Composites Industry Outlook: Positive

An exhibition like CAMX 2014, which draws together all aspects of the composites manufacturing industry, demands a comprehensive and thorough review of the health of the industry and where it’s headed.

An exhibition like CAMX 2014, which draws together all aspects of the composites manufacturing industry, demands a comprehensive and thorough review of the health of the industry and where it’s headed. The dynamic and fast-evolving nature of composites manufacturing means that keeping track of the forces shaping each composites end market is more important than ever. As the show approaches, CAMX caught up with Dr. Sanjay Mazumdar, CEO of Lucintel (Dallas, Texas), for a closer look at today’s most important material, process and market factors.

Overall, says Mazumdar, the composite materials market grew in 2013 by 1.7 percent to reach $7 billion in value and 4.7 billion lb (2,132 metric tons) in annual shipments. The U.S. gross domestic product (GDP) grew by 2.4 percent in 2013, which will help the U.S. composites market restore confidence again amongst composites part fabricators. Demand in the U.S. composites market is expected to reach $10.3 billion by 2019, at a compound annual growth rate (CAGR) of 6.6 percent. Strong growth in the transportation, aerospace and construction sectors is expected to drive this trend.

Below is a review of Mazumdar’s specific market expectations.

Aerospace. Composite materials continue to gain market traction, and OEMs show strong confidence in composites technology. Demand for composite materials in the U.S. aerospace market grew by 10.2 percent in 2013. New aircraft programs such as Boeing’s 787 Dreamliner, Airbus’ A380 and A350 XWB, Bombardier’s CSeries and general aviation aircrafts such as Cirrus and Diamond are using a significantly higher amount of composites than previous aircraft and thus driving composite materials’ growth.

Boeing 787 had a huge order backlog – 909 aircraft – as of March 2014. To fulfill orders, Boeing escalated production capacity of 787s to 10 aircraft per month by the end of 2013, followed by an expected increase to 12 aircraft per month by 2016 and 14 aircraft per month by 2020. Airbus’ A350 XWB, which is in flight testing ahead of market entry in the second half of 2014, had 824 orders as of August 2014. A350 XWB is expected to launch in 2015 and have a production rate of 10 aircraft per month by late 2018.

Of great interest in the aerospace market is the forthcoming Learjet 85 business jet, manufactured by Bombardier. Wingskins and spars for the plane are manufactured in Belfast, Northern Ireland, using an in-autoclave resin transfer infusion (RTI) process. The fuselage and empennage are manufactured in Querétaro, Mexico, via an out-of-autoclave (OOA) process. The plane makes use of composites not only to reduce airframe weight and increase fuel economy, but also to significantly reduce part count because composites have enabled Learjet to produce large, integrated structures. In the process, Bombardier has learned much about materials characterization, materials management, process development and certification.

Automotive. Auto sales were projected to reach 15.6 million vehicles in 2013, from 14.7 million vehicles in 2012, driven mainly by low interest rates, increasing consumer confidence and vehicle replacement. Composite materials are used in interior headliners, underbody systems, bumper beams and instrumental panels. The demand for composites in the U.S. automotive market grew by 8.8 percent in 2013. Increase in the use of composite materials in racing and high-performance vehicle components, such as chassis, hoods, wheels and roofs, is one of the driving factors for the increase in composites penetration in the automotive industry.

As automakers work to meet Corporate Average Fuel Efficiency (CAFE) standards of 36.6 mpg by 2017 and 54.5 mpg by 2025, vehicle weight reduction has become a major strategy. For instance, Daimler had set a target to reduce its gross vehicle weight by 10 percent in all new models by 2013. Similarly, GM and Ford set targets of weight reductions of 15 percent by 2016 and 250 to 750 lb (113 to 340 kg) by 2020, respectively.

The vehicle of greatest immediate interest to the composites industry is the BMW i3, and all-electric, four-door passenger car that features a carbon fiber passenger cell, or Life Module. It’s the first production vehicle (40,000 units/year) to make such significant use of carbon fiber in a relatively high-volume manufacturing environment. The carbon fiber is sourced exclusively from a joint venture of BMW and SGL Group in Moses Lake, Wash.; parts are molded via resin transfer molding (RTM) at BMW’s vehicle manufacturing and assembly facility in Leipzig, Germany. The car entered the European market in late 2013 and is being introduced to the U.S. in spring 2014.

