Composite pressure vessels enable future energy storage

Q&A between Hexagon Purus, Infinite Composites and Hyosung USA delves into the future of H2 storage, including scalability and production goals, materials and application trends and other dynamics.

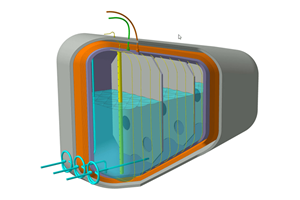

A 37-kilogram HGV2/EC79 bus system using 350-bar COPVs (far left) and an aerospace hydrogen tank (bottom right) by Hexagon Purus, as well as some tank examples (top right) from Infinite Composites. Sources | Hexagon Purus and Infinite Composites

The global hydrogen (H2) pressure vessel market has seen significant growth over the last decade. Veteran Hexagon Composites spun off its H2 business as Hexagon Purus, which has opened three new manufacturing facilities for composites pressure vessels on three continents in the last 18 months, providing substantial capacity for growth. Meanwhile, automotive suppliers Forvia and OPmobility have also announced multiple new factories with capacities up to 140,000 and 210,000 vessels/year. This market is being driven by increased H2 infrastructure investments and the adoption of H2 combustion engines (like the Cummins B6.7H and HELM series) and fuel cell electric vehicles (FCEVs). Growing dominance by Type 4 carbon fiber/epoxy wrapped tanks is reported even by Type 3 (aluminum line) vessel producers, while Hexagon Purus reported its 2024 revenues are up 67% in Q1 and 60% in Q2 versus 2023. This growth includes H2 infrastructure (distribution, mobile refueling, stationary storage) as well as mobility, including new contracts for bus (New Flyer, Gillig) and heavy trucks (Toyota). Meanwhile, growth in Type 5 linerless, all-composite tanks continues by suppliers such as Infinite Composites. (Read more in “Composites end markets: Pressure vessels (2024)”.)

Carbon Fiber 2024 hydrogen panel speakers (left) to right): Jim Harris, Judy Johnson and Matt Villarreal

CW presented a panel discussion on H2 pressure vessels at Carbon Fiber 2024 (Nov. 8-10, Charleston, S.C.) which includes Q&A between the panel’s three industry experts — Matt Villarreal, founder and CEO of Infinite Composites, Jim Harris, VP HMI North America at Hexagon Purus and Judy Johnson, carbon fiber business development manager at key pressure vessel fiber supplier Hyosung USA Inc. Here, CW shares highlights from that discussion.

Audience: H2, in terms of its supply and storage, has become very prominent in the mobility sectors. Could we discuss what technologies are currently out there, whether there are any new applications being seen and what the general outlook is?

Jim Harris, Hexagon Purus: First and foremost, for the scalability of H2 mobility markets, there are H2 hubs that need to be installed to produce H2. The H2 global supply is mostly used in numerous markets other than H2 mobility applications. To increase the mobility market adoption of H2, the U.S has launched a total of seven H2 hubs within the U.S. However, it’s going to take some time for the H2 hubs to get built, electrolyzers ready for H2 production and to have a supply of H2 to support the mobility markets.

Matt Villarreal, Infinite Composites: When thinking about this long-term, if we want to have H2 as a primary energy source, I'd like to see more distributed H2. This idea may be a little bit out there but we’re seeing other renewables proliferating — putting solar panels on houses and ramping up wind energy, for example — and H2 needs to catch up. Rather than consolidated, massive H2 plants, I'd like to see distributed versions among many different entities. I think that would make a more robust and flexible supply system, and it would somewhat lower rental cost to keep producing new power plants. We basically need more capacity. That’s the key factor there.

Audience: Judy, you have talked a bit about compressed natural gas (CNG), and it seems that this is Hyosung’s primary focus. Is there anything that fits into this conversation on H2?

[Editor’s note: CNG also uses Type 4 tanks and Hyosung announced in 2019 it would expand production from 2,000 to 24,000 tons/year for CNG and H2 pressure vessels. Meanwhile, the carbon-negative version of CNG, renewable natural gas (RNG), and Cummins new X15N engine, has driven Hexagon Composites revenue to an all-time high and resulted in two new Type 4 pressure vessels line being installed in its Salisbury, North Carolina, plant with room to add four more.]

Judy Johnson, Hyosung Advanced Materials Corp.: CNG is out there in some over-road applications, and H2 is being adopted [for modes that use] captive fueling stations — e.g., city buses. What we’re going to have to see for wider H2 adoption is for fueling stations to no longer be captive but where anybody can get to them. The U.S. government has made some moves toward that, but I think it’s going to be a long adoption curve.

Audience: If over-the-road use of storage is at 700 bar, and your fueling stations are presumably at around 1,000 bar, how are you pressurizing gaseous H2 and storing it?

