Natural fibers, new markets. In recent years, the landscape for natural fiber materials — materials, processes and end markets — has expanded beyond niche applications and R&D labs into increasingly larger-scale commercial projects. A few examples pictured include Formula 1 and other motorsports applications (top left image), skis and other sporting goods (top right), furniture and other interior applications (bottom left) and automotive interiors (bottom right). Photo Credit, left clockwise: Bcomp Ltd., Autonational and Lingrove

Natural fibers — derived from plant-based sources such as flax, hemp, jute or bamboo — have been used for thousands of years, but adoption of natural fiber-reinforced composites (NFC) as we currently define them has been much more recent, with commercial applications slowly emerging over the past decade.

Despite the sustainability appeal of a plant-based, renewable alternative to carbon or glass fiber, commercial adoption of natural fibers in composites has been relatively slow, due to industry challenges such as limited supply, variable fiber quality, limited mechanical performance in finished parts, differences in manufacturability and, depending on the material, higher material costs compared to fiberglass.

Still, progress is being made and the landscape has changed much over the past decade, especially in the area of flax fiber composites. According to Laurent Cazenave, communications officer at flax farming cooperative Terre de Lin (Saint-Pierre-le-Viger, France), “Ten years ago, flax was not widely used in industrial applications, [though] university studies highlighted the advantages of flax fiber, notably low density contributing to lightweight composite parts.”

Stemming from years of university and industry research, the first major use cases were sustainability-minded sporting goods manufacturers of products like tennis rackets and skis. Over time, various “players, projects and industrial successes have gradually given [NFCs] visibility and credibility,” Cazenave says.

Renewable fibers. The sustainability appeal of natural fiber composites from plant-based sources (like flax, pictured) is to replace synthetic materials like carbon or fiberglass with natural, renewable alternatives. Companies continue to make NFCs more sustainable still by localizing supply chains, reducing carbon footprint for manufacture and using bio-based resins in addition to natural fibers. Photo Credit: Bcomp Ltd.

In 2013, CW reported that biocomposites — both natural fibers and bio-based resins — were beginning to reach a level of commercialization and competitiveness with more traditional synthetic fiber products. At the time, cellulose fiber, which is processed from plant-derived pulp into uniform fibers, appeared to be the top contender in the natural fibers space. By CW’s 2016 feature on the same topic, improvements in performance and increased processing options had enabled flax fiber to rise as the natural fiber of choice for sporting goods applications and some automotive parts, with research in bamboo fibers showing promise.

Over the past two or three years, sustainability has become increasingly important. Once a niche interest, sustainability focused on emissions reduction is now being driven by standards. Governments, regulatory organizations, OEMs and consumers are demanding materials and process solutions that favor decarbonization.

One example related to materials is the EU’s 2022 European Green Deal which proposed several strategies that mandate EU-manufactured products ranging from construction materials to textiles be made from sustainable, recyclable or recycled materials.

This push for sustainability solutions, alongside supply chain and technical advancements in natural fiber materials, and processes to manufacture them into composites, are fueling R&D and commercial growth into new markets.

Natural fiber composites landscape

What does today’s NFC market look like? The Alliance for European Flax-Linen & Hemp (Paris, France) tracks data on flax and hemp supply, demand and applications from its member suppliers across Europe. Chantal Malingrey, director of marketing and communication, says that flax fibers are the most used natural fibers in composites today, though composites are still the smallest end market for these fibers overall, compared to the much more established fashion and textile industries. “In broad terms, we typically say the breakdown is 60% for fashion textiles, 30% for furniture textiles and 10% for technical applications, which includes composites.”

Still, Malingrey says that demand for natural fibers has been “increasing strongly since 2020. Whereas a few years ago, natural fibers were more of an R&D exercise, now we see fully developed products entering the market.”

