New report reveals U.S. saw 60% growth for offshore wind targets

Business Network for Offshore Wind’s inaugural quarterly report details market trends, supply chain and technology advancements.

The Business Network for Offshore Wind’s (Baltimore, Md., U.S.) inaugural U.S. Offshore Wind Quarterly Market Report shows that landmark federal policy, record investments and new state-level actions drove the U.S. offshore wind industry forward in the third quarter of 2022, with coastal states increasing their long-term targets by 58%, a new record for quarterly growth.

The report examines the factors contributing to this historic expansion and provides insight on key market trends, supply chain and technology advancements, and the key challenges.

It details three important developments that made the third quarter among the most consequential for the U.S. offshore wind industry, including:

- The passage of the Inflation Reduction Act (IRA), which appropriated $369 billion in new, clean energy funding, including billions in tax credits for critical offshore wind manufacturing;

- Federal support to stand up a floating wind turbine industry in the U.S., with the current administration announcing a Floating Offshore Wind Shot initiative and a goal to deploy 15 gigawatts (GW) of offshore wind power by 2035; and

- Ambitious new targets set by coastal states including California, which announced its planning goal to deploy 25 GW of floating offshore wind generation by 2045, and New Jersey, which increased its target from 7.5 GW by 2035 to 11 GW by 2040.

“Our inaugural quarterly report could not come at a more exciting time for offshore wind,” Liz Burdock, president and CEO of the Business Network for Offshore Wind, says. “With historic federal funding, new support for floating wind turbine technology and increasingly ambitious state-level goals, the longstanding aspirations of the American offshore wind industry are poised to become reality. Despite this growth, the industry still must overcome challenges to upgrade our grid and transmission system, localize a robust supply chain and train a skilled workforce. Capitalizing on this momentum requires continued coordinated action from our state and federal government to deploy a comprehensive national offshore wind industrial strategy that includes critical investments in our infrastructure, ports and manufacturers.

Key takeaways from the report include:

- New federal investments from the IRA and the Infrastructure Investment and Jobs Act, combined with efforts to bring greater transparency to the federal permitting system, underpin the beginnings of a National Offshore Wind Industrial Strategy and put the U.S. in striking position to achieve its goal of deploying 30 GW of offshore wind by 2030.

- The U.S. is taking serious steps to become a key competitor in the floating wind turbine industry, launching a new initiative aimed at driving down construction costs by at least 70% and allocating critical funding for R&D.

- While attention has been trained on California for setting the nation’s largest planning goal, East Coast states remain at the forefront of offshore wind commitments, development and deployment, with notable actions in Massachusetts, New Jersey, New York and Rhode Island (also see “U.S. administration announces offshore wind energy auction for the Carolinas” and “U.S. administration sets stage for offshore floating wind turbines”).

- Supply chain development continues at pace, with domestic shipbuilding and port redevelopment seeing gains, but additional domestic growth is needed to meet the demand for the growing pipeline of projects.

To read the full U.S. Offshore Wind Quarterly Market Report from the Business Network for Offshore Wind, click here.

Related Content

RTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

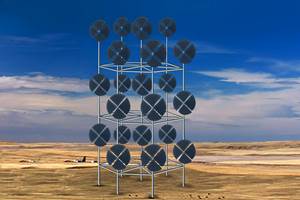

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)