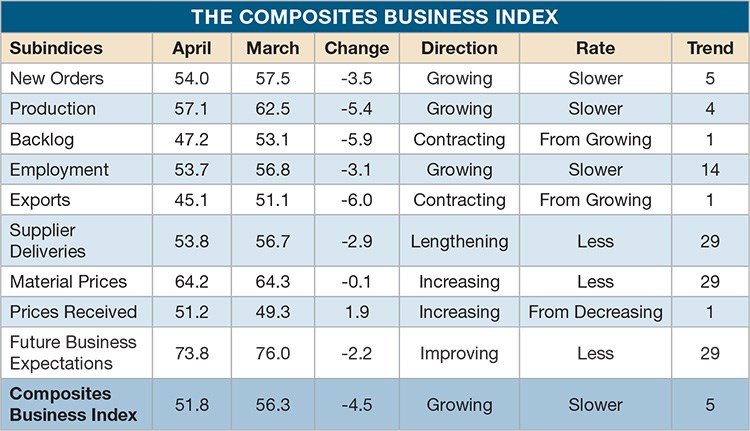

Composites Business Index 51.8: Growth rate cools

Gardner Business Media's director of market intelligence Steve Kline, Jr., charts the Composites Business Index for March and April 2014.

n March, the U.S. Composites Business Index reached a recent high of 56.3, and grew at its fastest rate since March 2012. The Index was 8.7 percent higher than in March 2013, and it was the seventh month in a row that it was higher than in the same month the year before.

New orders grew for the fourth straight month. Production expanded for the third consecutive month, reaching its fastest rate in nearly two years. Backlogs grew at an accelerating rate in the first three months of 2014, indicating that capacity utilization and capital spending should increase all this year. Employment had increased for 13 months, and the hiring rate picked up sharply. Exports grew for the first time, and supplier deliveries lengthened at their fastest rate, since April 2012. Material prices increased again, but at a noticeably slower rate than in February. Prices received, however, contracted for the second time in five months. Future business expectations fell slightly, but was still strong and near its highest levels since the CBI began (December 2011).

The CBI was up sharply for facilities with 20+ employees, and at a rate as high as at any time in CBI history. But fabricators with 19 or fewer employees contracted after two “up” months.

For the first time, all U.S. regions grew in the same month. The East North Central and Pacific regions grew fastest in March and the Pacific grew for the sixth consecutive month.

After contracting significantly in February, future capital spending plans increased 16.3 percent compared to March 2013.

April’s CBI of 51.8, lengthened the growth string to the fifth straight month and the sixth time in the previous seven months. Compared to one year ago, the index was up 2.2 percent. This was the eighth consecutive month the index was higher than it was one year earlier. The annual rate of change had accelerated for three months, but it was also the CBI’s lowest showing in 2014.

Every subindex contributed to the slower rate: New orders grew for the fifth straight month, but the rate had slowed significantly since its January peak. Production had expanded for four straight months but at its slowest rate in 2014. Backlogs contracted for the first time this year but were still 6.5 percent higher than they were one year earlier. The annual rate of change in backlogs continued to accelerate, indicating higher capacity utilization and capital spending for the remainder of 2014. Employment, for two months, increased at a faster rate than at any time since August 2012. After growing in March, exports contracted significantly in April. Supplier deliveries lengthened at a noticeably slower rate but continued a trend begun in October 2013.

Material prices increased at the March rate, and material prices continued to increase at a significantly faster rate than in 2013. Prices received increased slightly in April after decreasing in March. Future business expectations remained high, despite falling in the previous two months.

A prime cause of April’s noticeably slower growth was the change in business conditions at mid-size fabricators (50 to 249 employees). After growing at significant rates for some time, they saw sharp contraction in April. For those with 100 to 249 employees, the overall index fell nearly 20 points. The largest fabricators saw their growth rate dip, but this slower rate was counterbalanced by faster growth at plants with 20 to 49 employees. Those with fewer than 20 employees contracted at a rate similar to that in March.

Four U.S. regions grew in April. The North Central – East grew at its fastest rate for the second month in a row, having grown for seven straight months. The Northeast, Southeast and West followed, the latter growing for the ninth month in the past 10. Only the North Central – West contracted, ending three months of growth.

Future capital spending plans had been above $1,000,000 in five of the previous six months. Compared to one year ago, April’s spending plans subindex was up 9.1 percent. Although the annual rate of change was noticeably lower than it was from November to January, it had grown at an accelerating rate since January.

Read Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)