Composites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

The automotive composites market is expected to grow, led by emerging markets like battery electric (BEV), solar electric (SEV) and hydrogen-powered vehicles, incorporating more efficient or sustainable composite materials and process technologies. Source (clockwise from top left) | SABIC, Aptera, Hankuk Carbon and Dymag, Bossard, Sonichem

Composites have long offered advantages — such as light weight and moldability into complex geometries — for exterior, structural and even some interior automotive components. Composite materials have been adopted most heavily in the development of racing vehicles, where weight-driven performance is key, and luxury vehicles, which tend to be produced in lower volumes and benefit from the premium aesthetic of carbon fiber.

These materials have also broken into a variety of applications in higher volume commercial vehicles, though more slowly, as the raw materials for carbon or glass fiber composites can be more expensive than metal alternatives, and manufacturing processes have historically been better suited to lowervolume components.

However, the automotive composites space is projected to double in revenue by 2032, according to a 2023-2032 automotive composites market report published by Allied Market Research (Wilmington, Del., U.S.), a full-service market research and business consulting wing of Allied Analytics LLP (Portland, Ore., U.S.).

Report insights highlight growth in automotive composites through 2032. Source | Allied Market Research

This growth is expected to be led by a rise in battery electric vehicle (BEV, or EV) development and sales. EVs present many opportunities for adoption of composites for lightweighting, as automakers seek to offset the extra weight of the larger battery pack and to decrease overall vehicle weight to extend its range per charge.

According to Allied Market Research, the projected industry growth is also made possible by advances in composite manufacturing technologies toward faster processes, like resin transfer molding (RTM), which can make composites a more competitive option for high production volumes.

Continuing developments in EV battery enclosure technology

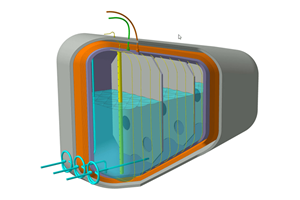

One of the biggest opportunities for composites in BEVs is battery enclosures — covers and trays that hold and protect the frames and battery cells within an EV. As reported by CW in Part 1 of a two-part 2022 feature on composite battery enclosures, empty metallic battery enclosures are said to add 110-160 kilograms to vehicle mass even before they’re loaded, making them the heaviest component on BEVs — presenting an opportunity for lighter weight composite materials.

UL standard 2596 is based on a protocol from Forward Engineering and Hyundai, which uses resistive heaters, as opposed to open flames, to see how materials respond to real-world heating and pressure situations. Ultimate failure or yield is evidenced by the emission of flames and/or plasma from the top of the specimen, shown here.

Beyond lightweighting, switching to composite battery enclosures can also enable a host of other benefits such as more complex geometries, better impact performance, corrosion resistance, faster assembly, greater durability and — with specific formulations — improved flame resistance/fire containment. The latter is especially advantageous in combating automakers’ stringent requirements (like UL standard 2596, published by UL Solutions in 2022), for containing thermal runaway, which is the overflow of heat and potentially fire and smoke that occurs when a lithium-ion battery overheats.

As reported in Part 2 of CW’s battery enclosure feature, materials suppliers have made substantial efforts in the past several years to develop higher performing composites that meet current and future needs of automakers and battery module producers as performance and safety requirements become more demanding.

Within the last year, several new products launched by materials suppliers targeting thermal runaway mitigation in battery enclosures include Syensqo’s (previously Solvay, Alpharetta, Ga., U.S.) Xencor Xtreme family of long glass fiber (LGF) PPA solutions; Envalior’s (Düsseldorf, Germany) new recyclable thermoplastic Tepex material tailored to extreme battery enclosure situations; and Syensqo’s SolvaLite 716 FR, a fire-retardant, fast-curing epoxy prepreg system.

On display at JEC World 2024, Mitsubishi Chemical Group’s prototype battery box top cover is designed for easy assembly and compatibility with a range of the company’s materials. Source | CW

New battery enclosure designs also continue to be developed, not only by automakers but by Tier 1 automotive suppliers and even materials suppliers aiming to showcase their technologies’ effectiveness in this type of application. For example, one recently covered by CW is materials supplier Mitsubishi Chemical Group’s (MCG, Tokyo, Japan) compression-molded, material-agnostic battery box top cover design debuted at the JEC World 2024 trade show in March. According to company representatives at the show, the design aims for easy assembly and compatibility with multiple MCG materials including bio-based or recycled materials, thermoset prepregs or thermoplastics.

