faster rate.

Material prices increased at their fastest rate since February 2013. The rate was noticeably faster than the previous two months. Prices received had increased five of the past six months. Future business expectations improved in May and remained at a historically high level.

Most fabricators saw improved business conditions — most dramatically in shops with 19 or fewer employees. At 58.6, their subindex grew at its fastest rate since the Index began. After contracting in April, facilities with 50 to 99 employees expanded slightly in May. The largest facilities (250+ employees) grew at the second fastest rate since July 2012.

Regionally, the West grew faster than any region since the index began, followed by the Northeast, which had grown for six straight months. The Southeast, North Central – West and North Central –

East expanded; the latter continuing a strong three months of steady growth.

Compared to one year ago, May’s future capital spending plans were up 14.9 percent, while the annual rate of change had grown at a relatively constant rate the past four months.

Read Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)