Why are suppliers morphing into fabricators? Part II

In the second part of this two-part examination of this significant trend, CT managing editor Mike Musselman posts the results of a survey on the subject.

Last issue, in this space, we observed that materials suppliers and distributors — purveyors of not just resin, core and fabric, but tooling, molding compounds and other items necessary to the production of finished composite components in many end-markets — are venturing, in greater numbers, into parts manufacturing. Either directly or through subsidiaries, they are electing, at least to a degree, to compete with their customers. (To read the commentary, click on its title under "Editor's Picks" at top right.) At its end, CT asked: Where does that leave the suppliers’ customers — composite parts manufacturers?

To find out, CT asked a select group of readers — suppliers/distributors and parts fabricators — to participate in an online survey. A total of 8,621 survey invitations were sent out on Wednesday, April 9. As of April 21, 2014, 104 surveys were returned for a 1.2 percent rate of response. Respondees each represented one or more of the major markets served by the composites industry and the group included businesses of every size, from 1- to 10-employee shops through plants that employ 100 or more.

Survey says ....

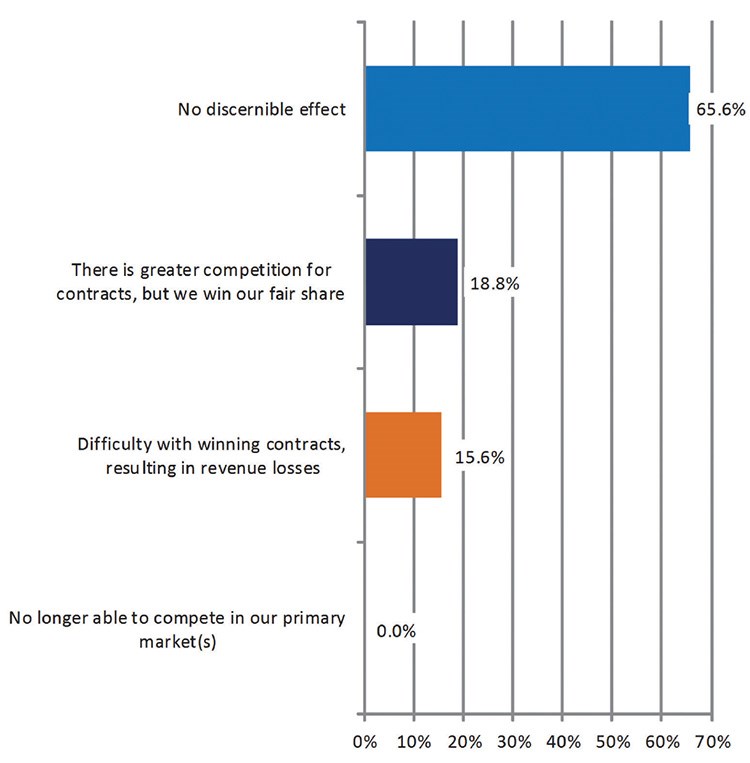

Survey results indicate the trend is growing and likely will continue to do so. But, as the graph in Fig. 1 (at top left) shows, those who manufacture composite parts, for the most part, say their businesses are currently unaffected by the trend. However, 18.8 percent say that the entry of suppliers/distributors into part manufacturing has increased competition for contracts, and 15.6 percent say that they’ve experienced greater difficulty in winning contracts, with the result that business revenue is down.

