Composites fuel growth of fuel cell technology

Composite components in hydrogen fuel cell systems help handle higher heat and reduce stack size.

Two billion cars and trucks could be driving the world’s roadways by 2050. Eliminating the carbon monoxide and other air pollutants emitted by this many fossil fuel vehicles has become a global imperative. Among the candidates to replace the internal combustion engine — hybrids, “plug-in” electrics, and hydrogen (H2) fuel cell electrics — only the latter can truly eliminate emissions. No wonder, then, that automakers worldwide are prototyping a wide range of fuel cell vehicles (FCVs): sedans, sports cars, SUVs, taxis, buses and light trucks. Fuel cells also are undergoing tests on vehicles for military combat, delivery and maintenance (such as street cleaners) and materials handling (e.g., forklifts), as well as motorcycles, scooters, electric bicycles and rickshaws.

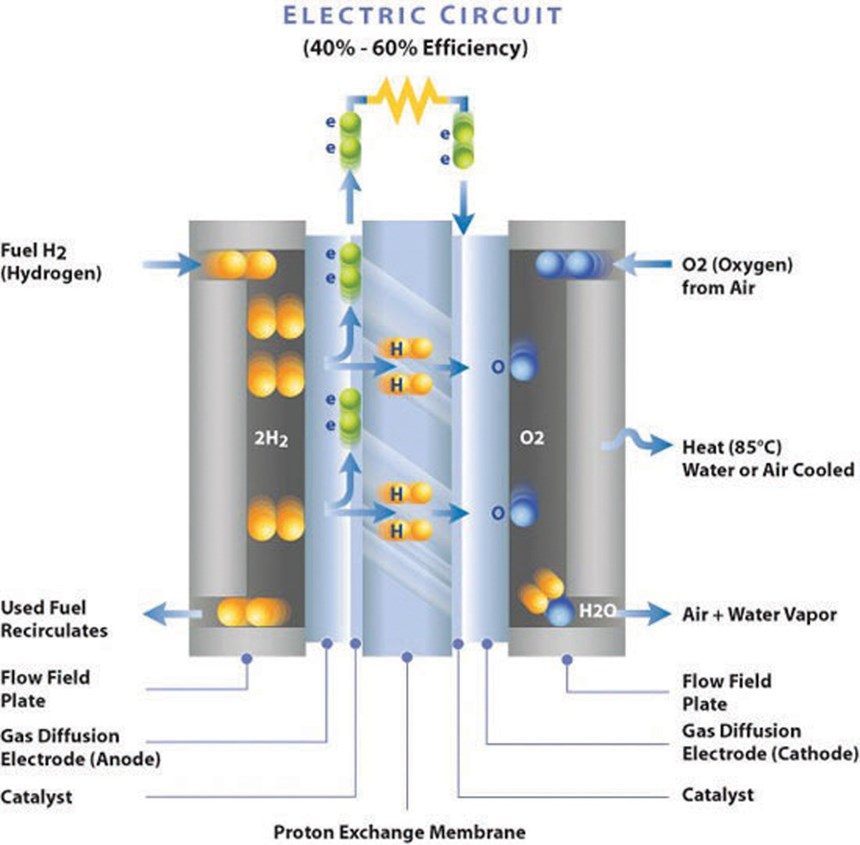

The predominant fuel cell type for transportation applications is the proton exchange (or polymer electrolyte) membrane fuel cell (PEMFC), which uses pure gaseous hydrogen (H2) stored onboard in pressurized tanks. At the heart of a PEMFC is the “stack,” the core element that generates electrical energy to power the vehicle. Hydrogen fuel and oxygen (O2) from ambient air mix through a complex, electrochemical reaction. Unlike internal-combustion and hybrid powerplants, the only emissions from the fuel cell’s noncombustible reaction are a small amount of water and heat in the range of 175°F to 400°F (80°C to 200°C).

Although fuel cell stacks can be, and are, built with metals, designing key stack components with composites has contributed to system weight and parts-count reductions, yet at the same time, increased mechanical strength and corrosion resistance, provided for tailorable conductivity, and given fuel-cell manufacturers the ability to easily mold complex geometries into PEMFC components.

