Composite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Share

Largest GFRP rebar project

Roughly 11,000 kilometers of GFRP rebar reinforce this concrete flood mitigation channel in Jizan, Saudi Arabia, and enable its 100-year service life. Photo Credit for all images: Mateenbar

Worldwide, concrete structures are under attack like never before. Not only has traffic increased on roads, bridges and overpasses, but climate change has increased extreme weather events, including violent storms and torrential rains that result in flash floods and other destructive events. Under such stress, concrete can crack. This allows rapid deterioration in aggressive environments through exposure to elements such as saltwater, which is corrosive to steel rebar.

“Cracks create paths for the agents of the aggressive environments to reach the reinforcing and/or prestressing steel and begin the corrosive oxidation process,” explains the Florida Dept. of Transportation (FDOT, Tallahassee, Fla., U.S.) structures innovation website. “An innovative approach to combat this major issue is to replace traditional steel bar and strand reinforcement with fiber-reinforced polymer (FRP).” FDOT has been a leader in FRP rebar use and testing, as well as the development of design and use standards, like those issued by the American Concrete Institute (ACI, Farmington Hills, Mich., U.S.). Although composite rebar is primarily made with glass fiber (GFRP or GRP), products have also been developed using basalt (BFRP) or carbon fiber (CFRP).

“With a long and costly history of corrosion worldwide, steel is no longer viewed as a cost-effective option in aggressive environments,” says Nick Crofts, CEO of GFRP rebar manufacturer Mateenbar (Dubai, UAE and Concord, NC, U.S.), lead supplier for the largest GFRP rebar project in the world. This project is the 23-kilometer-long and up to 80-meter-wide flood mitigation channel in Jizan, Saudi Arabia. Although GFRP rebar has been around for 30-40 years, says Crofts, key projects like the Jizan Flood Channel are now propelling it into mainstream infrastructure. This growth is already justifying Mateenbar’s new factories in Saudi Arabia and the U.S.

Pioneering GFRP rebar technology

Mateenbar GFRP rebar was developed by Pultron Composites (Gisborne, New Zealand), a pioneer and specialist in pultrusion technology and product innovation. Mateenbar addresses the unique challenges of the rebar market, which not only demands high volume and low prices, but also requires the product to be specified by project architects and/or engineers. Thus, Mateenbar’s first factory in 2008 was built close to potential customers and project engineering firms in Dubai, United Arab Emirates, a region known for large infrastructure projects and pioneering use of composites in construction. Pultron remains a strategic partner to Mateenbar and a key supplier of bespoke technology and product development.

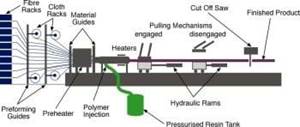

Mattenbar’s factory uses Pultron’s advanced technology to produce very consistent pultruded rebar at high throughput without volatile organic compound (VOC) emissions. “We inject resin and cure inside the engineered steel pultrusion die,” says Crofts.

“This rebar is an engineered product with dimensional performance better than ±1%,” he adds. “There is no excuse to see resin on the floor or dust in the air. The fiber used is corrosion-resistant ECR glass from Owens Corning (Toledo, Ohio, U.S.) and the resin is our own variant of an epoxy back-boned vinyl ester. It maximizes toughness, strength and durability, and is far superior to a polyester backbone with epoxy terminations.”

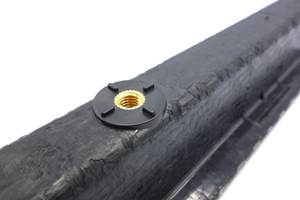

The pultruded round rods are then machined to create a spiral profile that enables load-bearing adhesion inside the concrete. “That is also a closed operation,” Crofts points out, “using machining booths equipped with Donaldson (Bloomington, Minn., U.S.) air filtration systems. We then apply a resin film on the outside to improve handling.” Mateenbar’s rebar is produced in lengths of up to 80 feet, cut to length as required. “It is typical to see 40-foot lengths for most infrastructure and construction projects,” says Crofts.

“Our average straight rebar is 0.75-inch in diameter, with a tensile modulus of 8,700 ksi (60 GPa) made from 11,600-ksi (80-GPa) glass fiber; thus, the fiber content is very high — more than 80% by weight. There is no way to bend this, so our bent GFRP rebar is made using a different process and resin, with proprietary technology.”

World’s largest GFRP rebar project

Jizan (also spelled Jazan) is the capital of the Jizan Region, which lies in the southwest corner of Saudi Arabia, north of the border with Yemen. Disastrous flash flooding occurs during periodic heavy rains due to runoff from nearby mountains. The 23-kilometer-long reinforced concrete stormwater drainage channel was built to protect a large industrial zone that includes an oil refinery for Saudi Aramco (Dhahran, Saudi Arabia).

Until the COVID-19 pandemic, Saudi Aramco was the world’s largest company in terms of revenue. It handles all of the Kingdom’s oil and derivative products business and also accounts for 10% of all construction in Saudi Arabia. “Saudi Aramco realized that a huge percentage of its annual budget was spent replacing concrete structures,” says Crofts. “The high salinity in the region’s sand and high delta in temperature from day to night causes faster cracking in the concrete. Saudi Aramco began looking for alternative technologies, and, as members of ACI, they took their strategy from the FRP rebar standards developed, further adapting and refining them as Saudi Aramco standards. The company then mandated use of GFRP rebar in certain high-corrosion environments.”

