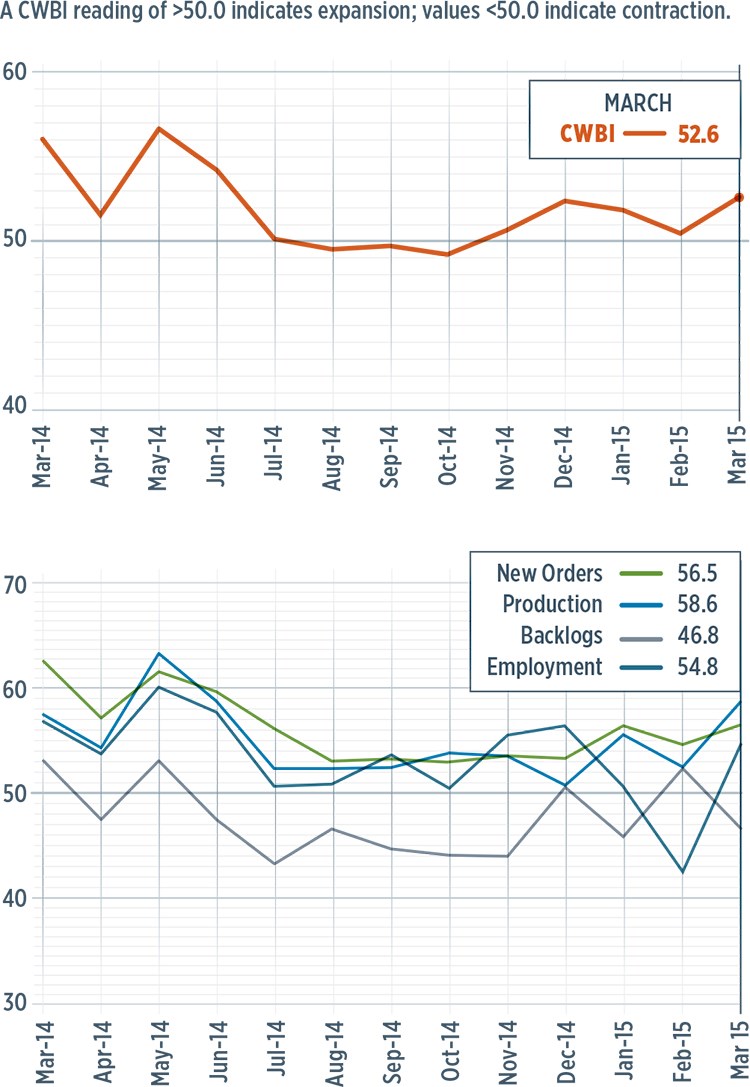

CW Business Index at 52.6 – Fastest growth since June 2014

Gardner Business Media Inc.'s director of market intelligence, Steve Kline, Jr., reports the CompositesWorld Business Index for March 2015.

An overall reading of 52.6 in the March 2015 CompositesWorld Business Index showed that the US composites industry expanded for the fifth straight month. And, the Index reached its highest level since June 2014. However, compared with one year earlier, the Index had contracted for three months. So, although the industry had been growing and the growth rate was picking up, according to the March index, the industry was growing at a slower rate than it had during the same period in 2014.

New orders in the US increased for the 16th consecutive month. That subindex had increased steadily since July 2014 and had reached its highest level since June 2014. Production expanded for the 15th month in a row in March. The rate of expansion had increased dramatically since November 2014. Backlogs contracted for a third straight month and for the ninth time in the preceding 10 months. Compared with one year earlier, backlogs had contracted for three straight months. The annual trend indicated that capacity utilization had peaked. However, the trend in backlogs could soon change. In March, employment had increased for 25 consecutive months and the rate of increase had been accelerating since May 2014. Exports continued to contract due to the relatively strong dollar. Supplier deliveries continued to lengthen, but they did so at nearly their slowest rate in 15 months.

While US material prices were still increasing in March, the rate of increase had declined dramatically since May 2014. In fact, the rate of increase was at its slowest since July 2012. On the other hand, prices received had been increasing at a generally accelerating rate since November 2014. The net effect, going forward, should be improved profitability at composites fabricating facilities. Future business expectations in March were down from February, but the general trend in expectations had been up significantly since August 2014.

As a group, US-based composites fabrication plants with 20 or more employees saw improved business conditions in March. Plants with 100-249 employees had the most dramatic improvement as their subindex jumped to 63.0 from 50.1. Facilities with 20-49 employees improved to 55.1 from 47.1, while plants with 50-99 employees also moved to expansion from contraction, although the increase was much smaller. Facilities with 19-or-fewer employees contracted for the ninth time in 10 months.

Regionally, The US Northeast and North Central – East expanded at significant rates in March after contracting the previous month. The North Central – West expanded for the fourth month in a row, but the rate of expansion was quite modest in March. The West region contracted for the first time since August 2013.

Compared with one year earlier, future capital spending plans contracted for the seventh time in nine months. In March, the rate of change resulted in the fastest contraction since the CW Business Index was first recorded in December 2011. The annual rate of change itself had contracted, by April 1, in three of the four preceding months.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)