These materials are growing in appeal not just because they come from a renewable source, but because of technical advantages in composites like lightweighting and vibration and noise damping, as well as aesthetic appeal. Vibration and noise damping specifically are broadening the appeal of NFCs in applications like automotive interior components, explains Nicolas Juillard, VP of technology and development at materials supplier Texonic Inc. (Saint-Jean-sur-Richelieu, Quebec, Canada). Texonic, which is part of the Textile Monterey Group (Drummondville, Quebec, Canada), has been working on optimizing natural fibers for use in composites at the R&D level with various partners since 2012, launching its first flax fiber fabric line in 2017.

According to Juillard, Texonic continues to be involved in R&D work to develop and optimize additional materials for use in NFCs — with a large focus on hemp fiber as well, which is also continuing to grow in supply and usage. As he explains it, one of the largest factors in choosing natural fiber materials is not necessarily the properties of one type of fiber over another, but localization of the supply. Currently, due in large part to climate, flax is produced most widely in Europe, while the market for hemp agriculture grows in North America.

“Technically, if you look at the literature, one type of [natural fiber] may have more resistance and one has higher modulus, but right now, talking about the differences isn’t the right approach, because none of them are totally optimized for use in composites. We have some good products now, but there’s still a lot of work to do. Choosing one over the other isn’t about processing or properties. It’s about supply chain, and which material you can get at which cost,” Juillard says.

Flax and hemp. A variety of plant-based fibers exist today, with the top two in the composites space being hemp and flax (pictured). The formats and processing capabilities of these materials continue to expand as more companies enter the arena of supplying NFC materials. Photo Credit: Bcomp Ltd.

Today, numerous suppliers have natural fiber materials marketed for composites use. Bcomp Ltd. (Fribourg, Switzerland) launched its first two products in 2012. The company’s powerRibs reinforcement grids and ampliTex dry fabrics and prepregs come in a range of compatibility options, including thermoplastics or thermoset resins, and processes including resin transfer molding (RTM), vacuum infusion, autoclave cure or compression molding.

The increase in interest in sustainability — and, importantly, the increase in high-quality flax and hemp fiber — has also led several mainstay suppliers of more traditional composite reinforcements, like fiberglass or carbon fiber, to begin offering natural fiber products.

For example, longtime reinforcements and resins supplier Hexcel (Stamford, Conn., U.S.) launched an NFC-specific, HexPly Nature Range in 2022, which includes woven and stitched flax fiber reinforcements with HexPly M49, M79-LT and M79.1-LT epoxy resins containing partially bio-derived content. The partially bio-based resins can also be used with traditional fiberglass or carbon fiber reinforcements, as well, notes Achim Fischereder, industrial marketing director at Hexcel.

Fischereder adds, “Increased sustainability and enhanced health and safety are both areas where our input raw materials can have a major impact. As the bio-derived chemical raw materials industry has continued to develop, Hexcel has moved to partially replace petrochemical-based epoxy content with bio-derived alternatives. A key target for us was to make sure that the excellent resin characteristics remain unchanged in the new Nature Range products, maintaining high mechanical performance and consistent processing properties while giving customers a more sustainable material option.”

Porcher Industries (Eclose-Badinières, France) and Saertex (Saerbeck, Germany) have also announced NFC offerings, with flax fiber/thermoplastic automotive-grade materials (Porcher) and flax fiber noncrimp fabrics (NCF) for marine and leisure applications (Saertex), each in partnership with flax supplier Terre de Lin. Terre de Lin, which claims to produce about 15% of the world’s flax supply, manages all stages of flax production for its 700-member farms, from seeds, to processing of the harvested flax, to manufacture of fibers specific for composites and other markets. Over the past decade, recognizing the value for its flax fibers within the composites industry, Terre de Lin has worked to offer flax fibers “adapted to the composites market,” Cazenave says, including controlled quality and development of a versatile range of rovings compatible with composites processes.

