Green resins: Closer to maturity

As more players approach the market, R&D expands, but overall market growth in the composites arena is still slow but steady.

CW first covered bio-based resins in 2008, when the price of a barrel of oil topped US$110, making plant-based polymers look pretty good. We tackled the subject again in late 2011, when sustainable resins appeared ready for a breakthrough, noting significant investments by several market players in bio-resin processing facilities. It was a hot topic at that point, recalls Robert Moffit of Ashland Performance Materials (Dublin, OH, US), and was attracting a lot of attention and money (click on “Bio-composites update: Bio-based resins begin to grow" and/or "Green resins: Growing up," under "Editor's Picks" at top right).

What’s happened since? Fracking, the technology that enables extraction of oil and natural gas from tight shale formations, changed the picture, especially in the US, contributing to a steep decline in oil prices (currently,

“The drop in oil prices made petroleum-based monomers, such as olefins, much cheaper, and the green-based materials had trouble competing,” says Moffit. The result was one familiar to those active in the field of composites: “Cost has been the big influence, depressing the sales of the green products.”

That said, an ever-increasing push for sustainability and a reduced carbon footprint, driven especially by younger consumers coming into the marketplace, has helped maintain high interest in renewably sourced resins. Although they are not yet widely commercialized, green polymers nevertheless are being formulated and implemented in some surprising composites applications. “Bio-resins have been around for decades, and a low oil price won’t stop their development,” contends Dan Houston of Ford Motor Co.’s (Dearborn, MI, US) Plastics and Materials Sustainability group. “Bio-materials offer lightweighting opportunities better than any other products, and they’re not going away.” This article’s focus is on bio-based resins; watch for our story in 2016 on the growth of renewable bio-fibers and bio-fillers for composites.

A bit of bio background

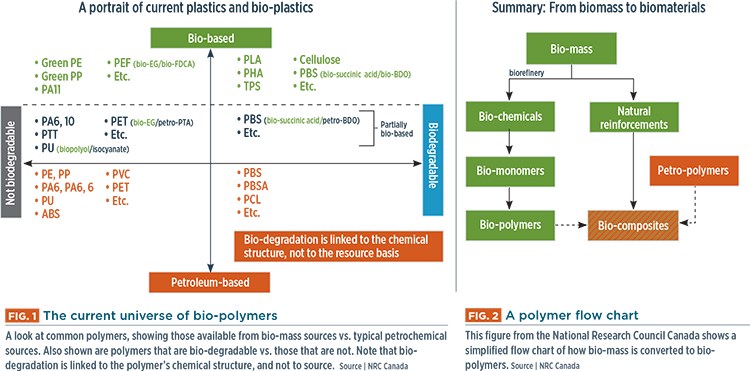

Bio-resins can be derived from a huge range of biological carbon sources. The current universe of bio-polymers, both degradable and non-degradable, is depicted in Fig. 1, at left. In each case, the biomass is broken down using adapted chemical processes in a bio-refinery to produce monomers that, in turn, can be polymerized to obtain bio-based polymers (see Fig. 2, at left). Dr. Karen Stoeffler, leader of the Polymer Bioproducts team at National Research Council Canada (NRC, Boucherville, QC, Canada), explains, “For example, fermentation of sugarcane molasses leads to bio-ethanol, which has exactly the same chemical formula and the same properties as ethanol derived from petroleum. With a conventional dehydration reaction, it’s converted to ethylene, which in turn is polymerized into 100% bio-based polyethylene, with exactly the same properties as petroleum-based polyethylene.” Biomass that does not impact the food chain is generally preferred.

