US wind power booming

The roster of U.S. wind projects under construction and in advanced development as of the end of the third quarter of 2017 has reached 29,634 megawatts (MW), the highest level since this statistic was first measured at the beginning of 2016, according to a new report from the American Wind Energy Association.

The roster of U.S. wind projects under construction and in advanced development as of the end of the third quarter of 2017 has reached 29,634 megawatts (MW), the highest level since this statistic was first measured at the beginning of 2016, according to a new report from the American Wind Energy Assn. (AWEA, Washington, DC, US) released on October 26. The “U.S. Wind Industry Third Quarter 2017 Market Report” shows wind power is competing for and winning the business of a growing set of major utilities and Fortune 500 brands.

AWEA released the report at the annual Wind Energy Finance & Investment Conference in New York. Interest was evident from the U.S. wind power capital market, with a large number of investors, including tax equity, private equity, institutional, sovereign wealth funds, and banks, looking to provide financing to wind projects.

“Wind power’s value to investors, utilities and corporate purchasers is clear: fixed-cost

clean energy at competitive prices,” says Tom Kiernan, CEO of AWEA. “The high level of

wind under construction and in advanced development shows we are on track to deliver

10 percent of America’s electricity by 2020, along with $85 billion in economic activity

and 50,000 new jobs.”

With year-over-year construction and advanced development activity up 27 percent,

wind’s strong growth reflects a new status quo – with wind power competing for, and

winning, a place in the energy mix of some of America’s largest companies. The

combined pipeline of 29,634 MW of wind capacity includes 13,759 MW under

construction and 15,875 MW in advanced development, defined as not yet under

construction, but having signed a power purchase agreement, proceeding under utility

ownership, or announcing a firm turbine order. Within the pipeline, new third quarter

activity represents 4,248 MW of capacity entering advanced development and 638 MW

beginning construction.

Utilities made large-scale announcements to develop and own wind power during the

third quarter, including American Electric Power’s (AEP) 2,000 MW Wind Catcher

project in Oklahoma, Alliant Energy’s 500 MW New Wind II project in Iowa, and Xcel

Energy’s 300 MW Dakota Range I and II in South Dakota. The companies’ executives

have spoken to the affordability and reliability of wind.

“There’s a rebalancing of the generation resources, not only in our company but in this

country, that’s going on,” says Nick Akins, the chief executive of AEP. “This project is

consistent with our strategy of investing in the energy resources of the future, and it will

save our customers money while providing economic benefits to communities.” Doug Kopp, president of Alliant Energy’s Iowa utility, says, “The goal of this project is to

bring additional low-cost, clean energy to ourcustomers and the State of Iowa.” Chris Clark, president of Xcel Energy – Minnesota, South Dakota, North Dakota said,

“Our customers count on us to provide reliable, affordable and clean energy, and this

investment will do just that."

Fortune 500 companies contracting for wind power have emerged as another major

demand driver. The low, stable price of wind makes business sense, helping them to

cost-effectively meet sustainability goals. The third quarter witnessed a broadening and deepening of this customer base. Four corporations signed power purchase agreements for the first time, including major manufacturers Anheuser-Busch, Cummins, and Kimberly-Clark. Target and General Motors also became repeat customers, having previously signed PPAs.

View a map of every wind farm and factory in America: http://gis.awea.org/arcgisportal/apps/webappviewer/index.html?id=eed1ec3b624742f8b18280e6aa73e8ec.

Related Content

RTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

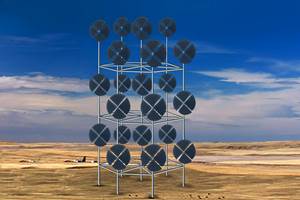

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)