Composites Business Index 50.1: Three straight months of growth

Steve Kline, Jr. , director of market intelligence at Gardner Business Media (Cincinnati, Ohio) updates the Composites Business Index.

In April, the Composites Business Index (CBI) of 50.7 indicated continued growth, but at a slower rate than in March (51.6). New orders grew for the fourth month, but also at a slower rate — one of the most significant reasons the overall rate slowed in April. Production grew for the fourth month, and its rate accelerated each month. Slowing new orders growth combined with the accelerating growth in production is probably why backlogs contracted faster in March and April, and it is another significant reason the composites industry slowed in April. Employment grew for the third month in the past four. Exports continued to contract as the dollar remained relatively strong against world currencies. Supplier deliveries, which had lengthened at a steadily increasing rate since October 2012, lengthened in April at their slowest rate since November 2012.

Material prices were still increasing, but at a much slower rate than in February. Prices received contracted for the first time since November 2012. Increasing material prices, decreasing prices received, slightly slower new order growth and increasing employment put pressure on profits. Also, declining prices received and an accelerating contraction in backlogs indicated excess capacity at composite manufacturers. Future business expectations continued to improve and reached their highest level since June 2012.

Throughout the first four months of 2013, facilities with more than 50 employees grew at a significant rate. But in April facilities with fewer than 50 employees began to contract again, which is the primary reason April’s growth rate slowed.

The East South Central, Pacific and West North Central regions grew in March and April, and New England and the West South Central posted growth in April. But the Middle Atlantic and South Atlantic moved from growth to contraction, and the East North Central and Mountain regions contracted again.

Future capital spending plans remained strong. In April, expected spending for the next 12 months was roughly 10 percent above the historical average.

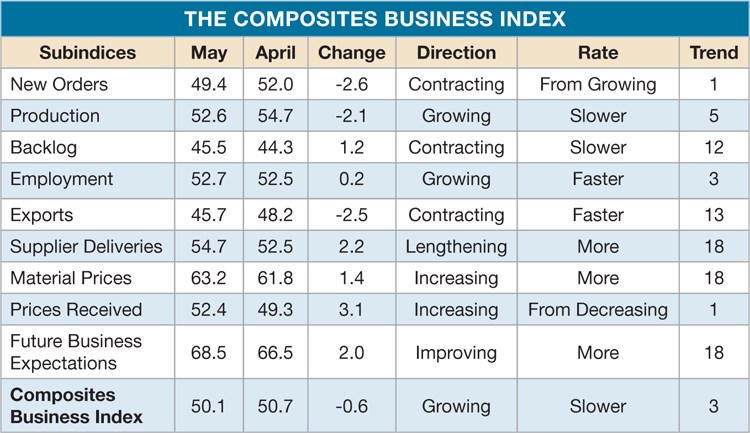

In May, the CBI of 50.1, indicated that business activity in the composites industry grew for the third consecutive month. However, the rate of growth had slowed each month.

New orders contracted for the first time in four months. A slide in the new order growth rate over three months was the most significant reason the CBI grew more slowly during that period. Production, however, grew for the fifth month and employment was on the rise at a consistent rate for three months. Supplier deliveries lengthened at their second fastest rate since October 2012. Backlogs continued to contract, which they have done since June 2012. Exports also continued a prolonged contraction. These two subindices held back what could otherwise have been significant growth.

Material prices continued to increase. Prices received increased in May after decreasing in April. However, the rate of growth in prices received was much lower than the rate of growth in material prices. Future business expectations, however, continued to improve; they hit their highest level since May 2012.

April’s bifurcation in performance between facilities with more than 50 employees and facilities with fewer than 50 employees continued in May.

The West North Central grew for the third straight month and was the second fastest growing region in May. The South Atlantic and West South Central had grown in three of the past four months. The East North Central region started growing after contracting for the previous three months. After growing in four of the previous five months, the East South Central was flat in May. Both the New England and Pacific regions began to contract in May. The Middle Atlantic had contracted in three of the past four months. And the Mountain region showed contraction for the third consecutive month.

Although future capital spending plans in May were at their second lowest level of 2013, they were still slightly above the historical average.

Read Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)