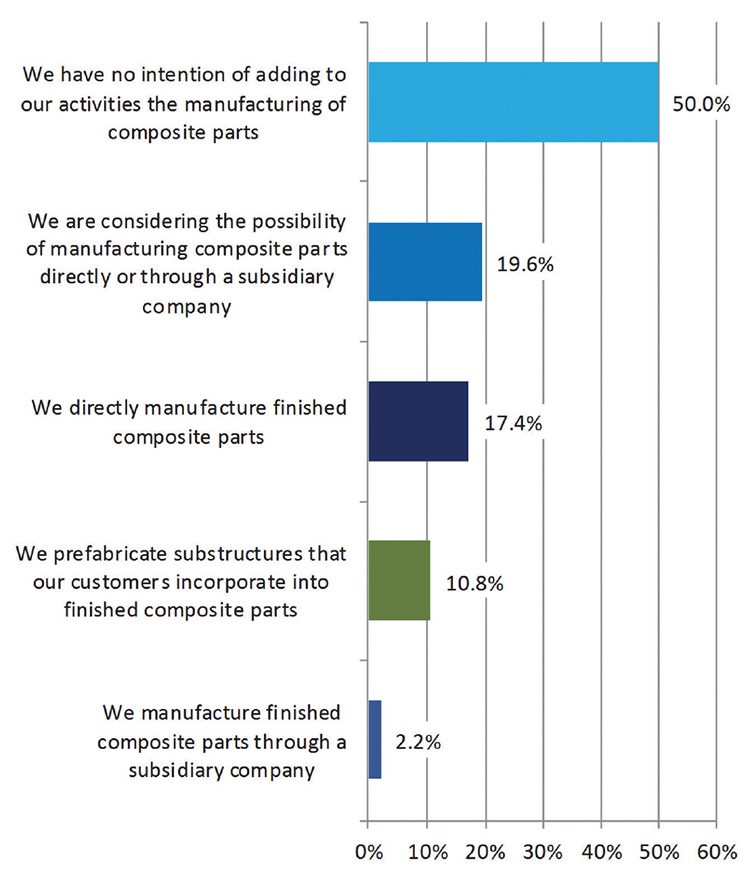

Exactly half the suppliers/distributors who responded told CT that they currently have no intention of adding part manufacture to their range of business activities (see Fig. 2). But nearly 20 percent said they were considering the manufacture of finished parts, either directly or through a subsidiary. Today, more than 17 percent already manufacture finished parts directly and another 2.2 percent say they do so through a subsidiary. An additional 10 percent provide premaunfactured substructures to part fabricators. Put that all together and we also see that fully 50 percent of suppliers and distributors are, today, either engaged in or considering the manufacture of substructures and/or finished parts.

When we asked the same group to give us a peek at their short-term futures (see Fig. 3), almost 60 percent said they anticipate no change in their current approach, but almost 25 percent intend to manufacture parts (directly or through a subsidiary) and 2.2 percent said that they will move from prefabricated-substructures manufacturing to making finished parts.

These data harmonize with the anecdotal evidence from survey respondees who also contacted CT with comments about the trend. “Your editorial … gave a great account of the state of things,” commented Brett McAteer, the director of marketing and communications at Aonix Advanced Materials Corp. (Ottawa, Ontario, Canada). He noted that materials advances in thermoplastics, for example, “have outpaced the developments on the molding side of the business.” Aonix responded by developing proprietary molding systems to guarantee material/machine compatibility, rather than to mold the actual parts. “Aonix works with OEMs and end-users and with suppliers, in fact, to get our UltraMaterials specified. Then we offer the molders (wherever they may sit in the supply chain) an integrated solution — blanks, machines and support …. We see this approach as one that can actually protect the molders’ place in the supply chain while allowing suppliers to focus on what they do best,” he adds.

Retired from Röhm Tech, the U.S. marketing arm of ROHA- CELL foam manufacturer Röhm GmbH (Sontheim/Brenz, Germany; ROHACELL is now produced in the U.S. by Magnolia, Ark.-based Evonik Foams), Donald J. Loundy observes that in the diverse and still quickly evolving composites industry, “smaller companies, frequently operated by their founders, often have narrow visions of their role in the overall market. They are reluctant, uncomfortable to expand those visions, thus limiting their ability to adapt and grow with changing technologies and market demands.” Given that reality, he suggests, “maybe developers of new materials or methods are forced to bypass those further along the chain in order to move those developments into the market.”

Michael J. Cichon, director of product marketing at TenCate Advanced Composites USA Inc. (Morgan Hill, Calif.), agrees that suppliers offer added value to customers if they can also be an enabler of a materials technology, especially “if the subcontractor level does not have the skills or knowledge of emerging technologies, and the technology is shifting, then perhaps the faster and more direct way to market could be offering fabricated parts.” But Cichon warns that the obvious conflict of interest might, sooner or later, hinder progress. “I wonder if there is a limit to how far a material supplier can go with fabrication given both the obvious competitive issues with customers and the reality of the investments needed for capital and personnel to run a successful fabrication business?” he asks.

CT’s survey data, however, point to a third option, that of supplier/distributor/fabricator collaborations. Almost 29 percent of those surveyed said they are exploring such possibilities: 13.1 percent see a partnership or joint venture in their future, and 2.4 percent see a merger with, or acquisition by, a supplier in their sights. Both groups saw these moves as “essential if we are to remain in business.” Further, more than 10 percent of parts fabricators “welcome the opportunity to outsource previously inhouse functions to our suppliers.” Notably, only 28 percent of them said this trend has no significance or impact on their businesses. The rest said it had import to varying degrees, with 46 percent indicating moderate to significant impact.