Other battery box developments covered by CW include a vacuum-assisted wet compression molded design from Stellantis division CpK Interior Products (Corbyville, Ontario, Canada), a multi-material “toolbox” of options from Tier 1 Katcon (Monterrey, Mexico), a multi-material demonstrator from Continental Structural Plastics (now part of Teijin Automotive, Auburn Hills, Mich., U.S.) and a smart thermoplastic RTM process for a battery box cover demonstrator.

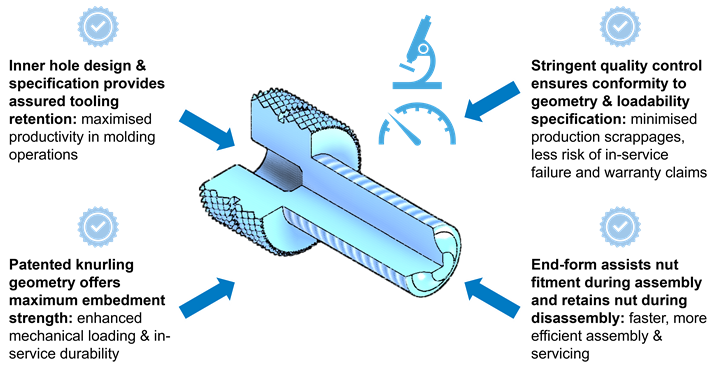

It’s worth noting that top and bottom covers aren’t the only potential applications for composites in the battery enclosure. Successful performance of a battery enclosure requires seamlessly designed fastening and assembly solutions. Bossard (Zug, Switzerland) contributed a column to CW detailing its work developing a novel fastening solution for meeting tight tolerances (and OEM and Tier supplier cost targets) in an EV truck battery enclosure application. The company used its knowledge of fasteners in composite materials to develop a new insert stud design that increased strength and durability, and reduced overall costs and tooling needs.

Pressure vessels for hydrogen power

EVs aren’t the only alternative fuel option being developed for road vehicles, especially in the heavy-duty truck market. Much development is also going into use of zero-emissions fuels like hydrogen (H2) and renewable natural gas (RNG) to decarbonize the transportation industry.

As reported in CW Senior Technical Editor Ginger Gardiner’s Pressure Vessels 2024 end market report, “the most mature and predominant storage systems for both of these fuels include Type 3 and Type 4 pressure vessels comprising carbon fiber/epoxy wrapped over an aluminum or plastic liner, respectively, using filament winding.” Read her full report for more of an in-depth look into this technology and developments. Follow CW’s Pressure Vessels page for the latest news updates in this market pertaining to H2 and RNG storage tanks for heavy-duty trucks, passenger vehicles, buses and more.

Aptera: Composites enabling a solar-powered vehicle design

In addition to battery-electric and hydrogen-powered vehicles, there are several concepts in development for solar-powered cars as an alternative to traditional gasoline and internal combustion engine (ICE) vehicles.

Aptera (Carlsbad, Calif., U.S.) is a startup developing an sEV featuring solar panels that charge while the vehicle is driving or parked. The debut production vehicle, called the Launch Edition, will have a range of 400 miles on one charge with approximately 700 watts of solar cells. The vehicle requires ultimate performance efficiency in its structures, leading to a carbon fiber composite body in carbon (fiber), or BinC. This structure is also said to be able to be recycled up to five times.

Aptera’s carbon fiber-reinforced polymer (CFRP) body at the assembly stage. The body in carbon (BinC) structural approach uses carbon fiber sheet molding compound (CF-SMC) techniques developed in collaboration with CPC Group to achieve high strength-to-weight ratios and scalability in production. Source | Aptera

In November 2022, Aptera signed an agreement with the C.P.C. Group (Modena, Italy) to produce these specialized composite bodies. The first composite pre-production parts were revealed in September 2023. In 2024, Aptera announced it was entering the United Arab Emirates market and that it had secured $33 million in new funding for its initial production phases.