Plant-based materials are more costly to process than a straight petrochemical, Braskemat least for now, because it typically takes a lot of plant matter to produce a bio-chemical compared to hydrocarbons. For example, at the 2013 Bioplastics: The Re-invention of Plastics conference (Las Vegas, March 4-6, 2013), James Kahn, commercial manager for Braskem America USA, the Philadelphia, PA, US branch of one of the world’s largest bio-refiners, Braskem S.A. (São Paulo, Brazil), acknowledged in an update on the then current state of bio-based polyethylene (PE), titled “Green PE: Value Proposition & Success in MarketPlace,” that to produce 1 MT of bio-PE requires approximately 28 MT of sugar cane converted to 2,400 liters of ethanol. In contrast, it’s been reported by the Indian Institute of Science, Centre for Ecological Sciences (Bangalore India) that 1 MT of conventional PE can be produced from 1.6 MT of crude oil. Further, although bio-refineries are certainly not new, they lack economy of scale, says Stoeffler: “The oil industry has been optimizing its processes for a century, but modern bio-refineries have only started working on the production of building blocks for polymers, particularly for plastics and composites, in the past 15 years. The processes are not yet necessarily optimized to ensure competitive costs.”

The cost premium inhibits the use of bio-resins in many composite applications, explains Moffit: “A bio-based resin, historically, has cost about 10% more than a petroleum-based resin, and as oil and petro-based raw material cost declines, this differential increases. Eight years ago, some bio-resins cost the same compared to petroleum-based equivalents. For green resins to really take off, we need better cost parity compared to petrochemical products.”

Despite these factors, bio-resin performance is proven. Researchers have routinely documented the properties of bio-based composites as equivalent to petrochemical-based composites. Composites industry consultant Louis Pilato (Bound Brook, NJ, US), a member of the American Chemical Society and the Society for the Advancement of Materials and Process Engineering (SAMPE), is bullish on bio-resin growth: “I’m seeing attractive polyamides, polyesters and polycarbonates emerging from bio-based building blocks.” Pilato notes a number of examples: Nylon 4/10, 6/10, and 10/10 for auto applications, Durabio polycarbonate from Mitsubishi Chemical and polybutylene succinate (PBS), heretofore available only from petrochemicals, is a very attractive biodegradable resin that could displace non-degradable PE.

Bio-based resins have definitely found a place in consumer applications where buyers are willing to pay a premium for sustainability. A case in point is Coca-Cola’s PlantBottle, introduced in 2009, which contains 30% bio-based polyethylene terephthalate (PET) derived from ethylene glycol from sugar cane molasses. Automotive OEMs are also actively researching use of bio-composites, particularly in interiors, in the quest for weight reduction to meet impending fuel-efficiency standards (see the “Green resins: Automotive research on the rise” Side Story at the end of this article or click on its title under "Editor's Picks"). Another driving force, says Moffit, is the Leadership in Engineering and Environmental Design (LEED) program of the US Green Building Council: “LEED is driving builders, architects, designers and others to search out lower-impact products and building methods, and more ‘transparent’ materials that use fewer synthetic chemicals, which is creating opportunities for alternative resins.”

The current marketplace: green polyols and esters

Composite resin producers typically buy bio-sourced chemicals as feedstocks to make their own products. In the US, several bio-refineries are in operation, among them Archer Daniels Midland Co.’s (Decatur, IL, US) propylene glycol (PG) facility, based on soybean and corn bio-mass. Others include Cargill’s BIOasis (Fort Dodge and Eddyville, IA, US and Blair, NE, US) and DuPont Tate & Lyle Bio Products Co. LLC (Louden, TN, US), which refine corn. Opened in mid-2013, Domtar Corp.’s (Montreal, QC, Canada) commercial-scale lignin separation plant in Plymouth, NC, is theDom first US-based facility of its type in more than 25 years. It produces trademarked BioChoice lignin (a complex organic polymer present in plant matter) using papermaking pulp waste as feedstock. And Brazil’s Braskem is a major supplier of bio-PE, based primarily on sugar cane. SABIC recently launched a portfolio of renewable polyolefins, including PE and polypropylene (PP) made from waste non-food vegetable oils and fats, at its production plant located in Geleen, The Netherlands.

Ashland’s Envirez unsaturated polyester resin (UPR), made from corn-based alcohols and soybean oil, was the first to market, in 2002, and was used initially in a program at John Deere (Moline, IL, US) for tractor body panels. Since then, Envirez has expanded into nearly all markets and manufacturing processes as a “drop-in” replacement for petrochemical UPRs, particularly for building and construction companies involved in the LEED building program.