Harris: Storage at 700 bar is why you're seeing some slower adoption of H2 when compared to transit buses, which operate at 350 bar. Typically, these refueling systems [for H2 storage tanks] use a cascading effect, starting at 500 bar, then they go to 700 bar. As the pressure increases, typically you're going to use composites.

You need to have enough bulk storage, so that when you fuel some type of mobility application, you're able to fill fast. And usually [the H2 gas] is chilled to about -20 to -40°C and you also need to compress the H2 for refueling.

H2 and H2-based fuels (like ammonia, methanol and synfuel) are finding purchase across a variety of mobility segments, from road vehicles to large ships to aerospace. Note: Mid-size maritime vessels such as ferries are not included, but H2 vehicles in this segment are expected to use liquid or compressed H2. Source | Hexagon Purus the IEA ETP, IHS, “A Portfolio of Powertrains for Europe (2010),” Thiel (2014), Hydrogen Council

Audience: Do you see transportation applications like buses, aviation, trucks or military converging on one pressure vessel technology?

Villareal: I think there’s a mix of technologies that are being developed. One of the challenges is that a lot of people like to have an internal combustion engine (ICE) versus fuel cell options. By companies developing those H2 ICE engines, they’re going to be able to bring more people on board with H2. The fuel cell technologies are already available in various forms, but I really see this end market being a multifaceted approach, with certain technologies applicable to certain applications, and I think we should optimize for those things to make them as practical as possible.

Johnson: I think it will be a broad range of energy conversion types whether that’s fuel cells or ICE based on the needs of that particular [transportation].

Harris: I fully agree. I think it’s just going to come down to the OEM and what they select.

Audience: On the consumption side, how many kilograms of H2, either per hour or per mile, would a typical bus use?

Harris: Most transit buses are typically running a minimum of 35 kilograms of [H2] storage depending on the size of the bus. This, of course, depends on what routes they’re running. Typically, these buses are refueling once a day, depending on the routes and most bus routes are consuming about half of the 35 kilograms.

Audience: Where is the industry going between using wet winding versus towpreg?

Villareal: We have custom resin formulations with wet winding that give us flexibility, but longer term for scale-up, I think towpregs are more optimal as you can go faster with more control. We still have to customize a lot, like expanding the capabilities of our tanks to different environmental conditions and different requirements, and wet winding is more practical for that. But on a large scale and for more commodity products, towpregs might be better. For Infinite Composites, it also comes down to cost. At this point, our customers and OEMs are very sensitive to cost/price. We’ve developed some proprietary processes to get wet winding to run at very high speeds and still maintain very low variability.

Harris: Towpreg, in the end, should be where everyone is headed, but it comes down to cost. The prepreggers and towpreggers that exist today are just not scaled up to really meet our demanding environment, it just doesn’t exist.

Johnson: On the commercial side of things — selling and delivering — most of the high-volume tank providers are doing wet winding, and they express limited interest in towpreg, particularly if [the towpreg requires] cold storage. And you’re going to be looking at cold storage, because those [products] aren’t going to be optimized for long out-life.

Audience: With wet winding, it’s difficult to get as many tows down at once without sliding between the tows, whereas towpreg allows us to produce much faster.

Harris: Wet winding versus towpreg and the variability is simply part of our design process. So, the processing issues that you may be mentioning we do not experience within our filament winding processes.

Audience: Do you see the pressure vessel industry driving the development of particular types of carbon fiber, as we have historically seen in aerospace and also the cost?

Johnson: Market price is $26-30/kilogram based on what the U.S. Department of Energy looked at last year. That varies based on the quantities people were purchasing and the delivery terminals. I think the pressure vessel market is important enough to push carbon fiber suppliers to customize products for them. It’s a significant market. And based on what we [Hyosung] have for sales, we don’t feel compressed to the point of no margins like we do in some other industries.

Governments globally are investing billions of dollars in developing the H2 economy. Most H2 today is produced from natural gas, but in order to realize the promise of zero-emission hydrogen, solutions like the adoption of composite pressure vessels will be required. Source | Infinite Composites

But Hyosung is purely a small tow industrial producer. We don’t make big tows and we don’t make [materials] for aerospace. [The pressure vessel market] has gained enough to drive development of customized fibers, but [these] will be used in other areas because developing a fiber for just one end market isn’t really that practical.

Harris: From Hexagon’s perspective, we work with several carbon fiber suppliers … and are pushing the carbon fiber suppliers to look at methods of increasing strength without adding cost. The biggest challenge for adoption as H2 grows is decreasing the cost of carbon fiber.

Audience: Would a 100K tow T700 be applicable for pressure vessels? [Editor’s note: 12K or 24K is currently the standard for pressure vessels].

Villareal: Maybe in larger vessels, the higher tow count could be practical. That’s where I see that getting potentially used, but there is much less application for those large tows, especially when you’re trying to optimize for mass and other things. It’s harder to control as you use higher tows when you’re wanting to lay down a precise area. And if you have big, wide tows, it’s much harder to keep it all together and in the same position that you want.