CW Contributing Writer Stewart Mitchell had the chance to speak with Steve Fambro, one of Aptera’s co-founders, to talk about the sEV’s design and manufacture, targets for production and more. Read the full interview for more.

Thermoset and thermoplastic structural components

Regardless of the type of fuel system for the vehicle, OEMs continue to incrementally adopt composite structural components where they make sense, and to move toward more efficient, more automated composites processes to match the volumes possible with metal alternatives.

According to reporting from CW Contributing Writer Peggy Malnati, “Thermoset composites have a long history of use on passenger vehicles for semi-structural vertical and fully structural horizontal exterior body panels as well as chassis/monocoque elements.” Since the 1950s, when the Chevrolet Corvette first sported glass fiber-reinforced (GFRP) exterior panels, thermoset composite structural parts have evolved from hand layup to compression molding of sheet molding compound (SMC), which has expanded in use from body panels to structural pickup boxes, chassis components and EV battery boxes.

Injection molded, short glass fiber-reinforced thermoplastics debuted in the early 1980s on non-structural bumper fascia, followed by use in various vertical panels like fenders and, eventually, liftgates. According to Malnati, thermoplastic horizontal body panels with a Class A finish — like hoods, roofs and trunk lids — have been notoriously more difficult, though desirable for their light weight, high impact strength, and high-quality surface out of the tool, meaning less post-mold finishing is needed.

In 2023, Malnati wrote about an innovative horizontal thermoplastic sandwich panel technology developed by RLE International (Cologne, Germany), first used for interior bulkheads, then investigated in concepts for external roof panels and hoods.

RLE International developed an innovative, low-cost/low-pressure compression molding variant and thermoplastic sandwich panel technology that has been in production on the interior bulkhead (above) of a commercial vehicle since 2019. The technology is now being investigated to produce exterior roof panels and hoods. Source | SABIC

Also in thermoplastics, in fall 2023 polyolefins and biopolymers producer Braskem (Philadelphia, Pa., U.S.) announced a demonstrator beltline stiffener made with woven composite lattice reinforcements combining polypropylene (PP) sheets with unidirectional, fiber-reinforced composite tapes from Weav3D Inc. (Norcross, Ga., U.S.). Weav3D’s process, which produces thermoplastic composite lattice structures at high volumes for a variety of industries, is said to reduce part weight, costs and waste compared to a composite organosheet alternative.

In early 2024, the HyWaSand project showcased a demonstrator storage compartment flap for a truck interior, comprising a thermoplastic composite sandwich structure made with a fully automated thermoforming process. The project, which involved Germany-based partners Daimler Truck AG (Stuttgart), ElringKlinger AG (Stuttgart), ThermHex Waben GmbH (Halle), Edevis GmbH (Leinfelden-Echterdingen), the Fraunhofer Institute for Microstructure of Materials and Systems (IMWS, Halle) and Austria-based Engel Austria GmbH (Schwertberg), said the results were promising for producing lightweight, low-cost, high-volume interior components, and were looking into customer applications.

Also of note in recent years, in 2022 BMW Group (Munich, Germany) rolled out its newest battery-electric sports activity vehicle (SAV), the iX, featuring a “Carbon Cage” body frame that combines RTM’d braided preforming, fiber-reinforced thermoplastic injection molding, compression molding and metallics in a multi-material design that builds upon BMW’s previous composite strategies for the i3, i8 and 7-Series.

Carbon fiber wheels

Like structural and exterior components, lightweight carbon fiber composite or hybrid-metal composite wheels have long secured a place on high-performance, low-volume race vehicles, where their ultra-low weight helps shave time off a vehicle’s lap times.

In recent years, developments in composite or hybrid wheels for production vehicles have gained more attention. The first carbon fiber wheels to be fully commercialized for the automotive industry were those produced by Carbon Revolution (Waurn Ponds, Australia), introduced to the market in 2008. In 2015, Carbon Revolution introduced carbon fiber wheels for the Ford Mustang Shelby GT350R. At $15,000 per set, however, these wheels were not a good fit for higher volume vehicles.