Stack as power core

The FCV stack is made up of individual cells, each comprising two thin conductive plates (bi-polar plates) that, in combination with a membrane electrode assembly (MEA), separate the two reactant gases and direct gas flow through anode and cathode electrodes to produce the desired electrical current in the power system. In a four-passenger FCV sedan, this is typically 85 to 100 kW. In buses and trucks, it can range as high as 300 kW. Control of the H2 and O2 flow is maintained as the gases move through intricate channels or grooves called flow fields that are machined, embossed or molded into the rectangular plates. Exact flow field designs and the depth and width of individual channels are confidential to fuel cell stack manufacturers; for a frame of reference, composite bi-polar plates are now about 0.04 inch (1 mm) thick or less.

Plates with polarity plus

There are two types of PEMFC plates: conductive bi-polar plates, which contain the flow field channels that carry H2 on the anode side and O2 or air on the cathode side, and end plates (a/k/a pressure plates). The latter are nonconductive and somewhat thicker because they must handle compression forces when the stack is bolted together. Crucial performance properties in bi-polar plate materials include conductivity, close dimensional tolerance, compression creep resistance, and gas impermeability.

Although metal plates have a high degree of gas impermeability and exhibit positive power density behavior, they require expensive anti-corrosion coatings and are limited, in terms of manufacturability, to stamping processes. Composite plates can handle the heat and are far better suited to the corrosive environment in a PEMFC. The complex flow fields and other openings can be molded in a single step. Further, composite plate design has evolved, focusing on reducing thickness (and thus material cost), optimizing conductivity, evaluating lower-cost fiber/resin ratios, and shortening the molding cycle. All of these efforts focus on the application of composites in mass-manufacturing scenarios.

The composite bi-polar plates discussed here contain flake, granule or powder filler made from natural or synthetic graphite and a portion of discontinuous carbon fiber in some compounds. (The amount of fiber used and the selected modulus value are typically proprietary.) These plates can be molded by compression, compression/injection and injection processes. Plates made with pyrolized carbon/carbon or monolithic graphite, with flow fields machined or etched into them, also have been tested.

Suppliers of bi-polar plate carbon filler materials include SGL Carbon SE (Wiesbaden, Germany), the Asbury Carbons div. of Asbury Graphite Mills Inc. (Asbury, N.J.), Superior Graphite Co. (Chicago Ill.), Poco Graphite Inc. (Decatur, Texas), Columbian Chemicals (Marietta, Georgia), TIMCAL Group (Bodio, Switzerland), and Graphit Kropfmuhl AG (Hausenburg, Germany).

Since plates make up 70 percent of a PEMFC’s stack mass, the plate material significantly affects overall stack cost. Plates account for about 200 lb/90 kg of a fuel cell’s total weight in a passenger auto (or ~1,000 plates in a 120 kW stack), and account for 30 percent of the stack’s cost. The U.S. Department of Energy’s (DoE) R&D cost target for FCV systems by 2010 is $45/kW, with cost reduction by 2015 to $30/kW for production volumes of 500,000 units using a platinum catalyst load of 0.25 mg/cm² to deliver 715 mW/cm² power density at 176°F/80°C. In December 2008, the DoE reported that R&D progress toward these targets had reached $73/kW. Of this total, $34/kW is attributed to the stack, representing a $16/kW reduction over 2007 stack cost per kW estimates. Cost attributed to bi-polar plates is $6/kW each, but the DoE believes production FCV volumes can eventually reduce the cost to less than $1/kW per plate.

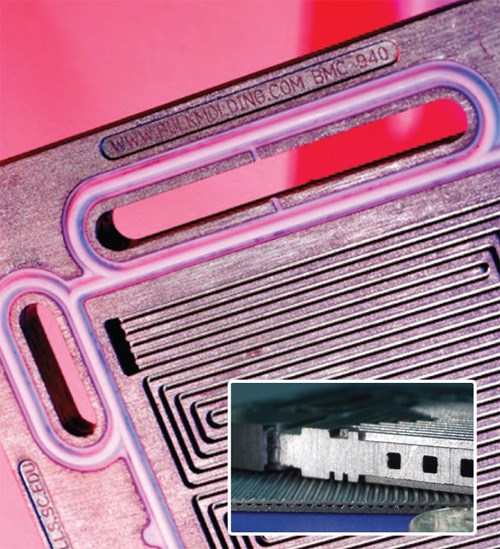

Material formulation directly affects a component’s cost. For example, in 1998, when Bulk Molding Compounds Inc. (BMCI, Chicago, Ill.) began formulating its BMC 940 chopped carbon fiber and graphite particle filled/vinyl ester compounds for compression molded bi-polar plates, costs were high for reasons related to operational quality. BMCI technical specialist John Clulow explains that carbon content determines to a great degree a plate’s electrical conductivity (measured in Siemens per centimeter, or S/cm) as well as mechanical properties. Moreover, plate flatness is extremely important.