Other resin suppliers followed, as CW reported in 2011, including Reichhold Inc. (Durham, NC, US). Reichhold’s technology manager Paul Henderson says that the company offers a range of green Envirolite UPR resins for laminating, casting, pultrusion and sheet molding compound (SMC)/bulk molding compound (BMC) formulations. Envirolite products are formulated from ethanol distilled from soybean oils and bio-derived glycols as well as recycled plastic waste streams. Henderson says that the sources of and supply chain for renewable content vary with market dynamics: “Our Envirolite 31325 resin for SMC/BMC and pultrusion contains 25% renewable content, and our 32167 resin for casting parts like countertops for LEED-related construction offers up to 20% renewable content. Big demand for bio-resins isn’t here yet, but it’s growing along with the overall composites market.”

Another early adopter was AOC Resins(Collierville, TN, US). AOC’s R&D director John McAlvin says that the company’s EkoTek line of UPRs continues to use feedstocks derived from soy and corn, and one product, H431-AKAG, has up to 42% renewable and/or recycled content: “Performance criteria are the same regardless of feedstock, so therefore the commercially available bio-based resins are designed to meet these same minimum mechanical properties and processing requirements.” McAlvin says that growth in bio-resins depends on cost parity with crude oil and natural gas-derived feedstock, but that AOC sees moderate and steady demand: “I believe that over time they will become more common, but are unlikely to completely displace traditional resins in composites in the near future.”

Since 2011, new players include Dixie Chemical Co. Inc. (Pasadena, TX, US). Dixie offers two lines, MAESO and MAELO, based on soybean oil and linseed oil feedstocks, respectively. Dixie’s development engineer Alexander Grous explains that while epoxidized linseed and soy oils have been around for years, Dixie’s versions are functionalized with maleic anhydride and other chemistries to incorporate reactive sites. The resins have properties comparable to typical UPRs, and like conventional resin systems, contain a reactive diluent, such as styrene, vinyl toluene or Dixie’s bio-based methacrylated fatty acid (MFA): “The typical formulation is 33% by weight reactive diluent. In systems using styrene and vinyl toluene, the bio-based content is about 65% by weight. However, when our MFA, which has a bio-based content of 60% itself, is used to replace styrene, the total bio-based content in the resin can be increased up to 85% by weight — a positive for sustainability.” Grous adds that, due to its linear structure, MFA also can increase resin flexibility and toughness, yet maintain low viscosity for processing.

Dixie has worked with Premix (North Kingsville, OH, US), now a part of the Engineered Composites business unit of A. Schulman Inc. (now LyondellBasell), on several MAESO- and MAELO-based SMC and BMC formulations and, Grous claims, “MAESO and MAELO in these molding compounds offer superior thickening profiles compared to hydrocarbon-based resins, and maintain equivalent physical performance with common unsaturated polyester systems.” Dixie says its bio-based resins are competitively priced with conventional commercial resin systems and believes customers will increasingly require renewably sourced resin products: “As building construction and transportation sectors continue to recover and grow, we expect strong growth for these applications,” Grous adds.

Eastman Machine Co. (Kingsport, TN, US) offers grades of cellulose esters that are renewably sourced from sustainably harvested softwood trees and cotton bio-mass, says Dr. Jingjing (Jean) Xu, a technology associate with Eastman. This “natural plastic” is based on cellulose acetate, first formulated back in 1865 and originally used as a film base for photography. Cellulose from bio sources is reacted with acetic anhydride to form cellulose acetate, which is then blended with suitable plasticizers and additives to form granules for thermoplastic processing. Eastman sells its thermoplastic cellulosic grade under the trademark Tenite.

Xu explains that Tenite is manufactured from 100% renewable softwood trees that are harvested according to sustainable forestry management practices: “For every pound of Tenite produced, approximately 40-50% by weight is renewable content.” She cites customer RKS Design’s (Thousand Oaks, CA, US) green guitar design, which combines Tenite with cellulose-based Thrive fibers from Weyerhaeuser (Federal Way, WA, US), to make sustainable electric guitars on which composites replace restricted fine hardwoods, such as Indian ebony and Brazilian rosewood (see photo at left, and learn more at the RKS Web site). Adds Xu, “Eastman has seen an increased interest in bio-based polymers in packaging, electronics and durable applications, and we believe this trend will continue.”

