Boeing, Airbus announce Q1 2020 results

The COVID-19 pandemic has drastically decreased air passenger travel, causing a dramatic decline in new aircraft orders and production. Boeing and Airbus are implementing efforts to reduce costs.

Airbus A350 final assembly line. Source | Airbus

Boeing (Chicago, Ill., U.S.) and Airbus (Toulouse, France) each reported Q1 2020 earnings on April 29. Both companies said that the COVID-19 pandemic is having substantial and negative impacts on aircraft orders and deliveries.

Boeing

Boeing reported Q1 2020 revenues of $16.9 billion, a 26% decrease from $22.9 billion in revenues in Q1 2019. In a statement, the company said, “As the pandemic continues to reduce airline passenger traffic, Boeing sees significant impact on the demand for new commercial airplanes and services, with airlines delaying purchases for new jets, slowing delivery schedules and deferring elective maintenance. To align the business for the new market reality, Boeing is taking several actions that include reducing commercial airplane production rates. The company also announced a leadership and organizational restructuring to streamline roles and responsibilities, and plans to reduce overall staffing levels with a voluntary layoff program and additional workforce actions as necessary.”

Boeing’s Commercial Airplanes unit has updated its production rate assumptions to reflect impacts from COVID-19 on its operations and demand outlook, and will continue to assess them on an ongoing basis. Production of the composites-intensive 787 will be reduced from 14 per month to 10 per month in 2020, and then gradually reduced to seven (7) per month by 2022. The 777/777X combined production rate will be reduced to three (3) per month in 2021. At this time, production rate assumptions have not changed on the 767 and 747 programs. Production of the 737 MAX, when it resumes, will gradually increase to 31 per month.

In a letter to Boeing employees, president and CEO Dave Calhoun, noted that U.S. passenger volumes are down 95% and that global commercial air travel revenue is expected to drop $314 billion in 2020. As a result, he said, “We have begun taking action to lower our number of employees by roughly 10% through a combination of voluntary layoffs (VLO), natural turnover and involuntary layoffs as necessary. That is 10% in total for the enterprise. We’ll have to make even deeper reductions in areas that are most exposed to the condition of our commercial customers — more than 15% across our commercial airplanes and services businesses, as well as our corporate functions.”

Boeing 787-10 in flight. Source | Boeing

Calhoun added that “the ongoing stability of our defense, space and related services businesses will help us limit the overall depth of the cut. And in the end, because there are so many unpredictable drivers for this crisis, we’ll have to monitor continuously what’s happening in our markets, and we will make adjustments whenever needed to ensure we’re matching the size of our business to the changing demand in the market.”

Looking ahead, Calhoun said he is confident of the company’s perserverence and said, “We will continue to concentrate on what is most important across Boeing. We will continue to invest in the future. We will continue to focus on our values, and to drive safety, quality, integrity and operational excellence in everything we do.”

Airbus

Airbus reported Q1 2020 revenues of €10.6 billion, compared to 12.5 billion in Q1 2019. “We saw a solid start to the year both commercially and industrially but we are quickly seeing the impact of the COVID-19 pandemic coming through in the numbers,” said Airbus CEO Guillaume Faury. “We are now in the midst of the gravest crisis the aerospace industry has ever known. We’re implementing a number of measures to ensure the future of Airbus. We kicked off early by bolstering available liquidity to support financial flexibility. We’re adapting commercial aircraft production rates in line with customer demand and concentrating on cash containment and our longer-term cost structure to ensure we can return to normal operations once the situation improves.”

As Airbus announced earlier in April, the COVID-19 pandemic has forced the company to reduce average monthly aircraft production rates to 40 for the A320 Family, two (2) for the A330 and six (6) for the composites-intensive A350. This represents a reduction of roughly one third compared to pre-crisis average production rates. On the A220, the final assembly line in Mirabel, Canada, is expected to progressively return to a monthly rate of four (4) aircraft.

“Now we need to work as an industry to restore passenger confidence in air travel as we learn to coexist with this pandemic,” Faury said. “We’re focused on the resilience of our company to ensure business continuity.”

Related Content

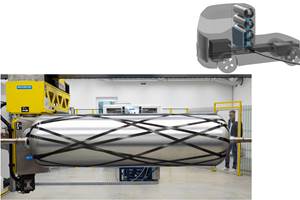

Infinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More