Over the past five years, BMCI has reduced this compound’s cost from $25/lb to less than $5/lb by reducing plate thickness from 0.28 inches to 0.070 inches (7 mm to 1.7 mm). BMCI works closely with established bi-polar plate molders, such as Metro Mold & Design (Rogers, Minn.), to achieve thinner plates through superior flow properties. Additionally, the compression-molded plate cure cycle with BMC 940-15252A is currently 15 seconds. The company developed E-Sealant 9400 vinyl ester adhesive to reduce surface-to-surface contact resistance and speed plate assembly.

As a result, says Clulow, BMC 940 compounds deliver minimum deviation from parallelism — that is, optimum alignment of all the plates in a stack — and negligible warp under compression. “BMC 940-15252A, formulated with up to 60 percent filler load specifically for transportation applications, now provides through-plane conductivity up to 70 S/cm,” he adds. The compound also maintains stability and corrosion resistance, and is recyclable.

Automakers are steering toward PEMFCs with higher operational temperatures — a thermal regime of 248°F to 356°F (120°C to 180°C) — in part, to make system startup time faster. BMCI has responded to this requirement with its phenolic-based, low-viscosity BMC X-Cel compound that increases conductivity at a carbon particulate or powder load of 85 percent.

Premix Inc. (North Kingsville, Ohio), through its wholly owned subsidiary Quantum Technologies Worldwide Inc. (Bay City, Mich.), developed electrically conductive Pemtex thermoset compounds in the late 1990s, and tested the materials in many thousands of end and bi-polar plates. In 2000, injection molding grades of Pemtex were commercialized. Patented in 2005, Pemtex II boosts conductivity by reducing through-plane resistivity by 60 percent through the use of larger graphite particles — in the range of 150 to 600 microns in diameter.

“Central to our compounding strategy with Pemtex was the interdependence of rheology and conductivity, or maximizing conductivity without sacrificing moldability,” says Marc Imbrogno, Premix sales and marketing manager. “Today, the high temperatures sought in automotive PEMFCs require that filled resins perform at 392°F/200°C in an acidic environment. Currently available phenolic-based materials can handle this, but require a lengthy cure cycle. More investigation is needed into high-temperature resin systems that can perform in this PEM fuel cell service environment and also be processed cost-effectively,” Imbrogno says.

Bac2 (Southampton, U.K.) already is addressing this issue with its ElectroPhen material in compression-molded bi-polar plates that have been tested to 392°F/200°C and also provide a degree of ductility or “give” that complements hard gaskets. James Lewis, Bac2’s sales and marketing director, explains that large-diameter graphite flakes (150 microns), when added to the proprietary resin (which he identifies as similar to phenolic chemistry), “result in a low-cost, electrically conductive polymer that ensures negligible interfacial resistance and critical through-plane conductivity on the order of 60 S/cm. This is important in order to keep resistive losses within the stack to a minimum.”

The company has most recently developed CSR10 latent acid catalyst that accommodates a relatively simple pre-mix process at room temperature prior to plate molding, and provides a shelf life of more than 90 days. “This offers predictable performance across large batches of plates,” Lewis says, adding that careful selection of solvents used in the raw material package and an in-depth understanding of the proprietary reaction processes (in which the CSR10 breaks down at a predefined temperature threshold to enable polymerization) “are the keys to successfully molding plates that can operate at this higher temperature.” He also believes higher temperature PEMFCs could exhibit greater resilience to impurities in raw materials, “which would broaden the base of graphite grades used as conductive filler, to increase cost savings.”

Through its partnership with U.K.-based compression molders, Bac2 is pursuing manufacturing savings via low-cost tooling with minimum part count for high-volume plate production. Lewis says that plate thickness was recently reduced to <0.4 inch/1 mm. Web thicknesses of as little as 0.01 inch/0.15 mm are now being tested.

Other companies involved in the manufacturing of composite bi-polar plates include Entegris (Chaska, Minn.), Dana Holding Corp. (Paris, Tenn.), Pacific Fuel Cell Corp. (Tustin, Calif.), Showa Denko K.K. (Omachi, Japan), Schunk Kohlenstofftechnik GmbH (Heuchelheim, Germany), Eisenhuth GmbH & Co. KG (Osterode, Germany) and Zentrum fur Brennstoflzellen (Duisburg, Germany).

