Umoe Advanced Composites enters JV for large-scale glass fiber pressure vessel production in China

Large-scale production facility ramps up hydrogen expansion, with an annual production capacity of 12,000 glass fiber pressure vessels.

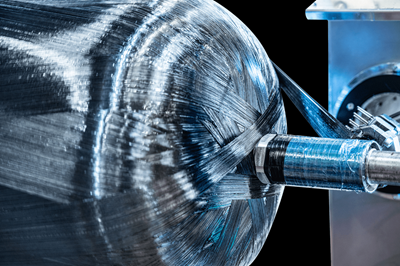

Photo Credit: UAC

It was announced on May 3 that Umoe Advanced Composites AS (UAC, Kristiansand, Norway), a supplier of fiberglass pressure vessels and transportation modules for hydrogen, biogas and compressed natural gas (CNG) has entered into a joint venture (JV) to build up a large-scale production facility in China. A $60 million conditional order has already been placed with the JV.

“We believe our fiberglass-based pressure vessels represent a technological sweet spot for large-scale hydrogen expansion in particular, and we are delighted that leading Chinese industrial and technology institutions share this view,” says Øyvind Hamre, CEO of UAC.

UAC has entered into an agreement with Chinese investment fund Yield Capital, which has invested an undisclosed amount to become a minority shareholder in UAC. Yield Capital is the investment fund of incubation engine Beijing Tsinghua Industrial R&D Institute (China), which is said to be the main player behind China’s hydrogen value chain and part of the country’s leading technology university, Tsinghua University.

The majority of Yield Capital’s investment in UAC is earmarked under the establishment of a JV company in China. UAC will become a majority owner in the JV with an ownership share of 50.001%. The other owners are Yield Capital’s RMB fund in cooperation with Chinese industrial group Befar Group (Binzou City, China), which is one of China’s 500 largest companies.

According to UAC, the JV’s purpose is to build a production facility in China with an estimated annual production capacity of 12,000 pressure vessels. Such a facility is said will provide significant scale advantages and improved competitive position for UAC in all markets, including China and the rest of Asia where the hydrogen market is experiencing huge growth.

The Chinese companies Hypower and Binhua Hydrogen Energy, a subsidiary of Befar Group, have already placed on order for hydrogen pressure tanks worth a total of $60 million. The order is conditional upon the establishment of the JV company and the production facility, plus customary product approval in China.

“The production facility in China will provide powerful scale advantages for customers that today develop their expansion plans based on conventional steel tanks. Further, the partnership with Befar Group and Yield Capital provides with the market access we believe is necessary to succeed in China,” says Hamre.

UAC specializes in the development and manufacturing of glass fiber pressure tanks, which, the company notes, is significantly less costly than using carbon fiber. Moreover, because of its light weight, enables the transport of two to three times more hydrogen compared to similar-sized tanks in steel.

It is this technological sweet spot between carbon fiber and steel that has encouraged Chinese technology investors to invest in UAC.

“UAC’s pressure vessel technology provides large environmental and cost savings compared with competing products. The hydrogen market is expected to grow significantly in the coming years and we are well positioned to become a major player in important markets, allowing even more customers to benefit from our technology and production ramp-up,” says Hamre.

UAC notes that it also expects to invest in its Norwegian production facility, located in Kristiansand, Norway. The plan is to quadruple the manufacturing capacity, from 1,000 to 4,000 pressure tanks annually.

Related Content

Composites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreRead Next

Nikola Corp. selects Hexagon Purus to supply Type IV hydrogen cylinders for serial production

High-performance composite pressure vessels to be tested and validated later in 2021, and certified for distribution in European and North American markets.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)