Since then, a variety of automotive composites fabricators have been pursuing materials and process combinations that might allow carbon fiber wheels to compete — on cost and performance — with forged and cast aluminum wheels. These have included:

- Vision Wheel’s (Decatur, Ala., U.S.) wheel entry in 2021 combining A&P Technology (Cincinnati, Ohio, U.S.) braided fabric with IDI Composites (Noblesville, Ind., U.S.) for scaling up for performance vehicles and ultimately EVs.

- Bucci Composites’ (Faenza, Italy) 20-inch carbon fiber composite rims, made via high-pressure RTM (HP-RTM), launched in 2022 for the aftermarket sportscar/supercar segment.

- Carbon Revolution’s introduction of new wheels in 2023 targeting aftermarket sales for EVs and trucks.

- Hyundai’s (Seoul, Republic of Korea) debut in February 2024 of a concept carbon fiber hybrid wheel for its Ioniq 5 N NPXI vehicle. Developed with wheel manufacturer Dymag (Wiltshire, U.K.) and composites materials specialist Hankuk Carbon (Seoul), the bespoke wheel combines a carbon fiber composite outer rim with a precision-machined, five-spoke, forged metallic centerpiece.

This 21-inch, ~10-kilogram hybrid wheel, developed by Dymag in partnership with Hankuk Carbon, is part of an intensive development program by Hyundai. Source | Dymag and Hankuk Carbon

Recycled or bio-based materials

Beyond a focus on electrification, the automotive industry also continues to innovate toward more sustainable material solutions for many components, from natural fiber composites to bio-based resins, recyclability and more. This drive for sustainability could be soon mandated by legislation in some regions, such as the European Union’s (EU) proposed set of rules that would cover the entire vehicle life cycle from design to end of life (EOL) requiring, for example, minimum recyclability rates in the design of a vehicle, that 25% of the plastic in a vehicle be sourced from recycled material, and mandating recovery and reuse of certain components.

There are a variety of new developments in this field, including these covered over the past year by CW:

- Automotive technology supplier Forvia (Nanterre, France) has announced several initiatives for enabling more sustainable automotive manufacturing and design, including modular interiors concepts that reduce materials use and parts needed to assemble, use of recycled or bio-based materials and ramping up its hydrogen storage tank manufacture.

-

Forvia also launched an R&D division in Lyon, France in 2022, called Materi’Act, which aims to develop, produce and sell materials with up to 85% lower carbon footprint than traditional materials. This work includes development of resins with up to 90% recycled content, new versions of the company’s NAFILean hemp fiber/polypropylene products, and carbon fiber made from bio-based precursors and manufactured in less energy-intensive processes.

One goal of Materi’Act is to produce low carbon footprint carbon fiber made from bio-based precursor, as well as to produce fibers with a less energy-intensive process. Source | Forvia

- Under the project CIDER (“Circular product Design for automotive components made from Recycled and sustainable composite material”), resins supplier Arkema (Colombes, France) and its partners debuted an automotive door panel made from recycled fibers and Arkema’s recyclable Elium resin.

- Flax fiber supplier Bcomp’s (Fribourg, Switzerland) flax fiber/epoxy materials have been used on a variety of automotive exterior and interior parts, including recently the seats for Cupra’s (Barcelona, Spain) Born VZ EVs and bus A/C covers for automotive Tier 1 supplier Eberspächer (Esslingen, Germany).

- Optiplan GmbH (Oelsnitz, Germany) and resin supplier AOC (Schaffhausen, Germany) have collaborated to develop materials for automotive sandwich panels that combine Optiplan’s recycled PET sheets and AOC formulations derived from post-consumer PET waste.

- A consortium led by sustainable technology innovator Sonichem (Southampton, U.K.) is developing proprietary Sonichem ultrasound technology and the production of renewable, cost-effective alternatives to petrochemicals commonly used in the production of plastics, resins and composites within the automotive industry.

Sonichem’s U.K. initiative will work to convert biomass byproduct into lignin for automotive plastics, resins and composites. Source | Sonichem

Related Content

Honda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreRead Next

Composites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreComposites end markets: Industrial (2024)

The use of composites in industrial applications is increasing, driven by the need for higher performance and longer life, whether its parts for industrial machinery, EOAT components, corrosion-resistant equipment and more.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;width=70;height=70;mode=crop)