Continuous conductivity

Bi-polar plates made of GRAFCELL expanded graphite from Graftech International (Parma, Ohio) have undergone millions of miles of road trials in test-fleet FCVs because many of the PEMFCs were built by transportation system innovator Ballard Power Systems (Burnaby, B.C., Canada). Although Ballard has shifted focus to commercializing fuel cells for near-term markets (backup power, residential cogeneration and materials-handling applications), it continues to leverage the conductivity and processability benefits of GRAFCELL materials in its products.

Under development since 1992, GRAFCELL’s properties are unique, claims Graftech staff scientist Ryan Wayne. “GRAFCELL materials feature a patented, continuous matrix of expanded graphite, which is filled with thermoset binder at 15 to 35 percent content, depending on the plate design and required mechanical properties,” he explains. “The electrical and mechanical properties of GRAFCELL materials do not vary widely within this range because graphite is the continuous conductive phase, and resin fills the porosity of the graphite matrix.” Plates made with GRAFCELL, therefore, exhibit low surface-to-surface contact resistance and relatively high conductivity of 1,200 S/cm.

To make the “resin-reinforced” GRAFCELL in bipolar plates as thin as 0.024 inch/0.6mm, naturally inert crystalline graphite flakes are chemically treated and heated. This causes expansion of the flakes into worm-like shapes that are then compressed into a flat sheet of flexible graphite that is subsequently impregnated with resin to form a continuous, compression moldable prepreg sheet. The addition of the binder resin improves both gas impermeability and mechanical stability. The material’s high thermal diffusivity provides for more complete evacuation of heat from the central, active area of the plate that supports the MEA. This can extend stack lifetime.

To meet targets for higher temperature PEMFCs, Graftech partnered with Ballard, Huntsman Advanced Materials (The Woodlands, Texas), and Case Western University to develop GRAFCELL expanded graphite bi-polar plates with benzoxazine resin. The formulation exhibits a Tg of 500°F/260°C, and in a short stack (10 plates) tested to 1,000 hours at 248°F/120°C, the bi-polar plates showed no evidence of degradation or failure.

Other companies that provide compounds for bipolar plates are Eisenhuth GmbH & Co. KG (Osterode, Germany), Zentrum fur BrennstoffzellenTechnik ZBT GmbH (Duisburg, Germany), and Celanese Corporation (Florence, Ky.).

Perfect world

Although many auto OEMs have FCV prototypes — Mercedes-Benz plans to start series production on its B Class F-CELL sedan in the next three months — FCVs won’t be widely commercialized overnight. Much remains undone, not the least of which is provision of a hydrogen refueling infrastructure. But the promise of an emission-free automobile is no longer fantasy, and composites will help realize this now very possible world, providing components not only for the power stack (bi-polar plates), other powerplant components (housings for pumps, motors, blowers, filtration elements) but also for the H2 storage tanks (see sidebar, below) and lightweight body panels — not to mention the fueling station storage tanks and fuel dispenser systems, and the fiberglass pipeline for hydrogen transport. All of these composite applications are currently in development, with new materials and manufacturing process improvements hitting the road every day.

Related Content

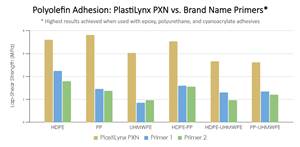

XlynX Materials BondLynx and PlastiLynx for low surface energy PP, PE substrates

Award-winning Xlynx materials use breakthrough “diazirine” technology to boost bond strength up to 950% as adhesives, primers and textile strengtheners.

Read MoreXlynX’s PlastiLynx PXN crosslinking primer enhances polymer adhesion

PFAS-free diazirine primer makes surfaces receptive to all manner of adhesives, including epoxies and polyurethanes, outperforming alternative options by 150-350%.

Read MoreBiDebA project supports bio-based adhesives development for composites

Five European project partners are to engineer novel bio-based adhesives, derived from renewable resources, to facilitate composites debonding, circularity in transportation markets.

Read MoreHeat-activated foaming core rapidly achieves net-shape 3D parts

CAMX 2024: L&L Products exhibits its InsituCore foaming core structural technology, which can be used to create foam core composites minus machining or presses, as well as the Phaster A K-700, a rapid-cure adhesive.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More