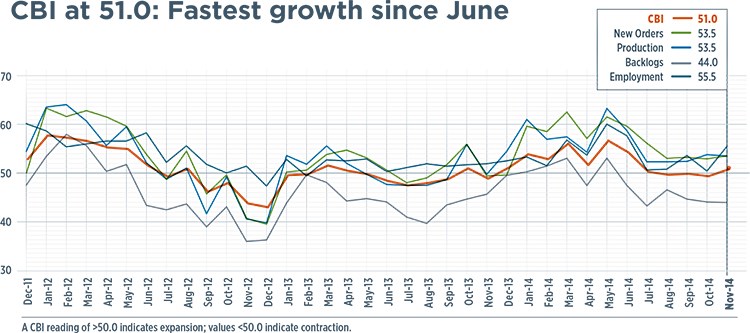

CW Business Index at 51.0: Fastest growth since June

Gardner Business Media's director of market intelligence Steve Kline, Jr., presents the CW Business Index for November 2014.

With a reading of 51.0, the CompositesWorld Business Index for November 2014 was up from October’s reading of 49.6, and showed that the composites industry in the United States had expanded for the second time in 3 months. The industry had been bouncing between moderate growth and contraction since July. Although the index had been relatively flat for five months, the month-over-month rate of change had grown in 4 of those 5 months. The annual rate of growth had decelerated for 3 months, but in November, the industry was still growing at a decent rate.

New orders in the US were up, again, for a 12th consecutive month at a rate of increase that had remained fairly constant for 5 months in a row. The production subindex showed expansion for the 11th month. Although its rate of expansion had slowed sharply in the May-August timeframe, it had remained virtually unchanged during the previous 4 months. Backlogs continued to contract at nearly their fastest rate since the fall of 2013. Compared to one year earlier, the backlog index had contracted for 2 months. Annually, the rate of growth in the backlog index fell below 10% for the first time since May 2014. As was true in October, the solid growth in its annual rate of change in November was a good indication that capacity utilization and capital equipment investment will increase into the second quarter of 2015. Employment continued to grow, increasing at its fastest rate since June, after rebounding in October from relatively weak growth in 3 of the previous 4 months. Exports continued to contract but at a rate noticeably slower than that seen in October, a significant drop attributable to the rising US dollar. US supplier deliveries continued to lengthen at a fairly steady rate after falling, in October, to its slowest rate since November 2013.

Through October, material prices in the US had increased at a rate that had been slowing since June 2014. In November, that index reached its lowest level since September 2013. Prices received were flat in November after falling, marginally, for the first time since March 2014. Future business expectations recorded a big jump after declining in October to a low point last recorded in September 2013. Expectations have been on wild up-and-down swings since June.

US composite manufacturing facilities with more than 50 employees continued to expand at a decent rate in November after posting an October growth rate nearly 10 points lower than in September — the prime reason the overall CBI moved from growth to contraction in October. Fabricators with 20-49 employees, however, contracted for the 3rd month in a row. Although facilities with 1-19 employees contracted for a 5th month, November was easily the slowest contraction.

Regionally in November, the US West was the best performer for a 4th consecutive month and was the only region to grow in all of the 4 preceding months. The Northeast and Southeast also grew in November. The North Central – East and North Central – West had contracted, for the most part, since July 2014.

Future capital spending plans in November were above US$1 million for the first time since June 2014. And, it was the first time the month-over-month rate of change had grown during that same period. Although the annual rate of change was still growing, it was growing at its slowest rate since the CBI began in December 2011.

Read Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)