Saudi Aramco asked for tenders for the Jizan flood channel project and then selected three GFRP rebar suppliers. Mateenbar was awarded 50% of the contract. “We waited for several months while the project geared up,” Crofts recalls, “and then, suddenly, all of the materials were needed immediately. The Dubai factory went to being flat out within the space of a week and produced almost 6,000 kilometers of GFRP rebar over seven months.”

Once delivered, the rebar was installed by the project’s contractor, Al Yamama Group (Dammam, Saudi Arabia). “We thought we would need to provide a lot of assistance during installation, but it wasn’t necessary,” says Crofts. “They found it much faster to install than steel rebar.” With a weight 25% that of steel rebar, GRFP rebar enables handling of longer lengths with fewer people and is easier to move and position. “There are also fewer positioning pipes required,” he adds. “These round sections of pipe are used to support the rebar at the right height position within the concrete.”

After the rebar is placed, tied together with stainless steel wires and inspected, it is ready for concrete to be poured on top. The rebar installation team moved so quickly, notes Crofts, they were actually a kilometer down the 40- to 80-meter-wide channel before they realized the concrete pouring operations couldn’t keep up. “So, they stopped and let the concrete catch up,” he adds. “This is important because if heavy rains come, the flooding fills the channel with sand. This happened on a couple of occasions, causing delays, but also highlighting the importance of this drainage channel.”

After pouring the concrete on top of the rebar, the installation team tamps and compresses it to remove air bubbles, and then it cures over the following days and weeks. “There is no difference between GFRP and steel rebar for these steps,” says Crofts. “We finished supplying rebar in January 2020, and the channel has just been completed.”

The finished reinforced concrete channel in Jizan will direct flood water away from roads and industrial production facilities. Photo Credit: Al Yamama Group

Design, cost and GFRP future

Crofts points out that GFRP rebar is not a direct replacement for steel. “GFRP rebar has different properties to that of steel rebar. These differences must be accommodated in the design. So whereas concrete reinforced with steel would typically be designed to ACI 318, this would not be suitable for GFRP rebar, which relies on the ACI 440 design guide instead. As an example, GFRP rebar has a higher tensile strength than steel, but a lower tensile modulus. It is also elastic to the point of failure.” Crofts notes that in a steel design, the quantity of rebar would typically be determined by the tensile strength. However, for GFRP, the modulus is typically the factor which determines the quantity of rebar required. Meeting this requirement typically results in a structure that will exceed the ultimate strength requirements. It also ensures a desirable failure mode in the GFRP rebar-reinforced structure.

Another consideration is the production of bends and shapes. Crofts notes the ratio of bent to straight rebar in projects is, on average, roughly 30%. With steel rebar, this fabrication is often completed on site. “Mateenbar bent bars are produced in our controlled-environment factory and delivered directly to site without intermediate fabrication steps,” he explains. “This can be a challenge from a supply point of view as needs change from one week to the next. We have found that flexibility and having a factory located in the same region are very important.”

“When you measure its cost by volume, GFRP rebar is cost-competitive with steel.”

“The cost of GFRP rebar is 3-4 times higher than steel if calculated in dollars per pound,” says Crofts, “because our product is one-fourth the density. The appropriate measure is dollars per foot because rebar is actually specified and bought as a fraction of the concrete volume. When you measure its cost by volume, GFRP rebar is cost-competitive with steel.”

“Jizan was the first mega-project not to allow steel,” says Crofts. “They had a team to design the required structures with a service life of more than 100 years. Several GFRP rebar producers are looking to locate in Saudi Arabia now as demand grows.” Mateenbar is also building a new factory there, as well as one in Concord, N.C., U.S., to serve North America, which is the second-largest market after the Middle East. Both new factories are modern, 100,000-square facilities, using Pultron’s advanced pultrusion technology. For both, equipment was delivered in October 2020, and production is expected to begin by early 2021.

As demand for GFRP rebar ramps up in the Middle East, the market in North America continues to mature. “Currently, the largest GFRP rebar applications in North America are sea walls and bridges along the coast or where roads are heavily salted,” says Croft. “However, DOTs and asset owners are now looking to improve cost over the lifetime of structures [CW agrees, see “The growing role of composites in infrastructure”], which includes reducing the need for maintenance and building infrastructure that is both long-lasting and sustainable. Consulting engineers and end-users are seeing the value of GFRP rebar technology and GFRP rebar producers are cooperating on quality and performance standards. There are also leading users, such as FDOT, who are promoting the technology and assisting other DOTs, which has helped to spread knowledge.”

Crofts notes that FDOT recently hosted a webinar on GFRP-reinforced concrete design with 200 attendees. In another webinar, Dr. Antonio Nanni, one of the key researchers at University of Miami (Miami, Fla., U.S.) working with FDOT stated, “FRP rebar is ready for prime time.” That has been proven, says Crofts. “The job now is for more companies to specify it and contractors to use it.”

Related Content

Robotized system makes overmolding mobile, flexible

Anybrid’s ROBIN demonstrates inline/offline functionalization of profiles, 3D-printed panels and bio-based materials for more efficient, sustainable composite parts.

Read MoreExel Composites pultruded rods enhance Umbrosa parasol durability

The Belgium-based manufacturer chose pultruded fiberglass ribs for many of its umbrella and parasol designs to effectively endure exposure to high wind speeds, saltwater, rain and UV.

Read MoreExel Composites supplies fiberglass profiles for Foton electric buses

Partnership with Chinese automotive manufacturer will see the implementation of pultruded profiles in various bus models, backed by weight savings, complex geometries and long life.

Read MorePultrusion: The basics

A primer describing what pultrusion is, its advantages and disadvantages, and typical applications.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More