More green resins: epoxies and beyond

Brothers Desi and Rey Banatao started Entropy Resins (Hayward, CA, US), a fairly new entrant in the bio-resins arena, about 10 years ago to develop Earth-friendly materials for surfboards. The company’s Super Sap line of thermoset epoxy systems feature bio-based content ranging from 20-40% as measured by ASTM D 6866, and sourced from a variety of bio-based feedstocks. Says Desi Banatao, “We’ve designed our products to be drop-in replacements for existing hydrocarbon-based resins. We understand that our customers aren’t willing to trade off performance for environmental benefits, so our goal is to provide solutions that offer both.”

The company has experimented with many bio-based polymers, including those derived from sugar (sorbitol) and vegetable oil esters. And, explains Banatao, it continues to look for a 100% bio-based technology and ways to work it into the product portfolio. Although they admit that bio-resins still need greater economies of scale to compete on price in large-volume resin applications, Banatao says that in medium- to small-volume projects, they already can: “We also try to work with our customers to communicate the advantages of sustainable products with their consumers, which can help convert raw material premiums.” Entropy participates in the US Department of Agriculture’s (USDA) Biopreferred Labeling program, which sends an environmental benefit message. Entropy’s Super Sap products are used by sporting goods fabricators, including Niche Snowboards (Salt Lake City, UT, US) and Firewire Surfboards (Carlsbad, CA, US). See photos, at left.

Solvay (Brussels, Belgium) attracted press attention recently for its trademarked Epicerol bio-based, epichlorohydrin (ECH) epoxy, produced in a patented proprietary process using renewable glycerol, a by-product of bio-diesel and oleo-chemical production (including rapeseed oil). The company won a JEC Award at the recent JEC Asia conference in October for the resin, which was formulated as a drop-in replacement for a petrochemical-based ECH with equivalent part properties.

Solvay commissioned a lifecycle analysis (LCA) in order to benchmark Epicerol against ECH made with state-of-the-art petroleum-based processes. The LCA demonstrated that Epicerol’s overall environmental benefits, in comparison with propylene-based ECH, include a 57% reduction of non-renewable energy consumption and 61% reduction of global warming potential (GWP, defined as the sum of greenhouse gas emissions and biogenic CO2 capture). By incorporating 1 MT of Epicerol instead of propylene-based ECH, customers can reduce the footprint of their products by 2.56 MT of CO2 (equivalent), says Solvay. Epicerol was selected to fabricate the Punch One World Solar Challenge 2015 solar car by students from the University of Leuven in Belgium. The car incorporated carbon fiber prepregs impregnated with Epicerol BisA epoxy and a novolac resin hardener made from cashew nut shell liquid (CNSL) from Cardolite Corp(Ghent, Belgium and Newark, NJ, US), a specialist in CNSL-derived products.

Cardolite has been, arguably, the best-known supplier of CNSL-based epoxy curing agents, resins, diluents and “friction resins” used in brake linings, brake pads and clutch plates for many years. CNSL was developed in the 1920s from cashew plant sources in Nigeria, India and the Ivory Coast for brake lining applications and coatings, and later, as a chemical additive for epoxies. The nutshell liquid is decarboxylated and distilled to yield cardanol, a desirable alkylphenolic compound with high temperature-, chemical- and impact-resistance. Another supplier, London, UK-based composites distributor Elmira, offers a range of bio-based prepregs with glass or carbon fiber impregnated with CNSL, called Coral, which it says offers better impact strength and chemical resistance than hydrocarbon-based epoxy. Fully bio-based versions are available, with flax and cellulose fiber reinforcement. The materials are working their way into sporting goods applications, notably, a racing bicycle frame from Revolution Frames (Kent, UK).

Not to be left out, Covestro LLC (Leverkusen, Germany, formerly Bayer MaterialScience), and Reverdia, a joint venture between Royal DSM (Heerlen, The Netherlands) and Roquette Frères (Lestrem, France), recently announced an agreement to jointly develop and promote thermoplastic polyurethanes (TPU) based on renewable raw materials. Covestro will employ trademarked Biosuccinium, a succinic acid from Reverdia, for the production of its trademarked Desmopan-brand TPU for use in the footwear and consumer electronics industries, among others. Biosuccinium has been produced at commercial scale since 2012, using Reverdia’s patented low-pH yeast technology, and enables Covestro to capitalize on years of research, says the company. Covestro plans to expand its bio-based TPU production in Taiwan to industrial scale.