Harris: Typically, with larger tow products, the stiffness is there, but the strength is not. And pressure vessels, including Type 4 and Type 5, are mostly strength-driven. [That’s also true] for Type 3, but there you need stiffness to achieve the necessary cycle life. Even the larger tows that exist today don't have the strength that the 12K or 24K tows have.

Audience: Is there any flexibility or dynamic changes coming or do you anticipate new players or some innovation that would help drive down that cost but maintain the performance?

Harris: Hexagon Purus is getting down to the fiber-matrix interface, working with our fiber suppliers to make sure we're getting the maximum we can out of these materials to drive weight down without increasing the cost of the fiber.

This is one of the main focus areas that we’ve worked solutions. I have been in this industry for a long time, and I have seen it go through many cycles, but T700 type carbon fiber has so far been the sweet spot, and it hasn’t changed much year over year. Maybe as demand rapidly increases, and supply for all of these markets grow, processes will be improved and there will be additional methods to drive down costs.

Johnson: There was a presentation yesterday where they spoke about how new technologies and new lower-price suppliers may enter the industry with a wider range of products and more capacity that could result in some [carbon fiber suppliers] losing out. That's certainly a possibility in the market. There are a lot of research dollars being spent globally on looking at different technologies and different ways to cook the fiber. But right now, from a practical perspective, I don’t see a big breakthrough. It looks like most of the larger commercial producers are struggling along in relatively the same cost space.

Audience: What kind of testing are you doing [for pressure vessels], and what kind of industry standards are you working with?

Harris: The primary industry standard for H2 mobility applications within the U.S. is HGV-2. For Europe, there’s an outgoing standard, EC79 which is being replaced by the GTR-13 and R-134, which are more global standards, but mostly European-centric. There are different ISO standards for stationary and/or distribution applications. On the distribution side, usually you’re also getting special permits with the U.S. DOT. There is a significant amount of testing listed in these standards. You’re typically performing three virgin [tank] bursts, three cycle bursts, a bonfire test, a gunfire test and a pneumatic cycle test, where you’re pneumatically cycling with (usually 500-1,000 cycles) with H2.

It usually takes about 6-9 months to complete all the testing with an approximate test cost of a million dollars to test a new product.

Villareal: At least for aerospace pressure vessels, AIAA S-081 is the main standard we use. It’s significantly less rigorous than the transportation and automotive side, because aerospace pressure vessels are not subject to the abuse and repeated use like road vehicles. You’re typically doing some kind of burst test, pressure cycle test, but in automotive you're doing tens of thousands of cycles. Conversely, in an aerospace pressure vessel standard, you have a minimum of 50 pressure cycles because the applications have widely varying use types. For example, if you send a satellite to space, you may pressure cycle it only five times over its entire life, so you have to do a minimum of 50 pressure cycles. But beyond burst cycles, you have shock and load testing where you're simulating the launch of a rocket, or the landing of a lunar lander, etc. But [compared to mobility pressure vessels] these tests are much less intense. You test it, you save your records for it and you provide it to the range for military applications or to your launch provider.

Audience: If we do have some catastrophic event occur with a H2 vehicle, do you think that’s something that would kill this market altogether?

Johnson: There was a case in the 70s where Ford was sued for a massive amount of money for a gasoline car that exploded. It killed that particular model [Ford Pinto], but there are still gasoline cars all over the place. Every time we drive a car, we've got stored energy in it, whether it's electricity or gas or H2. So [for a similar situation with H2] it may put off a particular technology, a particular type, but people rely on vehicles to get around places. I don't see it as a technology-killing event for us.

Villareal: I also think that the testing standards are pretty rigorous. For example, in some of these tests you’re pressurizing a tank to 10,000 psi with H2, shooting it with an armor piercing round and ensuring it can’t catastrophically rupture on the road. Even with one of Infinite Composites’ army contacts testing with rocket-propelled grenades on 5,000-10,000 psi pressure vessels, they literally penetrated through, vented the gas out and it still didn't catastrophically rupture. But like Judy said, anything that has high energy is going to be dangerous. You can't get to space without a million pounds of thrust underneath you on a rocket. But I don't think that the dangers are necessarily more profound for H2 versus gasoline or other types of fuels, and the regulations and testing standards help mitigate that.

Related Content

Collins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

CW reflects on 2024 and looks ahead to 2025

This year placed growing emphasis on sustainable materials and processes in composites manufacturing. What trends will be top of mind for the composites community in 2025?

Read MoreCryomotive prepares CcH2 storage for demonstration on heavy-duty trucks

Cryogas system is based on carbon fiber towpreg wrapped Type 3 inner tank at 400 bar storing 38 kilograms of CcH2.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More