Alternative energy growth creating secular demand for composites

Alternative energy sources, such as solar, wind, and geothermal, are finally emerging as contenders alongside our primary electric-power-producing fossil fuels, natural gas and coal (but not oil), primarily because these technologies are ready for widespread distribution and adoption, based on average pricing for electricity.

The 2006 World Energy Outlook report by the International Energy Assn.

(IEA) stated that solar, wind, ocean and geothermal power technologies

will account for just over 9 percent of global power generation by

2030. That does not sound like much of an energy revolution — until you

consider that 9 percent of total global power generation in 2030 will

be on the order of 1 billion megawatt hours. A second, more recent

United Nations Environmental Programme (UNEP) study entitled Global

Environment Outlook: Environment for Development (GEO-4) predicted even

higher percentages for alternative energy, perhaps as much as 23

percent, by 2030. A third report from IEA concerning carbon emissions

has estimated that a global investment of $45 trillion (USD) in

alternatives will be needed by 2050 to attain the 50 percent reduction

in carbon emissions suggested by the Intergovernmental Panel on Climate

Change. Alternative energy is now a viable, sustainable industry with

interesting financial implications for advanced composites.

Alternative energy sources, such as solar, wind, and geothermal, are

finally emerging as contenders alongside our primary

electric-power-producing fossil fuels, natural gas and coal (but not

oil), primarily because these technologies are ready for widespread

distribution and adoption, based on average pricing for electricity. To

help these alternatives compete in the growing energy marketplace,

governments in some areas of the world, at least, are offering

significant incentives that make investments in alternative energy

attractive. Germany and Japan, for example, have funded developmental

programs in solar energy that have been largely successful. China,

simply based on need, is bankrolling various government investments in

alternative energy, as are Italy and Spain. In the U.S., the growth of

alternative energy sources, particularly wind power, is strong thanks

to individual state renewable portfolio standards. Yet the federal

government continues to drag its feet on long-term extensions of the

solar investment tax credit (ITC) and the wind/geothermal production

tax credit (PTC) — both of which are set to expire in December of this

year.

So where do advanced composites fit into this burgeoning

market? Composite materials are important components in several of the

alternative energy subsectors, primarily wind power and compressed

natural gas, and soon will assume a greater role in automotive and

transportation applications.

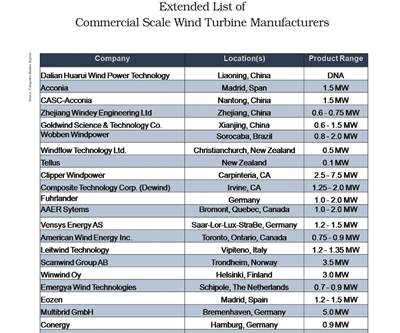

Wind power growth continued in 2007

with 20 gigawatts (GW) of new installations in 2007, according to the

Global Wind Energy Coun-cil (Brussels, Belgium), with the U.S. leading

the way at an estimated 5.2 GW installed. The price to produce

electricity from wind is a bit higher (5.5 to 7.5 cents per kilowatt

hour) than fossil fuel “grid pricing,” which is estimated at 2 to 4

cents per kilowatt hour for coal. (Consumers in the U.S. pay, on

average, about $0.15/kWh.) That is why the soon-to-expire PTC — a

2-cent incentive (30 percent of a producer’s average cost) — is so very

important to sustained growth in the U.S. As the public’s desire for

clean energy is coupled with the need for energy independence, the

financial viability of wind projects is an important factor for further

deployment, and composite materials offer a compelling solution for

increasing energy efficiency and reducing the cost of energy as well.

Wind power is a well-understood, mature technology, and increasing the

scale of turbines up to perhaps 5 MW is one of the best methods to

increase efficiency, reduce costs, and achieve that as yet elusive

point of “grid parity,” whereby the costs of produced electricity from

wind power and from fossil fuels are equal.

OEMs are able to

increase turbine size and capacity because the use of advanced

composites makes it practical to build the much longer rotor blades

they require. Using a combination of fiberglass and carbon fiber,

blades built to lengths of up to 50m/164 ft are lighter and stronger

than all-glass blades, thus increasing turbine efficiency and reducing

the cost to implement wind power.

Natural gas is a cleaner

alternative to coal and oil, but a lingering issue for natural gas is

that much of the known reserves are “stranded” or located far from

existing infrastructure and pipelines. At least one major new

application, still under development, would transport natural gas to

market in large composite storage cylinders on purpose-built ships.

Carbon fiber demand driven by this application could approach 2,000

metric tonnes (more than 4.4 million lb) in 2008. Another major

application that could spur demand for natural gas storage cylinders is

natural gas-powered transportation vehicles, which have begun to gain

some market acceptance.

A third application for composites in

relation to alternative energy is the introduction of carbon fiber into

automotive vehicle parts for any type of vehicle, whether conventional,

electric or hybrid. Lightweight composites could reduce weight by as

much as 30 percent when compared to steel, thus increasing fuel mileage

without commensurate reductions in safety. But, as many of you well

know, material pricing, fabrication and tooling remain large

impediments to achieving a mass-production scale.

Additional

applications for composites still in the research and development stage

include hydrogen fuel storage vessels, fuel cell components, electrical

transmission lines, flywheel technology, tubing and piping for

geothermal directional drilling, solar panel support structures and

wave/ocean power components. Many of these R&D projects might never

see commercial adoption, yet the focus on and investment in alternative

energy will continue to propel novel applications for composites.

The 625 percent increase in investment in alternative energy

technologies from the 2001 estimate of $714 million to $5.2 billion in

2007 signals long-term, secular growth in the industry. I estimate that

the annual use of carbon fiber related to alternative energy

applications could approach 18,150 metric tonnes (40 million lb) by

2010, producing nearly $650 million in revenue. In the same time frame,

annual figures for fiberglass could reach almost 226,800 metric tonnes (500 million lb), with

revenue of $1.5 billion in revenue for fiberglass, by 2010.

Without question, the continued penetration of composites technology

into the alternative energy industry is stimulating rapid — and

increasingly stable and sustainable — growth in the demand for

materials and manufactured components from the advanced composites

industry.

Brian Yerger covers

the alternative energy industry for Jesup & Lamont and publishes

from the Mid Atlantic regional office in Wilmington, Del. He joined the

company’s research department in 2007, after 15 years on Wall Street in

sales, trading and investment banking. Yerger holds a BS in business

administration from the University of Delaware. Frequently quoted in

Barron’s, Bloomberg, BusinessWeek, Forbes and the Wall Street Journal. A presenting expert at forums presented by CFA Society of

Philadelphia and COMPOSITESWORLD Conferences, he is a Chartered

Financial Analyst (CFA)™ charterholder and a member of the CFA Society

of Philadelphia, holding the following series registrations: 7, 63, 65,

86 and 87.

Related Content

Hexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreUpdate: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

Read MoreRead Next

Wind turbine blades: Big and getting bigger

Two decades of technical and market development has made this once marginal application a global giant and one of the world’s largest markets for composites.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;maxWidth=300;quality=90)