Wood-like composites. Lingrove’s ekoa materials are marketed as a flax fiber and plant-based resin alternative to wood for building and automotive interiors. Texonic, too, has developed a wood-like NFC for use in a variety of sporting goods, automotive, furniture applications and more. Photo Credit: Lingrove (top and middle) and Texonic (bottom)

A number of other companies have also entered this space, with the goal of making their specific end markets more sustainable. Lingrove (San Francisco, Calif., U.S.) launched its flax fiber and plant-based resin composite material, called ekoa, to replace wood in ukuleles and guitars in 2013, followed by sporting goods in 2014. It then worked to commercialize and industrialize ekoa for automotive interiors and the furnishings/interiors market.

Joe Luttwak, CEO at Lingrove, explains that architects, designers and executives in the interiors industry, for residences and commercial spaces, are increasingly “looking to decarbonize, and need high-performance products.” The company supplies prefabricated panels and surface veneers designed to provide the look of luxury wood. Applications of ekoa veneers include wall and ceiling panels and cabinetry/caseworks products, with flooring in development.

Lingrove has has worked to develop ekoa for automotive interiors for years, and is now targeting structural applications in the construction industry.

Also in the interiors space, Culture iN (Montaigu-Vendee, France) was founded in 2014 with the goal of producing sustainably sourced and processed textiles for furniture and luggage applications. Company founder David Ambs “wanted to change our living spaces” to be more focused on “sensorial appeal [and] respect for health and the environment,” explains Ronan Legrand, commercial director.

Interior applications. Culture iN’s flax fiber and plant-based PLA Varian product were developed specifically for more sustainable, aesthetically pleasing interior applications, like the pictured light fixture. Photo Credit: Culture iN

After several years of research, today the company’s core product is called Varian, a patented “composite thread” that weaves together flax fibers and plant-based PLA resin; it’s available in prepreg sheets or rolls. Made from materials sourced locally within France, Varian is customizable with choices of weave, finish and colors.

Furthermore, beyond natural fiber fabrics and tapes, short natural fibers are being developed as additives for use in plastic parts. For example, in 2022, Heartland (Detroit, Mich., U.S.) launched Imperium, its first hemp fiber additive product line. According to Jesse Henry, CEO and founder, the company began as a bio-based plastics company, but pivoted to hemp fiber additives in 2020, aiming to support customers with cost-effective, carbon-negative additives for use in thermoplastics. Heartland sells Imperium in powder and masterbatch format for use in injection molding, compression molding, extrusion, thermoforming and other types of plastic and rubber manufacturing.

“Our materials replace and augment commonly used plastic additives like fiberglass, talc and calcium carbonate. Our LCA [lifecycle assessment] gives brands and suppliers a predictable path to reduce the carbon footprint of the plastic they use everyday just by changing the additive and reducing the amount of plastic required to create the same product,” Henry says.

The product was also developed to help solve compatibility challenges for compounders. Typically, “Natural fibers don’t mix well with petroleum-based plastics,” Henry explains, but, “Imperium focuses on solving the bonding, dust, flammability, moisture and bulk density problems that plastic compounders face when working with natural fibers.” Over the next two years, the company plans to scale up its current production to meet growing demand.

Solving processing challenges

The number of NFC materials available has grown in recent years, but Texonic’s Juillard notes that one hurdle of NFC development continues to be limitations in processing compared to traditional fiber materials. Although natural fiber materials can be manufactured via a variety of processes, with common methods being prepreg layup/autoclave cure, compression molding and RTM, unique challenges remain.

One is that natural fibers absorb resin differently than other fiber types — “like sponges,” as Juillard describes. For this reason, he says a manufacturing process such as compression molding, RTM or other vacuum-assisted process that introduces pressure during consolidation is needed for optimum results. He adds, “If you try to do wet layup with no pressure, you won’t be able to control the resin-to-fiber ratio [with NFCs].”

