Automotive: On the fence

When it comes to the debate about composites vs. metals in car manufacture, the post-recession automotive industry could as easily fall into old habits as tip over into new possibilities.

It’s hard, looking at the fast-evolving automotive industry, not to get a little excited about the real and potential change at work that favors substantially increased use of composites in cars and trucks over the next couple of decades.

Increasing fuel prices, changing Corporate Average Fuel Economy (CAFE) standards, peak oil, rapid growth in developing countries, focus on sustainability and increasing consumer demand for alternate energy vehicles all seem to signal a new and different automotive industry. On top of this is evidence that composites of almost every ilk provide the best method of decreasing vehicle weight and increasing fuel efficiency. This is thanks not only to part-by-part weight loss, but also the ripple effect it provides — a lighter chassis, for example, requires a smaller engine and a less robust braking system. Indeed, a 2007 report issued by engineering and consulting firm Ricardo (West Sussex, U.K.) noted that on a small car, a 20 percent weight loss increases fuel efficiency 8.4 percent. And if the engine on that small car is downsized, fuel efficiency increases 13 percent. This means a car that averages 39 mpg could see that number jump to 44 mpg.

The automotive industry, it appears, is responding. As we’ve reported in CT over the past few months, there are scores of new and emerging automakers working with composites to develop hybrid and electric cars that could be on the road soon. Even established carmakers (e.g., BMW, with its Megacity Vehicle) promise to make new and innovative use of composites in auto structures.

Despite all of this apparent momentum, however, I think it’s clear that the automotive industry is still sitting uncertainly on the evolutionary fence, and could as easily fall back into old habits as tip over into new possibilities. The reasons for this tipping point can be found in the auto market and in the culture of auto manufacturing.

Auto market: Growth of smaller, alternatively powered cars relies first on the consumer, who, in the U.S., still prefers relatively large, powerful, comfortable vehicles that are easy to fuel and maintain. Will that preference change? If so, what will change it? My view: The wallet guides much American decision-making. As long as gas prices remain competitive with other energy sources, the combustion engine reigns. Rising gas prices ushered in many of the auto industry changes we’re seeing now, but prices since have stabilized. That, coupled with the recession, has slowed the rate of change.

Auto culture: GM, Ford, Chrysler, Toyota, Honda and other legacy automakers use established manufacturing materials and systems reinforced by decades of reliance on steel. If increased use of composites required only that metallic structures be replaced by a glass- or carbon-reinforced plastic, then adapting to this changing market would be simple. But optimal use of composites in a vehicle requires from-scratch design and engineering work, along with adoption of manufacturing processes that don’t exist in a steel-dominated environment — not a trivial matter.

Automakers will change their ways and embrace composites integration only if the market demands it. And the market will demand it only if the cost of ownership and operation of a vehicle tips the consumer toward smaller, more efficient cars. The next few years, I suspect, will show us just how much change this important market will embrace — and on which side of the evolutionary fence.

CT invited several automotive composites experts to comment, in this issue, on our industry's prospects in post-recession auto maufacture. Click on our "Q&A Forum" under "Editor's Picks."

Related Content

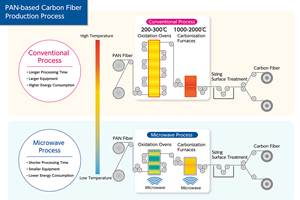

Microwave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreHexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreRead Next

Q&A Forum: Automotive Composites

How will fiber-reinforced polymers fare in a post-recession, cost- and fuel-economy-obsessed auto market?

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More