Composites Business Index 49.6: Virtually flat since July

Steve Kline, the director of market intelligence for Gardner Business Media Inc. (Cincinnati, Ohio), the parent company and publisher of Composites Technology magazine, reviews the Composites Business Index for September and October 2014

Although September’s U.S. Composites Business Index, 50.2, indicated a slight overall expansion, the industry remained flat for a fourth month. The rate of change was a mere 2.4 percent, the slowest month-over-month growth since August 2013.

New orders in the U.S. grew for a tenth consecutive month, at a rate virtually unchanged for three months. Production expanded for a ninth straight month, at a rate that ticked up after slowing since June. Backlogs contracted for the fourth month in a row, but remained 2.5 percent higher than one year earlier. Its annual growth rate — above 10 percent for four straight months — decelerated for the first time in 2014 but still strongly signaled that capacity utilization and capital equipment investment will increase throughout 2015. Employment growth accelerated and, for a second month, exports contracted at their fastest rate in CBI history. Supplier deliveries lengthened, as they had done at an accelerating rate since June.

Material prices continued to increase, but at their slowest rate of 2014. Prices received were up for a sixth month — their longest sustained increase since summer 2012 and the highest level reached since June 2012. After falling significantly for two months, future business expectations rebounded sharply.

Larger facilities (250+ employees) continued to see exceptional growth, and the growth rate accelerated as it had in previous months, mid-sized plants contracted for the first time since December 2013 and plants with 19 or fewer employees contracted for a third month and at their second fastest rate since November 2013.

Regionally, the U.S. West was the best performer for a second month, and the Southeast was up for the first time since May. Contraction in the Northeast and North Central – East was moderate but accelerated in the North Central.

Future capital spending plans contracted at a rate that slowed for a third straight month. Although the annual rate of change was still growing, it did so at its slowest rate during the preceding year.

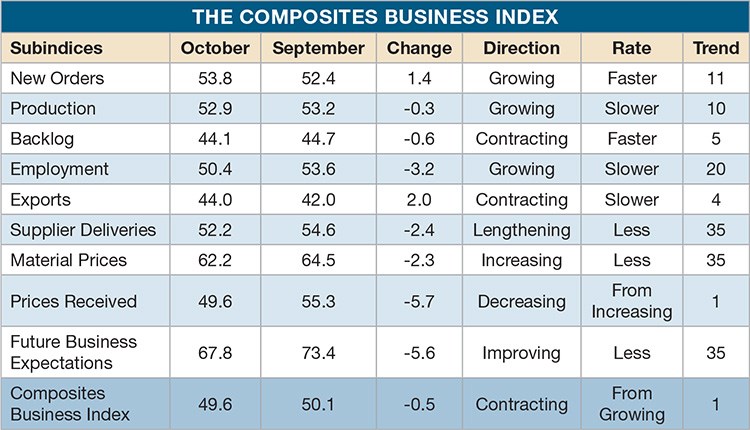

At 49.6 for October, the CBI continued its bounce between moderate growth and contraction, which began in July. Although the Index had been flat for four months, the month-over-month rate of change contracted for the first time since August 2013.

New orders grew for the eleventh consecutive month at a rate that had slowed somewhat the four previous months. Production expanded for a tenth month at a rate that had slowed since June, but remained virtually unchanged for a third month. Backlogs contracted for a fifth month in a row, running 1.3 percent below the backlog index of one year earlier. Its annual growth rate had been above 10 percent for five straight months. Although it slowed for a second month, it was a strong sign that capacity utilization and capital equipment investment will increase at least into second quarter 2015. Employment continued to grow but its increase had been relatively weak three of the previous four months. Exports continued to contract significantly because of the rising dollar. Supplier deliveries lengthened again, but at their slowest rate since November 2013.

Material prices had increased at slower rates since June and were at their lowest since December 2013. Prices received fell, marginally, for the first time since March. Future business expectations fell back to a September 2013 low.

Facilities with more than 50 employees expanded but at a rate nearly 10 points lower — the prime reason the CBI moved from growth to contraction. Fabricators with fewer than 50 employees contracted at a slower rate than in September. For a second month, only two regions expanded. The West was the best performer and was the only one to grow in three consecutive months. The North Central – West showed the only other growth while the Northeast was flat and the North Central – East and Southeast both contracted significantly.

Future capital spending plans contracted, but at a slower rate for a fourth straight month. Although the annual rate of change was still up, it was growing at its slowest rate since the CBI began.

Read Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)