Another challenge is sensitivity to temperature, especially as companies expand into new types of processing methods and resins. “At the same temperatures used to process carbon or glass fibers, natural fiber might start to char or decompose,” explains Christopher Oberste, president and chief engineer of composite lattice manufacturer WEAV3D Inc. (Norcross, Ga., U.S.).

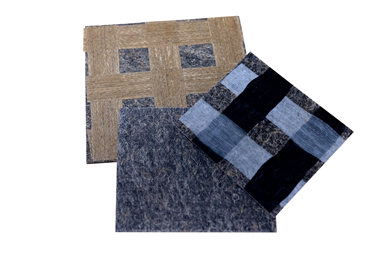

Reinforcing NFCs with lattices. WEAV3D Inc. produces carbon, fiberglass or natural fiber lattice reinforcements for a variety of materials. The company has recently entered the NFC space with its hemp and jute-reinforced NFC panels for automotive trunks and other interior applications. Photo Credit: WEAV3D Inc.

Oberste and WEAV3D are relatively new to working with NFCs. Originally, WEAV3D developed an automated weaving system that manufactures tunable thermoplastic composite lattices that can be used to reinforce a variety of materials, from concrete to automotive panels. The company began with carbon and glass fiber lattices, and has in recent years expanded its R&D work to include natural fiber lattices, which are used to reinforce NFC panels for the automotive market.

The automotive interiors industry already mass-produces compression-molded NFC panels for use in trunk floors and sidewalls, made primarily from hemp or jute in the form of nonwoven mats or long fibers. Typically, Oberste says, these panels are reinforced with injection overmolded glass fiber-reinforced ribs to add strength and stiffness where needed, but these ribs add unwanted weight and geometry to the panels. With an OEM partner, WEAV3D began an effort to replace these ribs with layers of carbon, glass or natural fiber thermoplastic composite lattices produced via WEAV3D’s automated system.

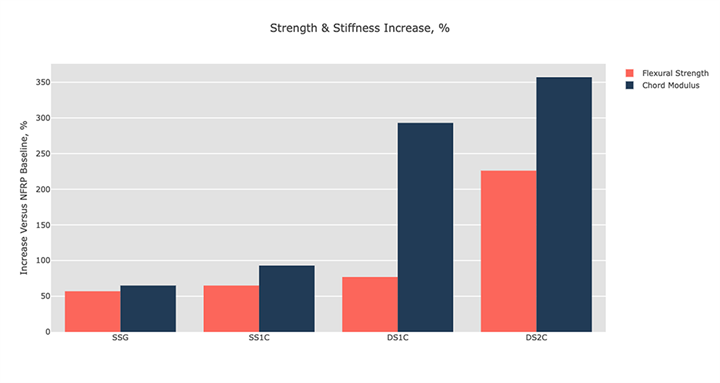

Adding strength and stiffness. WEAV3D’s lattices (DS1C, DS2C at right) are shown to increase flexural strength and stiffness on an NFC panel versus traditional rib reinforcement (SSG, SS1C at left). Photo Credit: WEAV3D Inc.

As WEAV3D worked in this area, it became clear that because thermoplastics are involved, the processing window was “very narrow,” Oberste explains. The melt temperature of the polypropylene commonly used in the company’s products is only 10 to 15°F lower than the top temperature the natural fibers can survive. The WEAV3D process is an adhesive-free technology that relies on heating the tape to the resin’s melt temperature in order to bond it to the material the lattice is being made to reinforce. Therefore, “the amount of heat and how fast [the tape] moves through the heating zone have to be very carefully controlled, so that you don’t have degradation of the fiber during processing.”

So far, despite these challenges, WEAV3D has seen positive results, showing that even a single, 0.3 to 0.5-millimeter lattice layer adds enough bending stiffness that the OEM could not only eliminate the ribbing but also make the overall panel thinner. WEAV3D demonstrated that it could produce a lattice-reinforced composite panel with the same mechanical properties as the original rib-reinforced panel, at about a 25% reduction in part mass. For added stiffness, additional layers can be added, and the tapes can be made from carbon, glass or natural fiber tapes as needed. WEAV3D continues to work with Tier 1 suppliers and OEMs on prototype panels and tests, aiming toward serial production.