Out of the game for more than a decade, Jeff McClelland, who retired from Dexter Corp. (Bay Point, Calif.) when its resin and adhesive divisions were absorbed by Henkel Corp. in 2000, contends that the supplier-cum-manufacturer phenomenon is “nothing new.” Although vertical integration is more prevalent today, “it was alive and well several decades ago,” he affirms. “The ‘issue’ has been around for a long time and appears to be alive, well and growing!” In fact, he says, the need for growth is an underlying morph motivator. “Senior management, especially in public companies, always wants growth,” he points out. “Of course what they mean is EPS [earnings-per-share] growth for the shareholders. For the minions running the various businesses, it means finding ways to increase volume, margins and income. Preferably all three, but especially income. Oft’ times — and probably now more than ever — it means to seriously consider forward and/or backward integration of your capabilities.”

Breaking the trend down

When the survey results are calculated for individual groups of suppliers, there are significant differences in the trend’s impact on both suppliers and fabricators. Further, the most revealing data identified the suppliers who are most deeply involved in the transition to part fabrication, and I’ve hazarded some guesses as to why, below.

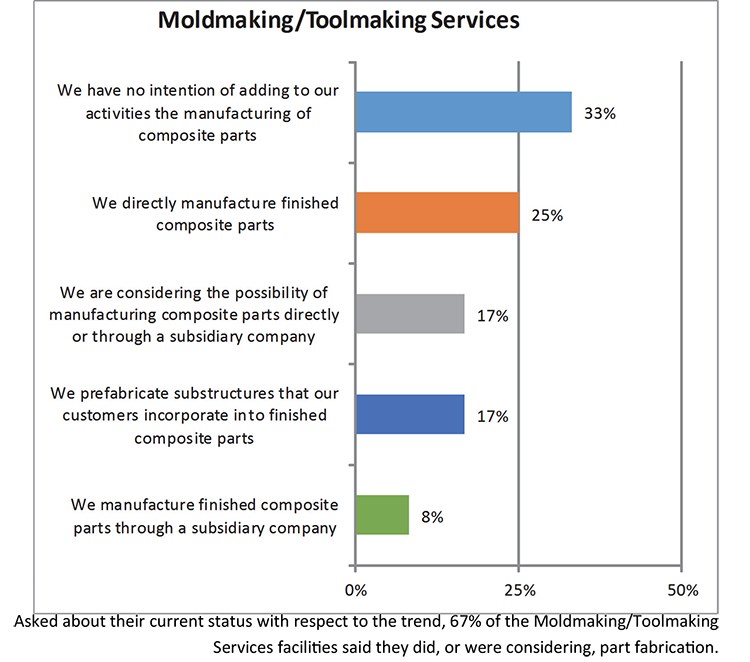

First, we’ll review some survey results that differentiate the various groups of suppliers/distributors. Almost 70 percent of the toolmakers that participated in the survey — more than two out of three — said that they either already produced finished parts form tools they made, or were planning to do so in the future (see Fig. 4). Statistically, this group had the highest percentage of all the supplier subgroups (two groups actually scored higher, but in each case, the result was unreliable because the number of participating companies in each group was too small to yield a reliable figure. Generally, however, these sub-groups showed that the trend is real, and likely to continue.)

This result for toolmakers makes sense, because, although tool quality is so critical to demolded part part quality, the way the tool is prepared for molding and the way it is employed (the temperatures that are applied, the ramp up to and down from cure temperature and many other factors and decisions made during the production cycle) have a great impact on not only part quality but production efficiency and tool longevity. Given the complexity of today’s parts and tools, and the skills required to optimize mold cycle times and production efficiency, it’s no surprise that toolmakers in greater numbers are only to happy to take responsibility not only for the tool, but how it is used.

