Green resins: Growing up

High hurdles remain, but the push for sustainable sources of resin monomers is gaining momentum.

The greening of the global economy, carbon footprint sensitivity, increased emphasis on sustainable systems, and the evolution of product lifecycle analysis have led many thermoset resin manufacturers away from the oil-and-gas wellhead and back to the farm. Indeed, resin feedstock derived from plants, just a novelty a few years ago when CT last explored this market, is now a full-fledged product line, and one that is apparently here to stay.

In the thermoset bio-resins market today, two drivers push expansion, but two hurdles restrain faster growth. All four are typical for a young market like this one and revolve around cost, technology and customer preference. The drivers are (1) increased demand from consumers and end-users for a sustainable and environmentally friendly resin, and (2) new refinery technology that can produce plant-based bio-chemicals for key resin monomers. The hurdles? One is the need for technology to produce plant-based bio-chemicals for the remaining resin monomers; the other is the hardest to overcome: cost. Since CT’s last report, however, the bio-resins push has gained some momentum. If the drivers keep driving, it appears to be just a matter of time before the hurdles fall.

A bio-resin is a resin that derives some or all of its constituent monomers from biological sources. Today’s sources are plant-based, usually corn or soybean by-products from bio-diesel fuel refinement. Other candidates include sugar cane, sugar beets, potatoes, lignocellulose, whey and algae. Corn and soybeans are appealing primarily because they are available in abundance. They are, for example the top two crops each year in the U.S. In 2011, farmers planted 92.3 million acres of corn and 75 million acres of soybeans.

Bio-resins have substantial appeal. They reduce dependence on petrochemicals, and their price volatility allows manufacturers who use them to promote a greener product. Further, they have a more favorable lifecycle profile than petrochemical-based materials. The trick so far has been to cost-effectively convert corn and soybean products into the monomers required to build a resin.

Making a sustainable monomer

Along these lines, the big news in the bio-resins market during the past few years was the development by agriculture supercompany Archer Daniels Midland (ADM) (ADM, Decatur, Ill.) of propylene glycol (PG) derived from plant-based by-products. Specifically, ADM developed a process that converts soybeans into glycerol and corn into sorbitol/dextrose. Through hydrogenolysis (decomposition via interaction with hydrogen), the glycerol and sorbitol/dextrose are converted into PG. So promising is the process that ADM opened a new facility in April of this year in Decatur, Ill., to produce 100,000 metric tonnes (more than 22 million lb) of PG each year.

All of this is important because PG, which historically has been derived only from petrochemical sources, is a major ingredient of unsaturated polyester resin (UPR). And, as noted by John McAlvin, R&D manager at resins manufacturer AOC Resins (Collierville, Tenn.), “The source of PG is irrelevant.” That is, PG from soybeans and corn is no different than PG from oil and gas. As a result, this new PG supply chain opens up a variety of green doors for resin manufacturers and their UPR customers.

This is the point, however, where the technological hurdle comes in. Although ADM earns kudos for its PG manufacturing process, it must be noted that the recipe for UPR also calls for several acids and anhydrides, as well as the much-debated styrene, all of which are still produced from petrochemical feedstocks. “There are no high-performance, plant-based monomers that can take the place of petrochemical-based styrene,” notes McAlvin. This means that a UPR with bio-based PG still relies on oil for its other ingredients and, thus, is only green-ish. For now.

Green resin pioneer

Many of the major thermoset resin manufacturers serving the composites industry now produce at least one type of UPR with PG derived from bio-based sources. The first to market with a bio-based UPR was Ashland, LLC (Columbus, Ohio), which introduced its Envirez line nine years ago and applied it first in a body panel for a John Deere tractor. Since then, the line has expanded to cover almost all manufacturing processes and end-markets, including construction, energy, automotive and solid surface. The bio-based content in the Envirez line ranges from 8 to 22 percent, depending on the application and intended manufacturing process.

Bob Moffitt, senior product manager at Ashland, says that each product in the Envirez line has been developed as a drop-in replacement for an all-petrochemical UPR and offers comparable mechanical properties in the finished part. He admits, however, that, in general, the company’s bio-based monomers make Envirez resins more expensive than their all-petrochemical cousins. This restricts the market for a bio-based UPR to customers whose preference for the green aspects of the resin outweigh the additional cost. This is particularly true of customers that manufacture composites for the construction market, where the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) program encourages use of recycled or bio-based materials. Here, Envirez has been applied mostly to solid surface products for kitchen and bath use (see photo, at right).

“Building and construction has a great driver in the LEED program,” says Moffitt. “It’s driven a great deal of interest in environmental awareness.” In fact, one Ashland customer, Campion Boats (Kelowna, British Columbia, Canada), publicly announced in 2010 its commitment to use Envirez UPRs for all its new boat construction, a decision expected to eliminate 100,000 lb (45.4 metric tonnes) of CO2 per annum from the environment.

AOC joined the bio-resins fray in 2010 with a line of UPRs in its EcoTek segment, which also includes styrene-free resins and resins that contain recycled chemical content. AOC’s UPRs range from 10 to 30 percent bio-content and are formulated for casting, cured-in-place pipe (CIPP), closed molding and open mold laminating. Like Ashland’s Envirez, EcoTek is designed as a drop-in replacement for traditional UPRs and offers comparable mechanicals.