Oberste notes that use of natural fiber tapes over the past year has been new for WEAV3D, involving a back-and-forth process with the tape supplier to optimize the materials and the processing. “The behavior of the tape is different, and it handles differently,” he explains. For example, natural fiber tapes are more prone to curling or twisting, but must consistently lie flat to go through the WEAV3D machine or other processes.

Filament winding with NFCs. Companies continue to expand the processing capabilities of NFCs from prepregs and infusion, such as Autonational's R&D work on filament winding with flax fiber/bio-based resin.

Photo Credit: Autonational

Other composites processes are also being adapted for use with NFCs, such as filament winding. For the past several years, the R&D branch of filament winding machinery supplier Autonational BV (IJlst, Netherlands) has been working on filament winding, prepreg processing and related machinery specifically geared toward the different mechanical requirements of manufacturing natural fiber composites with bio-based resins, explains Harry Fietje, sales manager at Autonational. This work started with collaboration with a team at the University of Amsterdam (Netherlands), which had created a plant-derived epoxy and were looking for an industry partner to test the material in a real process.

Backed by government funding, Autonational’s R&D team began working with the university team and the resulting spin-off company Plantics (Arnhem, Netherlands), which now sells its resins commercially. Adapting its filament winding machinery for natural fibers and bio-based resins required about a year and a half of trial and error, Fietje says, requiring many adjustments to the temperature and processing conditions.

Growing into commercial applications: From skis to aircraft interiors

What types of commercial applications are being manufactured with NFCs today? Many of the initial commercial NFC applications were sporting goods and furniture pieces, and these continue to be two leading market areas for the materials, but as raw material supply, natural fiber fabrics and processing technologies evolve, NFCs are increasingly used for applications in even higher-volume or higher-performance markets like automotive and even aerospace.

Starting with sporting goods. The vibration-damping properties of NFCs, plus their aesthetic appeal, contributed to the materials’ appearance early on in the market, particularly in sporting goods like skis. Photo Credit: Bcomp Ltd.

As CW reported in 2016, early commercial adopters of NFCs included ski and snowboard manufacturers adopting Bcomp flax fiber/epoxy materials, taking advantage of the lighter weight of flax fiber compared to fiberglass and the high vibration damping for a smoother ride. Today, Carlson reports that Bcomp still has a large share of business in sporting goods as well as motorsports applications. One recent example that CW reported on is an award-winning motorbike brake disc cover made in part with Bcomp’s flax fiber/epoxy.

Further, Hexcel’s Nature Range materials were first prototyped on Blizzard skis at the Tecnica Group Ski Excellence Center. “We expect that winter sports is going to grow into a key market for the Nature Range products, as it provides a challenging set of technical requirements, and successes there will really confirm that we’ve delivered a more sustainable prepreg solution that maintains the performance of our previous products,” notes Fischereder.

Within the recreational market, NFCs have also found a home on recreational and racing boats and yachts, starting with a number of prototypes. As one example, the CrossCall racing yacht, which won the Class40 World Championships in June 2022, was reported to be the first Class40 yacht to make significant use of flax fiber composites. Infused, hybrid flax/glass fabrics were used to manufacture the hull, cockpit and several other components of the boat.

Marine expansion. Some of the largest NFC parts manufactured to date have been for recreational and racing marine vessels, including infused decks and hulls. Hybrid fiberglass/natural fiber is also being used. Photo Credit: Bcomp Ltd.

Terre de Lin’s Cazenave also notes that several of the company’s partners have begun successfully replacing fiberglass with flax fiber composites in a variety of recreational and racing boats. One notable and large example is the 9-meter-wide, 18-meter-long flax fiber composite deck for the We Explore proof of concept catamaran, developed by Outremer shipyard, VPLP Design and Kairos Environnement.

