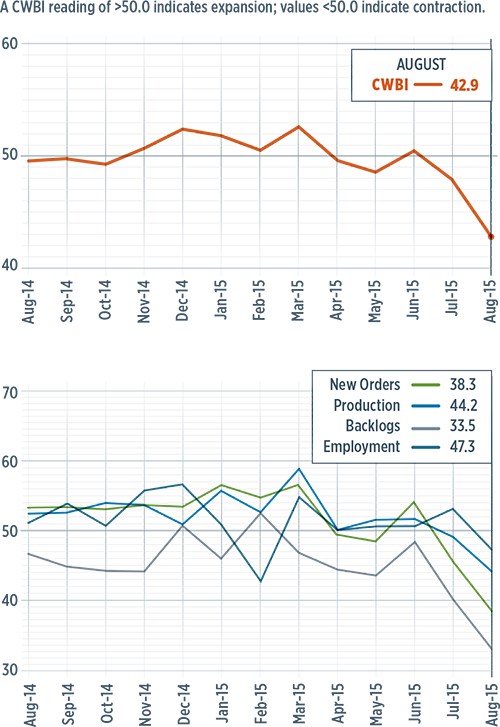

CW Business Index at 42.9 – Lowest since December 2012

Steve Kline, Jr., the director of market intelligence for Gardner Business Media Inc. (Cincinnati, OH, US), the publisher of CompositesWorld magazine, presents the CompositesWorld Business Index for the US composites industry through August 2015.

With a reading of 42.9, the CompositesWorld Business Index for August showed that the US composites industry had contracted for the fourth time in five months. Further, the rate of contraction had accelerated in June, July and August. And the Index fell to its lowest level in August since December 2012. Compared with one year earlier, the Index had contracted for eight consecutive months.

New orders contracted in August for a second month. The drop in that subindex was so steep that in August, it fell to its lowest level since the CWBI survey began in December 2011. Likewise, the production subindex had contracted two months in a row but its decline wasn’t as sharp. Because production had shown relatively greater strength than new orders, however, the backlog subindex plunged. In August, backlogs contracted at their fastest rate since the survey began. The trend in backlogs indicates that factory capacity utilization will fall heading into 2016. Employment contracted for the first time since February 2013. Because of the strong dollar, exports continued to contract. And in August, supplier deliveries continued to lengthen at about the average rate for 2015.

After going up at a steadily accelerating rate, the increase in material prices slowed in August. The rate, in fact, was below the rate of increase for 2013 and 2014. Prices received increased for the second month in a row. However, the rate of increase was minimal. Future business expectations had been trending lower since February of this year, and they hit their lowest level in August since October 2014. In August, expectations fell below their average level for the first time since October 2014.

The subindices at manufacturing plants of all sizes were below 50.0 in August. Plants with more than 250 employees performed significantly better than the other categories, however: the subindex for this largest facilities category was just under 50.0 at 49.4. All of the other plant sizes had posted numbers of 45.0 or less. Fabricators with fewer than 20 employees contracted for the sixth straight month. Companies with 50-99 employees contracted for the fourth time in five months. Plants with 100-249 employees contracted for the second time in four months. Facilities with 20-49 employees have contracted every month but two during the past 12 months.

All regions in the US contracted in August, too. The North Central-East contracted at the slowest rate, with an subindex of 47.7. This was the second month in a row this region contracted. The North Central-West contracted at a similar rate. It had contracted in two of the preceding three months. The subindex in the South Central dropped to 44.0 from 60.4 in July month. The Southeast contracted for the first time since February of this year. Both the West and the Northeast had an subindex below 40.0 in August.

Despite the negative trends in the August data, future capital spending plans for the 12-month period ending in August actually increased significantly. In fact, the month’s future capital spending plans figures were nearly double the July numbers, putting that category at about the average level recorded since December 2011. Compared with one year earlier, future spending plans increased 21.2% — the first month-over-month increase since June 2014.

Related Content

Plant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MorePlant tour: Spirit AeroSystems, Belfast, Northern Ireland, U.K.

Purpose-built facility employs resin transfer infusion (RTI) and assembly technology to manufacture today’s composite A220 wings, and prepares for future new programs and production ramp-ups.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)