AOC’s McAlvin agrees that the LEED program, via the construction market, is a major driver for the use of bio-resins. But McAlvin also believes that cost is the only factor that prevents wider use. “The general public, or the end-user, desires to have a green product, or what they perceive as a green product,” he says, “but, it’s rare that they are actually willing to pay for it.” Nonetheless, McAlvin reports that AOC has sold more than 20 million lb (9,070 metric tonnes) of EcoTek resin.

AOC uses renewable PG but also has experimented with other bio-based monomers, including ethanol and 1,3-propanediol. DuPont Tate & Lyle Bio Products Co. LLC (Loudon, Tenn.) has developed Susterra 1,3-propanediol from corn dextrose via fermentation. “Nothing performs as well as PG,” McAlvin notes, “so we don’t have much motivation to use other bio-derived diols. But we continue to look at alternatives.”

Reichhold LLC2 (Research Triangle Park, N.C.) has developed its own bio-derived resins, trade named ENVIROLITE. Paul Henderson, technology manager at Reichhold, says ENVIROLITE’s bio-source is proprietary, but its bio-content ranges from 12 to 35 percent. The resins are designed for sheet molding compound (SMC), bulk molding compound (BMC), pultrusion and cast-polymer applications. It’s also a drop-in replacement for traditional general-purpose UPR, one that reportedly offers comparable mechanicals. Henderson also cites the LEED program as a significant driver in this market, but he also points to the U.S. Department of Agriculture’s BioPreferred program, which promotes increased use of bio-based products.

Although most bio-resin activity focuses on UPR, there is one manufacturer that has developed a bio-based epoxy. EcoPoxy (Providence, R.I.) joined the composites market in 2009 and makes a line of epoxies, hardeners, topcoats and adhesives with a soy-based feedstock. Vincent Corsi, president, says the company is “trying to make folks aware of our product and its capabilities.” He says the UV-stable, odorless, no-VOC formula can be filament wound, is suitable for tooling use and has mechanical properties “in range with commonly used epoxies.” The company, Corsi says, is working on a high-temperature version and already has placed some product in marine applications. Other applications include aerospace, where Corsi says the company sees opportunities in aircraft repair. EcoPoxy’s annual capacity is 20 million lb (9,070 metric tonnes), and Corsi believes there is no reason to think that won’t increase over the next few years.

What the future holds

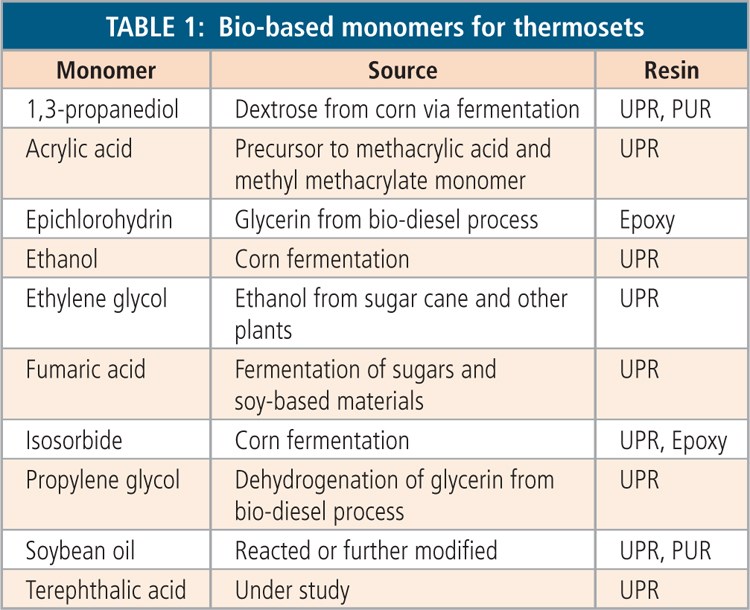

The final hurdle the bio-resins market faces is on the supply side. Despite ADM and DuPont Tate & Lyle’s advances with PG and 1,3-propanediol (respectively), there are still several UPR monomers available in production quantities only from petrochemical sources (see Table 1, at right). The goal, of course, is to develop bio-based sources for all the chemicals in the resin at production volumes and at prices that are competitive with petrochemical-based sources.

“Looking ahead, more acid streams based on bio-sources will be developed soon,” contends Ashland’s Moffitt. “Maleic anhydride may not be in five years,” he cautions, “but it’s reasonable to think it could be 10 years.”

The most problematic monomer, however, appears to be the common diluent styrene, a key component in thermoset crosslinking. All sources contacted for this article noted that there is currently no bio-based alternative to styrene. Further, the U.S. Department of Health and Human Services recently listed styrene as a possible human carcinogen, a decision that, if not rescinded, is likely to force suppliers to seek a short-term alternative.

Related Content

Manufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreJEC World 2024 highlights: Thermoplastic composites, CMC and novel processes

CW senior technical editor Ginger Gardiner discusses some of the developments and demonstrators shown at the industry’s largest composites exhibition and conference.

Read MoreRead Next

Bio-Resins Tackle Durable Applications

Bioplastics were initially created for single-use applications like packaging and hotel key and gift cards.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More