Beyond high-performance marine and sports, the appealing sustainability aesthetic of natural fibers lends these materials to decorative interior items and furniture, as Lingrove and Culture iN have discovered with their product lines.

From furniture to floors. Interior commercial applications of NFCs range from tables (top) and chairs (bottom) to ceiling and floor panels. Photo Credit: Autonational (top) and Lingrove (bottom)

For example, Autonational’s first commercial filament winding line specifically for NFCs was developed for furniture manufacturer Vepa (Hoogeveen, Netherlands). The winder was first used to build prototypes of filament-wound table legs and chairs from flax fiber and bio-based epoxy, with the first commercial line delivered at the end of 2022.

After several initial prototypes of table legs and chairs done at Autonational’s R&D center, the commercial filament winding line was delivered to Vepa at the end of 2022.

Companies are also using NFCs in exterior applications in construction and infrastructure. The multinational design, engineering and architecture firm Arup (London, U.K.) won a JEC award in 2015 as part of the EU-funded BioBuild project, demonstrating a self-supporting facade system comprising 4 x 2.3-meter flax fabric/bioresin panels. The NFC panels reportedly reduce the embodied energy in façade systems by up to 50% compared to conventional construction materials with no increase in cost. More recently, Exel Composites (Vantaa, Finland) produced 6 kilometers of flax/bioresin profiles for a “fauna passage” viaduct in the Netherlands and three flax fiber/bioresin bridges will be completed by 2023 as part of the “Smart Circular Bridge” project. Luttwak notes these exterior architecture applications are an end goal of Lingrove’s. Autonational, too, has begun working on filament-wound NFC prototypes for outdoor structures like poles for road signs, with additional applications to come.

Wood-fiber composite, 3D printed house. This R&D prototype, announced in fall 2022, experiments with locally sourced wood fiber as a reinforcing material for a 3D-printed house structure to solve housing shortage issues. Photo Credit: UMaine ASCC

One of the latest, most ambitious exterior construction applications to date was announced in November 2022 by the University of Maine Advanced Structures and Composites Center (UMaine ASCC, Orono, Maine, U.S.), which fabricated a 600-square-foot, 3D-printed prototype house made entirely from bio-based resins reinforced with a locally sourced wood-based fiber. Called BioHome3D, the prototype was developed with funding from the U.S. Department of Energy (DOE) and in partnership with Oak Ridge National Laboratory (ORNL, Knoxville, Tenn., U.S.)

Mobility: A natural, next-level fit

Over the past few years, a lot of attention has been paid to the emergence of NFCs in automotive components. This has included body panels and hoods for a variety of supercars and racecars, as well as interior applications for commercial vehicles.

Automotive exteriors. Starting with motorsports and Formula 1, natural fibers continue to find a place in high-performance automotive exteriors and supercars. The bottom image shows the focus on flax fiber composites for BMW’s latest M4 GT4 race car, developed with partner Bcomp. Photo Credit: Bcomp Ltd.

Notably, in 2022 BMW Group’s investment arm iVentures acquired a stake in Bcomp, signaling a commitment to commercial uses of sustainable materials. In June 2022, BMW unveiled a new M4 GT4 racecar sporting Bcomp’s flax fiber materials in several body components. The company announced at the time that the switch to NFCs reduced greenhouse gas emissions for the vehicle production by up to 85% for those components, while improving vibration damping performance.

“Automotive is picking up, as the release date of large-scale serial production cars is getting close — these are projects that we have worked on together with OEMs for several years and that are now finally about to hit the consumer market,” Bcomp’s Carlson says.