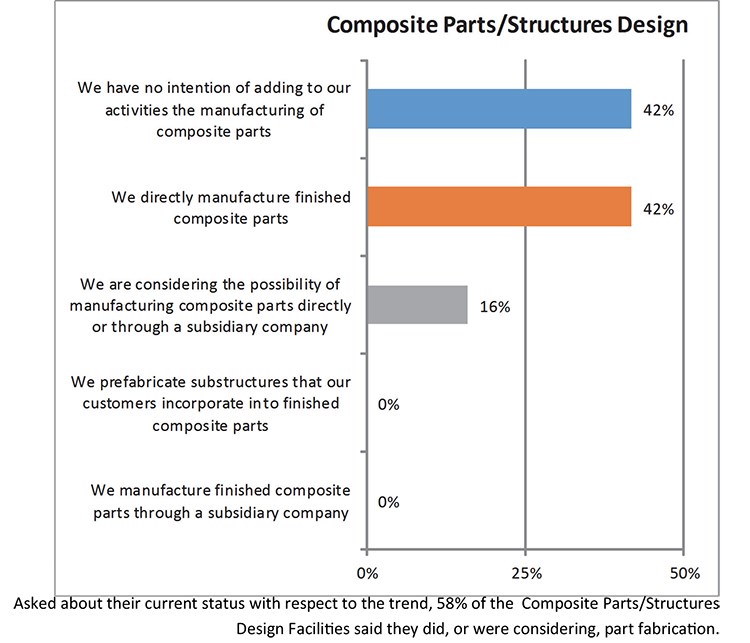

A surprising response came from survey participants whose core business is designing composite parts. An equal number said they do and don’t manufacture finished parts, while another 16 percent of those who responded said they were considering entering into part production (Fig. 5). Again, this seems to tally with the opinions expressed by our interviewees. It makes sense that those who understand how best to design the part are a logical choice for fabrication, too, if they can gain access to the means of production.

On that note, we’ve recently been in communication with Michael Del Pero, a financial-services operative who is significantly involved in mergers and acquisitions (M&A) activities in the composites industry. Del Pero, who works with FocalPoint Partners LLC (Los Angles, Calif.), told us recently that there is strong desire in a number of markets served by distributors/suppliers to the composites industry to form partnerships or joint ventures and/or to acquire companies with other capabilities, including the means and expertise required to implement rate production, seeking to expand their product offerings, particularly in recently “hot” markets such as the automotive sector.

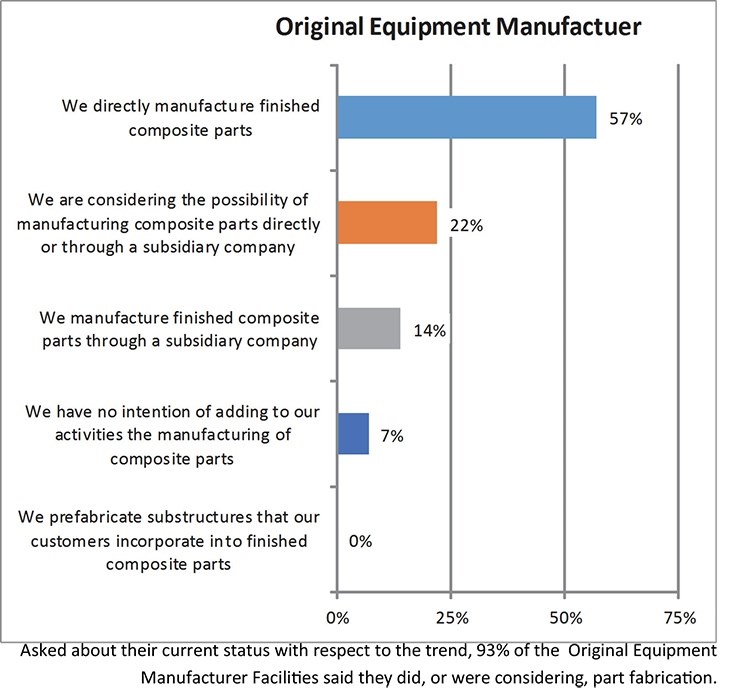

That may help to explain why 93 percent of the OEMs who participated in our survey do now, or intend to, manufacture finished composite parts, either directly or though subsidiaries (see Fig. 6). In many cases, the clearest path to that end is not to attempt to develop the expertise internally, but rather to acquire a company that already possesses production capability and know-how.

In this light, McClelland’s comment, above, about “backward or forward integration” of capabilities takes on an unusually prophetic tone. Del Pero tells us that the composites industry is ripe for significant M&A activity. Stay tuned ….

Related Content

XlynX Materials BondLynx and PlastiLynx for low surface energy PP, PE substrates

Award-winning Xlynx materials use breakthrough “diazirine” technology to boost bond strength up to 950% as adhesives, primers and textile strengtheners.

Read MorePittsburgh engineers receive $259K DARPA award for mussel-inspired underwater adhesion

The proposed META GLUE takes inspiration from hydrogels, liquid crystal elastomers and mussels’ natural bioadhesives to develop highly architected synthetic systems.

Read MoreScott Bader, Oxeco partner for high-performance bonding solution

Joint technology breaks barriers to bonding lightweight flexible solar panels to roofing structures made from aluminum, coated steel and composites.

Read MoreXlynX’s PlastiLynx PXN crosslinking primer enhances polymer adhesion

PFAS-free diazirine primer makes surfaces receptive to all manner of adhesives, including epoxies and polyurethanes, outperforming alternative options by 150-350%.

Read MoreRead Next

Why are suppliers morphing into fabricators?

CT managing editor Mike Musselman asks the question and examines the forces at work to make it a compelling trend. Part I of II.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;maxWidth=300;quality=90)