Data from Reverdia suggest a roughly 65% reduction in the carbon impact with succinic acid-based Desmopan parts, compared with products produced with petrochemicals. The bio-mass content of Desmopan TPU reportedly can be as high as 65%. “Our customers in the footwear and consumer electronics industries are constantly looking for new solutions to reduce their CO2 footprint, and bio-based TPU from Covestro is one such solution,” says Marius Wirtz, head of Covestro’s TPU business. “We are looking forward to working with Reverdia to bring these modern materials to the market.”

Meanwhile, Sicomin Epoxy Systems (Châteauneuf les Martigues, France) has produced its trademarked GreenPoxy resins for eight years, and has industrial projects that are now coming to fruition says the company. SR GreenPoxy 56 is a clear epoxy with more than 50% carbon content derived from plant and vegetable sources, while Surf Clear EVO is an epoxy dedicated to the surfboard market. The company won’t identify exact plant sources for its resin, and Sicomin’s export manager Marc Denjean says that its epoxies can be combined with a wide selection of hardeners (non-bio-based) to match specific processes, including hand layup, infusion, compression molding, or others: “In the months to come, we will be manufacturing other GreenPoxy resins suitable for a wider range of applications, and our goal is to develop a 100% bio-based carbon content epoxy in industrial quantities.” He adds that the price gap between bio-based and petroleum-based resin has gradually decreased, and is “directly quantity-related. We see demand growing for our GreenPoxy product.”

SR GreenPoxy 56 is being used by Archer Daniels Midland (ADM) (Brisbane, QL, Australia) to infuse sustainable cork laminate and flax fibers to create skateboards, which won a JEC Innovation award in 2014 in the sustainability category (see photo, at left).

Archer’s founder and designer Simon Heading says that he chose Sicomin’s GreenPoxy 56 “because it displays one of the highest bio-based contents and really complements the other sustainable resources used.” He adds that use of a bio-resin takes nothing away from ’board responsiveness: the skateboard has been tested by professional riders who are impressed with its technical performance.

Future growth?

Bioresins, and the bio-sourced chemicals to make them, are more readily available today and the market is expanding. Says Moffit, “Fabricators will move to bio-based resins because of customers that want sustainability ... especially in cases where bio-resins bring a specific performance property or an added value to the table.” Stoeffler cites data from nova-Institut (Hürth, Germany) that predicts a tripling of global bio-plastic production capacity between now and 2018, from ~2,000,000 MT to ~6,700,000 MT.

Entropy Resins’ Banatao adds, “Finding the balance between creating products that are beneficial for the environment, cost effective for customers and profitable for manufacturers is the hard work that we have ahead of us to help this segment of the industry grow.”

Related Content

Syensqo launches Swyft-Ply brand for electronics, smart devices

Multifunctional composites leverage traditional advanced material benefits while meeting specific industry manufacturing and performance requirements.

Read MoreTeijin lightweight materials enable VAIO portable displays

Teijin's Tenax TPCL and Panlite Sheet materials allow for the creation of complex, three-dimensional shapes in a single molding step.

Read MoreMCVE 3DFlaxtronics enables functional composites for printed electronics

The novel process produces intelligent, highly functional films embedded in flax fiber organosheets with a bio-sourced PA 10-10 resin to advance electronic parts and components development.

Read MoreCarbon Mobile, SABIC to develop, deploy advanced carbon fiber in connected devices

Collaboration aims to deliver the next generation of thinner, lighter, stronger and more sustainable composite materials used in consumer electronics and automotive industries.

Read MoreRead Next

Bio-Composites Update: Bio-Based Resins Begin to Grow

Substituting agricultural for fossil-based feedstocks in polymer resins is not new, but maturing technology now promises composites less dependent on petrochemicals for their performance.

Read MoreGreen resins: Growing up

High hurdles remain, but the push for sustainable sources of resin monomers is gaining momentum.

Read More