According to WEAV3D’s Oberste, more sustainable, renewable and/or recyclable materials within automotive designs is no longer a niche idea, and companies are willing to pay a bit more to be able to claim a certain percentage of natural fiber or other sustainable materials within a vehicle. “There are several different approaches the industry is taking to ‘sustainable’ content — natural fibers is one option within that,” he says.

Oberste sees the prototyping work WEAV3D has done with lattice-reinforced NFC panels as the first step toward use of WEAV3D’s lattices for automotive applications. “The OEMs [we’ve worked with] are interested in the idea of whether [this technology] could strengthen the natural fiber panels to the point where other types of reinforcements in the assembly could be eliminated as well as the ribbing, such as brackets or stiffening plates, and therefore reducing weight and part count in the overall assembly.”

In automotive interiors, a variety of companies are beginning to get involved — and some have been in the space for many years. For example, global automotive supplier Faurecia (Nanterre, France), part of the Forvia Group, has been working on automotive interiors for decades and announced a number of new technologies in 2022. The company aims to reduce the carbon footprint of its materials by 87% by 2030 across several of its divisions, with a focus on sustainable materials.

This includes the company’s NAFILean products, a hemp fiber-based, injection moldable material first launched in 2011 for components like instrument panels. The company also offers natural fiber-reinforced polypropylene (NFPP) products that can be compression molded and combined with other materials like recycled carbon fiber. New product lines and serial applications for NAFILean and NFPP are reported to be underway.

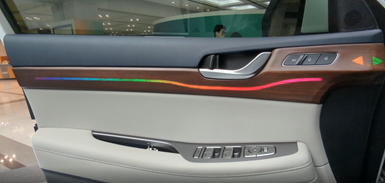

Automotive interiors. From trunk panels to visual interior components like those pictured, the vibration damping properties of NFCs serve automotive interiors well while meeting automotive OEM goals for increased use of sustainable materials. The bottom image shows Lingrove’s ekoa materials in use on a color-changing visual doorspear on the Hyundai Palisade concept vehicle. Photo Credit: Lingrove

Also making recent headlines is Lingrove’s ekoa product, enabling the color-changing, interactive doorspear component inside Hyundai’s Palisade concept vehicle. Similarly, in 2022, Cobra Advanced Composites (CAC, Chonburi, Thailand) launched a line of exterior and interior finish components made from flax fiber prepregs.

Even further, NFCs in the mobility space may some day soon take to the skies, transitioning into aircraft interiors applications. Aeroflax, an aerospace-grade flax fiber/bio-based resin product developed by Lufthansa Technik (Hamburg, Germany) with Bcomp’s ampliTex and powerRibs flax fiber reinforcements, is said to be at technology readiness level (TRL) 5 or 6, with the potential to increase sustainability and reduce weight in aircraft ceiling panels, door frame linings and more.

Challenges and goals

The market for NFCs has come a long way in the past 10 years, but efforts continue to ready the natural fiber supply chain, materials and processes for more widespread adoption by manufacturers.

Bcomp’s Carlson says, “For suppliers of natural fiber reinforcements, the market is relatively immature and developing as we speak. There are so many factors that must come together: Combining expertise in natural fibers with the industrial knowledge to scale, the technical knowledge to develop a high-performance product and the commercial capacity to take it to the market, and convincing markets with high inertia to change and high entry barriers to try something new.”

Malingrey of the Alliance for European Flax-Linen & Hemp agrees, noting that scientifically driven datasets on both the environmental and technical advantages of flax and hemp fiber composites are needed to truly prove out their value in the market and allow for established guidelines on their use.

Next step: NFCs in aircraft? Several companies and R&D products are working toward use of natural fibers with aerospace-grade resins for qualification in aircraft interiors. This concept image uses Culture iN’s Varian flax fiber-based composite material. Photo Credit: Culture iN

The supply chain for flax and hemp themselves also continues to grow, but as with any agricultural product, it can be somewhat volatile. And though materials suppliers agree that the quality of the product has come a long way in recent years, measurement of that quality and standardization are still ongoing endeavors.