Demand for carbon fiber composites will significantly grow as major OEMs have entered into joint ventures with carbon fiber suppliers to have a secured raw material supply. Zoltek (now Toray) entered into strategic alliance with Magna International for the development of low-cost carbon fiber sheet molding compounds (SMC). Ford Motor Co. is working with carbon fiber supplier DowAksa to develop materials and processes for automotive composites manufacturing, and GM and Teijin are working along similar lines to develop a thermoplastic composites molding process for future vehicles. Molders such as Plasan Composites worked with Globe Machine Manufacturing Co. and Weber Manufacturing to develop an autoclave-like manufacturing process called RapidClave to fabricate automotive composite parts in 17 minutes. More recently, Toray bought a stake in Plasan, which is expected to help Plasan develop high-speed resin transfer molding (RTM) capabilities.

Wind Energy. The U.S. federal government’s Production Tax Credit (PTC) has remained a key driver for wind energy development in the United States, but the uncertainty of extension led to a “boom and bust” cycle. In 2012, the market grew as renewable energy developers rushed to complete construction in time to qualify for the credit before its expected expiration at the end of the year. This huge increase affected the new wind energy capacity installation in 2013, as most of the planned projects had been completed in 2012. Approximately 3,000 MW of new wind energy capacity was installed by the end of 2013, a 77 percent decrease from 2012.

The PTC was renewed again in early 2013, but expired at the end of that year and has not been renewed since. Still, incentives built into that PTC have driven moderate growth in the U.S. wind energy industry. Without a PTC, economists predict modest to flat wind energy growth in the U.S. for the next several years. Although wind energy, on a cost per kilowatt-hour basis, has approached that of coal, wind’s primary energy competitor is natural gas, which is plentiful and thus the least expensive of all U.S. energy sources.

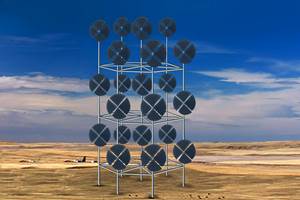

Advanced materials are making headway in the wind market. GE started using carbon fiber in its two wind turbine models, GE 1.6-100 and GE 4.1-113. Major Brazilian blade manufacturer, Tecsis, is manufacturing wind blades for GE energy using large-tow carbon fiber prepreg supplied by Gurit. The largest consumer of carbon fiber in wind blades is Vestas Wind Systems, followed by Gamesa. As wind turbine size increases, blade will get longer, driving wind turbine manufacturers toward lighter and cheaper materials. Low-cost carbon fiber and high-performance glass fiber are expected to see increased use as a result.

Oil and Gas. Oil and gas and chemical segments together accounted for more than 55 percent of the fiber-reinforced plastics (FRP) pipe market in the United States in 2013, followed by retail fuel, marine/offshore, waste/wastewater, sewage, power and pulp/paper. In the last five years, the power segment grew at a faster rate with a major focus on large-diameter pipes. There also is a trend toward using large-diameter pipes in sewage applications. In 2013, FRP pipes in municipal water systems and pipe rehabilitation grew slightly.

In the last several years, major players established strategic alliances. The largest FRP manufacturer, NOV Fiberglass, acquired two major U.S. FRP pipe manufacturers – Ameron and Fiberspar. Future Pipe Industries acquired ITT Exelis. Ershigs established a joint venture with Hanwei Energy Service to establish Hanwei Ershigs. Last year, Ershigs acquired Fibra S.A.

FRP tanks had a mixed performance. Underground petroleum-based tanks grew at a faster pace among all segments due to increasing demand of FRP tanks from independent service stations, whereas underground water-based tanks grew marginally.

Other Markets. In the construction industry, composites demand registered 8.3 percent growth in 2013. Construction continues to be the second largest market (after transportation) for composite materials. The main drivers for composites use are new housing and remodeling, both of which have grown significantly thanks to the economic recovery. The government is also allocating funds for the retrofitting of old infrastructures, especially bridges and roads, which further drives composites demand in the construction sector.

In the marine industry, composite materials grew 3.4 percent in 2013 due to the improving economy, increased consumer spending and the rise in employment rates. In the United States, boat production grew more than 5 percent. Such growth benefits the composites industry since approximately 70 percent of all boats are made with composite materials.

The U.S. consumer goods market grew 3 percent in 2013. Composites are used in seven out of 10 products in the most popular outdoor sports and recreational activities. For example, carbon fiber is the predominant material in golf shafts, fishing rods and tennis rackets.

At CAMX, program topics will touch on all the trends identified above through technical paper presentations as well as tutorial and educational sessions that discuss best practices and provide insights for all those involved in the composites and advanced materials industry.

Related Content

Update: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreComposites end markets: Pressure vessels (2024)

The market for pressure vessels used to store zero-emission fuels is rapidly growing, with ongoing developments and commercialization of Type 3, 4 and 5 tanks.

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More