CW Business Index at 50.5 – Growth slows for second month

Steve Kline, Jr., the director of market intelligence for Gardner Business Media Inc. (Cincinnati, OH, US), the publisher of CompositesWorld magazine, outlines the CW Business Index for February 2015.

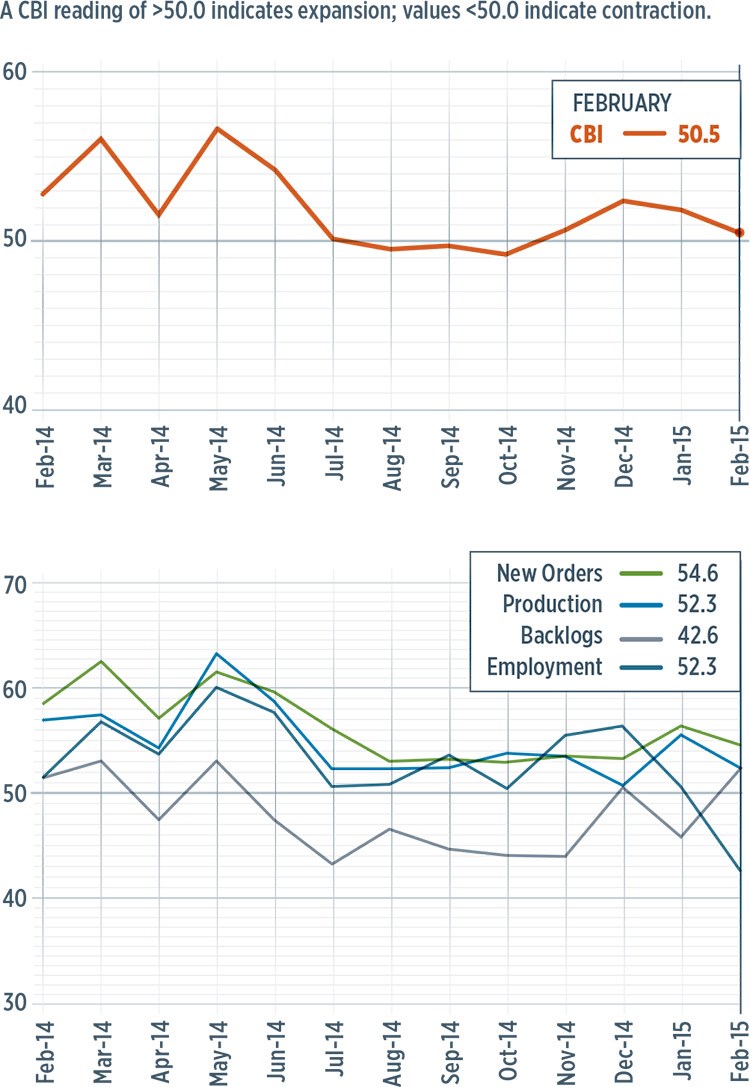

With a reading of 50.5 in February 2015, the CompositesWorld Business Index showed that the composites industry in the United States had expanded for the fourth straight month. However, the index had moved lower in both January and February. Compared with one year earlier, the Index had contracted more than 4% in each of those months. While the annual rate of change was still growing, by the end of February, it had been growing at a slower rate for six full months.

New orders grew for the 15th consecutive month. Although the new order subindex fell somewhat from its January number, the trend for new orders has been up, generally, since September 2014. Production was only slightly less active, showing growth for a 14th straight month. However, other than in December 2014 and January 2015, production has expanded at a consistent rate since August 2014. Backlogs contracted for a second month in a row. The backlog subindex, in fact, was at its lowest level since August 2013 and was 17.3% lower than it was one year previously. Further, it was the fourth time in five months that the month-over-month rate of change had contracted, a clear indication that capacity utilization had probably seen its peak rate of growth in the composites industry. Employment continued a growth stint that began in March 2013. Exports continued to contract due to the strengthening dollar. Supplier deliveries lengthened at virtually the same rate in February as in January, which was the fastest rate since April 2012.

Material prices continued to increase, but at a slower rate. In February, this subindex had declined every month since May 2014. The prices received subindex, meanwhile, had increased significantly since October 2014. In fact, the prices received subindex was higher than the material prices subindex in February for the first time in the CWBI survey’s history (since December 2011). Future business expectations shot up in February to their highest level since January 2012.

Slowing growth at larger composites fabricators was the reason the overall Index slowed in February. At facilities with more than 100 employees, the February subindex fell to 50.1 from 65.3. And, at plants with 50-99 employees, the subindex fell to 48.1 from 56.0. Both of these plant sizes had been growing at much stronger rates during the second half of 2014. Facilities with 20-49 employees contracted for the sixth consecutive month. Facilities with fewer than 20 employees, however, expanded for the first time since June 2014. In fact, these were the fastest growing facilities in February.

Regionally, The North Central – West was the fastest growing in the US for a third straight month. The only other region to grow in February was the West. The Northeast contracted at a moderate rate and was followed by the North Central – East and Southeast regions.

Future capital spending plans exceeded US$1 million for the third time in four months. And, for the second time in four months, the month-over-month rate of change increased by more than 20%. However, the annual rate of change contracted in December 2014 and in January and February of this year.

Read Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)