To this end, Malingrey says the Alliance has released an open-source, downloadable LCA for studying the environmental impact of flax fibers grown and scutched in western Europe. All fiber suppliers in the study were part of the Alliance’s European Flax certification and use the European Commission’s Product Environmental Footprint (PEF) approach. Malingrey notes that additional mapping and data collection projects are in progress.

“In the same way that other high-end industries use quality standards, the Alliance engages the flax and linen sector in the application of traceability and transparency procedures. This is one of the key strategic commitments to the composites sector,” she says.

Lingrove’s Luttwak adds that localizing the supply chain is of vital importance, particularly for materials suppliers that currently reside in areas where flax and hemp are not grown.

Next steps in sustainability: Bio-based resins, thermoplastics, recyclability

The choice to adopt flax or hemp over synthetic or petroleum-based fibers is a step toward increased sustainability, but natural fibers alone are not enough to truly make a product sustainable. Today, many NFCs are made from traditional resins like epoxy.

As Fietje of Autonational notes, to be effective, the ideal supply chain would involve natural fibers with bio-based resins derived from plant sources, plus an end of life (EOL) solution that allows the part or its original components to be recycled for another use.

Multiple suppliers are working on bio-based resins for use with natural fibers, including Hexcel. Fischereder says, “In the future, we believe that bio-derived epoxy content, in addition to equivalent mechanical performance, will not just be offered as an option. It will start to become the baseline and a must-have to proceed with material qualification.” For Hexcel, this means working on new, bio-derived versions of HexPly resin systems, which are currently undergoing certification by TÜV.

What about an NFC part’s EOL? In general, several recycling options for composites exist, at various levels of commercialization. For example: Mechanical recycling, involving the shredding of entire parts into small pieces that can be reused for injection molding or another purpose; pyrolysis or thermolysis, where heat is introduced to a part until the resin is burned off, leaving a reusable fiber behind; or solvolysis, which uses some type of chemical process to separate a resin from its original fibers.

Much of the work done in composites recycling focuses on recovering and reusing higher-performance, higher-cost carbon fiber, begging the questions: Are lower-cost, renewable NFCs worth recycling? Can they survive the same processes as carbon fiber, with high enough properties to reuse? These considerations are still being worked out. As Hexcel’s Fischereder notes, new applications for recycled NFCs are also an important part of the conversation. With a field as new as NFCs, both demand for recycled NFCs and supply are also still immature.

Carlson explains that for Bcomp’s flax fiber/epoxy parts, thermal energy recovery is currently the best option available. This involves incinerating the part at its EOL in a process that recovers and uses the heat from the incineration for another purpose, such as generating electricity or capturing the heat for use in houses.

Several suppliers, including Bcomp and Terre de Lin’s manufacturing branch TDL Technique, are also working on natural fiber materials that are suited for use with thermoplastic resin systems. Carlson notes that as more thermoplastic-based NFCs are developed, recycling will likely become more viable, as thermoplastics can be heated, softened and reshaped via injection molding or extrusion.

Additional efforts are ongoing at the R&D level. For example, Fietje reports that Autonational and its partner Plantics are working on a pilot recycling system using steam to separate fibers and resins — specifically with the mechanical requirements of NFCs and bio-based resins in mind.

Along with solving these challenges, in the near term, suppliers aim to scale up their production capacity, expand their product ranges, and penetrate further into new markets and increasingly large-scale applications.

One of Bcomp’s goals is to qualify its flax fiber materials for use in rail and interior aircraft applications, which means developing higher-performance products that can pass stringent fire tests. “Our goal is to help decarbonize mobility; our impact increases as we reach into even larger markets,” Carlson says.

Ultimately, there is still much opportunity for growth in both technology and adoption of NFCs, but the past few years have solidified these as an option for sustainable manufacturing across a variety of end markets.

.jpg;width=70;height=70;mode=crop)